2024 Changes to BOI Reporting: A Guide for Small Business Owners

In today’s increasingly transparent financial ecosystem, the importance of Beneficial Ownership Information (BOI) Reporting has never been more pronounced. With the global push towards clamping down on illicit financial flows, money laundering, and the financing of terrorism, understanding and complying with BOI reporting requirements has become crucial for businesses across the spectrum. This initiative, fundamentally aimed at peeling back the layers of corporate structures to reveal the individuals who ultimately own or control a company, marks a significant step in the right direction for financial integrity and transparency.

The enactment of the Corporate Transparency Act (CTA) has been a pivotal moment for small business owners in the United States. Introduced as part of broader efforts to fortify financial systems against abuse, the CTA mandates the reporting of beneficial ownership information, fundamentally altering the compliance landscape for small businesses. By requiring companies to disclose the identities of their beneficial owners, the Act aims to curb the misuse of corporate entities for illicit purposes, ensuring a level playing field for all businesses.

However, with new regulations come new challenges. The 2024 changes to the BOI Reporting requirements, as outlined by the Financial Crimes Enforcement Network (FinCEN), have left many small business owners navigating a complex web of compliance obligations. This evolution in reporting requirements underscores the government’s commitment to tightening the reins on financial crimes but also poses a significant compliance burden on the small business community.

Pro-Tip

Integrate Compliance into Business Processes: Proactively integrate BOI reporting requirements into your regular business processes and internal audits. This ensures that compliance becomes a seamless part of operations, reducing the risk of missed deadlines or overlooked changes in beneficial ownership.

Understanding BOI Reporting Requirements

What is BOI?

Beneficial Ownership Information (BOI) reporting refers to the regulatory requirement for certain businesses to disclose key information about the individuals who ultimately own or control the business entity, often referred to as beneficial owners. This information typically includes details such as names, addresses, dates of birth, and identification numbers for these individuals. The purpose of collecting this information is to peel away the layers of ownership or control that can obscure the true owners of a company, especially in complex corporate structures with multiple layers of ownership.

The importance of BOI in combating financial crimes cannot be overstated. By shedding light on the individuals who ultimately own or control a company, authorities can more effectively trace illicit funds, combat tax evasion, prevent fraud, and disrupt financing channels for terrorism and other criminal activities. This transparency is critical in the global fight against financial crime, as opaque corporate structures can otherwise be exploited to hide illicit activities and the proceeds of crime.

BOI Reporting Company Definition

Why Report BOI?

The rationale behind requiring companies to report their beneficial ownership information is twofold: enhancing transparency and preventing misuse of corporate structures. Transparent corporate ownership structures make it more difficult for individuals to use companies for illicit purposes, such as money laundering, fraud, tax evasion, and financing terrorism. By understanding who ultimately owns and profits from a company, law enforcement and regulatory agencies can more easily identify suspicious activities and take appropriate action.

Furthermore, BOI reporting contributes to a level playing field in the business environment. When all companies are held to the same standards of transparency, it becomes more challenging for illicit actors to operate under the radar. This not only protects the integrity of the financial system but also ensures fair competition among businesses by mitigating the risk of reputational damage associated with being unknowingly involved with illicit activities.

Access to BOI

Access to the beneficial ownership information collected through BOI reporting is tightly controlled to protect sensitive personal information while still serving the purposes of law enforcement and regulatory oversight. Generally, access is granted to federal, state, local, and tribal law enforcement agencies for specific investigations or actions related to national security, intelligence, and law enforcement activities. Additionally, financial institutions may access BOI with the consent of the reporting company to fulfill customer due diligence requirements under anti-money laundering laws.

To ensure the confidentiality and security of the reported information, rigorous information security measures are implemented. These include storing the information in a secure, non-public database and restricting access only to authorized personnel who have a legitimate need to know the information for specific, approved purposes. The emphasis on confidentiality and security measures aims to balance the need for transparency and crime prevention with the need to protect individual privacy and prevent unauthorized access to sensitive personal information.

Pro-Tip

Utilize Digital Tools for Record Keeping: Leverage digital tools and software designed for compliance and record-keeping. Many of these tools offer features such as automated reminders for reporting deadlines, secure storage for sensitive documents, and easy retrieval of records when needed for reporting or audits.

The Reporting Process Simplified

Understanding the process and timeline for reporting Beneficial Ownership Information (BOI) is crucial for compliance. This section breaks down the reporting timeline, the submission process, and the fee structure to simplify the obligations for small business owners.

