Alabama Payroll Taxation: A Guide for Employers in 2025 and Beyond

Executive Summary: Navigating Alabama's Payroll Tax Landscape in 2025 and Beyond

Employers in Alabama face a multi-layered system of payroll tax obligations, encompassing state income tax withholding, state unemployment insurance contributions, and a variety of local taxes. The landscape for 2025 and the immediate years following presents a dynamic environment, marked by significant legislative shifts. Notably, a temporary exemption for state income tax on certain overtime pay is scheduled to terminate mid-2025, necessitating adjustments to payroll withholding processes. Looking further ahead, new rules governing the taxation of mobile workforces are set to take effect in 2026, introducing new considerations for employers with non-resident employees performing temporary work in the state.

Alabama's state income tax system is progressive, with rates increasing as income rises. The state unemployment insurance (SUI) program is funded exclusively by employers, with rates determined by factors including employer experience and overall fund health. Compounding these state-level responsibilities is a complex patchwork of local occupational taxes levied by various municipalities, each with its own rates and administrative requirements. Recent legislative sessions have also introduced a series of changes characterized as "taxpayer-friendly," aiming to alleviate certain burdens and modernize tax administration.

The confluence of these factors—expiring provisions, new legislation, and the existing multi-jurisdictional local tax system—points towards an increasingly intricate compliance environment for Alabama employers. The mid-year termination of the overtime pay exemption, for instance, will require a precise adjustment to withholding calculations. Simultaneously, the impending mobile workforce rules will necessitate new tracking mechanisms and withholding decisions for non-resident employees. Coupled with the ongoing need to navigate diverse local occupational tax ordinances, these developments underscore a heightened need for agility in payroll administration. Businesses may find it necessary to invest in more sophisticated payroll systems or seek specialized tax counsel to effectively manage these evolving obligations and mitigate the risk of non-compliance.

Furthermore, the pattern of recent legislative activity, including the introduction of "taxpayer-friendly changes" and measures designed to address contemporary work arrangements like the mobile workforce rules, suggests an active legislative environment concerning taxation in Alabama. The temporary nature of the overtime exemption itself indicates a willingness to employ short-term tax policies to achieve specific economic or fiscal objectives. This proactive legislative stance implies that employers should not view the changes slated for 2025 and 2026 as the final word. Instead, businesses must anticipate the potential for ongoing adjustments, clarifications, and new tax laws, necessitating continuous monitoring of legislative and administrative developments to ensure sustained compliance.

Overview of Employer Payroll Tax Responsibilities in Alabama

Employers in Alabama are tasked with managing a spectrum of payroll tax obligations, distinct from, yet often administered alongside, federal requirements. Understanding these responsibilities is fundamental to maintaining compliance and avoiding potential penalties.

Federal Context

For background, federal payroll taxes include the Federal Insurance Contributions Act (FICA) taxes, which fund Social Security and Medicare programs. Both employers and employees contribute to FICA taxes. Additionally, the Federal Unemployment Tax Act (FUTA) imposes a tax on employers to fund federal unemployment programs, which works in conjunction with state unemployment systems, as detailed by the U.S. Department of Labor.

State-Level Obligations

Beyond federal mandates, Alabama imposes its own set of payroll taxes:

- State Income Tax (SIT) Withholding: Employers must withhold Alabama state income tax from employees' wages.

- State Unemployment Insurance (SUI): Employers are liable for SUI taxes to fund unemployment benefits for eligible former employees.

- Local Taxes: Various municipalities in Alabama levy local payroll taxes, most commonly in the form of occupational taxes, which employers are typically required to withhold.

Employer Registration Requirements

A foundational step for payroll tax compliance is proper registration with the relevant state agencies. Employers are required to register with the Alabama Department of Revenue (ADOR) to obtain a withholding tax account number, which is essential for remitting state income tax withheld from employees' pay. For State Unemployment Insurance, employers must register with the Alabama Department of Labor, a process that can typically be completed online and results in the issuance of an SUI account number.

Securing these tax account numbers is more than a mere administrative formality; it is a critical step that integrates a business into the state's tax administration framework. This registration often initiates the flow of essential information from state agencies, including tax updates, forms, and notices regarding changes in laws or rates. Consequently, timely and accurate registration serves as a gateway to receiving crucial compliance information, whereas a failure to register can leave a business operating in an informational vacuum, significantly increasing the risk of non-compliance.

While registration for state-level taxes is centralized through the ADOR and the Department of Labor, the administration of local occupational taxes presents a more fragmented landscape. Information regarding these local taxes, as well as registration and remittance procedures, is highly decentralized. Employers must engage directly with individual city or municipal governments to ascertain their obligations. This decentralization imposes a considerable administrative burden, particularly for businesses with employees working in multiple jurisdictions across Alabama. The necessity to research, register, and comply with varying local ordinances for each work location elevates the risk of unintentional non-compliance and underscores the complexity of payroll administration in the state.

