Navigating H.R. 1: What the "One Big Beautiful Bill" Means for Your Small Business

On May 20, 2025, H.R. 1, titled the "One Big Beautiful Bill Act," was introduced in the House of Representatives. This comprehensive legislation aims to provide reconciliation pursuant to H. Con. Res. 14 and includes a wide array of provisions impacting various sectors of the U.S. economy. For small business owners, understanding these changes is crucial for future planning and compliance. This article focuses on the key elements of Title XI, "Committee on Ways and Means," particularly those designed to "Make Rural America and Main Street Grow Again," along with other significant tax adjustments affecting small enterprises. Access the full text of H.R. 1 here.

Core Tax Relief for Small Businesses and Pass-Through Entities

A cornerstone of H.R. 1 is the extension and enhancement of several tax provisions beneficial to small businesses, many of which originated from or were modified by the Tax Cuts and Jobs Act.

Enhanced Deduction for Qualified Business Income (Section 199A)

The bill proposes to make the deduction for Qualified Business Income (QBI) permanent and more generous. Key changes under Section 110005 include:

- The QBI deduction percentage is increased from 20% to 23% for eligible taxpayers.

- Modifications to the limitations based on taxable income, with new rules for phase-ins. Specifically, for taxpayers whose taxable income exceeds the threshold amount, the QBI deduction will be the greater of the sum described in paragraph (1)(A) (without phase-in) or that sum (with no limitations for specified service trades or businesses) minus a "limitation phase-in amount." The phase-in amount is 75% of the excess of taxable income over the threshold amount.

- The bill also introduces a provision allowing qualified interest dividends from Business Development Companies (BDCs) to be included in the QBI calculation.

- These changes are effective for taxable years beginning after December 31, 2025.

Note: The threshold amount for the QBI deduction phase-in will be adjusted for inflation for taxable years beginning after 2025, using 2025 as the base year for the cost-of-living adjustment.