Timeline for Reporting

The timeline for reporting BOI varies depending on whether your business is newly established or existing:

-

For Existing Businesses: Companies that were created or registered before January 1, 2024, are required to submit their initial BOI report by January 1, 2025. This provides a grace period for existing businesses to gather the necessary information and comply with the new requirements.

-

For New Businesses: Companies created or registered on or after January 1, 2024, have specific deadlines based on their registration dates:

- If registered in 2024, businesses have 90 calendar days from the date of registration to file their initial BOI report.

- For those registered on or after January 1, 2025, the deadline is within 30 calendar days from the date of registration.

It’s important to note that any changes to the beneficial ownership information after the initial filing require an updated report to be submitted within 30 days of the change.

Submitting Your Report

Submitting your BOI report involves several key steps and requires gathering specific documentation. Here’s a simplified guide:

Gather Necessary Information:

- Identifying information for each beneficial owner and company applicant, including full legal name, date of birth, residential address, and an identification number (such as from a passport or driver’s license).

Access the Reporting Portal:

- The BOI reports are submitted electronically via the FinCEN’s BOI E-Filing website. First-time users will need to create an account.

Complete the BOI Form:

- Fill in the required information for your company, beneficial owners, and any company applicants. Ensure accuracy to avoid the need for corrections later.

Attach Required Documentation:

- Upload images of identification documents for each individual listed in the report.

Review and Submit:

- Before submission, thoroughly review the report for accuracy. Once submitted, you will receive a confirmation for your records.

Keep Records:

- Maintain copies of the submitted report and any correspondence with FinCEN regarding the submission. This is crucial for compliance and future reference.

Fee Structure

As of the latest guidance:

Submission Fee: There is no fee for submitting a BOI report to FinCEN. This applies to both initial and updated reports, making compliance accessible for all businesses without the burden of additional costs.

Updating or Correcting Reports: Similarly, there are no fees associated with submitting updated or corrected BOI reports, ensuring that businesses can maintain their compliance status without financial penalty for making necessary changes.

Pro-Tip

Establish a Single Point of Contact: Designate a compliance officer or a single point of contact within your organization responsible for managing BOI reporting. This centralized approach ensures accountability and consistency in how your business meets its reporting obligations.

Identifying Your Reporting Obligations

Understanding whether your business falls under the scope of the Beneficial Ownership Information (BOI) reporting requirements is a crucial first step toward compliance. This section will help clarify which businesses are considered reporting companies, outline the exemptions available, and discuss special considerations for trusts, foreign entities, and other specific cases.

Who Needs to Report?

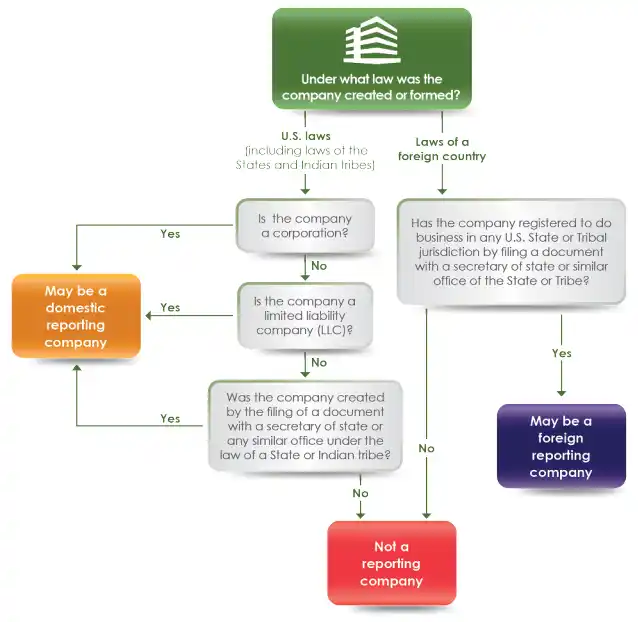

The Corporate Transparency Act (CTA) categorizes businesses required to report beneficial ownership information to the Financial Crimes Enforcement Network (FinCEN) as “reporting companies.” This includes:

Domestic Reporting Companies: Corporations, limited liability companies (LLCs), and any other entity created by filing a document with a state or tribal office within the United States.

Foreign Reporting Companies: Entities formed under the law of a foreign country that are registered to do business in the United States by filing with a state or tribal office.

Essentially, if your business is officially registered and operates within the U.S. or does business in the U.S. as a foreign entity, it likely falls under the category of a reporting company, requiring you to disclose beneficial ownership information unless an exemption applies.