Alabama State Income Tax (SIT) Withholding

Alabama's state income tax (SIT) is a key component of an employer's payroll responsibilities. The state utilizes a progressive tax system, where the tax rate applied to an employee's income increases as their income level rises, similar in structure to the federal income tax system.

2025 Tax Rates and Brackets

For the 2025 tax year, Alabama imposes three income tax rates: 2%, 4%, and 5%. The specific income brackets to which these rates apply vary based on the employee's filing status, as reported by sources like Valur.

| Filing Status | Taxable Income Bracket | Tax Rate |

|---|---|---|

| Single / Head of Household / Married Filing Separately | $0 - $500 | 2% |

| $501 - $3,000 | 4% | |

| Over $3,000 | 5% | |

| Married Filing Jointly | $0 - $1,000 | 2% |

| $1,001 - $6,000 | 4% | |

| Over $6,000 | 5% | |

| Source: Adapted from Valur. Employers should verify with official ADOR publications. | ||

Standard Deductions and Personal Exemptions for 2025

To determine an employee's taxable income for withholding purposes, standard deductions and personal exemptions are considered. Information updated in May 2025 indicates the 2025 standard deduction for single filers is $4,500, and for those married filing jointly, it is $11,500. Earlier information from March 2025 suggested different standard deduction amounts based on income levels for single filers. Given the later update, the figures of $4,500 (single) and $11,500 (married filing jointly) are presented here as the more likely current amounts for the standard deduction. However, this discrepancy highlights the critical importance for employers to consult official Alabama Department of Revenue (ADOR) publications for the 2025 tax year, once available, to confirm the precise figures. Such official sources provide the definitive amounts for tax calculations.

In addition to standard deductions, personal and dependent exemptions further reduce taxable income:

| Item | Single Filers | Married Filing Jointly | Dependent Exemption Details (per dependent) |

|---|---|---|---|

| Standard Deduction | $4,500 | $11,500 | N/A |

| Personal Exemption | $1,500 | (Not specified for MFJ, typically double single) | N/A |

| Dependent Exemption | N/A | N/A | $1,000 if employee wages are $0 - $50,000 $500 if employee wages are $50,001 - $100,000 $300 if employee wages are over $100,000 |

| Source: Adapted from Valur and GoCo.io. Employers should verify with official ADOR publications. | |||

Withholding Requirements and Employee Forms (Form A-4)

Employers are mandated to withhold Alabama SIT from employee wages based on the information provided by the employee on Form A-4, Employee's Withholding Exemption Certificate. This form serves as Alabama's counterpart to the federal Form W-4 and collects necessary details such as filing status and allowances to determine the correct withholding amount. It is important to note that Alabama law does not permit employees to elect no withholding entirely. For supplemental wages, such as bonuses, a flat withholding rate of 5.00% may be applied, according to resources like Paylocity.

