The Best Payroll Software Solutions: 2025

Choosing the right payroll solution is one of the most critical decisions for US and Canadian businesses. An effective payroll software does more than just cut checks; it serves as the core of your entire workforce management strategy. This guide dives deep into the best payroll systems on the market, comparing everything from payroll processing and tax compliance to integrated time and attendance tracking, employee scheduling, and HR management. We'll reveal why a natively integrated, all-in-one platform is the superior choice for achieving accuracy, efficiency, and scalability in 2025.

TL;DR

For businesses seeking the most robust, accurate, and efficient payroll solution, a natively unified platform is non-negotiable. While specialized tools have their place, a fragmented system introduces unnecessary risks and costs.

- Best Overall: TimeTrex earns the top spot for its all-in-one architecture, combining Payroll, Time & Attendance, Scheduling, and HR in a single, seamless system. It's designed to eliminate data-sync errors and offers unmatched deployment flexibility (Cloud & On-Premise).

- Best for User Experience: Gusto excels with its intuitive interface and strong benefits administration, ideal for startups.

- Best Value: OnPay offers comprehensive features at a simple, flat rate, with specialized compliance for niche industries.

- Best for Scaling: ADP RUN provides extensive HR support and services for rapidly growing businesses.

- Best for QuickBooks Users: QuickBooks Payroll offers flawless integration with its own accounting software, creating a unified financial ecosystem.

On This Page

- The Modern Payroll Imperative: Beyond Paychecks

- 1. TimeTrex: Best Overall for Integrated Workforce Management

- 2. Gusto: Best for User Experience and Benefits-Centric Startups

- 3. OnPay: Best for Value and Niche Industry Compliance

- 4. ADP RUN: Best for Rapidly Scaling Businesses

- 5. QuickBooks Payroll: Best for Integrated QuickBooks Accounting

- Head-to-Head Analysis: A Comparative Data Matrix

- Strategic Selection Framework: Choosing Your Ideal Payroll Partner

- Conclusion: Why a Unified Platform is the Future-Proof Choice

- Ready to Unify Your Workforce Management?

The Modern Payroll Imperative: Beyond Paychecks to Strategic Workforce Management

In today's business landscape, payroll management has evolved far beyond the simple task of issuing paychecks. It now sits at the operational heart of a company's entire workforce management strategy. For small and medium-sized businesses (SMBs) in the US and Canada, navigating diverse work models—from on-site to remote—and a complex web of labor law compliance, a fragmented approach to managing time, scheduling, HR, and payroll is a major financial risk. A minor error in a timesheet, a miscalculation in overtime, or a scheduling mistake can lead to payroll inaccuracies, costly penalties, and eroded employee trust. Effective payroll management is a vital component of financial oversight and risk mitigation.

To address these challenges, the evaluation of payroll software must go beyond a simple feature comparison. The core architectural principles that drive efficiency and accuracy are paramount. This analysis is grounded in five pillars of a superior payroll solution: Architectural Integrity, Compliance Automation, Strategic Scalability, Robust Security, and Total Cost of Ownership (TCO). The fundamental choice is between a natively unified platform versus an integrated hub of separate apps. This architectural distinction is the most critical factor in determining a solution's long-term value.

1. TimeTrex: Best Overall for Integrated Workforce Management

In our comprehensive analysis, TimeTrex earns the top ranking based on its fundamentally different architectural approach to workforce management. Unlike systems that are primarily payroll engines with bolt-on integrations, TimeTrex is built from the ground up as a single, holistic ecosystem. This design philosophy positions it as a powerful operational command center for businesses that prioritize precision, compliance, and scalability.

The Core Thesis: The Advantage of Native Integration

TimeTrex's key differentiator is its architecture: a single, all-in-one platform where Payroll, Time & Attendance, Employee Scheduling, and HR Management are native components sharing a single database. While many competitors offer solutions that "integrate" with separate apps, TimeTrex’s native payroll engine draws directly from its own scheduling and attendance modules. This design choice inherently eliminates entire categories of common payroll errors that arise from data transfer glitches or manual entry mistakes. The result is a system designed to reduce administrative overhead by removing tedious data validation steps, providing a single source of truth for all workforce data.

A Deep Dive into the Payroll Engine: Precision and Compliance at Scale

At its heart, the TimeTrex platform features a sophisticated payroll engine. It automatically computes gross wages, accounting for complex variables like multiple pay rates, overtime, and bonuses. For payroll tax compliance, it automatically calculates federal, state/provincial, and local taxes, a critical safeguard against costly fines. TimeTrex manages a wide array of deductions, from benefits to garnishments, and supports flexible payment options like direct deposit and printed checks. It also automates crucial tax reports and year-end forms, including federal W2, 940, 941 forms, Canadian T4s, and Records of Employment (ROEs).

