New York Pay Stub Regulations: A Guide for Employers

Navigating New York's Evolving Pay Stub Landscape

The Critical Role of Pay Stub Compliance in New York State

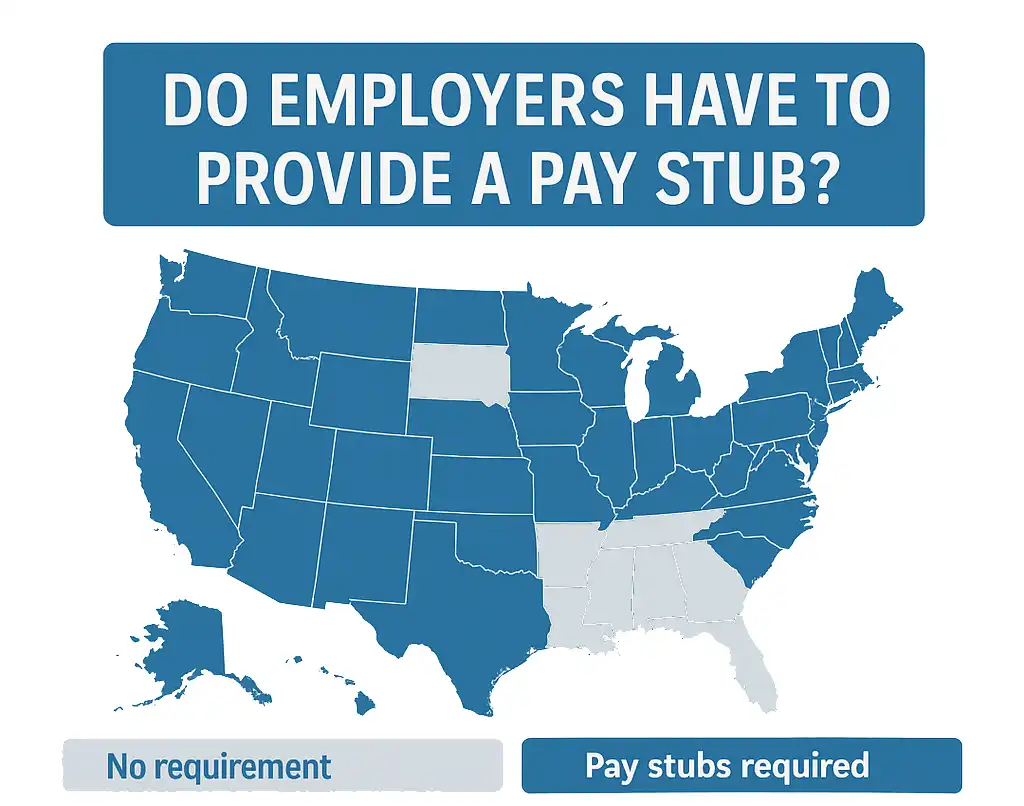

New York State is recognized for its comprehensive and robust employee protection laws, among which pay stub (also known as wage statement) regulations serve as a critical foundation for ensuring wage transparency and preventing wage theft. For employers, adherence to these regulations is not merely an administrative formality but a significant legal obligation. The New York Wage Theft Prevention Act (WTPA) specifically underscores the importance of providing employees with detailed and accurate information about their earnings, thereby safeguarding their hard-earned wages. Failure to comply can lead to substantial penalties, making a thorough understanding of these requirements paramount for all New York employers. The consistent evolution of these laws indicates a sustained commitment by the state to enhance worker protections, compelling businesses to adopt a proactive rather than reactive stance towards compliance.

Purpose and Scope of the Report

This report provides a comprehensive analysis of the current New York State pay stub regulations, with a particular focus on the requirements under New York Labor Law (NYLL) §195.3 and the Wage Theft Prevention Act. It will detail the mandatory information that must be included on every wage statement, the rules governing wage deductions, and the penalties for non-compliance. Furthermore, this report will examine significant regulatory changes taking effect in 2025, explore potential future legislative and regulatory developments, and offer actionable guidance to assist employers in navigating this complex legal environment.

The Dynamic Nature of NY Labor Law

Employers in New York must recognize that labor laws, including those pertaining to wage statements, are not static. They are continuously subject to legislative amendments, new interpretations by the New York State Department of Labor (NYSDOL), and evolving judicial precedents. Recent years have seen numerous updates, including adjustments to minimum wage rates, overtime exemption thresholds, and even the framework for assessing liquidated damages in certain wage payment disputes. This dynamic environment necessitates ongoing vigilance and a commitment from employers to stay informed and adapt their practices accordingly. The interconnectedness of payroll and broader human resources compliance is also a key consideration; changes in areas such as minimum wage, overtime rules, or the introduction of new leave entitlements often have a direct impact on the accuracy and completeness of pay stubs and associated record-keeping obligations.

Core Requirements of New York Pay Stub Laws

Understanding the core requirements under NYLL §195.3 and the WTPA is fundamental for New York employers.