Exemptions to Know

Not all businesses are required to report. The CTA and FinCEN provide specific exemptions for certain entities based on their nature and regulatory oversight. Exempt entities typically include:

Publicly Traded Companies: Businesses whose securities are listed on a U.S. stock exchange are exempt due to existing regulatory disclosures.

Governmental Entities: This includes entities established under the laws of the United States, a state, or a political subdivision of a state, among others.

Certain Regulated Financial Institutions: Banks, credit unions, and other entities that are already subject to regulatory oversight and beneficial ownership reporting requirements.

Large Operating Companies: Entities that employ more than 20 full-time employees in the U.S., report more than $5 million in gross receipts or sales on federal income tax returns, and have an operating presence at a physical office within the U.S.

Inactive Entities: Entities that have been inactive for over 12 months, are not sending or receiving funds, and do not hold any kind of assets.

| Exemption No. | Exemption Short Title |

|---|---|

| 1 | Securities reporting issuer |

| 2 | Governmental authority |

| 3 | Bank |

| 4 | Credit union |

| 5 | Depository institution holding company |

| 6 | Money services business |

| 7 | Broker or dealer in securities |

| 8 | Securities exchange or clearing agency |

| 9 | Other Exchange Act registered entity |

| 10 | Investment company or investment adviser |

| 11 | Venture capital fund adviser |

| 12 | Insurance company |

| 13 | State-licensed insurance producer |

| 14 | Commodity Exchange Act registered entity |

| 15 | Accounting firm |

| 16 | Public utility |

| 17 | Financial market utility |

| 18 | Pooled investment vehicle |

| 19 | Tax-exempt entity |

| 20 | Entity assisting a tax-exempt entity |

| 21 | Large operating company |

| 22 | Subsidiary of certain exempt entities |

| 23 | Inactive entity |

Special Considerations

Certain types of entities may require additional consideration to determine their reporting obligations:

Trusts: Generally, trusts are not required to report unless they are created by filing a document with a state office, such as a statutory trust. However, the specific requirements can vary based on the trust’s structure and activities.

Foreign Entities: Entities formed outside of the U.S. but registered to do business in the U.S. are considered foreign reporting companies and generally must report their beneficial ownership information unless an exemption applies.

Joint Ventures, Partnerships, and Other Non-Corporate Entities: These entities may have reporting obligations depending on how they are structured and whether they meet the definition of a reporting company under the CTA.

Pro-Tip

Educate Beneficial Owners and Company Applicants: Regularly educate and update beneficial owners and company applicants about their roles and responsibilities in compliance. Clear communication can prevent delays and ensure that necessary information for BOI reporting is readily available.

Defining Beneficial Owners and Company Applicants

Understanding who falls under the definitions of beneficial owners and company applicants is pivotal for compliance with the Beneficial Ownership Information (BOI) Reporting requirements under the Corporate Transparency Act (CTA). This clarity ensures accurate reporting and helps in the broader objective of enhancing transparency and combating illicit financial activities.

Criteria for Beneficial Owners

A “beneficial owner” in the context of BOI reporting, refers to individuals who:

- Exercise Substantial Control over the reporting company, or

- Own or Control at least 25% of the ownership interests in the reporting company.

Substantial Control can manifest in various ways, including but not limited to:

- Authority to make significant decisions regarding the reporting company’s operations, financial management, and other pivotal business aspects.

- Positions held within the company, such as a senior officer role, that confer significant influence over the company.

- The right to appoint or dismiss directors, or influence changes in the business structure and practices significantly.

Ownership Interest is defined broadly to include:

- Direct or indirect ownership of a significant portion (25% or more) of the company’s shares, voting rights, or other ownership instruments.

- Any arrangements that allow an individual to benefit financially from the company’s assets or profits equivalent to owning a 25% or greater interest.

The goal is to identify individuals who, through their control or ownership, could potentially use the company for illicit purposes, ensuring that companies cannot be used as vehicles for hiding ownership related to money laundering, financing terrorism, and other financial crimes.

Company Applicants Explained

Company Applicants are individuals who play a significant role in the creation or registration of a reporting company. Specifically, they are:

- The individual who directly files the document that creates the reporting company (e.g., articles of incorporation for a corporation or articles of organization for an LLC).

- If more than one person is involved in filing, the individual primarily responsible for directing or controlling the filing of the document.

The requirement to report company applicants aims to provide an additional layer of transparency during the initial phase of a company’s life cycle, making it harder for illicit actors to anonymously establish entities for nefarious purposes.

