100% Secondary Tariffs on Russian Allies

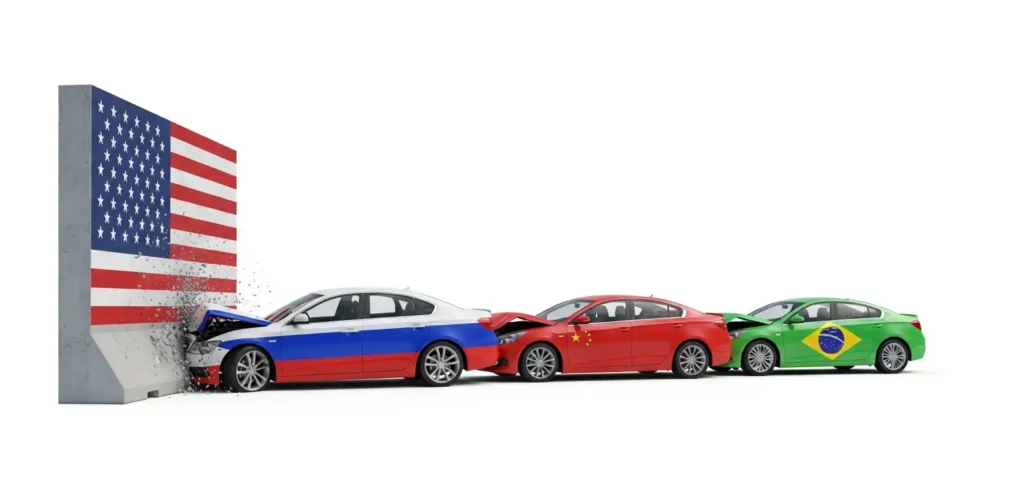

For US Businesses, understanding the nuances of 100% secondary tariffs on Russia is critical. This article explores the impact of these secondary tariffs, a significant tool of economic statecraft aimed at Russia. We will delve into how these tariffs affect global trade, supply chains, and the strategic calculations for US companies. This is a must-read for anyone involved in international trade, finance, and supply chain management, especially concerning the geopolitical landscape shaped by secondary tariffs on Russia.

Article Index

TL;DR

The proposal for 100% secondary tariffs on Russia is a major shift in economic policy. Instead of traditional sanctions, it uses access to the US market as a weapon. While aimed at crippling Russia's economy by targeting its trade with partners like China and India, these tariffs pose significant risks of blowback, including supply chain disruptions and inflation for the US and its allies. The policy could accelerate a split in the global economy, pushing countries towards non-dollar systems and undermining international trade rules. For US businesses, this means navigating a more fragmented and unpredictable global market.

Deconstructing the "Secondary Tariff" as a Tool of Economic Statecraft

The innovative proposal to levy "secondary tariffs" on Russia's trading partners is a pivotal change in economic coercion. This policy blends trade and financial warfare, using the logic of secondary sanctions with a tariff mechanism. For US businesses, understanding this hybrid tool is essential for navigating the evolving landscape of international trade.

From Sanctions to Tariffs: The Evolution of Economic Coercion

Economic sanctions have long been a foreign policy tool. The distinction between primary and secondary sanctions is key. Primary sanctions apply to entities within the sanctioning country's jurisdiction. In contrast, secondary sanctions are extraterritorial, penalizing third parties for trading with a sanctioned entity. The proposed "secondary tariff" is a new development, using a prohibitive import duty to enforce this extraterritorial reach.

| Attribute | Secondary Sanctions | Secondary Tariffs (Proposed) |

|---|---|---|

| Mechanism | Financial and market exclusion | Import duties (tariffs) |

| Primary Target | Specific non-U.S. entities or sectors engaging with a sanctioned country | All exports from a non-U.S. country that trades with a sanctioned country |

| Legal Basis | IEEPA, CAATSA, country-specific acts | IEEPA, Trade Expansion Act of 1962 (Sec. 232), Trade Act of 1974 |

| Penalty | SDN designation, asset freezes, denial of access to U.S. financial system, visa bans | 100% ad valorem duty on all imported goods, effectively an embargo |

| Enforcement Body | Dept. of Treasury (OFAC), Dept. of State | Dept. of Homeland Security (Customs and Border Protection) |

| Key Vulnerability Exploited | Dominance of the U.S. dollar and the U.S. financial system | Dominance of the U.S. as a consumer market and import destination |