The Mandate: Wage Statements with Every Payment

New York Labor Law §195.3 unequivocally mandates that employers must furnish each employee with a wage statement every time wages are paid. This requirement applies irrespective of the method of payment, whether it be by cash, check, or direct deposit. The Wage Theft Prevention Act reinforces this obligation, emphasizing that these statements are crucial for employees to understand how their pay is calculated and to ensure they are being compensated correctly. You can find a sample wage statement (LS49) on the NYSDOL website.

Mandatory Information on Wage Statements

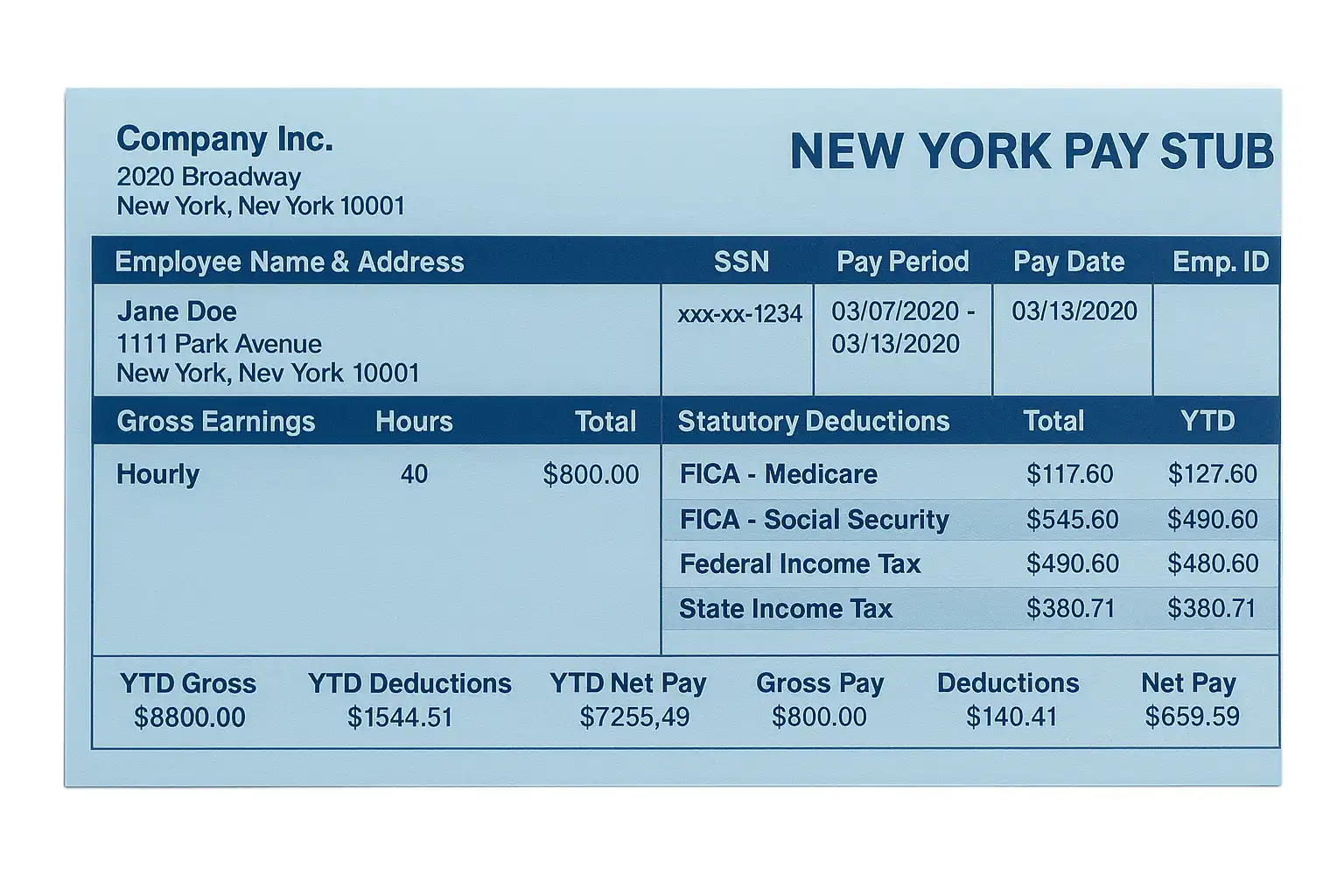

The information required on New York wage statements is extensive and precise. Each pay stub must serve as a clear and comprehensive record of an employee's earnings for the pay period. Failure to include any of the mandated items can result in significant penalties. Key information that must be included on every wage statement is detailed in NYLL §195.3 and further emphasized by the WTPA.

This includes, but is not limited to:

- The employee's name.

- The employer's name, address, and phone number.

- The dates of work covered by the payment (pay period).

- The rate or rates of pay and the basis thereof (e.g., hourly, salary, shift, day, week, piece rate, commission). This "basis thereof" requirement necessitates a clear articulation of how the employee is paid, not just the monetary amount, which is particularly crucial for employees with variable rates or complex pay structures.

- Gross wages.

- All deductions made from wages, itemized individually.

- Any allowances claimed as part of the minimum wage (e.g., tip, meal, or lodging allowances).

- Net wages.