Employer Reporting and Remittance

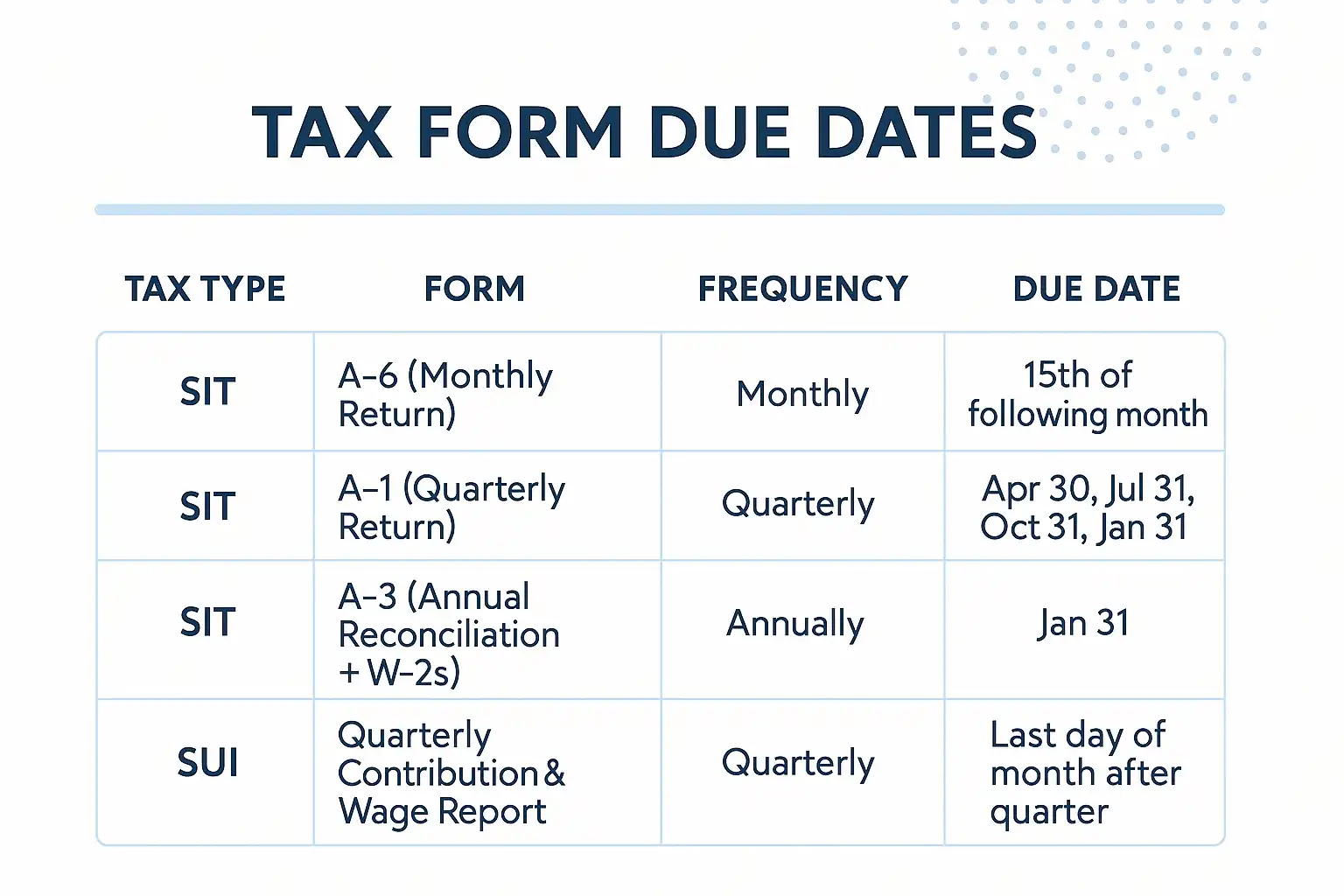

Alabama employers have specific reporting and remittance obligations for SIT withheld. These are managed through a series of forms and, increasingly, via electronic systems.

Forms:

- Form A-1, Quarterly Return of Income Tax Withheld: Filed by employers with smaller annual withholding liabilities, typically less than $1,000.

- Form A-6, Monthly Return of Income Tax Withheld: Required for employers who withheld more than $1,000 in SIT during the previous year.

- Form A-3, Annual Reconciliation of Alabama Income Tax Withheld: This form reconciles the total SIT withheld throughout the year with the amounts remitted. It must be filed annually and accompanied by copies of all employee W-2 forms.

Filing Frequencies and Due Dates:

- Form A-6 (Monthly): Due by the 15th day of the month following the reporting period.

- Form A-1 (Quarterly): Due on April 30, July 31, October 31, and January 31.

- Form A-3 (Annual) and W-2s: Due by January 31 of the following year.

Electronic Filing and Payment: The Alabama Department of Revenue encourages, and in some cases mandates, electronic filing and payment through its My Alabama Taxes (MAT) portal. Specifically, employers remitting payments of $750 or more are required to do so electronically. Furthermore, employers who issue 10 or more W-2 forms (and/or Form 1099s with Alabama tax withheld) must electronically file Form A-3 and its accompanying W-2s/1099s via the MAT system. These electronic filing and payment thresholds effectively steer a significant number of employers towards digital interaction with the ADOR.

| Tax Type | Form Name/Number | Filing Frequency | Due Dates | Typical Filer |

|---|---|---|---|---|

| SIT | Form A-6 (Monthly Return) | Monthly | 15th of the month following the reporting period | Employers withholding > $1,000 in previous year |

| SIT | Form A-1 (Quarterly Return) | Quarterly | April 30, July 31, October 31, January 31 | Employers withholding < $1,000 annually |

| SIT | Form A-3 (Annual Reconciliation) with W-2s | Annually | January 31 | All employers withholding SIT |

| SUI | Quarterly Contribution and Wage Report | Quarterly | Last day of the month following the end of the quarter (e.g., April 30 for Q1) | All employers subject to SUI tax |

| Source: Adapted from GoCo.io and ADOR guidelines. | ||||

Penalties for Non-Compliance (SIT)

Failure to comply with Alabama SIT withholding, reporting, and remittance requirements can result in significant penalties:

- Late Filing Penalty: A penalty for failing to timely file a return is assessed at the greater of 10% of the tax due on the return or $50, as noted by the ADOR. Other sources mention 10% of the unpaid tax amount, plus interest.

- Late Payment Penalty: A penalty for failing to timely pay tax due is 10% of the delinquent tax. This is echoed by multiple sources, including Deel.

- Interest: Interest accrues on any underpayment of tax from the due date until the date of payment. The interest rate is set in accordance with the rate established by the Secretary of the Treasury under 26 U.S.C. § 6621.

- Incorrect or Incomplete Filings: A penalty of $50 may be assessed for each inaccurate or incomplete Form A-4 submitted.

- Failure to File Form A-3 with W-2s: Employers who fail to file Form A-3 along with the required W-2 forms by the January 31 deadline may face an additional penalty of $50 for each missing or late W-2.