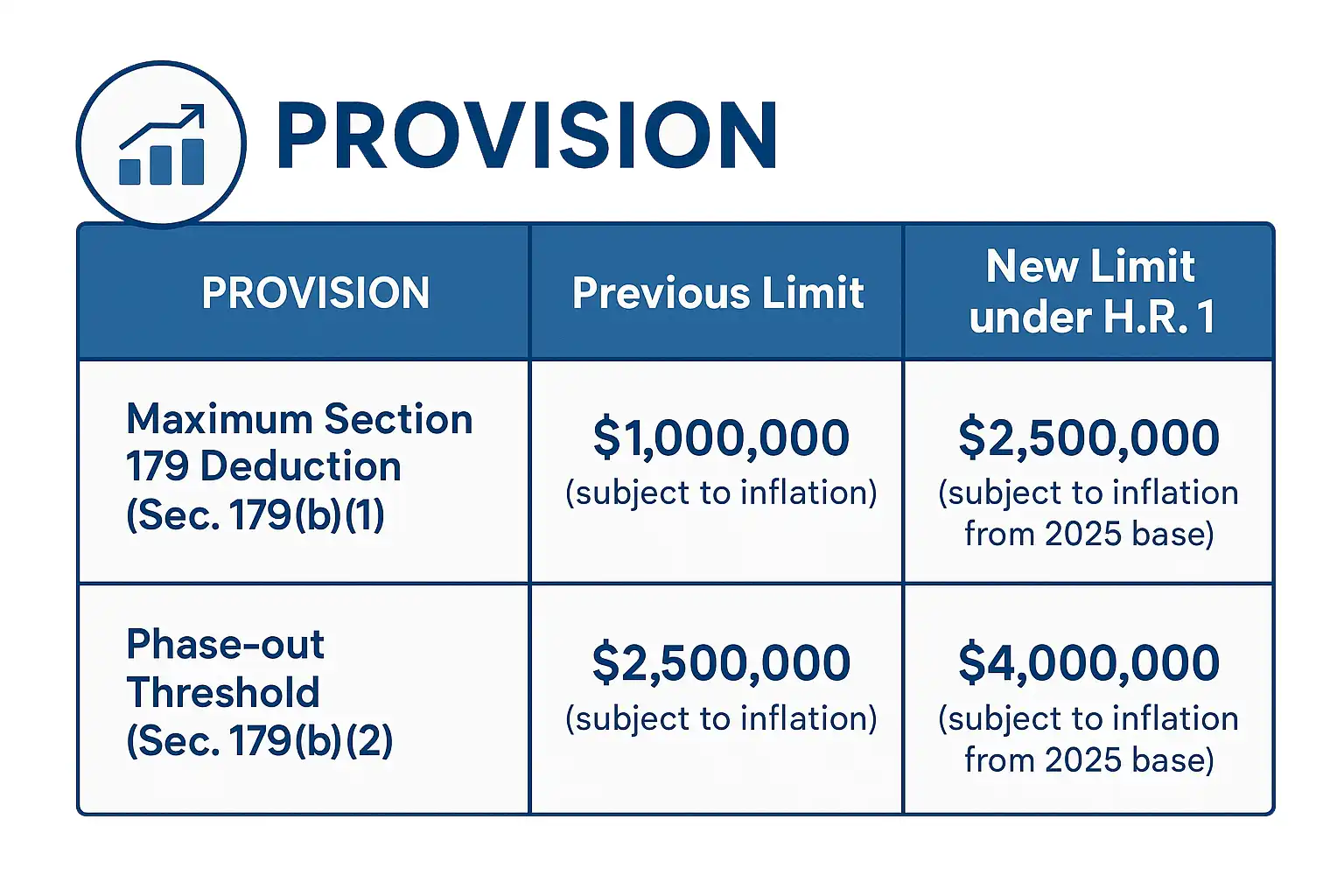

Increased Section 179 Expensing Limits

Section 111103 of the bill significantly increases the dollar limitations for expensing certain depreciable business assets under Section 179, a popular provision for small businesses investing in equipment.

| Provision | Previous Limit | New Limit under H.R. 1 |

|---|---|---|

| Maximum Section 179 Deduction (Sec. 179(b)(1)) | $1,000,000 (subject to inflation) | $2,500,000 (subject to inflation from 2025 base) |

| Phase-out Threshold (Sec. 179(b)(2)) | $2,500,000 (subject to inflation) | $4,000,000 (subject to inflation from 2025 base) |

These increased limits apply to property placed in service in taxable years beginning after December 31, 2024. The inflation adjustment for these new amounts will use 2025 as the base year.

Extension and Modifications to Special Depreciation Allowances (Bonus Depreciation)

H.R. 1 extends and modifies the 100% bonus depreciation rules under Section 168(k):

- For property acquired by the taxpayer before January 20, 2025, the bill extends the phase-down, setting the applicable percentage at 0% for property placed in service after December 31, 2026 (or after December 31, 2027, for certain longer production period property and aircraft).

- Crucially, for property acquired after January 19, 2025, and placed in service after that date and before January 1, 2030 (or January 1, 2031, for longer production period property and certain aircraft), the applicable bonus depreciation percentage is set back to 100%. This also applies to specified plants planted or grafted after January 19, 2025, and before January 1, 2030.

Section 111001 specifically addresses the general extension of special depreciation allowances, while Section 111101 introduces a new special 100% depreciation allowance for "qualified production property." This refers to the portion of nonresidential real property used by the taxpayer as an integral part of a qualified production activity (manufacturing, production, or refining of tangible personal property, with "production" limited to agricultural and chemical production). This property must be placed in service in the U.S., have its original use commence with the taxpayer, construction beginning after January 19, 2025, and before January 1, 2029, and be placed in service before January 1, 2033.

Deductibility of Domestic Research and Experimental (R&E) Expenditures

Section 111002 provides significant relief regarding R&E expenditures:

- The bill suspends the requirement to amortize domestic R&E expenditures for taxable years beginning after December 31, 2024, and before January 1, 2030.

- During this period, taxpayers can again deduct domestic R&E expenditures in the year they are paid or incurred, similar to the pre-2022 rules for such domestic expenses.

- Foreign R&E expenditures will continue to be subject to the amortization rules under Section 174.

Business Interest Expense Limitation (Section 163(j))

Section 111003 amends the calculation of adjusted taxable income (ATI) for the business interest expense deduction limitation. For taxable years beginning after December 31, 2024, and before January 1, 2030, ATI will be computed without regard to any deduction allowable for depreciation, amortization, or depletion (similar to an EBITDA-based calculation). Additionally, the definition of floor plan financing indebtedness is expanded to include certain trailers and campers.