For employees who are not exempt from overtime, the statement must also include:

- The regular hourly rate or rates of pay.

- The overtime rate or rates of pay.

- The number of regular hours worked.

- The number of overtime hours worked.

Specific additional information is required for certain categories of employees:

- Piece-rate employees: The applicable piece rate or rates of pay and the number of pieces completed at each rate.

- Home care aides: The benefit portion of the minimum rate of home care aide total compensation, if applicable.

- Prevailing wage workers: Prevailing wage supplements claimed, if any. The statement must either identify the type and hourly rate of each supplement or be accompanied by a copy of the applicable notice.

The meticulous detail required on pay stubs, combined with the potential for severe penalties for non-compliance, effectively positions the pay stub as a central document in wage and hour enforcement. An incorrect or incomplete pay stub can serve as direct evidence of other underlying wage violations, such as unpaid overtime or an improperly taken tip credit. Thus, the pay stub acts as a critical record for both the employee and regulatory authorities.

| Required Information | Reference |

|---|---|

| Employee's name | NYLL §195.3; WTPA |

| Employer's name, address, and phone number | NYLL §195.3; WTPA |

| Dates of work covered by the payment | NYLL §195.3; WTPA |

| Rate or rates of pay and basis thereof (e.g., hour, shift, day, week, salary, piece, commission) | NYLL §195.3; WTPA |

| Gross wages | NYLL §195.3; WTPA |

| Deductions (must be itemized) | NYLL §195.3; WTPA |

| Allowances claimed as part of minimum wage (e.g., tip, meal, lodging) | NYLL §195.3; WTPA |

| Net wages | NYLL §195.3; WTPA |

| For Non-Exempt Employees: | |

| Regular hourly rate or rates of pay | NYLL §195.3; WTPA |

| Overtime rate or rates of pay | NYLL §195.3; WTPA |

| Number of regular hours worked | NYLL §195.3; WTPA |

| Number of overtime hours worked | NYLL §195.3; WTPA |

| For Piece-Rate Employees: | |

| Applicable piece rate or rates of pay | NYLL §195.3; WTPA |

| Number of pieces completed at each piece rate | NYLL §195.3; WTPA |

| If Applicable: | |

| Benefit portion of home care aide total compensation | NYLL §195.3 |

| Prevailing wage supplements (identify type and hourly rate for each, or attach applicable notice) | NYLL §195.3 |

| For Railroad Corporations: | |

| Accrued total earnings and taxes to date; separate listing of daily wages and how computed | NYLL §195.3-a |

Wage Notices at Time of Hire (NYLL §195.1) and Notification of Changes (NYLL §195.2)

Beyond the pay stub itself, NYLL §195.1 mandates that employers provide a written notice to each employee at the time of hiring. This notice must contain essential wage information, including:

- Rate or rates of pay and the basis thereof (e.g., hourly, salary, commission).

- Overtime rate of pay, if applicable.

- Allowances claimed as part of the minimum wage (e.g., tip, meal, lodging).

- The regular payday.

- The official name of the employer and any "doing business as" (DBA) names.

- The physical address of the employer's main office or principal place of business, and a mailing address if different.

- The employer's telephone number.

Crucially, this notice must be provided in English and in the employee's identified primary language, provided the NYSDOL has prepared a template in that language. Employers must obtain a signed and dated written acknowledgment from the employee confirming receipt of this notice, which must be preserved for six years. This "primary language" requirement presents a notable compliance challenge for employers with diverse workforces, as they must accurately determine each employee's primary language and then verify if a corresponding DOL template is available. Failure to use an available template, even if the English notice is accurate, can lead to violations and associated penalties.

Furthermore, NYLL §195.2 requires employers to notify employees in writing of any changes to the information in the hiring notice at least seven calendar days before the changes take effect, unless such changes are reflected on the subsequent wage statement.

Electronic Pay Stubs

New York law permits employers to provide pay stubs electronically. However, this is subject to specific conditions designed to ensure employees have adequate access. According to a NYSDOL opinion letter, electronic pay stubs are compliant if the employer also provides either paper pay stubs or a workplace computer and printer that employees can use to view and print their pay stubs. Employees must be able to access and print these electronic statements without undue delay or effort and while on company time. The NYS Payroll Online system for state employees, for instance, allows opting out of paper stubs, reflecting a move towards digital access, but the core principle for private employers remains ensuring unfettered employee access.

Record-Keeping Obligations (NYLL §195.4)

Complementing the wage statement requirements, NYLL §195.4 obligates employers to establish, maintain, and preserve contemporaneous, true, and accurate payroll records for a minimum of six years. These records must show for each week worked:

- Hours worked (regular and overtime).

- Rate or rates of pay and basis thereof.

- Gross wages.

- Deductions (itemized).

- Allowances claimed as part of the minimum wage.

- Net wages.

- Amount of sick leave provided to each employee.

For employees not exempt from overtime, records must include regular and overtime hourly rates and hours worked. For piece-rate employees, records must show applicable piece rates and number of pieces completed.

Understanding Wage Deductions in New York

The rules governing deductions from employee wages in New York are stringent and detailed in 12 NYCRR Part 195, promulgated under Labor Law §193. These regulations are central to preventing wage theft, as improper deductions can unlawfully reduce an employee's earnings.