Alabama State Unemployment Insurance (SUI) Tax

Alabama's State Unemployment Insurance (SUI) system provides temporary financial assistance to individuals who have lost their jobs through no fault of their own and meet state-specific eligibility criteria. This program is funded by taxes levied on employers; employees do not contribute to the SUI fund.

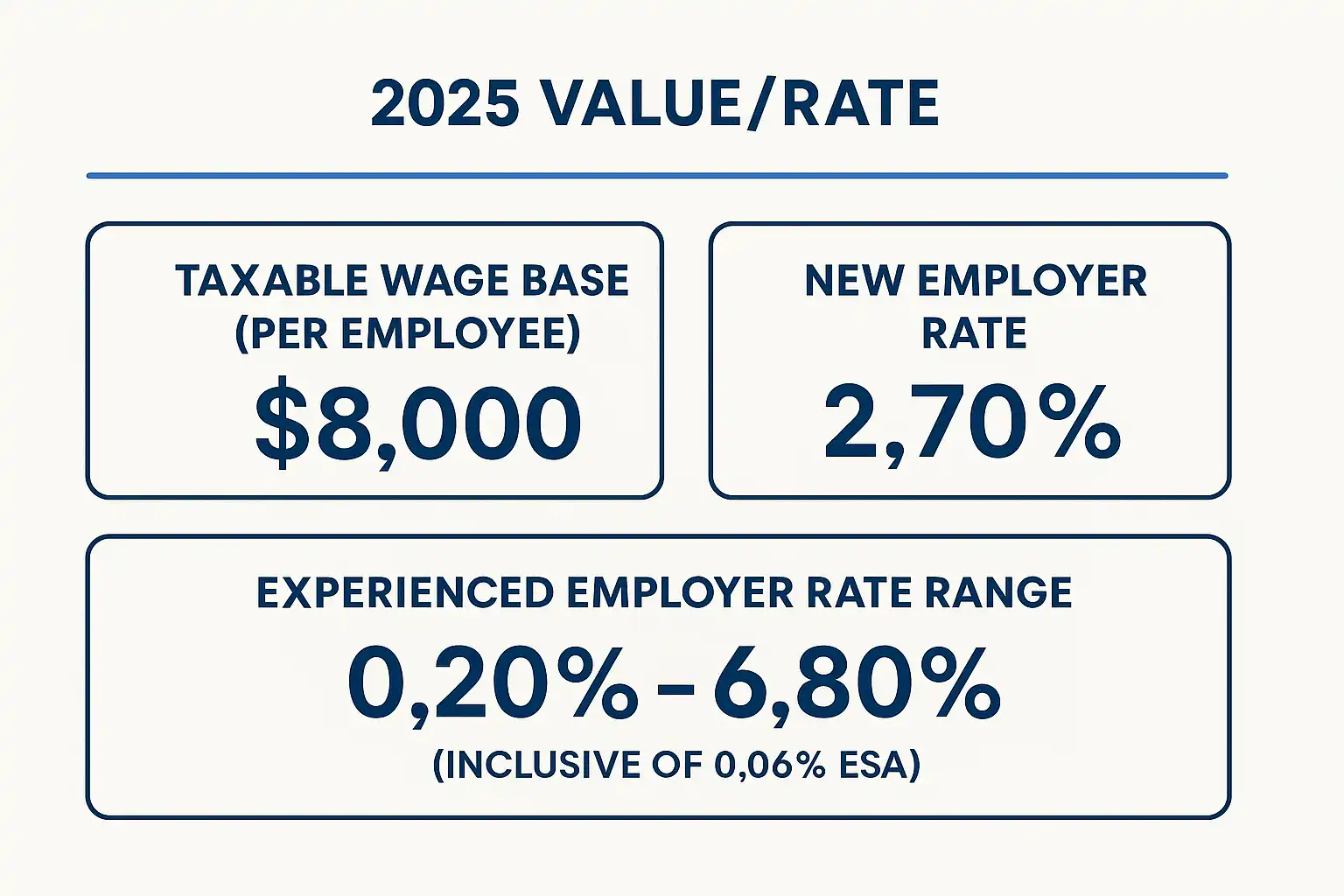

2025 Taxable Wage Base

For the 2025 calendar year, Alabama employers are required to pay SUI taxes on the first $8,000 of wages paid to each employee. This means that once an employee's cumulative earnings for the year exceed $8,000, no further SUI tax is due on that employee's wages from that employer for the remainder of the year. This $8,000 cap is a critical factor in calculating an employer's total SUI liability and is a common figure cited by payroll resources like Paylocity.

2025 SUI Tax Rates

SUI tax rates in Alabama vary depending on whether an employer is new to the system or has an established employment history in the state.

- New Employer Rate: For 2025, employers newly liable under Alabama's SUI law will pay taxes at a rate of 2.70% on the taxable wages paid to each employee, as reported by sources such as OnPay.

- Experienced Employer Rate Range: For employers with an established history, SUI tax rates are determined through an experience rating system. For 2025, these rates can range from 0.20% to 6.80%. This range appears more widely cited and aligns with tax rate schedules published by the Alabama Department of Labor.