Simplifying Reporting and Compliance

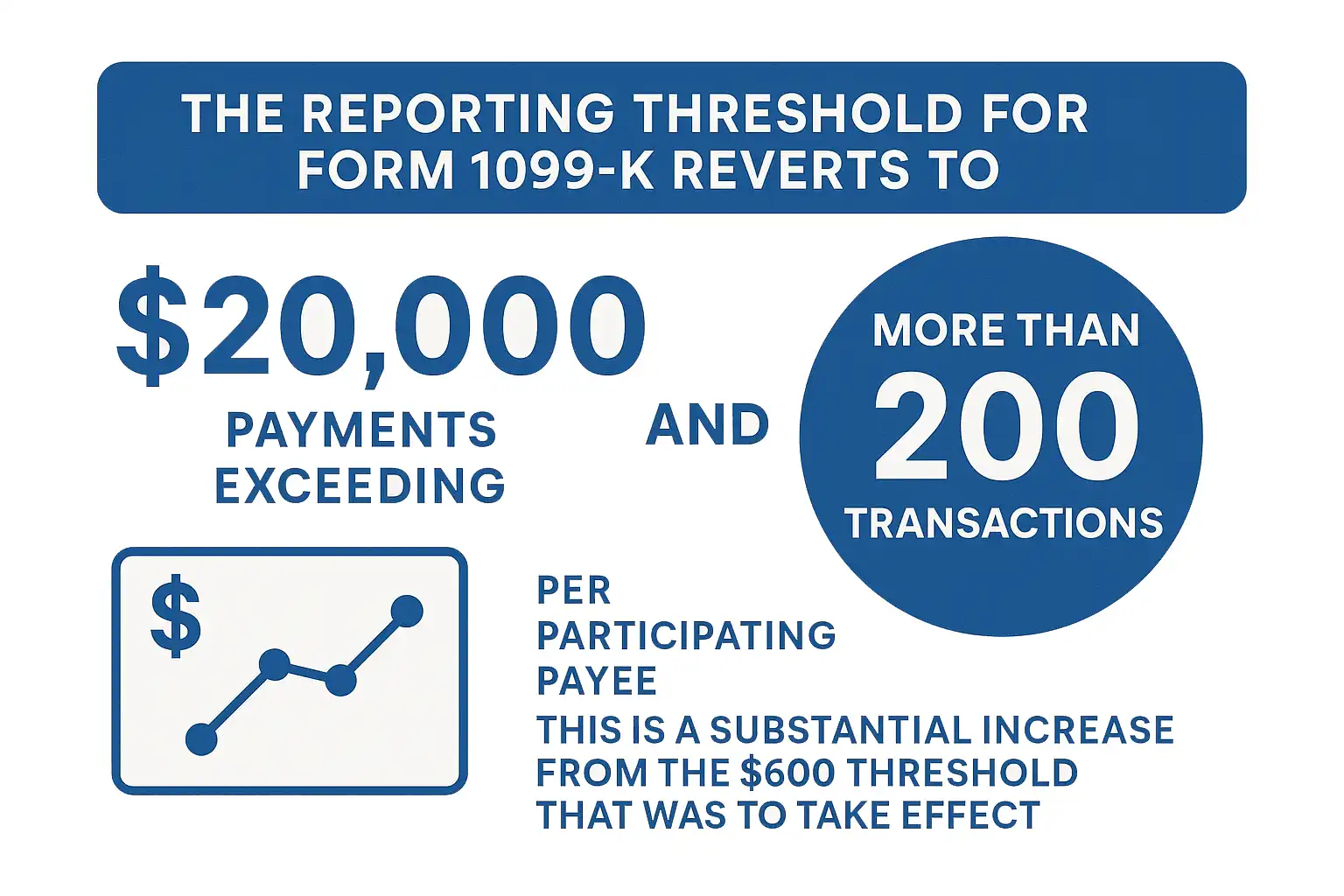

Third-Party Network Transactions (Form 1099-K)

A significant change for small businesses, especially those in e-commerce or utilizing payment settlement entities, comes from Section 111104. This section repeals the American Rescue Plan Act's revision to the de minimis exception for reporting third-party network transactions. Effective as if included in the original ARPA, this means:

- The reporting threshold for Form 1099-K reverts to payments exceeding $20,000 AND more than 200 transactions per participating payee. This is a substantial increase from the $600 threshold that was to take effect.

Additionally, for calendar years beginning after December 31, 2024, backup withholding on these transactions will only apply if the aggregate transactions exceed these higher reporting thresholds for the year, unless reportable payments were made in the prior year.