Beyond Payroll: A Synergistic Feature Set

What makes the TimeTrex platform robust is the deep, native integration of its payroll engine with a full suite of equally powerful workforce management tools.

- Strategic Time & Attendance: Features like Biometric Facial Recognition address "buddy punching," while Geolocation and Geofencing provide verifiable proof of presence for mobile employees.

- Intelligent Employee Scheduling: A rule-based engine can automate complex multi-week rotating schedules, transforming a manual chore into a streamlined function.

- Centralized Human Resources Management (HRM): Consolidates all employee information into a single database, streamlining performance reviews, incident tracking, and document management.

Scalability, Deployment, and Accessibility

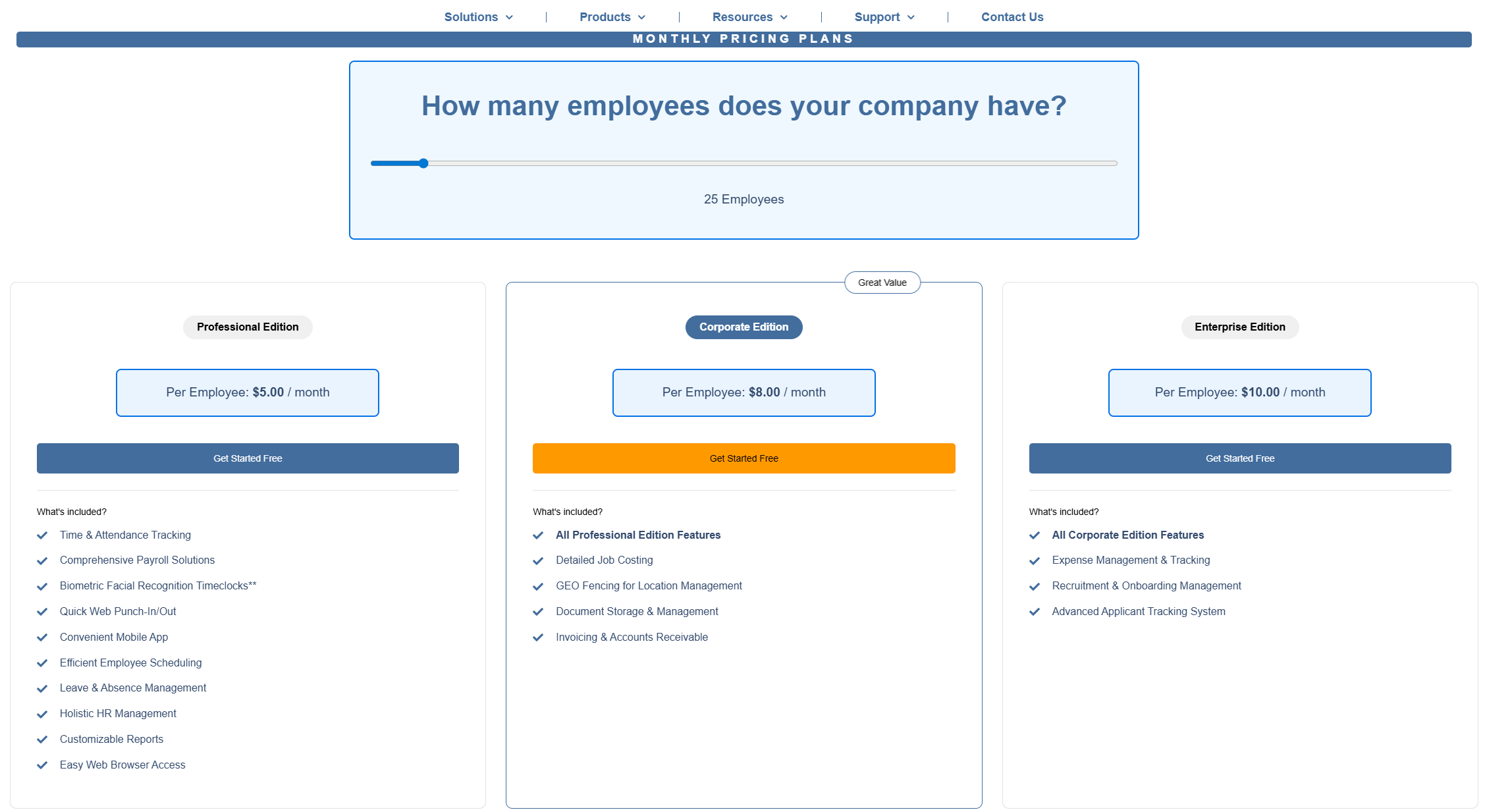

TimeTrex is positioned to serve businesses at every stage. Its tiered editions (Professional, Corporate, Enterprise) align with a company's evolving needs. A significant advantage in a market of cloud-only solutions is its dual deployment options: Cloud-Hosted and On-Premise. The on-premise option is vital for organizations with stringent security or regulatory mandates. Furthermore, its free Community Edition provides enterprise-grade scheduling, time and attendance, and complete payroll processing at no cost, making powerful tools accessible for startups and non-profits.

Verdict

TimeTrex's top ranking is a direct result of its product strategy. The natively unified architecture provides a foundation of data integrity and operational efficiency that integrated solutions struggle to match. For organizations seeking a strategic, secure, and future-proof platform, its integrated model presents a compelling case.

