Decoding Your Pay Stub: A State-by-State Guide for 2025

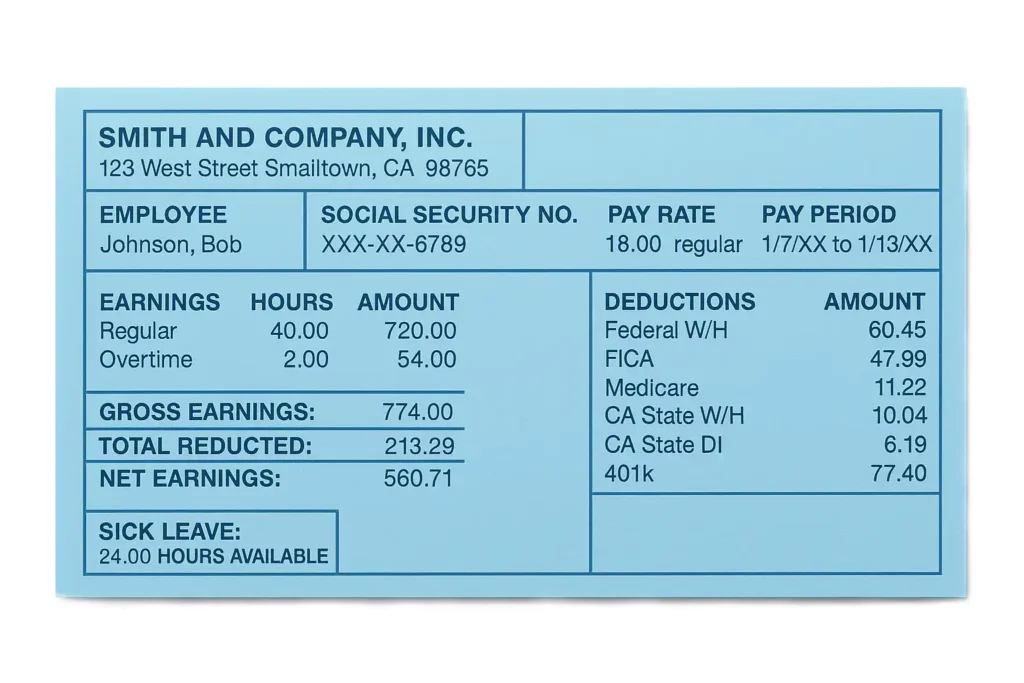

A pay stub, often called a check stub or earnings statement, is more than just a piece of paper or a digital file; it's a critical document for both employees and employers. For employees, it's a transparent record of earnings, deductions, and net pay, essential for financial planning and proof of income. For employers, providing accurate pay stubs is a cornerstone of transparent operations and crucial for legal and tax compliance.

Navigating the landscape of pay stub regulations can be tricky because requirements are not uniform across the United States. This guide will help you understand the varying state-level rules for 2025.

The Legal Landscape: Federal Guidelines vs. State Mandates

Interestingly, there is no overarching federal law that compels employers to issue pay stubs. However, the Internal Revenue Service (IRS) does require employers to maintain precise payroll records for at least four years. The specific rules about whether pay stubs must be provided, how they are delivered, and what information they must contain fall to individual state laws. This means businesses, especially those operating in multiple states, must be diligent in understanding and adhering to diverse local requirements.

