Full-Time Employee Defined for Each State

See Demo 1-800-714-5153 Analysis of “Full-Time” Status Across the United States TL;DR: The “Full-Time” Confusion The definition of a “full-time employee” in the US is not a single number. It is a fragmented mix of federal and state laws. While the FLSA uses a 40-hour standard for overtime, the ACA uses a 30-hour standard for […]

Staffing and Scheduling in Pop-Up Retail

See Demo 1-800-714-5153 Staffing, Scheduling, and Employment Contracts in Seasonal Pop-Up Retail Seasonal pop-up retail, especially dominant models like Spirit Halloween, requires a unique and highly agile approach to staffing, scheduling, and employment contracts. This article provides an in-depth analysis of the ‘phantom workforce’ that powers these temporary stores, exploring the complex challenges of seasonal […]

US Minor Work Hours

See Demo 1-800-714-5153 US Minor Work Hours: The Quick Compliance Guide 2025 Navigating the complex web of US minor work hours and child labor laws is a critical responsibility for every American business owner and manager. Compliance isn’t just about avoiding hefty fines; it’s about protecting young workers and safeguarding your company’s reputation. This guide […]

OPM Severance Pay Tax

See Demo 1-800-714-5153 OPM Severance Pay Tax: A Quick Guide to Severance Taxation Involuntary separation from federal service introduces major financial questions. The primary concern for many is understanding the OPM severance pay tax implications. This comprehensive guide provides a detailed analysis for US government employees on how OPM severance pay is calculated, paid, and […]

No Tax on Overtime

See Demo 1-800-714-5153 “No Tax on Overtime” Law 2025: A Quick Guide for Small Business Payroll & Compliance The recently enacted “One Big Beautiful Bill Act” (OBBBA) has introduced sweeping changes to the U.S. tax code. For small businesses, one of the most talked-about components is the “No Tax on Overtime” provision. While presented as […]

Alabama Payroll Tax

See Demo 1-800-714-5153 Alabama Payroll Taxation: A Guide for Employers in 2025 and Beyond Executive Summary: Navigating Alabama’s Payroll Tax Landscape in 2025 and Beyond Employers in Alabama face a multi-layered system of payroll tax obligations, encompassing state income tax withholding, state unemployment insurance contributions, and a variety of local taxes. The landscape for 2025 […]

New York Pay Stub Regulations

See Demo 1-800-714-5153 New York Pay Stub Regulations: A Guide for Employers Navigating New York’s Evolving Pay Stub Landscape The Critical Role of Pay Stub Compliance in New York State New York State is recognized for its comprehensive and robust employee protection laws, among which pay stub (also known as wage statement) regulations serve as […]

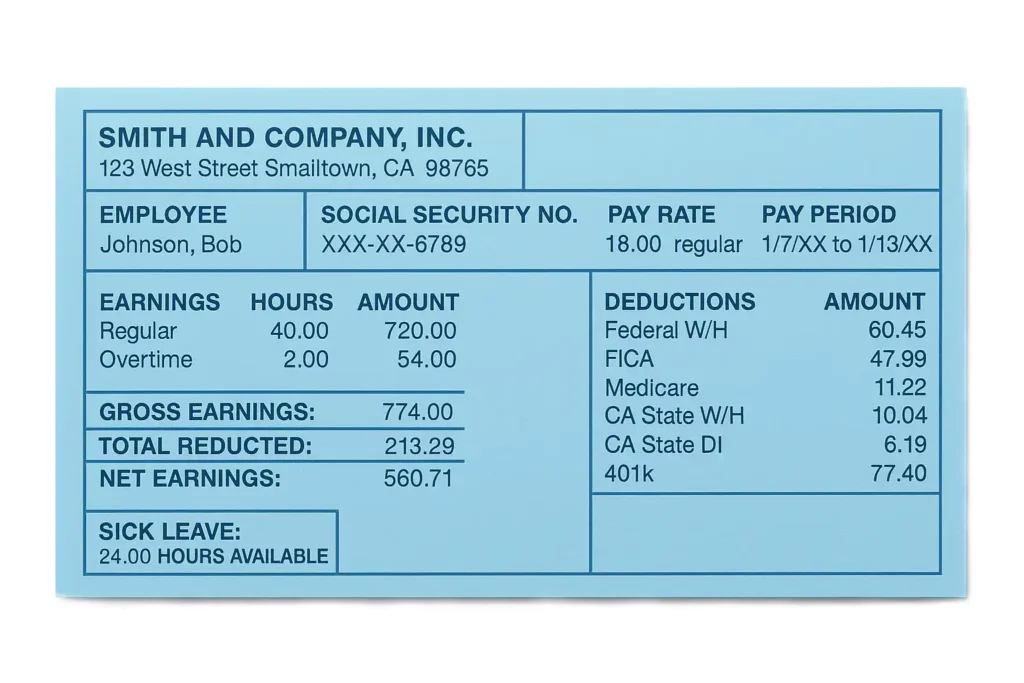

State Pay Stub Requirements

See Demo 1-800-714-5153 Decoding Your Pay Stub: A State-by-State Guide for 2025 A pay stub, often called a check stub or earnings statement, is more than just a piece of paper or a digital file; it’s a critical document for both employees and employers. For employees, it’s a transparent record of earnings, deductions, and net […]

OPM & Federal Retirement Guide

See Demo 1-800-714-5153 OPM & Federal Retirement Guide: CSRS, FERS, Benefits & Annuities Explained OPM’s Central Role in Federal Retirement The U.S. Office of Personnel Management (OPM) acts as the primary human resources agency for the Federal Government. A major part of its responsibilities involves managing retirement benefits for federal civilian employees. OPM creates and […]

OPM Schedule F

See Demo 1-800-714-5153 OPM Schedule F 2025: An Analysis of Federal Workforce Reform Introduction: Schedule Policy/Career in 2025 The United States federal civil service is undergoing a potentially transformative period following the reinstatement and modification of a controversial personnel policy in early 2025. Originally introduced as “Schedule F” in 2020 and subsequently rescinded, the policy […]