Reporting Requirements for Company Applicants:

- For companies formed or registered on or after January 1, 2024, information about company applicants is required as part of the initial BOI report.

- The information required includes names, dates of birth, addresses, and an image of an identification document (such as a passport or driver’s license) for each company applicant.

This reporting obligation ensures that there is a clear, traceable record of the individuals responsible for the establishment of the company right from its inception. By distinguishing between beneficial owners and company applicants, the CTA seeks to cast a wide net of accountability, covering both the operational control and the foundational aspects of companies.

Pro Tip

Engage with Industry Associations: Participate in forums, webinars, and workshops offered by industry associations. These platforms can provide valuable insights, updates on regulatory changes, and networking opportunities with peers facing similar compliance challenges.

Reporting Requirements Detailed

The Corporate Transparency Act (CTA) and the Financial Crimes Enforcement Network (FinCEN) mandate specific reporting requirements to enhance the transparency of business ownership in the United States. These requirements are designed to prevent and combat money laundering, terrorist financing, and other illicit financial activities. Understanding the detailed reporting requirements is crucial for businesses to ensure compliance.

Information to Report

For the Reporting Company:

- Legal Name and Any DBA (Doing Business As) Names: The official name under which the company is registered and any other names the business operates under.

- Address of the Principal Place of Business: For U.S.-based entities, this is typically the main office or headquarters address. For foreign entities operating in the U.S., it is the primary location where business is conducted within the U.S.

- Jurisdiction of Formation or Registration: The state or foreign country where the company was legally formed or registered.

- Taxpayer Identification Number (TIN) or Equivalent: For U.S. entities, this includes the Employer Identification Number (EIN). Foreign entities should provide a foreign tax identification number if a U.S. TIN is not available.

For Each Beneficial Owner:

- Name: The full legal name of the beneficial owner.

- Date of Birth: To verify the identity of the beneficial owner.

- Address: The residential address for individuals; for reporting entities listed as beneficial owners, the principal business address.

- Unique Identifying Number: Typically, this is a number from an acceptable identification document (more details under “Identification Needs”).

- Image of Identification Document: A copy of the document used to provide the unique identifying number.

For Company Applicants (for entities created or registered on or after January 1, 2024):

- Similar to beneficial owners, company applicants must provide their name, date of birth, address, a unique identifying number from an acceptable document, and an image of that document.

Identification Needs

The CTA and FinCEN require specific types of identification to verify the identity of beneficial owners and company applicants. Acceptable forms of identification include:

For U.S. Persons:

- A non-expired U.S. passport.

- A driver’s license issued by a U.S. state or territory.

- An identification card issued by any state, local government, or Indian Tribe.

For Foreign Persons:

- A non-expired passport issued by the government of a foreign country.

These identification requirements ensure that the information reported to FinCEN can be reliably verified, enhancing the accuracy of the beneficial ownership data maintained.

When submitting a BOI report, businesses must include an image of the identification document for each beneficial owner and company applicant. This image must clearly show the individual’s name, date of birth, photo (if applicable), and the document’s expiration date. This requirement helps to prevent identity fraud and ensures that the information provided is accurate and up-to-date.

Pro Tip

Monitor Regulatory Updates: Stay informed about regulatory updates and changes to BOI reporting requirements by subscribing to updates from FinCEN and other relevant regulatory bodies. Regulatory environments can evolve, and staying updated helps ensure ongoing compliance.

Filing Your Initial and Updated Reports

Navigating the process of filing your initial and updated Beneficial Ownership Information (BOI) reports is a critical aspect of compliance for businesses under the Corporate Transparency Act (CTA). This section provides detailed guidelines to ensure that your business meets its reporting obligations accurately and timely.

Initial Report Filing

When to File:

- Existing Businesses: If your business was established before January 1, 2024, you are required to file your initial BOI report by January 1, 2025.

- New Businesses: For businesses created or registered on or after January 1, 2024, the timeline to file your initial report depends on your registration date:

- If registered in 2024, you have 90 calendar days from the effective date of registration to file.

- For registrations on or after January 1, 2025, you must file within 30 calendar days from the registration date.

How to File:

- Gather Required Information: Before starting the filing process, ensure you have all necessary information about your company, beneficial owners, and company applicants (if applicable).

- Access FinCEN’s BOI E-Filing System: Visit the BOI E-Filing portal provided by FinCEN to access the reporting form. First-time users will need to create an account.

- Complete the Form: Fill out the form with accurate information about your business and the individuals or entities with beneficial ownership. Attach required documentation, such as identification images.