Experience Rating System: An employer's specific rate is calculated based on their individual experience, primarily their history of benefit charges (unemployment benefits paid to former employees) relative to their taxable payrolls over the three most recent complete fiscal years (July 1 - June 30). This system directly links an employer's SUI tax costs to their workforce stability.

Employment Security Enhancement Assessment (ESA): The SUI rates for experienced employers are inclusive of a 0.06% Employment Security Enhancement Assessment (ESA). The final rate assigned to an employer also depends on which of the four statutory rate schedules (A, B, C, or D) is in effect for the year, which is determined by the overall health of the state's unemployment trust fund.

| Item | 2025 Value/Rate |

|---|---|

| Taxable Wage Base (per employee) | $8,000 |

| New Employer Rate | 2.70% |

| Experienced Employer Rate Range | 0.20% - 6.80% (inclusive of 0.06% ESA) |

| Source: Adapted from Paylocity, OnPay, and Alabama Department of Labor. | |

Employer Reporting and Payment

Employers subject to Alabama SUI tax must file a Quarterly Contribution and Wage Report. These reports detail the wages paid to each employee during the quarter and calculate the SUI tax due. Typically, these quarterly reports and the accompanying tax payments are due by the last day of the month following the end of each calendar quarter (e.g., April 30 for the first quarter, July 31 for the second, October 31 for the third, and January 31 for the fourth). The Alabama Department of Labor provides an online portal, eGov, for employers to file these reports and make payments electronically.

Specific Employer Categories

The thresholds for SUI liability vary for different types of employers, as detailed by the Alabama Department of Labor:

- Non-Farm Business Employers: Become subject if they have one or more workers employed on any day in 20 or more different weeks in a calendar year, or if they pay wages of $1,500 or more in any calendar quarter.

- Agricultural Employers: Become subject if they employ 10 or more agricultural workers in 20 or more different weeks in a calendar year, or if they pay $20,000 or more in total cash wages to agricultural workers during any calendar quarter (consistent with federal guidelines).

- Household Domestic Employers: Become subject if they pay $1,000 or more in total cash wages to domestic workers in a private home, college club, or local chapter of a college fraternity or sorority in any calendar quarter.

Penalties for Non-Compliance (SUI)

While specific penalty amounts for SUI non-compliance in 2025 were not exhaustively detailed in the available information, general state tax provisions regarding late filing and late payment of taxes would apply. Employers can expect penalties and interest for failure to file quarterly reports or remit SUI contributions by the established deadlines. Timely and accurate reporting and payment are crucial to avoid these additional costs.

Local Payroll Taxes: Focus on Occupational Taxes

In addition to state-level payroll taxes, employers in Alabama must also contend with local payroll taxes, predominantly in the form of municipal occupational taxes. These taxes are levied by certain cities and counties on the wages earned by individuals for work performed within their specific geographic jurisdictions. The revenue generated from these taxes is typically used to fund local public services, such as city operations and local education initiatives, as noted by localities like Leeds, AL.

Employer Responsibilities

The administration of occupational taxes falls largely on employers:

- Withholding: Employers are generally responsible for withholding the applicable occupational tax from the gross earnings of employees who perform work within the taxing locality.

- Remittance: Unlike state taxes that are remitted to state agencies, occupational taxes must be paid directly to the finance or revenue department of the specific city or municipality imposing the tax. There is no central state-level collection agency for these local taxes, a point highlighted by the Alabama League of Municipalities.

- Reporting: Reporting requirements vary by municipality but commonly involve filing periodic returns (e.g., monthly or quarterly) detailing the wages subject to tax and the amount of tax withheld. An annual reconciliation of taxes withheld and paid is also often required.

- Record-Keeping: Employers are expected to maintain accurate records of wages paid, taxes withheld, and remittances made. For example, the City of Leeds requires such records to be kept for at least five years, according to their occupational tax information.

The absence of a centralized system for these local occupational taxes, coupled with the wide variations in rules and rates, creates a significant administrative and compliance challenge. This is particularly true for companies with employees working across multiple Alabama municipalities.

Variability in Rates and Rules

A defining characteristic of Alabama's local occupational taxes is their lack of uniformity. Tax rates, the definition of taxable wages, remittance frequencies, and reporting forms can differ significantly from one city or county to another.

| City | Occupational Tax Rate | General Remittance Frequency (if specified) |

|---|---|---|

| Auburn | 1% of gross wages | Quarterly (per City of Auburn) |

| Bessemer | 1% | Not specified in source |

| Birmingham | 1% | Not specified in source |

| Gadsden | 2% | Not specified in source |

| Leeds | 1% of gross earnings | Monthly (per City of Leeds) |

| Mobile | (Rate not specified in provided summary text) | Not specified in source |

| Montgomery | (Rate not specified in provided summary text) | Not specified in source |

| Opelika | 1.5% | Not specified in source |

| Tuskegee | 2% | Not specified in source |

| Source: Adapted from SBCTC document and city websites. Rates should be verified directly with each municipality. | ||

This hyper-local nature of occupational taxes inherently fuels the demand for more sophisticated payroll solutions capable of accurately assigning wages to specific tax jurisdictions and applying the correct local tax rates and rules.