2. Gusto: Best for User Experience and Benefits-Centric Startups

Strengths

Gusto has built a formidable reputation primarily on its outstanding user experience. The platform is consistently praised for being intuitive, with clean dashboards, guided setup processes, and a modern interface that demystifies the payroll process. This makes it an ideal choice for startups and small businesses where the founder or an office manager, rather than a dedicated HR professional, handles payroll. Gusto's other major strength lies in its seamless administration of employee benefits. It simplifies offering and managing health insurance, 401(k) plans, commuter benefits, and HSAs, integrating these deductions directly and automatically into the payroll run. This "all-in-one" feel for HR and benefits makes it very attractive to modern, employee-centric companies.

Limitations

Gusto's core strength is also its primary limitation. It is fundamentally a payroll and HR platform, not a comprehensive workforce management system. For businesses with complex operational needs, such as intricate employee scheduling or advanced time tracking (like manufacturing or retail), Gusto relies on a vast ecosystem of third-party integrations. While extensive, this integrated-hub model means businesses may have to manage multiple software subscriptions and deal with potential data lags or synchronization errors between systems. When an integration fails, it can be difficult to determine which software provider is responsible. Furthermore, some user reviews indicate frustration with the responsiveness of customer support, particularly when dealing with complex tax or compliance issues.