How States Handle Pay Stub Delivery

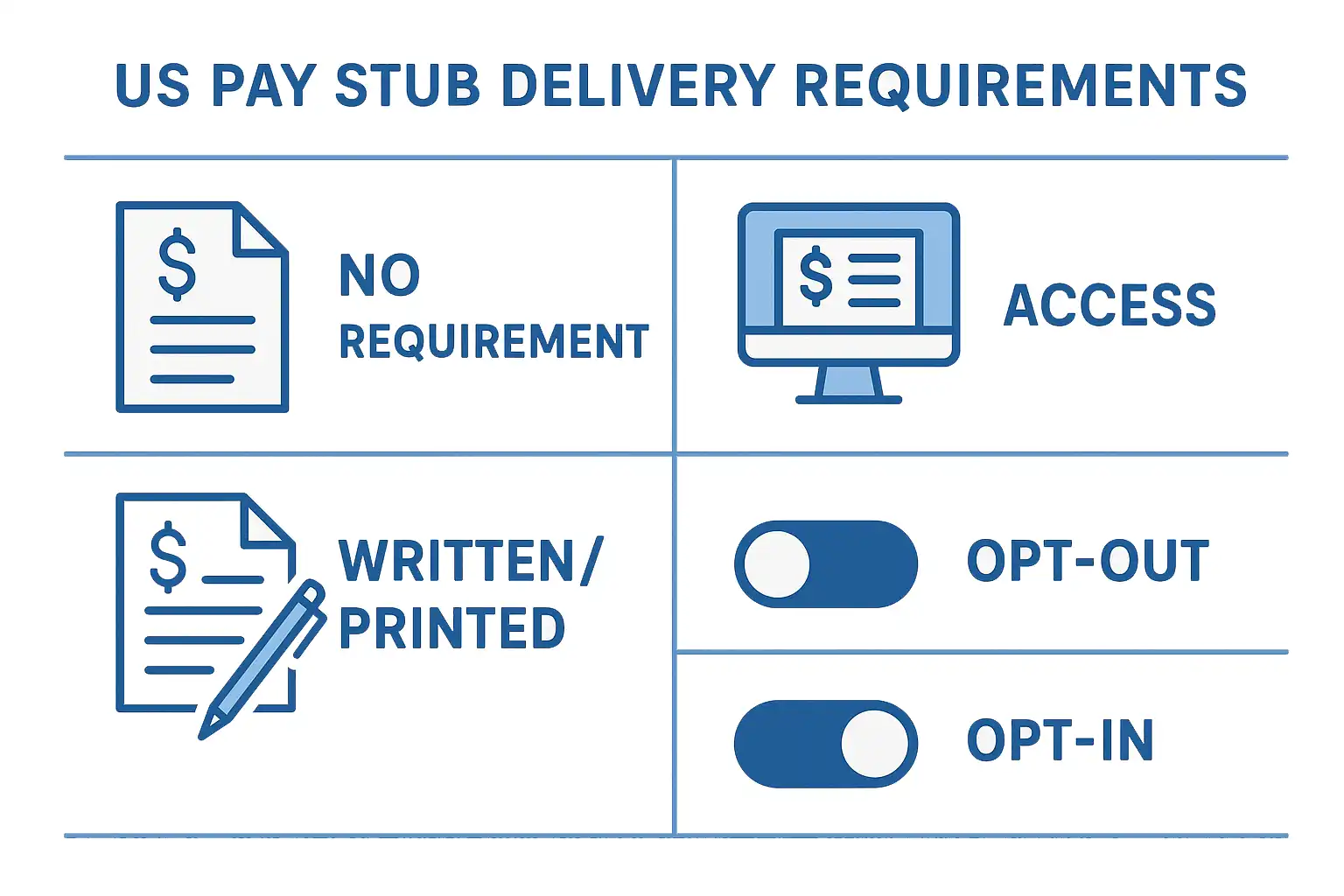

When it comes to providing pay stubs, states generally adopt one of the following approaches. Understanding which category your state falls into is the first step towards compliance:

- No Requirement: Employers in these states are not legally obligated by state law to provide pay stubs to employees, though many still do as a best practice.

- Access: These states require employers to grant employees access to their pay information. This access can be electronic (e.g., through an online portal) or via paper copies.

- Written/Printed: States in this category mandate that employers provide physical written or printed pay stubs to employees.

- Opt-Out: Here, employers can provide electronic pay stubs by default. However, employees must have the option to "opt-out" and request paper copies instead.

- Opt-In: In contrast to opt-out, these states require employers to obtain explicit employee consent before transitioning to electronic pay stubs. Without consent, paper stubs are the default.

State-by-State Pay Stub Delivery Requirements

Find your state in the table below to see its specific requirement type for pay stub delivery:

| State | Requirement Type |

|---|---|

| Alabama | No Requirement |

| Alaska | Access |

| Arizona | Access |

| Arkansas | No Requirement |

| California | Written/Printed |

| Colorado | Written/Printed |

| Connecticut | Written/Printed |

| Delaware | Opt-Out |

| Florida | No Requirement |

| Georgia | No Requirement |

| Hawaii | Opt-In |

| Idaho | Access |

| Illinois | Access |

| Indiana | Access |

| Iowa | Written/Printed |

| Kansas | Access |

| Kentucky | Access |

| Louisiana | No Requirement |

| Maine | Written/Printed |

| Maryland | Access |

| Massachusetts | Written/Printed |

| Michigan | Access |

| Minnesota | Opt-Out |

| Mississippi | No Requirement |

| Missouri | Access |

| Montana | Access |

| Nebraska | Access |

| Nevada | Access |

| New Hampshire | Access |

| New Jersey | Access |

| New Mexico | Written/Printed |

| New York | Access |

| North Carolina | Written/Printed |

| North Dakota | Access |

| Ohio | No Requirement |

| Oklahoma | Access |

| Oregon | Opt-Out |

| Pennsylvania | Access |

| Rhode Island | Access |

| South Carolina | Access |

| South Dakota | No Requirement |

| Tennessee | No Requirement |

| Texas | Written/Printed |

| Utah | Access |

| Vermont | Written/Printed |

| Virginia | Access |

| Washington | Written/Printed |

| West Virginia | Access |

| Wisconsin | Access |

| Wyoming | Access |

Unpacking the Details: What Information Must a Pay Stub Include?