Compliance Considerations

Given the decentralized and varied nature of these taxes, employers must exercise significant diligence. It is imperative to:

- Identify all municipalities where employees perform work, even temporarily.

- Contact the relevant city or county finance/revenue department for each location to obtain specific information on occupational tax rates, registration requirements, forms, and deadlines.

- Implement payroll systems capable of handling multiple local tax withholdings accurately.

Penalties for Non-Compliance with Local Tax Ordinances

Failure to comply with local occupational tax ordinances can lead to penalties and interest charges, as stipulated by each locality. For instance:

- The City of Leeds imposes interest at 12% per annum on unpaid occupational taxes, along with a 10% penalty on the unpaid amount.

- The City of Auburn also assesses penalties and interest on returns and payments received after the delinquent date.

While state-level penalty structures for late tax payments offer a general indication of the seriousness with which tax delinquency is viewed, the specific penalties for local tax non-compliance are governed by the ordinances of each individual municipality.

Significant Payroll-Related Tax Changes and Developments for 2025 and Beyond

The Alabama tax landscape is subject to ongoing legislative and administrative adjustments. Several significant changes will impact employer payroll responsibilities in 2025 and 2026.

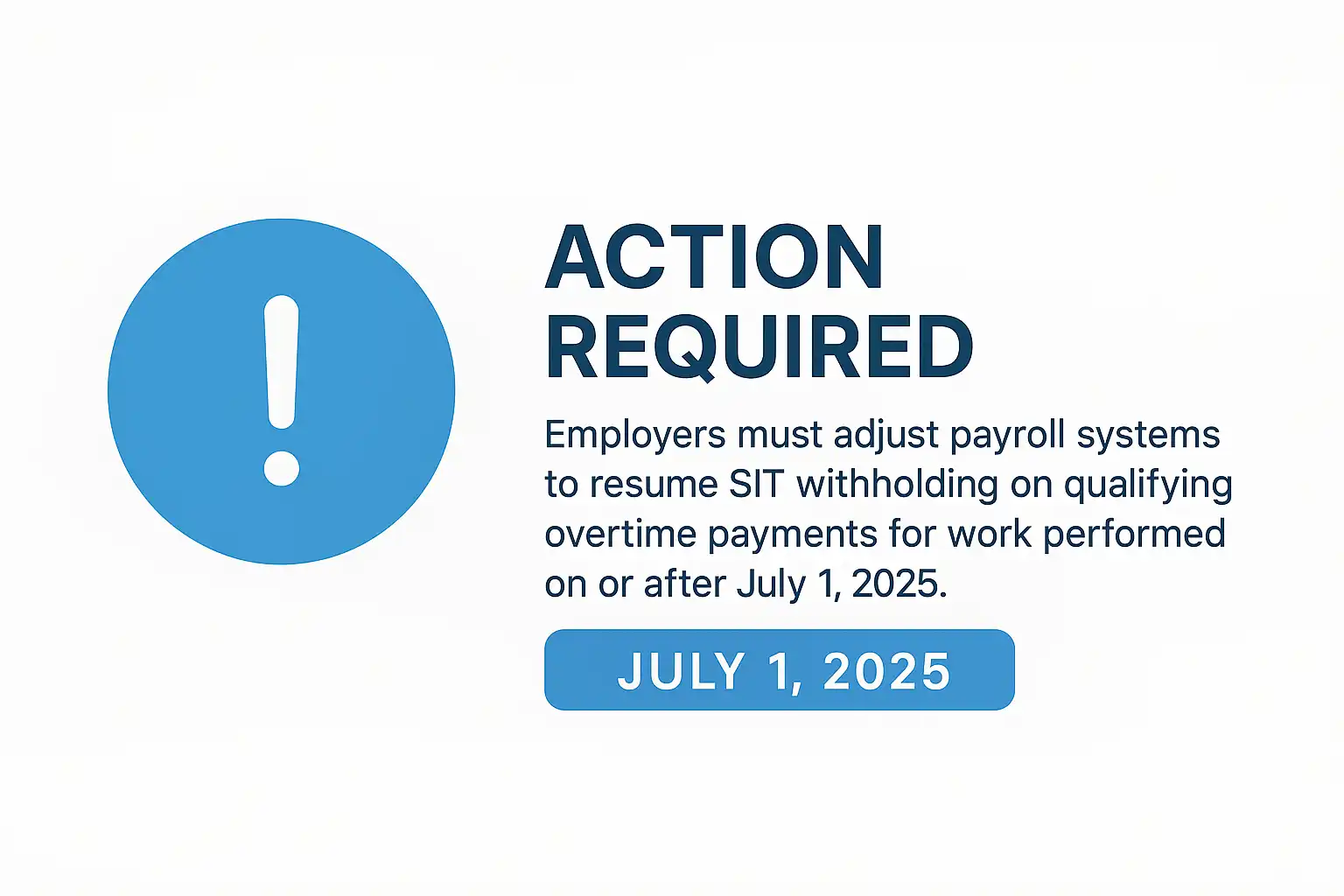

Overtime Pay Exemption Expiration

A notable temporary measure affecting Alabama State Income Tax (SIT) withholding is set to expire. Effective January 1, 2024, overtime pay received by full-time hourly wage employees for hours worked in excess of 40 in a workweek was excluded from gross income and therefore exempt from Alabama SIT, as explained by resources like Gusto.