General Rule and Permissible Deductions

The general rule is that no employer shall make any deductions from an employee's wages unless specifically permitted by law or regulation. Permissible deductions fall into limited categories:

- Deductions made in accordance with any law, rule, or regulation issued by any governmental agency: This includes items like federal and state income taxes, Social Security and Medicare (FICA) taxes, and legally mandated garnishments for child support or tax levies.

- Deductions authorized by, and for the benefit of, the employee: These are narrowly defined and require strict adherence to authorization procedures. Examples include payments for insurance premiums, pension contributions, and union dues.

- Deductions for the recovery of overpayments: Permitted only for overpayments due to mathematical or clerical errors by the employer, subject to specific procedures.

- Deductions for the repayment of wage advances: Allowed if the advance and repayment terms are properly documented.

The state maintains a restrictive interpretation of what constitutes a deduction "for the benefit of the employee." Notably, convenience to the employee is explicitly not considered a sufficient benefit to justify a deduction. Furthermore, deductions cannot result in financial gain to the employer at the expense of the employee, underscoring the protective intent of these rules.

Prohibited Deductions

New York law explicitly prohibits several types of deductions, even if an employee were to consent. These include, but are not limited to:

- Repayment of employer losses due to spoilage, breakage, or cash shortages.

- Fines or penalties for tardiness, excessive leave, misconduct, or quitting without notice.

- Employee purchases of tools, equipment, and attire required for work (these are generally considered business expenses of the employer).

- Recoupment of unauthorized expenses incurred by the employee.

- Fees, interest, or the employer’s administrative costs associated with a deduction.

Requirements for Employee Authorization

For deductions that are for the benefit of the employee (e.g., health insurance premiums, retirement contributions), the employer must obtain the employee's express, written, voluntary, and informed consent prior to making any such deduction. "Informed" consent means the employee must be provided with written notice of all terms and conditions of the deduction, its specific benefit to the employee, and the details of how the deductions will be made. This notice must be provided before the initial authorization and before any change in the amount of a deduction or a substantial change in the benefits of a deduction.

Rules for Recovery of Overpayments and Wage Advances

The procedures for recovering overpayments or wage advances are highly regulated to protect employees from arbitrary or excessive deductions:

- Overpayments: Employers may recover overpayments made due to their own mathematical or clerical error within eight weeks prior to issuing a notice of intent to recover. The recovery itself can occur over a longer period, up to six years from the original overpayment. Strict notice requirements apply: for full recovery in the next wage payment (if the overpayment is less than or equal to net wages), at least three days' notice is needed; otherwise, at least three weeks' notice before deductions commence is required. The notice must detail the overpayment amount, deduction schedule, and inform the employee of their right to contest the overpayment and the procedure to do so. Deductions generally cannot exceed 12.5% of gross wages per pay period and must not reduce the effective hourly wage below the state minimum wage. Failure to follow these dispute resolution procedures can render the deduction impermissible.

- Wage Advances: Deductions for the repayment of wage advances are permissible if the employer and employee agree in writing to the terms before the advance is given. This agreement must specify the amount advanced, the total amount to be deducted, the amount per pay period, and the date(s) of deduction. No interest or fees may be charged on advances. The employee must receive written notice of the procedure to dispute deductions not in accordance with the authorization. If an employee disputes a deduction, the employer must cease deductions until a reply is provided and appropriate adjustments are made.

The procedural rigidity for these recoveries underscores the state's emphasis on protecting employee wages. Employers cannot informally "dock" pay; they must meticulously follow these formal processes.

Reflection of Deductions on Pay Stubs

While 12 NYCRR Part 195 primarily governs the legality and authorization of deductions rather than their specific presentation on pay stubs, the overarching requirements of NYLL §195.3 mandate that all deductions taken from an employee's wages must be individually itemized on the wage statement. This ensures transparency and allows employees to verify the nature and amount of each deduction.

Penalties for Non-Compliance and Enforcement

Failure to comply with New York's wage statement and notice requirements can result in significant financial penalties for employers, underscoring the importance of meticulous adherence to the law. These penalties are primarily outlined in NYLL §198.

