Marginal Revenue & Cost

See Demo 1-800-714-5153 Marginal Revenue, Cost, and Profit Maximization for Small Businesses Article Index Part I: The Foundations of Marginal Analysis Part II: The Profit Maximization Framework Part III: Marginal Analysis in the Real World Part IV: Conclusion For small business owners, every decision counts. Whether it’s pricing a new product, hiring another employee, or […]

Iowa Payroll Tax for Small Business

See Demo 1-800-714-5153 Iowa Payroll Tax: A Quick Guide for Small Business 2025 Article Index Executive Summary The 2025 Individual Income Tax Transformation Iowa State Unemployment Insurance (SUI) in 2025 Economic & Fiscal Ramifications The Future Trajectory of Iowa Tax Policy Strategic Recommendations for Employers Executive Summary The year 2025 marks a watershed moment for […]

US State Corporate Tax

See Demo 1-800-714-5153 US State Corporate Tax: A Small Business Guide for 2025 The world of U.S. state corporate taxation in 2025 is a complex maze of different rules, rates, and regulations. For small businesses, understanding this landscape is crucial for making smart financial decisions. States are taking different paths: some are lowering taxes to […]

2025 US Tariff Timeline

See Demo 1-800-714-5153 2025 US Tariff Timeline for Small Businesses The first half of 2025 has been marked by a rapid and complex series of changes to United States tariff policy. For small businesses, which are often the most vulnerable to sudden shifts in trade duties and regulations, staying informed is not just beneficial—it’s essential […]

Nevada Payroll Tax for Small Business

See Demo 1-800-714-5153 Nevada Payroll Tax: 2025 For small businesses in the Silver State, understanding the tax landscape is crucial for success. This guide provides an in-depth look at Nevada’s unique payroll tax, the Modified Business Tax (MBT), to help you stay compliant and make informed financial decisions. On This Page Introduction: Understanding Nevada’s Unique […]

Utah Payroll Tax for Small Business

See Demo 1-800-714-5153 Utah Payroll Tax: A Quick Guide for Small Business Article Index Executive Summary Utah State Income Tax Withholding for 2025 Utah State Unemployment Insurance (SUI) in 2025 Corporate Income Tax: Considerations for Payroll Essential Employer Compliance: Filing, Payment, and Reporting Additional Payroll-Related Tax Provisions Future Payroll Tax Outlook for Utah Historical Context […]

Oklahoma Payroll Tax for Small Business

See Demo 1-800-714-5153 Oklahoma Payroll Tax: A Small Business Guide For small business owners in Oklahoma, navigating the complexities of payroll tax is a critical responsibility. The landscape in 2025 is defined by a mix of federal obligations, unique state tax structures, and significant legislative reforms that promise to reshape future liabilities. Understanding these multifaceted […]

South Carolina Payroll Tax

See Demo 1-800-714-5153 South Carolina Payroll Taxes: 2025 For small businesses in the Palmetto State, understanding the intricacies of payroll taxes is not just a matter of compliance—it’s a cornerstone of financial strategy. The South Carolina payroll tax landscape in 2025 is a blend of stable, ongoing requirements and significant legislative proposals that could reshape […]

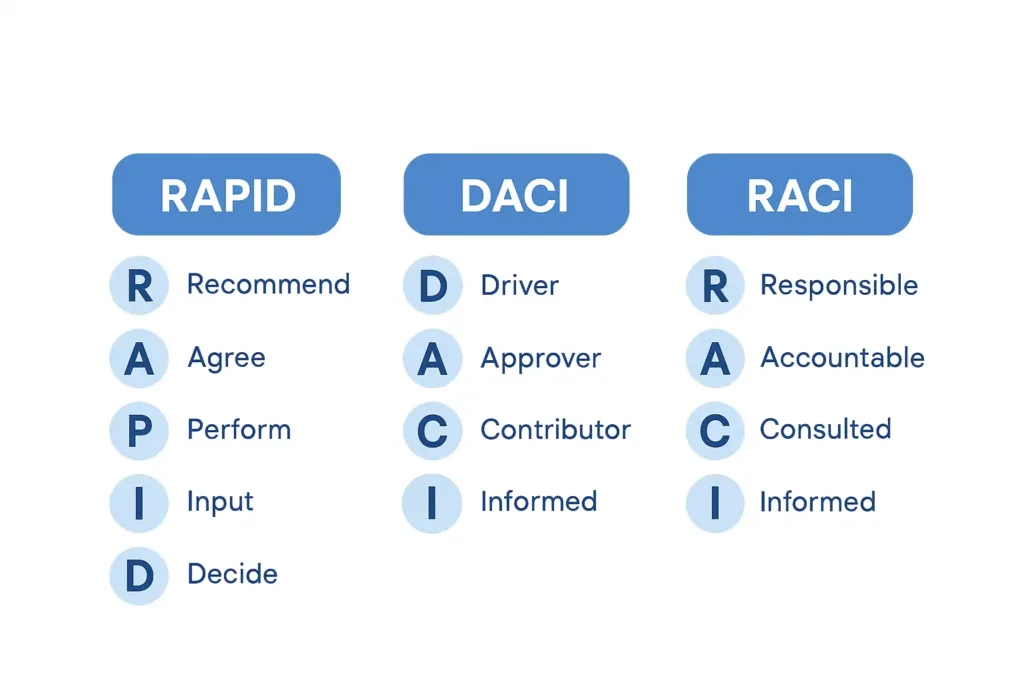

Rapid vs DACI vs RACI Frameworks

See Demo 1-800-714-5153 Decision-Making and Responsibility Frameworks: RAPID vs. DACI vs. RACI Article Contents Executive Summary Introduction to Decision-Making and Responsibility Frameworks Deep Dive: The RAPID Framework Deep Dive: The DACI Framework Deep Dive: The RACI Framework Comparative Analysis: RAPID vs. DACI vs. RACI Strategic Selection: Choosing the Appropriate Framework Effective Implementation: Best Practices and […]

Alaska Payroll Tax

See Demo 1-800-714-5153 Alaska Payroll Tax: A Quick Guide for Small Businesses (2025) For small business owners in Alaska, navigating the world of payroll taxes can feel like charting a course through icy waters. The state’s unique tax landscape—most notably, the absence of a state personal income tax—simplifies some aspects of payroll but places immense […]