- Review and Submit: Double-check the information for accuracy to prevent the need for future corrections. Submit the completed form through the E-Filing system.

- Confirmation: Upon successful submission, you’ll receive a confirmation receipt. Keep this for your records as proof of compliance.

Updating Your Report

Changes in beneficial ownership, company details, or company applicants’ information necessitate filing an updated BOI report. This ensures that the information FinCEN holds remains accurate and current.

When to Update:

- An updated report must be filed within 30 days of any change that affects the information previously reported. This includes changes in beneficial ownership, company address, or governance structures that alter who has substantial control.

How to Update:

- Identify Changes: Regularly review your company’s reported details to identify any changes that require reporting.

- Access the Update Form: Log into the FinCEN BOI E-Filing system and select the option to file an updated report.

- Fill in Updated Information: Provide the new information that reflects the changes in your business or beneficial ownership. You only need to report the changes, not re-submit information that remains the same.

- Attach Supporting Documents: If the update involves new beneficial owners or company applicants, attach images of their identification documents.

- Review and Resubmit: Carefully review the updated information for accuracy, then submit the form. You will receive a confirmation receipt, which should be retained for your records.

Key Points to Remember

- Timeliness is crucial for both initial and updated filings to avoid penalties.

- Accuracy in reporting not only fulfills legal obligations but also contributes to the broader goal of preventing illicit use of business entities.

- Regularly updating your BOI report as changes occur ensures ongoing compliance and reduces the risk of legal issues.

Pro Tip

Develop a Compliance Calendar: Create a compliance calendar that tracks all reporting deadlines, including initial BOI reporting and updates. Incorporating reminders and checkpoints throughout the year can prevent last-minute rushes and ensure timely submissions.

Compliance and Enforcement

In the effort to combat financial crimes and enhance transparency within the business environment, the Corporate Transparency Act (CTA) mandates strict compliance with Beneficial Ownership Information (BOI) reporting requirements. Understanding the penalties for non-compliance and the importance of accuracy in reporting is crucial for all businesses subject to these regulations.

Understanding Penalties

Failure to Report: Businesses that neglect to file their initial BOI report or fail to report significant changes within the designated timeframe may face severe consequences. These can include civil penalties, such as fines up to $500 for each day the violation continues, potentially accumulating to significant sums over time. More severe cases of non-compliance, especially those involving willful intent to hide beneficial ownership information, can lead to criminal penalties, including imprisonment for up to two years and additional fines.

Misreporting Information: Willfully providing false or fraudulent beneficial ownership information to FinCEN is treated with equal severity. Such acts are subject to criminal penalties, including fines and imprisonment, underscoring the importance of accurate and truthful reporting.

Correcting Inaccuracies: The CTA provides a mechanism for correcting inaccuracies in previously filed reports. Businesses that discover errors in their reports are expected to file corrected reports within 30 days of identifying such inaccuracies. This is not just a compliance requirement but also a protective measure against potential penalties for incorrect information that was initially filed without the intent to deceive.

Ensuring Accuracy

To avoid the pitfalls of non-compliance and the associated penalties, businesses must prioritize the accuracy of their BOI reports. Here are some tips to help ensure the information you report is both accurate and complete:

Regular Review and Verification:

- Conduct regular reviews of your internal records and the information previously reported to FinCEN to ensure it remains current and accurate. Pay particular attention to any changes in beneficial ownership or company details that may require an update to your BOI report.

Use Reliable Sources:

- Gather information for your BOI reports from reliable sources. For individual beneficial owners, this means official documents that verify their identity and ownership stake. For company information, use documents from your internal corporate records that accurately reflect the current state of affairs.

Maintain Comprehensive Records:

- Keep detailed records of the information used to complete your BOI reports, including copies of identification documents for beneficial owners and company applicants. This not only aids in ensuring accuracy but also serves as evidence of your due diligence should your submissions be questioned.

Utilize Legal and Professional Advice:

- Consider seeking advice from legal or compliance professionals familiar with BOI reporting requirements. Their expertise can help navigate complex ownership structures or ambiguous situations, ensuring that your reports meet all regulatory requirements.

Leverage Training and Resources:

- Take advantage of training sessions, webinars, and resources offered by FinCEN and other regulatory bodies. Staying informed about best practices and common pitfalls can significantly reduce the risk of inaccuracies in your reports.

Pro Tip

Leverage External Audits: Consider engaging external auditors or compliance specialists periodically to review your BOI reporting processes and documentation. External reviews can identify gaps or areas for improvement that internal audits might miss.