Pricing

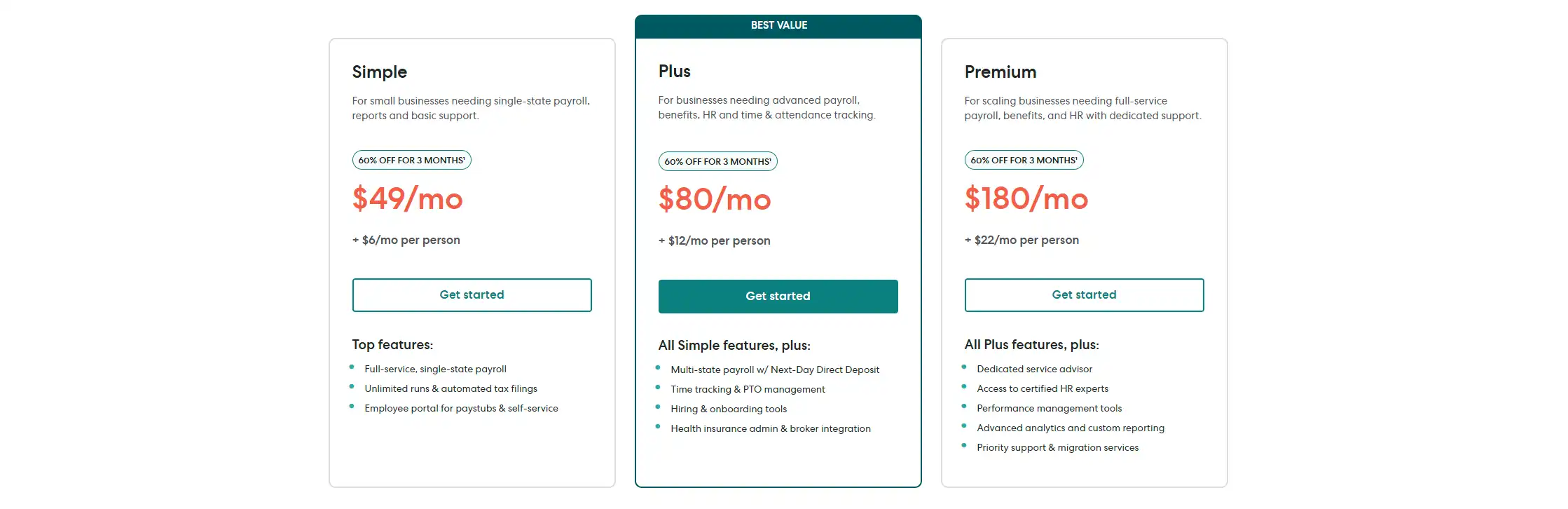

Gusto offers a transparent tiered pricing model. The Simple plan (starting at $49/month + $6/person) covers core single-state payroll processing and basic benefits integration. The Plus plan ($80/month + $12/person) adds multi-state payroll, next-day direct deposit, and more advanced HR tools like time tracking and project tracking. A Premium plan offers dedicated support and compliance alerts with custom pricing.

Verdict

Gusto is an exceptional choice for startups and modern service-based businesses where a premium is placed on user-friendliness and the seamless administration of employee benefits. However, it is less suitable for operations-heavy businesses in sectors that require robust, native scheduling and time management tools to ensure payroll accuracy from the ground up.

3. OnPay: Best for Value and Niche Industry Compliance

Strengths

OnPay’s most compelling attribute is its straightforward and exceptional value proposition. It offers a comprehensive suite of payroll, HR, and benefits administration features within a single, all-inclusive pricing plan. This transparency is a stark contrast to the complex tiered models of many competitors and is highly appealing to budget-conscious small businesses that want to avoid being upsold. OnPay consistently receives high marks for its responsive and knowledgeable US-based customer support. Its standout capability, however, is its specialized expertise in handling the unique compliance and tax filing needs of niche industries. It correctly processes specific forms and regulations for sectors like agriculture (Form 943), non-profits (501(c)(3) FUTA exemptions), and churches, which are often overlooked by more generic platforms.

Limitations

While powerful within its niche, OnPay's built-in HR tools are not as extensive as those found in more comprehensive platforms. They cover the essentials like document storage and e-signing but lack advanced functionality like performance management or applicant tracking. Some users have noted that the user interface, while functional, feels somewhat dated compared to the sleek designs of competitors like Gusto, potentially requiring more clicks to complete certain tasks. Its list of direct third-party software integrations is also more limited than that of its larger competitors, which could be a drawback for businesses reliant on a specific tech stack.

Pricing

OnPay features a simple, transparent pricing model: a base fee of $49 per month plus $6 per person paid in that month. This single plan includes all payroll and HR features, with no hidden fees for multi-state payroll, year-end W-2/1099 forms, or tax filings.

Verdict

OnPay delivers arguably the best overall value in the market. It is the premier choice for small businesses, particularly those in specialized industries that require expert compliance handling without the complexity and expense of a tiered, enterprise-focused system.

4. ADP RUN: Best for Rapidly Scaling Businesses Requiring Extensive HR Support

Strengths

As a long-standing leader in the payroll industry, ADP brings decades of expertise, unparalleled scalability, and a deep well of HR support services to the table. RUN Powered by ADP is its tailored solution for the SMB market, specifically designed for businesses on a rapid growth trajectory. Beyond core payroll and tax filing, ADP offers a comprehensive ecosystem of services, including background checks, State Unemployment Insurance (SUI) management, access to a dedicated team of live HR professionals, an employee handbook wizard, and a library of compliance training courses. This level of support can be invaluable for a growing business navigating complex labor laws. Its integration capabilities are vast, especially with enterprise resource planning (ERP) systems, making it a viable long-term partner for companies expecting to scale significantly.

Limitations

The primary drawback of ADP is its pricing structure, which is typically opaque, quote-based, and often more expensive than its competitors. This requires engaging with a sales team and can lead to complex contracts with potential for price increases upon renewal. The platform's sheer breadth of features can also make it more complex to set up and navigate than more streamlined solutions. For small businesses, accessing the most valuable HR advisory features often requires upgrading to a higher, more expensive tier, which may not be cost-effective until the company reaches a certain size.

Pricing

ADP RUN is sold on a quote-based model with four primary packages: Essential Payroll, Enhanced Payroll, Complete Payroll & HR+, and HR Pro Payroll & HR. Each tier progressively adds more advanced HR features, compliance support, and access to HR professionals.

