2026 401k Contribution Changes

See Demo 1-800-714-5153 Projected 2026 401k Contribution Changes & Strategic Analysis This comprehensive guide analyzes the projected 2026 401k contribution changes, offering a strategic analysis of retirement plan limits for 401(k)s, IRAs, and HSAs. Understanding these key adjustments, including the significant impact of the SECURE 2.0 Act, is crucial for maximizing your retirement savings. We’ll […]

New 2026 IRS Tax Brackets

See Demo 1-800-714-5153 New 2026 IRS Tax Brackets & Major Tax Law Changes The upcoming 2026 federal income tax season is shaped by two major forces: modest inflation adjustments announced by the IRS and the sweeping permanence brought by the “One Big Beautiful Bill Act” (OBBBA). This landmark legislation made the Tax Cuts and Jobs […]

US State Housing Affordability

See Demo 1-800-714-5153 The State of U.S. Housing Affordability: 2025 TL;DR The U.S. is facing a severe housing affordability crisis, with home prices dramatically outpacing income growth. The national median home price has soared past $410,000, while real median household income lags, making homeownership financially impossible for many. This national problem is driven by a […]

US State Cost of Living 2025

See Demo 1-800-714-5153 U.S. Cost of Living in 2025 Understanding the US State Cost of Living in 2025 is crucial for individuals, families, and businesses planning moves, managing finances, or making strategic decisions. This comprehensive guide dives deep into the varying cost of living across the United States, highlighting key factors like housing costs, grocery […]

30 an Hour Is How Much a Year?

See Demo 1-800-714-5153 $30 an Hour is How Much a Year? A 2025 State-by-State Breakdown Wondering “$30 an hour is how much a year?” is a critical question for financial planning, career moves, and understanding your true earning potential. While the simple calculation gives you a gross annual salary, your actual take-home pay—and what that […]

US Increases India Tariffs to 50%

See Demo 1-800-714-5153 US Increases India’s Tariffs to 50% Article Index Anatomy of a Trade Shock: The 2025 U.S. Tariffs on India The Rationale Re-examined: Geopolitics, Oil, and Enduring Trade Frictions Economic Tremors in India: A Sectoral Impact Analysis India’s Response: A Strategy of Resilience and Realignment The Ripple Effect: Economic Consequences for the United […]

Canada’s De-Escalation of Reciprocal Tariffs

See Demo 1-800-714-5153 Canada’s De-escalation of Reciprocal Tariffs on U.S. Goods An in-depth analysis of Canada’s pivotal August 22, 2025, decision to de-escalate the reciprocal tariff war with the United States. This article explores the impact of Canada’s strategic tariff removal on USMCA/CUSMA-compliant goods, the remaining tariffs on steel, aluminum, and autos, and what this […]

US-India Trade and Tariffs

See Demo 1-800-714-5153 U.S.-India Trade Relations Amidst Tariffs and Geopolitical Realignment The U.S.-India trade and tariff landscape is a critical area of focus for American businesses. Understanding the complexities of the current U.S.-India trade relations, the impact of recent US tariffs on India, and the underlying geopolitical tensions is essential. This article provides a shallow […]

OPM Severance Pay Tax

See Demo 1-800-714-5153 OPM Severance Pay Tax: A Quick Guide to Severance Taxation Involuntary separation from federal service introduces major financial questions. The primary concern for many is understanding the OPM severance pay tax implications. This comprehensive guide provides a detailed analysis for US government employees on how OPM severance pay is calculated, paid, and […]

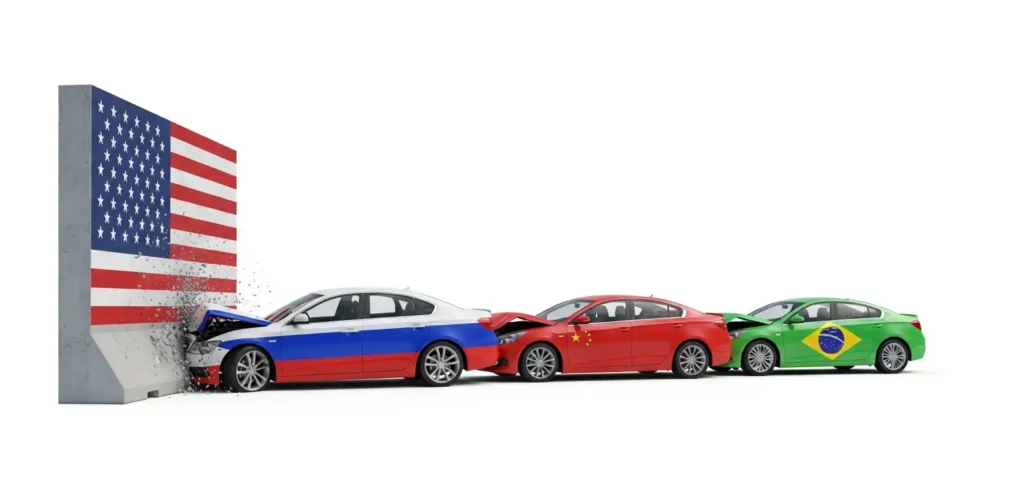

100% Secondary Tariffs on Russian Allies

See Demo 1-800-714-5153 100% Secondary Tariffs on Russian Allies For US Businesses, understanding the nuances of 100% secondary tariffs on Russia is critical. This article explores the impact of these secondary tariffs, a significant tool of economic statecraft aimed at Russia. We will delve into how these tariffs affect global trade, supply chains, and the […]