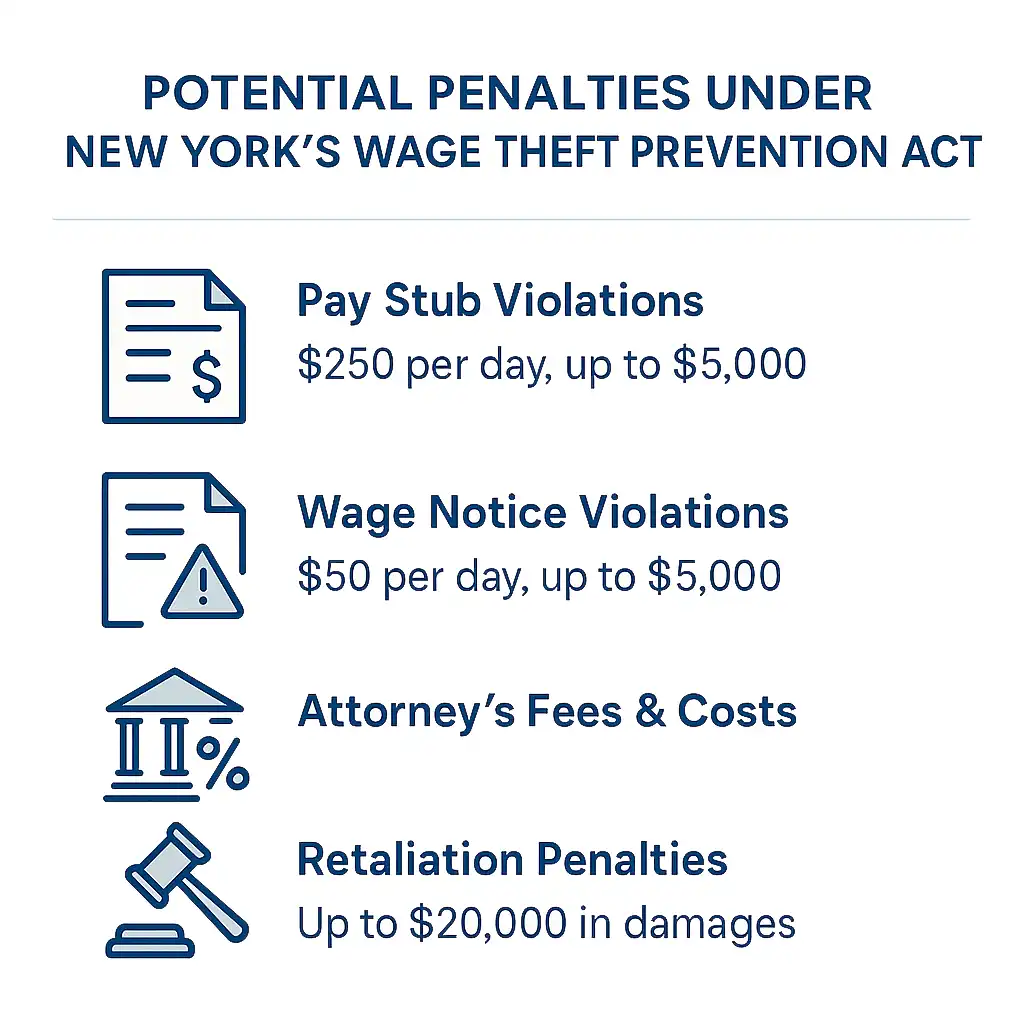

Statutory Damages for Pay Stub Violations (NYLL §198(1-d))

If an employer fails to provide an employee with a wage statement compliant with NYLL §195.3 (i.e., missing stubs or stubs with incomplete or inaccurate information), the employee may recover damages in a civil action. These damages are set at $250 for each workday that the violations occurred or continue to occur, up to a cumulative total of $5,000 per employee. In addition to these damages, the court shall allow the prevailing employee to recover costs and reasonable attorney's fees. The NYSDOL Commissioner may also bring an action to collect such claims on behalf of the employee.

Damages for Failure to Provide Wage Notices (NYLL §198(1-b))

Similarly, if an employer fails to provide an employee with the required written wage notice at the time of hire (as mandated by NYLL §195.1), the employee can recover damages of $50 for each workday that the violation occurred or continues to occur, also capped at $5,000 per employee. Again, costs and reasonable attorney's fees are recoverable, and the Commissioner may also pursue these claims. An affirmative defense exists if the employer made complete and timely payment of all wages due and reasonably believed in good faith they were not required to provide the notice under specific exemptions.

The potential for "stacking" these penalties is a significant concern. A single underlying payroll error, such as failing to pay correct overtime, will not only constitute a wage underpayment (subject to back wages and potentially 100% liquidated damages) but will also inherently result in an incorrect pay stub, triggering the separate $250 per day penalty. This dramatically increases the financial risk associated with any inaccuracies.

Broader Implications of the Wage Theft Prevention Act (WTPA)

Pay stub and wage notice violations are key components of the broader WTPA framework, which aims to combat wage theft through several mechanisms. The WTPA enhances protections against retaliation for employees who make complaints about Labor Law violations, with potential liquidated damages up to $20,000 for retaliation and possible personal liability for individuals who retaliate. Furthermore, wage underpayments (which can often be identified through deficient pay stubs) can lead to recovery of the underpayment amount plus liquidated damages, often calculated at 100% of the unpaid wages. Willful violations can even carry criminal penalties.

Recent Amendments to Liquidated Damages for Pay Frequency Violations (Manual Workers - NYLL §198(1-a))

A significant development, effective May 9, 2025, involves an amendment to NYLL §198(1-a) concerning liquidated damages for "manual workers" who are not paid weekly, as required by NYLL §191(1)(a). Manual workers are generally defined as employees who spend more than 25% of their working time performing physical labor.