Verdict

ADP RUN is the ideal strategic partner for ambitious SMBs that foresee significant growth and require the robust infrastructure, deep compliance expertise, and extensive HR support services of an established industry giant. It is often overkill for smaller, stable businesses.

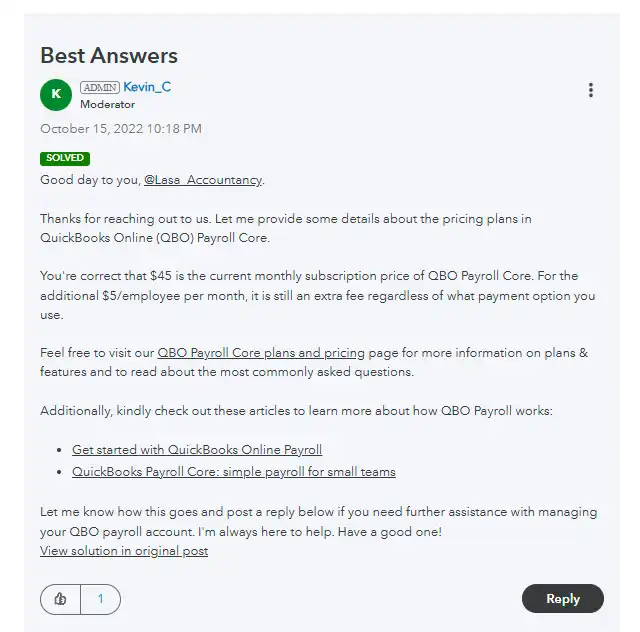

5. QuickBooks Payroll: Best for Integrated QuickBooks Accounting

Strengths

The single greatest advantage of QuickBooks Payroll is its flawless, native integration with the QuickBooks Online accounting platform. For the millions of small businesses that already use QuickBooks to manage their finances, this synergy is a powerful proposition. It creates a unified financial management system, automatically and instantly syncing all payroll data—including wages, taxes, and deductions—with the general ledger. This eliminates the need for manual data entry, drastically reduces the risk of costly accounting errors, and provides a real-time, holistic view of the company's finances. The platform itself is a full-service payroll solution, offering automated tax calculations and filings, employee self-service portals, and options for next-day or even same-day direct deposit.

Limitations

While its accounting integration is second to none, QuickBooks Payroll's standalone features for HR, advanced time tracking, and employee scheduling are less robust than those offered by dedicated workforce management platforms. Its time tracking lacks advanced features like biometric controls or geofencing found in specialized systems. Businesses that are not already invested in the QuickBooks ecosystem will likely find more comprehensive and powerful solutions elsewhere. User reviews have also pointed out that the software can have a steep learning curve and that the combined subscription costs for both accounting and the higher tiers of payroll can be significant.

Pricing

QuickBooks Payroll is offered in three tiered plans: Core ($45/month + $5/employee) for basic payroll, Premium ($80/month + $8/employee) which adds same-day direct deposit and the QuickBooks Time Elite tracking module, and Elite, which includes a personal HR advisor and tax penalty protection. The inclusion of robust time tracking only in the Premium and Elite tiers makes the Core plan less comprehensive.

Verdict

QuickBooks Payroll is the default and often the best choice for any business already using QuickBooks Online for its accounting. For these companies, the value of seamless financial data integration is a paramount concern that typically outweighs the platform's limitations in other workforce management areas.

Head-to-Head Analysis: A Comparative Data Matrix

To distill the analysis into a clear summary, the following table provides a side-by-side comparison of the top payroll solutions, highlighting fundamental strategic differences.

| Feature / Aspect | TimeTrex | Gusto | OnPay | ADP RUN | QuickBooks Payroll |

|---|---|---|---|---|---|

| Architecture | Natively Unified Platform | Payroll Core with Integrations | All-in-One Payroll & HR | Payroll Core with HR Services | Payroll Module for Accounting |

| Advanced Time Tracking | Biometrics & Geofencing Included | Via Third-Party Integration | Basic Time Tracking Included | Add-on Service | Included in Premium/Elite Tiers |

| Integrated HR Module | Comprehensive (PIM, Reviews) | Core HR & Benefits Admin | Core HR & Document Storage | Comprehensive Add-on Service | Basic HR Resources |

| Deployment Options | Cloud & On-Premise | Cloud-Only | Cloud-Only | Cloud-Only | Cloud-Only |

| Pricing Model | Tiered Subscription | Tiered Subscription | All-Inclusive Flat Rate | Quote-Based Tiers | Tiered Subscription |

| Noteworthy Free Plan | Full Payroll & WFM Included | N/A | N/A | N/A | N/A |

| Ideal Business Profile | Operations-Focused SMBs & Enterprises | Startups & Service Businesses | Niche Industries & Value-Seekers | Rapidly-Scaling SMBs | Businesses Using QuickBooks |

| Key Differentiator | Unified Architecture & Deployment Flexibility | Superior User Experience | Niche Compliance & Simple Pricing | Scalable HR Services & Support | Seamless Accounting Integration |