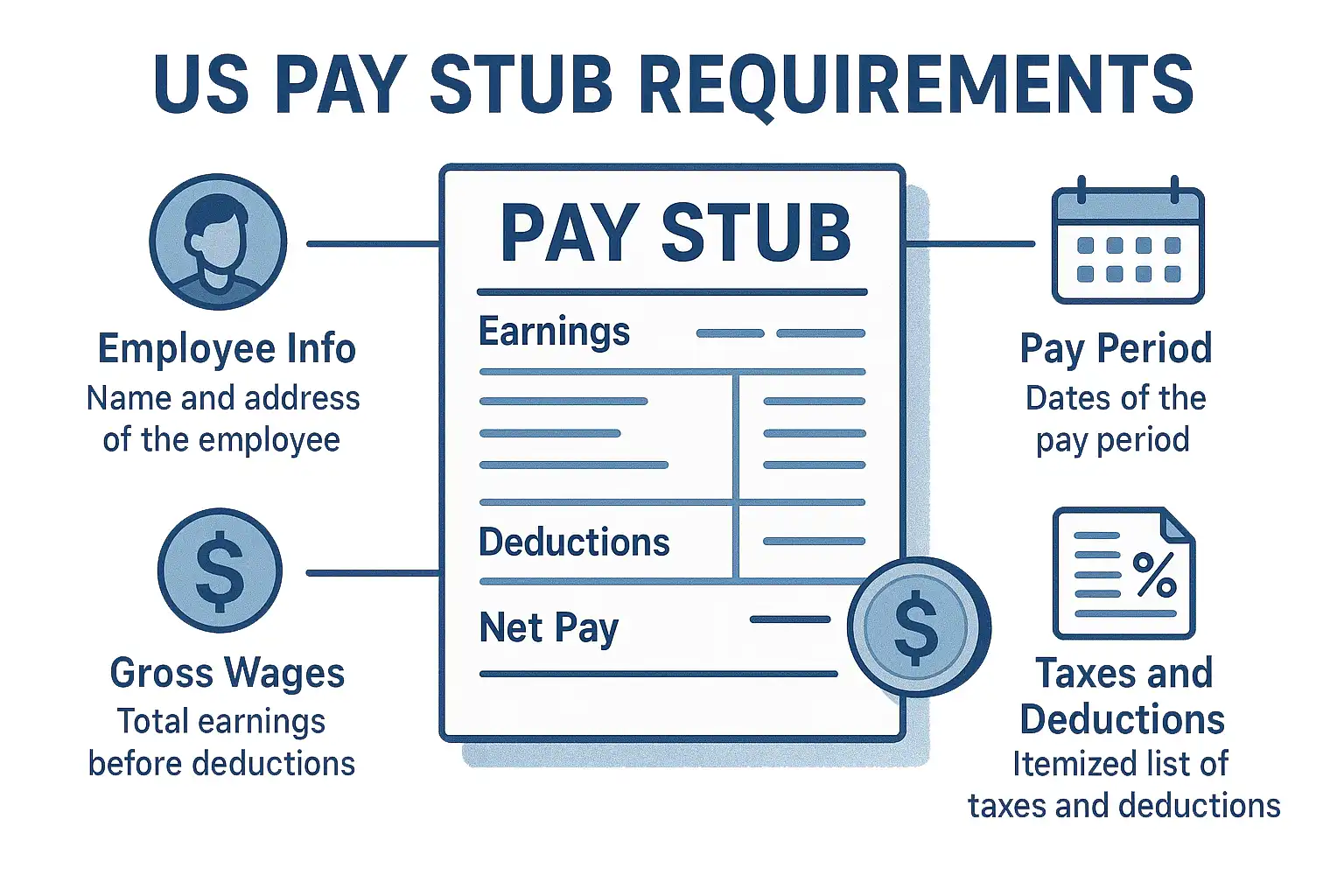

Beyond just *providing* a pay stub, many states also dictate the specific pieces of information that must be included. These requirements aim to ensure full transparency for employees regarding their compensation. Common elements include employee and employer identifiers, pay period dates, detailed earnings, itemized deductions, and net pay. However, the exact list varies significantly. Below, we explore the requirements in a few example states to illustrate this diversity.

Pay Stub Requirements in Texas

In Texas, employers who provide pay stubs should ensure they include at least the following:

- Employee’s name

- Employer’s name

- Employer’s address

- Pay period dates

- Hours worked

- Itemized deductions

- Gross pay

- Net pay

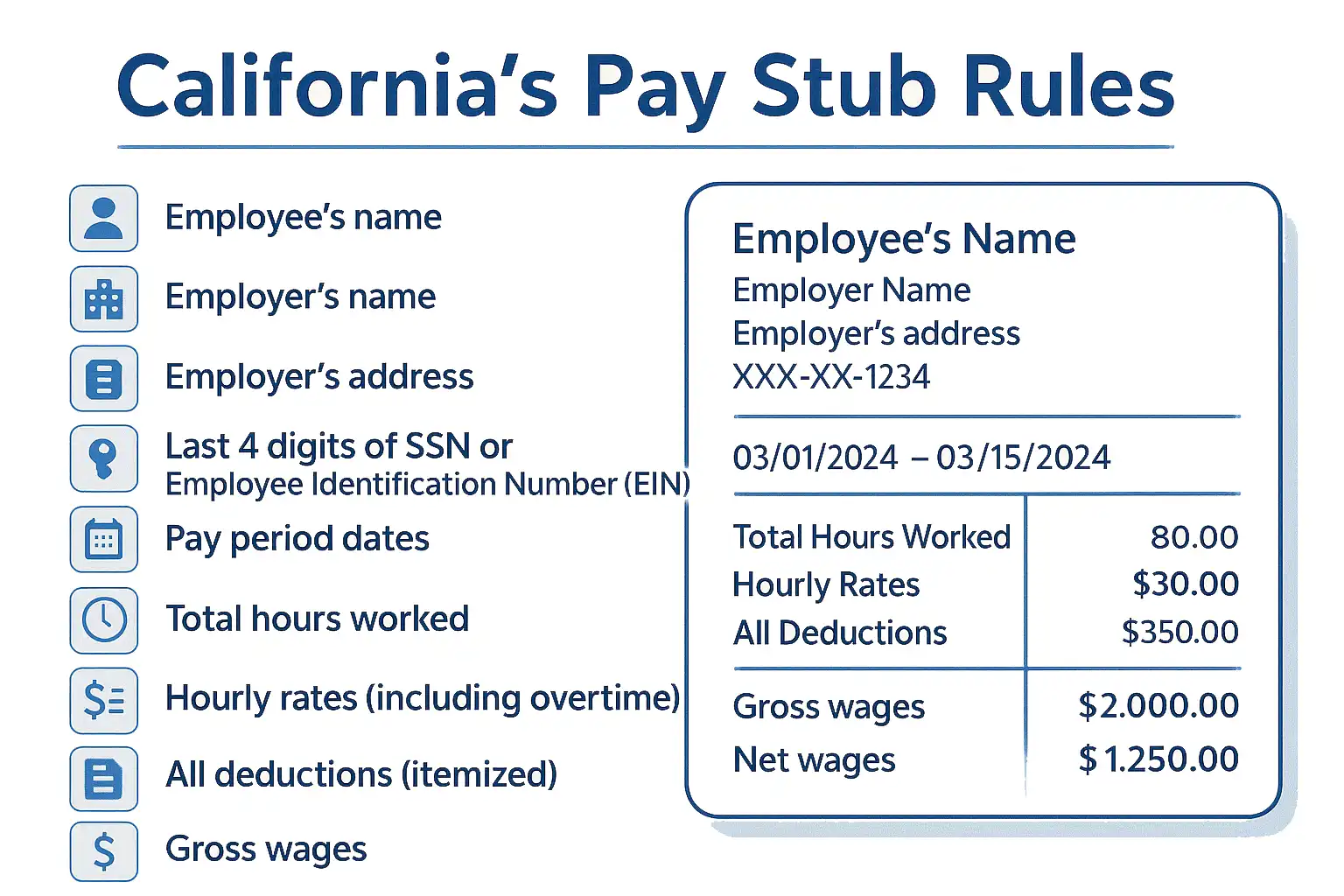

A Look at California's Pay Stub Rules

California has some of the most detailed pay stub requirements in the nation, mandating information such as:

- Employee’s name

- Employer’s name

- Employer’s address

- Last 4 digits of SSN or Employee Identification Number (EIN)

- Pay period dates

- Total hours worked

- Hourly rates (including overtime)

- All deductions (itemized)

- Gross wages

- Net wages

Colorado Pay Stub Essentials

Employers in Colorado are required to provide pay stubs that detail:

- Employee’s name

- Employer’s name

- Employer’s address

- Employee’s SSN

- Inclusive dates of the pay period

- All withholdings and deductions

- Gross wages earned

- Net wages

Illinois Pay Stub Information

In Illinois, pay stubs should clearly present:

- Employee’s name

- Employer’s name

- Employer’s address

- Hours worked

- Rate of pay

- Itemized deductions

- Gross wages

- Net pay

New York State Pay Stub Mandates

New York requires comprehensive details on employee pay stubs, including:

- Employee’s name

- Employer’s name

- Employer’s address

- Employer’s phone number

- Pay period dates

- Hours worked (detailing regular and overtime)

- Rate of pay (and basis thereof, e.g., hourly, salary, commission)

- Allowances claimed

- Deductions (itemized)

- Gross wages

- Net Wages

Massachusetts Pay Stub Breakdown

For employees in Massachusetts, pay stubs must contain:

- Employee’s name

- Employer’s name

- Date of payment

- Number of hours worked during the pay period

- Hourly rate

- All deductions or increases made during the pay period (itemized)

Ensuring Compliance: A Must for Employers

The examples above highlight the significant variations in state-level pay stub laws. For small businesses and payroll managers, staying abreast of these specific requirements is critical. Non-compliance can lead to penalties, employee disputes, and legal complications.

Always a Best Practice: Regardless of your state's minimum requirements, providing clear, comprehensive pay stubs fosters trust and transparency with your employees.

Actionable Advice: Regularly consult your state's Department of Labor website or seek guidance from legal counsel specializing in employment law to ensure you meet all current obligations for 2025 and beyond.

Simplify Your Payroll & Stay Compliant with TimeTrex

Feeling overwhelmed by the complexities of pay stub regulations and payroll management? TimeTrex offers robust payroll solutions specifically designed to help small and medium-sized businesses navigate these challenges, ensuring accuracy and compliance with ease.

Discover TimeTrex Payroll SolutionsDisclaimer: The content provided on this webpage is for informational purposes only and is not intended to be a substitute for professional advice. While we strive to ensure the accuracy and timeliness of the information presented here, the details may change over time or vary in different jurisdictions. Therefore, we do not guarantee the completeness, reliability, or absolute accuracy of this information. The information on this page should not be used as a basis for making legal, financial, or any other key decisions. We strongly advise consulting with a qualified professional or expert in the relevant field for specific advice, guidance, or services. By using this webpage, you acknowledge that the information is offered “as is” and that we are not liable for any errors, omissions, or inaccuracies in the content, nor for any actions taken based on the information provided. We shall not be held liable for any direct, indirect, incidental, consequential, or punitive damages arising out of your access to, use of, or reliance on any content on this page.

About The Author

Roger Wood

With a Baccalaureate of Science and advanced studies in business, Roger has successfully managed businesses across five continents. His extensive global experience and strategic insights contribute significantly to the success of TimeTrex. His expertise and dedication ensure we deliver top-notch solutions to our clients around the world.

Time To Clock-In

Start your 30-day free trial!

Experience the Ultimate Workforce Solution and Revolutionize Your Business Today

- Eliminate Errors

- Simple & Easy To Use

- Real-time Reporting

Saving businesses time and money through better workforce management since 2003.

Copyright © 2025 TimeTrex. All Rights Reserved.