The Proposal in Focus: Mechanics and Legal Underpinnings

The secondary tariff proposal is a coercive diplomatic move, threatening a 100% tariff on all goods from countries that continue to buy Russian oil and gas. The primary targets for this pressure are China, India, and Brazil. The legal authority for such a move likely rests on the International Emergency Economic Powers Act (IEEPA) and Section 232 of the Trade Expansion Act of 1962, which grant the President broad powers in national security matters.

The Target and the Collateral – A Multi-Actor Impact Analysis

The impact of 100% secondary tariffs on Russia would be widespread. This section analyzes the effects on Russia, key third-party nations, and the US and its allies. For US businesses, this multi-actor analysis is crucial for risk assessment and strategic planning.

Russia's Wartime Economy: Resilience Under Pressure and New Vulnerabilities

Russia's economy has been surprisingly resilient due to a wartime transition and a pivot to partners like China and India. However, this has created a new vulnerability: a heavy dependence on a few key trading partners. The secondary tariffs are designed to exploit this weakness, targeting Russia's energy exports and other key sectors like metals and agriculture. The loss of its two largest customers, China and India, would be a severe blow to Russia's economy.

The Third-Party Dilemma: Strategic Calculations in Beijing, New Delhi, and Ankara

The secondary tariffs force a difficult choice on Russia's main partners. China, Russia's most important economic ally, faces a potential trade disaster with the US. India, reliant on Russian arms and oil, will likely resist the pressure. Turkey, a NATO member with a fragile economy, is in the most precarious position and may be forced to comply.

| Country/Bloc | Projected GDP Impact (%) | Projected Inflationary Impact | Key Industries Affected |

|---|---|---|---|

| United States | -0.3% to -0.6% long-run level | High; Core PCE up 1.4-2.2 pp | Consumers (all goods), manufacturing (input costs), agriculture (retaliation) |

| European Union | Negative; risk of recession | Moderate to High; spillover effects | Automotive, manufacturing, exports subject to retaliation |

| China | -1.2% (approx.) | Low (domestic focus) | All export-oriented manufacturing, electronics, textiles |

| India | Significant negative impact | Moderate; driven by trade disruption | Exports (textiles, pharma), IT services, oil refining |

| Russia | Severe negative contraction | High; currency collapse | Energy (oil & gas), metals, all export sectors |

Blowback and Burden-Sharing: The Costs for the United States and its G7 Allies

The immediate costs of the secondary tariffs would be felt by the US and its allies. A 100% tariff on Chinese goods would trigger a massive inflationary shock in the US and disrupt global supply chains. US and European companies reliant on Chinese components would face chaos, and the policy could even spark a trans-Atlantic trade war.

Systemic Shock – Long-Term Ramifications for the Global Order

The 100% secondary tariffs on Russia could cause a systemic shock to the global order, accelerating long-term changes in trade and finance. For US businesses, these ramifications will define the international market for decades.

Accelerating Geoeconomic Fragmentation

The global economy is already fragmenting into competing blocs. The secondary tariffs would accelerate this trend, forcing countries to choose sides and potentially leading to a permanent loss of global economic output. This "re-globalization" would create two less efficient and more hostile trading webs.

The Future of the Dollar and Global Finance

The aggressive use of sanctions and tariffs is fueling de-dollarization efforts. The secondary tariffs would provide a powerful incentive for countries to develop alternative financial systems, such as China's Cross-Border Interbank Payment System (CIPS), and increase the use of the Chinese yuan in international trade.