Strategic Selection Framework: A Guide to Choosing Your Ideal Payroll Partner

Selecting the right payroll software is a critical strategic decision. The best choice depends on your company's unique operational needs, workforce, and growth ambitions. Use the following framework to conduct a thorough self-assessment.

The Self-Assessment Checklist

- Evaluate Your Operational Complexity: Do you manage complex, multi-shift, or rotating schedules? Is real-time job costing critical to your profitability? A "Yes" points toward a solution with advanced, integrated capabilities like TimeTrex.

- Analyze Your Workforce Composition: Is your workforce distributed or mobile? Is time theft a significant concern? A "Yes" suggests the need for tools like GPS tracking and biometric verification.

- Assess Your IT and Security Posture: Do you operate in a highly regulated industry or have internal governance that mandates on-premise software deployment? This makes a solution with an on-premise option, like TimeTrex, a leading candidate.

- Review Your Existing Technology Stack: Are you deeply integrated with an accounting platform like QuickBooks Online? The seamless harmony offered by QuickBooks Payroll may be your overriding priority.

- Consider Your Growth Trajectory: Are you planning for hyper-growth that will require extensive, hands-on HR guidance? This suggests a partner like ADP RUN, which is built to scale with robust services.

- Examine Your Industry Requirements: Do you operate in a niche industry like agriculture or a non-profit with unique tax filings? This makes a specialized provider like OnPay highly compelling.

- Define Your Primary User Profile: Who will run payroll? If the user is not a payroll expert, the exceptional ease of use of a solution like Gusto could be a deciding factor.

Conclusion: Why a Unified Platform is the Future-Proof Choice

The modern business landscape demands a strategic approach to workforce management that enhances efficiency and mitigates risk. This analysis reveals that a fragmented approach—cobbling together separate systems for scheduling, time tracking, HR, and payroll—is fundamentally a compromise. The greatest sources of cost and risk in the payroll process begin upstream, in the error-prone phases of scheduling and time tracking. A mistake at this stage inevitably corrupts payroll data.

This is why the architectural integrity of a platform like TimeTrex is so critical. By building a natively unified ecosystem, TimeTrex solves the problem at its source. It operates from a single, coherent source of truth. This unified approach, combined with its powerful feature set, unparalleled deployment flexibility, and scalability, makes TimeTrex more than just a better payroll tool. It represents a more strategic, efficient, and resilient way to manage your business's most critical asset: its people. For any organization serious about achieving operational excellence, a deeply integrated, all-in-one platform is the clear and definitive choice.

Ready to Unify Your Workforce Management?

Stop juggling disparate systems and eliminate payroll errors at their source. Discover how TimeTrex's all-in-one platform for Payroll, Time & Attendance, and Scheduling can transform your business operations. Click below to learn more and see why we are the #1 choice for businesses across the US and Canada.

Explore TimeTrex Payroll SolutionsDisclaimer: The content provided on this webpage is for informational purposes only and is not intended to be a substitute for professional advice. While we strive to ensure the accuracy and timeliness of the information presented here, the details may change over time or vary in different jurisdictions. Therefore, we do not guarantee the completeness, reliability, or absolute accuracy of this information. The information on this page should not be used as a basis for making legal, financial, or any other key decisions. We strongly advise consulting with a qualified professional or expert in the relevant field for specific advice, guidance, or services. By using this webpage, you acknowledge that the information is offered “as is” and that we are not liable for any errors, omissions, or inaccuracies in the content, nor for any actions taken based on the information provided. We shall not be held liable for any direct, indirect, incidental, consequential, or punitive damages arising out of your access to, use of, or reliance on any content on this page.

Time To Clock-In

Start your 30-day free trial!

Experience the Ultimate Workforce Solution and Revolutionize Your Business Today

- Eliminate Errors

- Simple & Easy To Use

- Real-time Reporting

Saving businesses time and money through better workforce management since 2003.

Copyright © 2026 TimeTrex. All Rights Reserved.