Leveraging Third-Party Service Providers

In the complex landscape of Beneficial Ownership Information (BOI) reporting under the Corporate Transparency Act (CTA), many businesses may find the process challenging due to its detailed requirements and the potential for costly errors. This is where third-party service providers can play a pivotal role, offering expertise and streamlined processes to ensure compliance. Understanding the advantages of using third-party services can help businesses make informed decisions about how to manage their reporting obligations efficiently.

Advantages of Using Third-Party Services

Expertise and Specialization:

- Third-party service providers specializing in regulatory compliance bring a wealth of knowledge to the table. They stay abreast of the latest regulatory changes, interpretations, and best practices, offering businesses peace of mind that their reporting is handled by experts.

- Their specialization in compliance processes allows them to navigate complex ownership structures and identify reportable beneficial ownership information accurately.

Time and Resource Efficiency:

- By outsourcing BOI reporting tasks, businesses can save significant internal resources and time that would otherwise be spent on understanding compliance requirements, collecting necessary information, and filling out reports.

- This efficiency allows companies to focus on their core operations, knowing that their compliance needs are being professionally managed.

Risk Mitigation:

- Missteps in compliance reporting can lead to severe penalties, including fines and criminal charges. Third-party providers mitigate this risk by ensuring accurate, timely submissions, and by keeping their clients informed of upcoming deadlines and any changes in their reporting obligations.

- They can also assist in maintaining proper records and documentation, further reducing the risk of non-compliance.

Scalability:

- For businesses that experience rapid growth or have complex corporate structures, third-party service providers offer scalable solutions that can adapt to changing needs. Whether it’s managing an increasing number of beneficial owners or integrating new entities into compliance frameworks, these providers can handle varying scales of complexity.

Cost-Effectiveness:

- While there is a cost to using third-party services, this expense can be outweighed by the potential cost savings from avoiding non-compliance penalties. Additionally, the operational efficiencies gained by outsourcing compliance tasks can translate into financial savings over time.

Technology and Tools:

- Many third-party service providers utilize advanced technology and tools to streamline the reporting process. This includes secure online platforms for data submission, automated reminders for upcoming deadlines, and digital record-keeping systems.

- These technological solutions not only enhance the accuracy and efficiency of the reporting process but also provide businesses with easy access to their compliance data and reports.

Selecting a Third-Party Service Provider

When choosing a third-party service provider for BOI reporting, businesses should consider the provider’s track record, the breadth of their services, their understanding of the specific industry and regulatory landscape, and their ability to offer customized solutions. Additionally, assessing the security measures in place to protect sensitive information is crucial.

Pro Tip

Prepare for Possible Exits or Transitions: Have a plan in place for reporting beneficial ownership changes in the event of major business transitions, such as mergers, acquisitions, or the sale of the business. Planning ahead can smooth these transitions and ensure compliance during periods of change.

Tools and Resources for Compliance

Navigating the complexities of Beneficial Ownership Information (BOI) reporting requires access to accurate information and resources. The Financial Crimes Enforcement Network (FinCEN) provides various tools and guides to assist businesses in complying with the Corporate Transparency Act (CTA). Additionally, there are circumstances when seeking professional help from a lawyer or Certified Public Accountant (CPA) becomes necessary to ensure accurate and timely compliance. This section delves into the resources available and guidance on when to seek professional assistance.

FinCEN Resources

FinCEN’s Official Website:

- Guidance Documents and FAQs: FinCEN regularly publishes detailed guidance documents and frequently asked questions (FAQs) to clarify reporting requirements, definitions, and processes related to BOI reporting. These resources are invaluable for understanding your obligations under the CTA.

- BOI Reporting Portal: Access to the online reporting portal, where businesses can submit their BOI reports, update information, or correct previously submitted reports. The portal also provides instructions and support for navigating the submission process.

- Educational Webinars and Workshops: FinCEN occasionally hosts webinars and workshops designed to educate businesses and professionals about BOI reporting requirements, updates to the law, and how to use FinCEN’s reporting tools effectively.

- Compliance Guides: Specifically tailored guides for small businesses, detailing step-by-step compliance processes, including how to identify beneficial owners and company applicants, and how to submit reports.

Customer Service and Contact Information:

- FinCEN maintains a dedicated service team to answer specific queries related to BOI reporting. Contact information is available on their website, providing businesses a direct line for assistance.

Seeking Professional Help

While FinCEN’s resources are extensive, the intricacies of BOI reporting and the potential legal and financial implications of non-compliance may necessitate professional advice. Here are scenarios when hiring a professional may be prudent:

Complex Ownership Structures:

- If your business has a complicated ownership or control structure, interpreting who qualifies as a beneficial owner for reporting purposes may require legal expertise.