Increased Threshold for General Information Reporting (Form 1099-MISC/NEC)

Section 111105 raises the general threshold for requiring information reporting for payments (such as those to independent contractors) from $600 to $2,000. This change applies to payments made after December 31, 2025, and the new $2,000 threshold will be adjusted for inflation for calendar years after 2026.

Targeted Tax Relief and Incentives

No Tax on Tips and Overtime (for Employees, with Employer Reporting Changes)

While directly benefiting employees, Sections 110101 and 110102 introduce deductions for qualified tips and qualified overtime compensation for individuals, effectively making these amounts non-taxable for income tax purposes for employees for taxable years 2025 through 2028.

For small businesses with tipped employees or employees who work overtime, there are important reporting implications:

- Tip Reporting (Sec. 110101): The bill mandates new reporting requirements for businesses regarding tips. This includes separate accounting of tips on Forms 6041 (Payments to Non-Employees), 6041A (Payments for Services and Direct Sales), 6050W (Third Party Settlement Organizations), and 6051 (W-2). The IRS is also directed to publish a list of occupations traditionally receiving tips.

- Overtime Reporting (Sec. 110102): Employers will be required to report the total amount of qualified overtime compensation on Form W-2.

- Tip Credit Expansion (Sec. 110101(e)): The employer tip credit under Section 45B is expanded to include tips received in connection with barbering, hair care, nail care, esthetics, and body/spa treatments. The credit calculation is also modified regarding the minimum wage in effect.

These provisions apply to taxable years beginning after December 31, 2024, and the deductions for tips and overtime are set to terminate for taxable years beginning after December 31, 2028.

Enhancement of Employer-Provided Child Care Credit (Section 45F)

Section 110105 enhances the tax credit for employer-provided child care facilities and services:

- The credit percentage for qualified child care expenditures increases from 25% to 40% (or 50% for eligible small businesses).

- The maximum credit amount per taxable year increases from $150,000 to $500,000 (or $600,000 for eligible small businesses), with inflation adjustments after 2026.

- "Eligible small business" is defined for the higher credit rate.

- The credit is allowed for contracts with intermediate entities that contract with qualified child care facilities.

- Jointly owned or operated child care facilities are explicitly covered.

These enhancements apply to amounts paid or incurred after December 31, 2025.

Extension and Enhancement of Paid Family and Medical Leave Credit (Section 45S)

Section 110106 extends the employer credit for paid family and medical leave and introduces enhancements:

- The credit, previously set to expire, is made permanent by striking subsection (i).

- Employers can elect to calculate the credit based on either the applicable percentage of wages paid during leave OR the applicable percentage of total premiums paid for an insurance policy covering paid family and medical leave.

- The definition of "qualifying employees" is modified, including allowing employers to elect a shorter employment duration requirement (not less than 6 months instead of 1 year) and requiring employees to be customarily employed for not less than 20 hours per week.

These changes apply to taxable years beginning after December 31, 2025.

Increased Gross Receipts Threshold for Small Manufacturing Businesses

Section 111110 amends Section 448(c) by increasing the gross receipts test for certain small businesses to use the cash method of accounting. For "manufacturing taxpayers," the threshold is increased from $25 million (inflation-adjusted) to $80 million. A "manufacturing taxpayer" is defined as a corporation or partnership substantially all of whose gross receipts are derived from the lease, rental, license, sale, exchange, or other disposition of qualified products that they have produced or manufactured, resulting in a substantial transformation. This applies to taxable years beginning after December 31, 2025.

Repeal of Excise Tax on Indoor Tanning Services

For businesses in the indoor tanning industry, Section 111106 repeals the excise tax on indoor tanning services, effective for services performed after the date of the bill's enactment.

Changes to State and Local Tax (SALT) Deduction Limitations

Section 112018 introduces a new limitation on individual deductions for certain state and local taxes. This is a significant change from the current $10,000 cap per household established by the Tax Cuts and Jobs Act.

Under the new Section 275(b):

- Foreign real property taxes are generally disallowed unless they are an "excepted tax" (e.g., paid in carrying on a trade or business).

- For "specified taxes" (which include state and local real property taxes, personal property taxes, and income or sales taxes not paid in a trade/business), the aggregate deduction is limited to:

- $30,000 for most taxpayers.