- Expiration Date: This exemption is legislatively scheduled to end on June 30, 2025. Barring any new legislative action to extend it, the taxation of such overtime wages for SIT purposes will resume on July 1, 2025.

Implications for Withholding: This mid-year expiration necessitates a critical adjustment in payroll systems and processes. Failure to update payroll systems accurately and promptly can lead to incorrect withholding.

Employer Reporting: During the exemption period, employers were required to report the total aggregate amount of overtime paid that qualified for the exemption and the total number of employees who received such overtime pay. These specific reporting requirements are expected to cease after the exemption period concludes and final reconciliations are made.

Mobile Workforce Legislation (H.B. 379 - Effective January 1, 2026)

Alabama has enacted legislation (H.B. 379) that introduces new rules for the income taxation and withholding for certain non-resident employees who perform work in the state on a temporary basis. These provisions are effective January 1, 2026, as detailed by tax news services like EY Tax News.

- 30-Day Safe Harbor: The legislation provides a safe harbor that exempts compensation paid to a qualifying non-resident employee from Alabama income tax and withholding if the employee performs duties in Alabama for 30 or fewer days during a calendar year.

Conditions for Exemption: To qualify for this 30-day exemption, several conditions must be met:

- The employee must have performed employment duties in more than one state during the calendar year.

- The compensation must not be paid to individuals working in their capacity as professional athletes, professional entertainers, or public figures (these roles have specific definitions under the law, as noted by firms like RSM US).

- The non-resident employee's state of residence must either provide a substantially similar income tax exclusion, not impose an individual income tax, or the employee's income must be exempt from Alabama tax under federal law.

Exceeding the 30-Day Threshold: If a non-resident employee performs services within Alabama for more than 30 days in a calendar year, then all compensation paid to that employee for work performed in Alabama during that calendar year becomes subject to Alabama state and local income tax and withholding, including wages earned during the initial 30-day period.

Employer Considerations and Record-Keeping: These rules impose new data tracking responsibilities on employers. Robust systems to accurately track the number of days non-resident employees perform work within Alabama will be necessary. This may necessitate daily work location tracking. Further guidance from the ADOR will be crucial, particularly concerning remote work arrangements.

Decoupling from Federal IRC Section 174 (Research & Experimental Expenditures)

Effective retroactively for tax years beginning on or after January 1, 2024, Alabama House Bill 163 decouples the state's income tax law from the federal treatment of research and experimental (R&E) expenditures under Internal Revenue Code Section 174, as amended by the Tax Cuts and Jobs Act (TCJA). As reported by Grant Thornton, Alabama's decoupling now provides taxpayers with the option to either currently deduct such R&E expenditures or treat them as allowed under Section 174 before the TCJA amendments. While primarily affecting business income tax, this can indirectly influence overall financial planning.

Other Relevant Tax Changes

As part of a broader legislative trend described as "taxpayer-friendly" by sources like RSM US, Alabama has enacted other tax adjustments:

- Sales Tax Reductions: The state sales tax rate on groceries is scheduled to be reduced to 2%, effective September 1, 2025. New sales tax exemptions for items like baby formula, diapers, maternity clothing, and menstrual hygiene products will also take effect on September 1, 2025.

- Tax Appeal Changes: Effective October 1, 2025, the jurisdiction of the Alabama Tax Tribunal will be expanded. The timeframe for filing certain tax appeals will be extended from 30 days to 60 days.

Special Considerations for Alabama Employers

Beyond the primary payroll tax categories, several special considerations and clarifications are pertinent for Alabama employers.

Exemptions from SIT Withholding

Alabama law exempts certain classes of employment from mandatory state income tax withholding requirements. According to the ADOR, these include:

- Domestic services in private homes

- Agricultural employees

- Duly ordained, commissioned, or licensed ministers (when performing duties of their ministry)

- Merchant seamen

It is crucial to understand that while wages for these services may be exempt from employer withholding, they generally still constitute taxable income for the employee, who is responsible for reporting and paying any tax due. Employers can voluntarily withhold Alabama income tax for these exempt employees but must register and comply with all standard requirements if they choose to do so, as clarified in ADOR FAQs such as the one regarding hiring home help.