International Entities:

- Foreign entities operating in the U.S. face additional complexities in compliance. Legal professionals or CPAs with international experience can provide clarity and ensure that reporting meets both U.S. and home country regulations.

Privacy Concerns:

- For individuals with privacy concerns or who wish to understand the implications of disclosing personal information, legal counsel can offer strategies to comply with the law while protecting personal privacy.

Legal and Tax Implications:

- Understanding the legal and tax implications of how your business is structured in relation to BOI reporting may require the insight of a CPA or tax attorney. This is particularly important for ensuring that the reporting aligns with your business’s broader legal and financial strategy.

Record Keeping and Documentation:

- Maintaining accurate records and documentation for compliance can be complex. Professionals can help set up systems to manage this information effectively, reducing the risk of non-compliance.

When Selecting a Professional:

- Look for expertise in corporate law, tax law, or accounting, with a focus on compliance and regulatory matters.

- Consider professionals with specific experience in your industry or with businesses of similar size and structure.

- Assess their familiarity with FinCEN’s regulations and the Corporate Transparency Act to ensure they can provide the most current and relevant advice.

Pro Tip

Prioritize Data Security: Given the sensitive nature of the information involved in BOI reporting, prioritize data security in all aspects of the reporting process. This includes secure transmission of reports, encrypted storage of beneficial ownership information, and controlled access to this information within your organization.

Frequently Asked Questions (FAQs) on BOI Reporting

1. What happens if beneficial ownership changes after filing the initial BOI report?

If there is a change in beneficial ownership, reporting companies must file an updated BOI report within 30 days of the change. This ensures that the information maintained by FinCEN remains accurate and current.

2. Can a company withdraw its BOI report if it goes out of business?

If a reporting company ceases operations, it cannot “withdraw” its BOI report, but it may need to file a final update indicating that it has dissolved. The specific requirements for reporting dissolution or cessation of business operations are outlined by FinCEN.

3. Are non-profit organizations required to file BOI reports?

Most non-profit organizations are exempt from BOI reporting requirements because they fall under the category of tax-exempt entities. However, it’s important to review the specific exemptions and criteria provided by FinCEN to confirm a non-profit’s reporting obligations.

4. How can a company correct errors in a previously submitted BOI report?

To correct errors in a BOI report, the reporting company must file a corrected report through FinCEN’s BOI E-Filing system within 30 days of identifying the error. The corrected report should accurately reflect the intended information.

5. Do changes in a company's address or contact information require an updated BOI report?

Yes, any changes to the reporting company’s address or contact information should be updated in a new BOI report within 30 days of the change. Keeping contact information current is crucial for compliance and communication purposes.

6. How does a company determine if it is "actively engaged in business" for exemption purposes?

A company is considered “actively engaged in business” if it is conducting substantive operations, generating revenue, or performing the activities for which it was established. Merely holding assets or being registered as a legal entity does not, on its own, constitute active engagement in business.

7. Are trusts required to file BOI reports?

Trusts are generally not required to file BOI reports unless they are structured in a manner that requires registration with a state office, such as statutory trusts. The obligations for trusts can be complex, and it may be beneficial to consult with a legal expert.

8. What are the penalties for knowingly providing false information in a BOI report?

Knowingly providing false information in a BOI report is a serious offense that can result in civil penalties, criminal charges, and fines. The penalties include fines up to $10,000 and/or imprisonment for up to two years.

9. Can a reporting company use a P.O. Box as its address in the BOI report?

No, reporting companies must provide a physical street address for their principal place of business or, for foreign entities, the primary business location in the U.S. P.O. Boxes are not acceptable for this purpose.

10. How does a reporting company obtain a FinCEN identifier, and is it required for all beneficial owners?

A reporting company or individual can request a FinCEN identifier by submitting an application through FinCEN’s portal. It’s a unique identifier that can simplify future reporting but is not mandatory for all beneficial owners. Beneficial owners can choose to provide their personal information directly in the BOI report instead of using a FinCEN identifier.

11. Are annual or periodic BOI reports required?

No, annual or periodic BOI reports are not required. However, reporting companies must file updated reports within 30 days of any change to the reported information, including changes in beneficial ownership, company applicants, or company information.

12. How should a reporting company handle beneficial ownership information for individuals with dual citizenship?

For individuals with dual citizenship, the reporting company should use the identification document that the individual prefers, provided it meets FinCEN’s requirements for acceptable forms of identification. It’s important to ensure that the documentation accurately reflects the individual’s identity and legal status.