Previously, following certain appellate court decisions, manual workers paid less frequently than weekly (e.g., bi-weekly) could sue for 100% liquidated damages on the "late-paid" wages, even if they were ultimately paid in full. The 2025 budget amendment modifies this. For violations of the weekly pay frequency requirement where the employer paid wages on a regular payday at least semi-monthly:

- For a first-time violation, if the employer can demonstrate a good-faith basis for believing their pay practices complied with the law, liquidated damages may be limited to the interest owed on the late-paid wages, rather than 100% of the wages.

- However, for employers with prior findings of violations or more egregious failures (e.g., not paying at least semi-monthly), the potential for 100% liquidated damages remains.

This amendment reflects a legislative effort to balance robust worker protection with concerns about potentially disproportionate damages for technical, good-faith errors in pay timing by employers who are otherwise meeting substantive pay obligations. However, weekly pay for manual workers remains the rule, and repeat or willful violations will still incur severe penalties.

NYSDOL Enforcement Powers and Trends

The NYSDOL possesses significant authority to enforce wage and hour laws, including conducting audits, issuing orders to comply, and assessing penalties. Recent legislative changes included in the 2025-2026 budget have further expanded these powers, granting the NYSDOL Commissioner "quasi-sheriff" authority. This includes the power to file wage orders with the county clerk, which then become liens with the full force of a civil judgment, and the authority to levy and sell an employer's assets to satisfy unpaid wage judgments, without the usual marshal or sheriff fees. The Commissioner can also impose an additional 15% surcharge on unsatisfied wage judgments. These enhanced collection mechanisms signal a clear intent by the state to not only identify wage theft but also to ensure that unpaid wages and penalties are collected more effectively and rapidly from non-compliant employers.

Liability for LLC Owners

The WTPA includes a provision holding the ten largest percentage owners of a Limited Liability Company (LLC) jointly and severally liable for wages owed to employees of the LLC. This aims to prevent business owners from evading responsibility for wage theft by hiding behind the corporate structure.

Key Regulatory Changes Effective in 2025

Several significant regulatory changes impacting wages, hours, and related payroll obligations took effect in New York State on January 1, 2025, or are slated for 2025. Employers must ensure their payroll systems and practices reflect these updates to maintain compliance and accurately populate pay stubs.

Scheduled Increases in Minimum Wage Rates

As of January 1, 2025, the minimum wage rates in New York State increased as follows:

- New York City, Long Island, and Westchester County: $16.50 per hour (up from $16.00).

- Remainder of New York State: $15.50 per hour (up from $15.00).

These rates are scheduled for further increases on January 1, 2026, to $17.00 and $16.00 per hour, respectively. If an employee earns wages at more than one rate of pay during an earning period, all applicable rates must appear on the employee's pay stub.

Adjustments to Overtime Exemption Salary Thresholds

The minimum salary thresholds for employees to qualify for the executive and administrative exemptions from overtime pay also increased on January 1, 2025:

- New York City, Long Island, and Westchester County: $1,237.50 per week (or $64,350.00 per year), increased from $1,200.00 per week.

- Remainder of New York State: $1,161.65 per week (or $60,405.80 per year), increased from $1,124.20 per week.

Further increases are scheduled for January 1, 2026. Employees earning less than these thresholds are generally considered non-exempt and must be paid overtime for hours worked over 40 in a workweek.

Changes to Tip Credits, Meal Credits, and Uniform Allowances

Effective January 1, 2025, various credits and allowances that can affect an employee's wages were adjusted. These details can be found on the NYSDOL website. For example:

- Tipped Food Service Workers (NYC, Long Island, Westchester): Cash wage $11.00/hr, tip credit $5.50/hr.

- Tipped Food Service Workers (Remainder of State): Cash wage $10.35/hr, tip credit $5.15/hr.

- Meal Credits (for food service workers, statewide): $3.95 per meal.

- Uniform Allowances (Maintenance Pay for workweek >30 hrs, NYC, Long Island, Westchester): $20.50 per week.

Updates to Paid Family Leave (PFL)

For 2025, New York's Paid Family Leave benefits and contributions were updated:

- The maximum weekly PFL benefit for eligible employees increased to $1,177.32.

- The employee contribution rate for 2025 is 0.388% of an employee's gross wages per pay period, with a maximum annual contribution of $354.53.

Introduction of Paid Prenatal Leave

A significant new benefit, effective January 1, 2025, is Paid Prenatal Leave. New York became the first state to enact such a requirement, mandating that employers provide eligible pregnant employees with an additional 20 hours of paid leave per year for prenatal care, such as medical appointments or procedures related to pregnancy. This leave is in addition to any existing paid sick leave entitlements. The introduction of this specific, targeted leave could signal a trend towards more particularized paid leave mandates in the future, requiring employers to stay alert to further legislative developments.

Cessation of COVID-19 Paid Sick Leave

New York State's COVID-19 Paid Sick Leave law is set to expire. Employers will no longer be required to provide this specific type of leave after July 31, 2025.