Record-Keeping Requirements

Maintaining accurate payroll records is fundamental. While specific state-level retention periods were not detailed across all tax types in the source text, best practices dictate keeping records for several years. Local ordinances, like that of the City of Leeds requiring occupational tax records for at least five years, may apply. Records should substantiate wages, taxes withheld and remitted, and all payroll calculations.

No State-Mandated Disability Insurance Payroll Tax (Clarification)

The State of Alabama does not operate a state-run disability insurance program funded by a mandatory payroll tax for off-the-job disabilities. While some older or less specific materials might anachronistically mention "Disability Insurance," current official Alabama state resources and comprehensive guides do not support the existence of such a broad, state-mandated payroll tax. Instead, Alabama's system for employee disability primarily relies on employer-funded Workers' Compensation insurance for work-related injuries or illnesses, managed by the Alabama Department of Labor. Employers should ensure they have the required Workers' Compensation coverage.

Strategic Recommendations for Payroll Tax Compliance in Alabama

Navigating Alabama's complex payroll tax landscape requires a proactive approach.

Proactive Monitoring of Official Sources

Businesses should regularly monitor official pronouncements from the Alabama Department of Revenue (ADOR) and the Alabama Department of Labor. Key resources include the ADOR's Forms Library and its Business Essentials for State Taxpayers (B.E.S.T.) resources.

Ensure Accuracy in Employee Data and Classification

Accurate employee data is foundational. Ensure correct filing status (Form A-4), work location (for local taxes), and classification (resident/non-resident, hourly for overtime).

Leverage Technology for Efficiency and Accuracy

Robust payroll software or professional services can automate calculations, manage multi-jurisdictional withholdings, facilitate e-filing via MAT, and provide legislative updates. The value of such systems is underscored by how providers like TimeTrex handled reporting for the overtime exemption.

Exercise Diligence with Local Occupational Taxes

Develop a systematic process for identifying and complying with local tax obligations in every municipality where employees work. Proactively contact city/county finance departments, as advised by resources like the Alabama League of Municipalities.

Prepare for Impending Legislative Changes

Take steps now to prepare for known changes:

- Configure payroll systems to resume SIT withholding on applicable overtime pay from July 1, 2025.

- Evaluate and upgrade time/attendance or work location tracking for the mobile workforce legislation effective January 1, 2026.

Seek Professional Advice When Needed

For complex scenarios, consult with qualified tax professionals specializing in Alabama state and local taxation.

By implementing these strategies, businesses can reduce risks, avoid penalties, and ensure robust payroll tax compliance, contributing to overall business stability.

Conclusion

The Alabama payroll tax environment in 2025 and beyond presents both challenges and opportunities for employers. Key obligations include state income tax withholding, State Unemployment Insurance, and a complex array of local occupational taxes.

Employers must be particularly vigilant regarding the expiration of the overtime pay SIT exemption on June 30, 2025, and the new mobile workforce rules effective January 1, 2026. These changes, alongside the decentralized nature of local taxes, demand meticulous record-keeping, robust payroll systems, and a proactive compliance approach.

To successfully navigate this environment, Alabama employers should prioritize staying informed through official state resources, ensuring data accuracy, leveraging technology, and diligently addressing local tax obligations. Seeking expert advice when needed remains crucial. By embracing these practices, businesses can effectively meet their payroll tax responsibilities in Alabama's dynamic tax system.

Simplify Your Alabama Payroll with TimeTrex

Managing Alabama payroll taxes can be complex and time-consuming. TimeTrex offers comprehensive payroll solutions designed to help small businesses like yours stay compliant and save valuable time. From automated tax calculations and filings to robust reporting, TimeTrex has you covered.

Learn More About TimeTrex Payroll SolutionsDisclaimer: The content provided on this webpage is for informational purposes only and is not intended to be a substitute for professional advice. While we strive to ensure the accuracy and timeliness of the information presented here, the details may change over time or vary in different jurisdictions. Therefore, we do not guarantee the completeness, reliability, or absolute accuracy of this information. The information on this page should not be used as a basis for making legal, financial, or any other key decisions. We strongly advise consulting with a qualified professional or expert in the relevant field for specific advice, guidance, or services. By using this webpage, you acknowledge that the information is offered “as is” and that we are not liable for any errors, omissions, or inaccuracies in the content, nor for any actions taken based on the information provided. We shall not be held liable for any direct, indirect, incidental, consequential, or punitive damages arising out of your access to, use of, or reliance on any content on this page.

About The Author

Roger Wood

With a Baccalaureate of Science and advanced studies in business, Roger has successfully managed businesses across five continents. His extensive global experience and strategic insights contribute significantly to the success of TimeTrex. His expertise and dedication ensure we deliver top-notch solutions to our clients around the world.

Time To Clock-In

Start your 30-day free trial!

Experience the Ultimate Workforce Solution and Revolutionize Your Business Today

- Eliminate Errors

- Simple & Easy To Use

- Real-time Reporting

Saving businesses time and money through better workforce management since 2003.

Copyright © 2025 TimeTrex. All Rights Reserved.