13. What is the process for filing an updated BOI report if there's a change in the company's structure, such as a merger or acquisition?

If a company undergoes a significant structural change, such as a merger or acquisition, it must file an updated BOI report within 30 days detailing the change. This includes any changes in beneficial ownership or company information resulting from the structural adjustment.

14. Are foreign-owned subsidiaries operating in the U.S. required to file BOI reports?

Yes, foreign-owned subsidiaries that are registered to do business in the U.S. are considered reporting companies under the Corporate Transparency Act and must file BOI reports unless they qualify for an exemption.

15. How does a company report beneficial owners who are minors?

For beneficial owners who are minors, the reporting company should follow the same process as for adult beneficial owners, including providing the minor’s full legal name, date of birth, address, and identification number. Parental or guardian consent may be required to obtain and submit this information.

16. Can a reporting company amend a BOI report to add a new beneficial owner before the 30-day deadline?

A reporting company can file an updated BOI report at any time before the 30-day deadline if new beneficial owners need to be added or other information needs to be changed, ensuring the report remains current and accurate.

17. What confidentiality protections are in place for the information provided in BOI reports?

FinCEN takes the confidentiality of BOI reports seriously. Access to this information is limited to authorized government agencies and, in certain circumstances, financial institutions, with strict controls to prevent unauthorized disclosure.

18. How are beneficial ownership thresholds calculated for companies with complex ownership structures?

For companies with layered or complex ownership structures, beneficial ownership thresholds are calculated based on direct and indirect ownership interests. It may involve aggregating ownership percentages across different levels of ownership to determine if an individual or entity meets the 25% threshold.

19. Are partnerships required to file BOI reports?

Partnerships, depending on their structure and the laws under which they were formed, may be required to file BOI reports. Specifically, if a partnership is registered with a state office, it likely falls under the definition of a reporting company.

20. Is there a grace period for newly established companies to file their initial BOI report?

Newly established companies created or registered on or after January 1, 2024, have a specific timeframe to file their initial BOI report based on their registration date, with no additional grace period beyond these prescribed deadlines.

21. How does a company determine the principal place of business for BOI reporting purposes?

The principal place of business is typically where the company’s senior management and direct support staff are primarily or predominantly located or, for foreign entities, where the company conducts a significant portion of its business activities in the U.S.

22. Can electronic signatures be used on BOI reports?

Electronic signatures are accepted on BOI reports submitted through FinCEN’s electronic filing system, as long as they comply with the system’s requirements and any applicable legal standards for electronic signatures.

23. What happens if a beneficial owner refuses to provide their information for a BOI report?

If a beneficial owner refuses to provide their information, the reporting company may face challenges in complying with the BOI reporting requirements. In such cases, companies should document their efforts to obtain the information and seek legal advice on how to proceed.

24. Are there exemptions for companies that only operate online with no physical presence?

The lack of a physical presence does not exempt a company from BOI reporting requirements. Online-only businesses must still file BOI reports if they meet the criteria for reporting companies, unless they qualify for a specific exemption.

Disclaimer: The content provided on this webpage is for informational purposes only and is not intended to be a substitute for professional advice. While we strive to ensure the accuracy and timeliness of the information presented here, the details may change over time or vary in different jurisdictions. Therefore, we do not guarantee the completeness, reliability, or absolute accuracy of this information. The information on this page should not be used as a basis for making legal, financial, or any other key decisions. We strongly advise consulting with a qualified professional or expert in the relevant field for specific advice, guidance, or services. By using this webpage, you acknowledge that the information is offered “as is” and that we are not liable for any errors, omissions, or inaccuracies in the content, nor for any actions taken based on the information provided. We shall not be held liable for any direct, indirect, incidental, consequential, or punitive damages arising out of your access to, use of, or reliance on any content on this page.

About The Author

Roger Wood

With a Baccalaureate of Science and advanced studies in business, Roger has successfully managed businesses across five continents. His extensive global experience and strategic insights contribute significantly to the success of TimeTrex. His expertise and dedication ensure we deliver top-notch solutions to our clients around the world.

Time To Clock-In

Start your 30-day free trial!

Experience the Ultimate Workforce Solution and Revolutionize Your Business Today

- Eliminate Errors

- Simple & Easy To Use

- Real-time Reporting

Saving businesses time and money through better workforce management since 2003.

Copyright © 2025 TimeTrex. All Rights Reserved.