The World Trade Organization at a Breaking Point

The secondary tariffs are a direct challenge to the rules-based trading system and the World Trade Organization (WTO). The policy violates the WTO's principle of non-discrimination and could trigger a wave of protectionism and retaliation, leading to a "law of the jungle" in global trade.

Precedents and Projections – Lessons from the Iran Sanctions Regime

The extensive sanctions against Iran offer a case study for the proposed tariffs on Russia's partners. While the strategy is similar, the scale and context are vastly different. US businesses can draw valuable lessons from the Iran experience to anticipate the potential outcomes of the Russia secondary tariffs.

| Metric | Iran Sanctions Regime | Russia Sanctions Regime |

|---|---|---|

| Target Economy Size | Smaller, less globally integrated | Large (G20), systemically important |

| Key Exports | Primarily oil and petrochemicals | Energy, grains, metals, fertilizers |

| Global Market Share (Energy) | Significant, but replaceable with market adjustments | Critical; major supplier to global markets |

| International Support | High (initially), backed by UN Security Council Resolutions | Low (Western coalition only); opposed by China, India |

| Key Circumvention Partners | UAE, China, Turkey | China, India, Turkey, UAE |

| Primary Coercive Tool | Secondary Financial Sanctions (banking/SWIFT exclusion) | Proposed Secondary Tariffs (market access exclusion) |

Strategic Outlook and Recommendations

The 100% secondary tariffs on Russia represent a high-stakes gamble. This final section provides a strategic outlook and actionable recommendations for governments and corporations, including US businesses.

Scenario Analysis: Four Potential Futures for Global Trade

There are four main scenarios for how this policy could play out: 1) Full-Scale Implementation & Geoeconomic Rupture, leading to a global trade war; 2) The "Grand Bargain" Threat, where the threat of tariffs forces a diplomatic solution; 3) The Bluff is Called, where the US backs down, damaging its credibility; and 4) Muddling Through with Targeted Leakage, a complex and unpredictable trade environment.

Policy Recommendations for Governments and Corporations

For the US Government, a rigorous cost-benefit analysis and allied coordination are essential. For European and G7 Governments, strengthening economic defense mechanisms is key. For Targeted Third Countries, accelerating de-risking and diversification is crucial. For Multinational Corporations, including US businesses, urgent supply chain audits, diversification, and enhanced sanctions compliance programs are necessary.

Navigate US Tariffs with Confidence

Stay ahead of the curve in this complex trade environment. Use our US Tariff Calculator to understand the potential impact of tariffs on your business.

Use the US Tariff CalculatorDisclaimer: The content provided on this webpage is for informational purposes only and is not intended to be a substitute for professional advice. While we strive to ensure the accuracy and timeliness of the information presented here, the details may change over time or vary in different jurisdictions. Therefore, we do not guarantee the completeness, reliability, or absolute accuracy of this information. The information on this page should not be used as a basis for making legal, financial, or any other key decisions. We strongly advise consulting with a qualified professional or expert in the relevant field for specific advice, guidance, or services. By using this webpage, you acknowledge that the information is offered “as is” and that we are not liable for any errors, omissions, or inaccuracies in the content, nor for any actions taken based on the information provided. We shall not be held liable for any direct, indirect, incidental, consequential, or punitive damages arising out of your access to, use of, or reliance on any content on this page.

About The Author

Roger Wood

With a Baccalaureate of Science and advanced studies in business, Roger has successfully managed businesses across five continents. His extensive global experience and strategic insights contribute significantly to the success of TimeTrex. His expertise and dedication ensure we deliver top-notch solutions to our clients around the world.

Time To Clock-In

Start your 30-day free trial!

Experience the Ultimate Workforce Solution and Revolutionize Your Business Today

- Eliminate Errors

- Simple & Easy To Use

- Real-time Reporting

Saving businesses time and money through better workforce management since 2003.

Copyright © 2025 TimeTrex. All Rights Reserved.