These various increases and new entitlements create a compounding impact on overall labor costs for many New York employers. Furthermore, the growing number of distinct rates and leave types adds layers of complexity to payroll administration and the accurate generation of pay stubs, potentially necessitating investment in more sophisticated payroll systems and enhanced staff training.

| Category | NYC, Long Island, Westchester | Remainder of NY State | Further Scheduled Increases (2026) |

|---|---|---|---|

| Minimum Wage (General) | $16.50/hr | $15.50/hr | $17.00/hr (NYC/LI/Westchester); $16.00/hr (Rest of State) |

| Overtime Exempt Salary Threshold (Exec/Admin) | $1,237.50/week ($64,350.00/year) | $1,161.65/week ($60,405.80/year) | $1,275.00/week (NYC/LI/Westchester); $1,199.10/week (Rest of State) |

| Tipped Food Service Workers (Cash Wage) | $11.00/hr | $10.35/hr | (Tip credits also adjust) |

| Tipped Food Service Workers (Tip Credit) | $5.50/hr | $5.15/hr | |

| Tipped Service Employees (Cash Wage) | $13.75/hr | $12.90/hr | (Tip credits also adjust) |

| Tipped Service Employees (Tip Credit) | $2.75/hr | $2.60/hr | |

| Meal Credit (Food Service Workers) | $3.95/meal | $3.95/meal | |

| Uniform Allowance (Workweek >30 hrs) | $20.50/week | $19.25/week | (Allowances also vary for 20-30 hrs and <20 hrs) |

| Paid Family Leave (Max Weekly Benefit) | $1,177.32 | $1,177.32 | (Based on NYSAWW, updated annually) |

| Paid Family Leave (Employee Contribution) | 0.388% of gross wages (max $354.53/year) | 0.388% of gross wages (max $354.53/year) | (Rate set annually) |

| Paid Prenatal Leave | 20 hours/year (additional) | 20 hours/year (additional) |

On the Horizon: Potential Future Developments Beyond 2025

While the changes for 2025 are concrete, employers must also look ahead to potential future developments in New York's labor law landscape. Pending legislation and emerging regulatory trends offer insights into areas that may see further evolution.

Analysis of Proposed Legislation

Several bills under consideration by the New York State Legislature could impact employer obligations related to compensation and payroll, even if they do not directly amend pay stub content requirements at present.

- Senate Bill S5990A - Benefit Transparency Act: This bill, which was on the Senate floor calendar as of May 2025, seeks to expand upon New York's existing pay transparency laws. If enacted, it would require employers advertising jobs, promotions, or transfer opportunities to disclose not only the compensation range (salary or hourly rate) but also other forms of non-wage compensation and a general description of benefits. You can track its progress on the NY State Senate website. While this bill does not currently alter the specific fields required on a pay stub, it reflects a strong legislative push towards greater "total compensation" transparency.

- Senate Bill S5467 - Payroll Processing Company Liability: This bill aims to create liability for payroll processing companies that "intentionally and without good cause" prevent the remittance of taxes or payment of wages. Affected employees could potentially recover up to three times the expected amount of any missed payments from such a payroll company. If passed, this could offer employers a degree of recourse against culpable payroll providers in egregious situations. However, the primary legal obligation to ensure employees are paid correctly and receive compliant pay stubs would still rest with the employer.

Anticipated Areas for Further Regulatory Scrutiny or Change

Based on current trends and common areas of employment dispute, several areas may see further regulatory attention:

- Remote Work: While existing laws generally apply to remote workers, the nuances of compensation, expense reimbursement, and the application of New York's geographically varied wage rates to out-of-state employees reporting to New York supervisors remain areas ripe for clarification. The Pay Transparency Act FAQ already addresses some remote work scenarios.

- Pay Equity and Transparency: Following the initial pay transparency law and the proposed Benefit Transparency Act, further measures to promote pay equity and expand transparency requirements are plausible.

- Wage Theft Provisions: The state may continue to refine and strengthen provisions aimed at preventing and penalizing wage theft, potentially through new definitions or enhanced enforcement mechanisms.

Evolving Enforcement Landscape

The NYSDOL is likely to continue enhancing its enforcement strategies. The recent granting of "quasi-sheriff" powers and other collection tools suggests a commitment to more robust enforcement. Future efforts may involve increased use of data analytics to target industries or employers with higher historical rates of non-compliance, such as the restaurant and construction sectors.

Special Considerations for Specific Employee Populations

New York's pay stub and wage payment laws include specific provisions and considerations for various employee populations whose pay structures may be more complex than standard hourly or salaried roles. Employers must be acutely aware of these nuances.

Tipped Employees

For employees who receive tips, New York law allows employers to take a "tip credit." Key requirements include written notice to employees, proper pay stub disclosure of the tip credit, strict regulation of tip pooling, and careful handling of service charges. Employers must also maintain daily records of tips. Further details on tipped employee regulations are available from the NYSDOL.

Commissioned Salespersons

For employees paid by commission, Article 6 of the NYLL requires a written agreement detailing how wages, commissions, and draws are calculated and paid. Upon request, employers must provide a statement of earnings. Pay stubs must reflect commission payments and state "commission" as a basis of pay. See the NYSDOL FAQ on payment of commissions.

Remote Workers

New York labor laws, including pay stub requirements, generally apply to employees working remotely if their employment is based in New York or if they report to a New York-based supervisor or office. Ensuring accurate pay rates based on applicable New York localities is crucial for remote workers.

