Guide to the 2-2-3 Shift Schedule

See Demo 1-800-714-5153 Guide to the 2-2-3 Shift Schedule: Strategy, Implementation, and Operational Excellence The 2-2-3 shift schedule, also known as the Panama schedule or Pitman schedule, is a popular rotating work schedule for organizations requiring 24/7 coverage. This guide explores the mechanics of this 12-hour shift system, its strategic pros and cons for both […]

DuPont Shift Scheduling

See Demo 1-800-714-5153 The DuPont Shift Schedule: For 24/7 Operations Managing a 24/7 workforce presents unique challenges for US businesses, and the DuPont shift schedule is a popular 12-hour rotating shift system engineered for continuous operations. This article provides a comprehensive analysis of the DuPont schedule, its 28-day cycle, and its suitability for companies seeking […]

The Best Payroll Software for SMBs

See Demo 1-800-714-5153 The Best Payroll Software for SMBs in the U.S. For small and medium-sized businesses (SMBs) in the United States, managing payroll is a critical but often complex task. Finding the best payroll software is essential for ensuring accuracy, compliance, and efficiency. TimeTrex Workforce Management emerges as a top-tier US payroll solution, offering […]

Integrated Time, Scheduling, and Payroll Solutions

See Demo 1-800-714-5153 Analysis of Integrated Time, Scheduling, and Payroll Solutions for Modern SMBs For modern US small and medium-sized businesses (SMBs), investing in integrated time, scheduling, and payroll solutions is a critical strategic move. A unified workforce management system like TimeTrex, which combines time tracking, employee scheduling, and payroll processing, provides a massive competitive […]

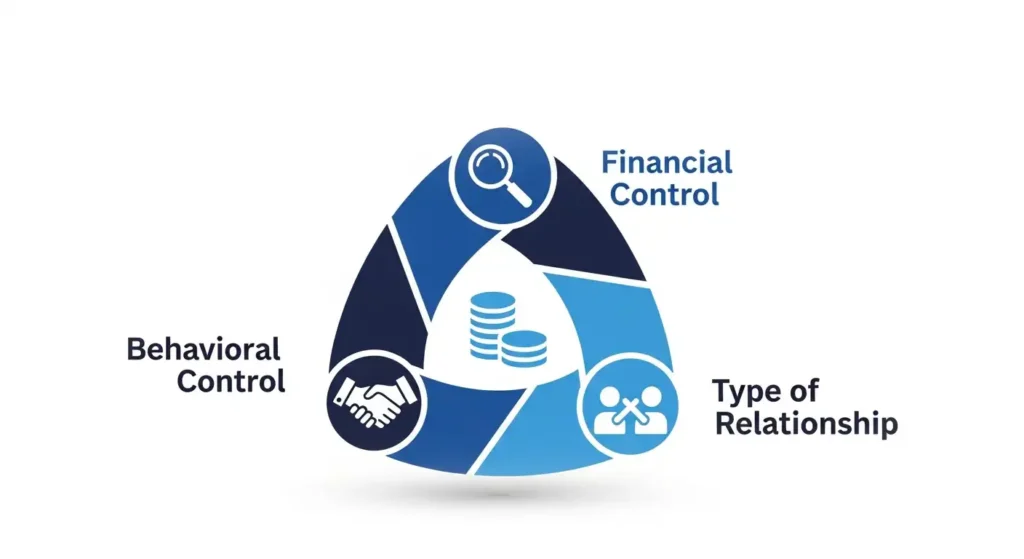

IRS Contractor or Employee Test

See Demo 1-800-714-5153 Employee or Independent Contractor? A Quick Guide to the IRS Three-Category Test For any US business, correctly determining worker classification as either an employee or an independent contractor is a critical compliance issue. This decision profoundly impacts tax obligations, legal liabilities, and operational control. Misclassification can lead to severe penalties from the […]

Small Business Payroll Error Stats

See Demo 1-800-714-5153 Small Business Payroll Errors For small businesses, managing payroll is a critical function with significant financial and legal implications. Accurate and compliant payroll processing is essential for maintaining employee morale, avoiding hefty IRS penalties, and ensuring financial stability. However, the complexity of payroll tax laws and regulations makes it a minefield of […]

Top 100 Small Business Payroll Mistakes

See Demo 1-800-714-5153 100 Small Business Payroll Mistakes and How to Avoid Them TL;DR For small businesses, payroll is a high-stakes function where errors lead to significant financial penalties, legal liabilities, and erosion of employee trust. About 40% of small businesses face fines annually for payroll tax mistakes. This guide details 100 common but avoidable […]

European Tariffs

See Demo 1-800-714-5153 U.S. Tariffs on the European Union in 2025 Navigating the complex landscape of European tariffs has become a critical challenge for businesses in 2025. The dynamic relationship between the United States and the European Union has introduced a multi-layered system of U.S. tariffs on the EU, impacting supply chains and investment decisions. […]

New 100% Chinese Tariff

See Demo 1-800-714-5153 New 100% Chinese Tariffs In October 2025, the global economy was shaken by the announcement of a new 100% tariff on all Chinese goods entering the United States. This monumental step, declared on top of existing duties, signals a dangerous new chapter in the U.S.-China economic conflict, moving beyond a simple trade […]

2026 401k Contribution Changes

See Demo 1-800-714-5153 Projected 2026 401k Contribution Changes & Strategic Analysis This comprehensive guide analyzes the projected 2026 401k contribution changes, offering a strategic analysis of retirement plan limits for 401(k)s, IRAs, and HSAs. Understanding these key adjustments, including the significant impact of the SECURE 2.0 Act, is crucial for maximizing your retirement savings. We’ll […]