- $15,000 for married individuals filing separately.

- These $30,000/$15,000 limits are phased down by 20% of the taxpayer's modified adjusted gross income (MAGI) exceeding $400,000 (or $200,000 for MFS).

- The reduction cannot bring the limit below $10,000 (or $5,000 for MFS).

The bill also addresses "substitute payments" designed to circumvent these limitations and includes rules for how state and local income taxes paid by partnerships and S corporations are taken into account by their owners. These SALT cap modifications apply to taxable years beginning after December 31, 2025.

Opportunity Zones Renewal and Enhancements

Section 111102 outlines a new round of Qualified Opportunity Zone (QOZ) designations and modifies some investment incentives:

- A new round of QOZ designations by States will be effective from January 1, 2027, to December 31, 2033. The initial round of designations is set to end on December 31, 2026.

- The definition of "low-income community" for QOZ purposes is modified, and certain census tracts with higher median family incomes are disallowed.

- For investments made after December 31, 2026, the basis increase rules are consolidated: a 10% basis increase for investments held at least 5 years.

- A special rule for Qualified Rural Opportunity Funds increases this basis step-up to 30% for investments held at least 5 years in these funds.

- The substantial improvement requirement for existing structures in rural QOZs is reduced, requiring additions to basis to exceed only 50% of the adjusted basis of the property (down from 100%).

- New information reporting requirements are mandated for Qualified Opportunity Funds and Qualified Rural Opportunity Funds.

Other Notable Provisions

- Limitation on Excess Business Losses (Sec. 112027): The limitation on excess business losses of noncorporate taxpayers under Section 461(l) is made permanent. The treatment of these losses as net operating loss carryovers is also clarified. This applies to taxable years beginning after December 31, 2025.

- Corporate Charitable Contribution Floor (Sec. 112028): For corporations, charitable contributions will only be deductible to the extent they exceed 1% of taxable income, while the 10% of taxable income cap remains. This applies to taxable years beginning after December 31, 2025.

- Termination/Phase-Out of Certain Clean Energy Credits (Subtitle C, Part 1): Several clean energy tax credits for vehicles, home improvements, and electricity production are terminated or phased out. Businesses in these sectors or those planning to utilize these credits should review these changes carefully (Sections 112001-112015).

Conclusion and Next Steps

The "One Big Beautiful Bill Act" proposes a wide range of tax changes that could significantly affect small businesses. While many provisions aim to provide relief and stimulate growth, particularly for "Main Street" businesses and those in rural areas, others introduce new limitations or accelerate the phase-out of existing benefits. Small business owners should consult with their tax advisors to understand the specific implications of these proposed changes for their operations and to plan accordingly. Keeping abreast of the bill's progress through the legislative process will also be essential.

Stay Ahead with TimeTrex

Navigating complex legislative changes can be challenging. TimeTrex is here to help simplify your payroll and workforce management, allowing you to focus on what you do best – running your business. Our solutions are designed to adapt to evolving tax laws and reporting requirements.

Learn More About TimeTrex Payroll SolutionsDisclaimer: The content provided on this webpage is for informational purposes only and is not intended to be a substitute for professional advice. While we strive to ensure the accuracy and timeliness of the information presented here, the details may change over time or vary in different jurisdictions. Therefore, we do not guarantee the completeness, reliability, or absolute accuracy of this information. The information on this page should not be used as a basis for making legal, financial, or any other key decisions. We strongly advise consulting with a qualified professional or expert in the relevant field for specific advice, guidance, or services. By using this webpage, you acknowledge that the information is offered “as is” and that we are not liable for any errors, omissions, or inaccuracies in the content, nor for any actions taken based on the information provided. We shall not be held liable for any direct, indirect, incidental, consequential, or punitive damages arising out of your access to, use of, or reliance on any content on this page.

About The Author

Roger Wood

With a Baccalaureate of Science and advanced studies in business, Roger has successfully managed businesses across five continents. His extensive global experience and strategic insights contribute significantly to the success of TimeTrex. His expertise and dedication ensure we deliver top-notch solutions to our clients around the world.

Time To Clock-In

Start your 30-day free trial!

Experience the Ultimate Workforce Solution and Revolutionize Your Business Today

- Eliminate Errors

- Simple & Easy To Use

- Real-time Reporting

Saving businesses time and money through better workforce management since 2003.

Copyright © 2026 TimeTrex. All Rights Reserved.