Piece-Rate Employees

For employees compensated on a piece-rate basis, NYLL §195.3 mandates that their wage statements include the applicable piece rate(s) and the number of pieces completed at each rate.

Home Care Aides / Prevailing Wage Workers

Specific disclosure requirements apply. Pay stubs for home care aides must include the benefit portion of their total compensation, if applicable. For prevailing wage work, any wage supplements claimed must be detailed on the pay stub or an accompanying notice.

"Manual Workers"

"Manual workers," generally those spending over 25% of their time in physical labor, must be paid weekly under NYLL §191(1)(a), unless specific permission for less frequent payment is obtained. Failure to comply can lead to significant liability, as discussed regarding recent amendments to liquidated damages.

For all these specialized employee populations, the risk of pay stub violations can be heightened. Proper worker classification (e.g., employee vs. independent contractor; exempt vs. non-exempt) is a foundational step for compliance.

Proactive Compliance Strategies for Employers

Given the complexity of New York's wage and hour laws, employers should adopt proactive strategies to ensure adherence.

Developing and Maintaining Compliant Payroll Policies and Procedures

Establish and maintain clear, written payroll policies covering pay schedules, overtime calculation, deduction procedures, error reporting, and pay stub access.

Regular Audits and Training

Conduct periodic internal audits of pay stubs, wage notices, payroll records, wage calculations, deduction practices, and worker classifications. Regular training for HR, payroll staff, and managers on New York wage and hour laws is essential.

Leveraging Technology for Accuracy

Modern payroll systems can help ensure accuracy and compliance, but they must be correctly configured for New York's specific rules. Human oversight and periodic system audits remain critical.

Staying Informed of Legislative and Regulatory Changes

Utilize resources like the NYSDOL website, alerts from employment law firms, and industry association updates to stay informed.

Consulting with Legal Counsel

Consulting with experienced New York labor and employment counsel is highly recommended for tailored advice, policy development, and navigating compliance challenges.

Compliance in New York is an ongoing process. The "set it and forget it" approach to payroll is particularly perilous in this state.

Simplify Your New York Payroll with TimeTrex

Ensuring compliance with New York's complex pay stub regulations doesn't have to be a headache. TimeTrex offers tools designed to help businesses like yours stay on top of payroll requirements, including generating accurate and compliant pay stubs.

Make pay day easier and reduce your compliance risk. Explore our resources, including the New York Pay Stub Generator.

Try Our NY Pay Stub GeneratorConclusion: Staying Ahead in New York Wage and Hour Compliance

Recap of Critical Compliance Imperatives

Navigating New York State's pay stub regulations demands meticulous attention to detail. Key imperatives include ensuring accuracy and completeness of wage statements as mandated by NYLL §195.3 and the WTPA, correct handling of wage notices, strict adherence to deduction rules, and preparedness for regulatory changes.

The Necessity of Ongoing Vigilance and Adaptation

New York labor law is dynamic. Employers must foster continuous learning, review policies regularly, and adapt swiftly to new requirements. This vigilance is essential for mitigating risks and maintaining fair employment practices.

Investing in robust wage and hour compliance can foster improved employee relations, enhance talent attraction and retention, and protect business reputation. Understanding the spirit of New York's wage laws—fairness, transparency, and prevention of worker exploitation—can guide employers in making decisions that are not only compliant but also cultivate a positive work environment.

Final Advisory Note

This report provides general information regarding New York pay stub regulations and related wage and hour laws. It is not intended to serve as legal advice for any specific situation or employer. Given the complexity and evolving nature of these laws, employers are strongly encouraged to consult with qualified New York labor and employment counsel to obtain guidance tailored to their particular circumstances and to ensure full compliance with all applicable legal requirements.

Disclaimer: The content provided on this webpage is for informational purposes only and is not intended to be a substitute for professional advice. While we strive to ensure the accuracy and timeliness of the information presented here, the details may change over time or vary in different jurisdictions. Therefore, we do not guarantee the completeness, reliability, or absolute accuracy of this information. The information on this page should not be used as a basis for making legal, financial, or any other key decisions. We strongly advise consulting with a qualified professional or expert in the relevant field for specific advice, guidance, or services. By using this webpage, you acknowledge that the information is offered “as is” and that we are not liable for any errors, omissions, or inaccuracies in the content, nor for any actions taken based on the information provided. We shall not be held liable for any direct, indirect, incidental, consequential, or punitive damages arising out of your access to, use of, or reliance on any content on this page.

About The Author

Roger Wood

With a Baccalaureate of Science and advanced studies in business, Roger has successfully managed businesses across five continents. His extensive global experience and strategic insights contribute significantly to the success of TimeTrex. His expertise and dedication ensure we deliver top-notch solutions to our clients around the world.

Time To Clock-In

Start your 30-day free trial!

Experience the Ultimate Workforce Solution and Revolutionize Your Business Today

- Eliminate Errors

- Simple & Easy To Use

- Real-time Reporting

Saving businesses time and money through better workforce management since 2003.

Copyright © 2025 TimeTrex. All Rights Reserved.