Net Pay vs Gross Pay

Understanding the difference between net pay and gross pay is crucial for both employers and employees, serving as the foundation of financial literacy in the workplace. Gross pay represents the total earnings before any deductions are made, such as taxes, benefits, and other payroll deductions. On the other hand, net pay, often referred to as take-home pay, is the amount an employee receives after all deductions have been accounted for. This distinction is not only vital for personal financial planning but also plays a significant role in employment negotiations and payroll management.

For employees, grasping the nuances between gross and net pay helps in better financial planning and setting realistic expectations regarding their income. It enables them to understand their compensation package more thoroughly and anticipate their monthly take-home pay accurately. For employers, familiarity with these concepts is equally important. It aids in transparent communication with employees about compensation, ensures compliance with tax and employment laws, and facilitates effective payroll administration.

What is Gross Pay?

Gross pay is the total amount of money an employee earns before any deductions are made. This figure represents the initial earnings agreed upon by the employer and the employee, not taking into account taxes, benefits, retirement contributions, or any other payroll deductions. Gross pay is the starting point of an employee’s compensation package and serves as the benchmark for financial and tax-related considerations.

The significance of gross pay extends beyond just a number on a paycheck; it is a critical element in salary negotiations and understanding tax obligations. When discussing compensation, both employers and employees refer to the gross pay to establish the terms of employment. It’s the figure used to compare job offers, evaluate salary increases, and determine eligibility for loans or credit. For tax purposes, gross pay is essential because it determines an individual’s tax bracket, affecting how much federal and state income tax they owe.

Gross pay can come in various forms, depending on the nature of the employment and the agreement between the employer and the employee:

- Annual Salary: A fixed amount paid to salaried employees, divided over the year’s pay periods. This figure does not vary with the number of hours worked, providing a steady income stream for employees.

- Hourly Wage: Compensation that varies with the number of hours worked. Employees paid on an hourly basis report their hours each pay period to calculate their gross pay.

- Overtime: Additional compensation for hours worked beyond the standard full-time hours, typically paid at a higher rate. Overtime pay contributes to the gross pay and is regulated by employment laws to ensure fair compensation for extended work hours.

Understanding gross pay and its implications allows for better financial management, ensuring that both employers and employees make informed decisions regarding compensation, budgeting, and tax planning. Try our free and easy Gross Pay Calculator here.

Pro Tip: Conduct Regular Pay Audits

Perform Internal Payroll Audits: Regularly review your payroll processes and records to identify discrepancies, inefficiencies, or areas for improvement. This can help you adjust policies before they become issues.

Calculating Gross Pay

Calculating gross pay varies depending on the type of employment, whether salaried or hourly, and it’s critical for both employers and employees to understand these differences. Here’s how to calculate gross pay for both salaried and hourly employees, including considerations for overtime.

Salaried Employees

For salaried employees, gross pay is determined by dividing the annual salary by the number of pay periods in a year. The frequency of these pay periods can vary—monthly, semi-monthly, bi-weekly, or weekly—and affects the calculation of each paycheck.

Understanding Pay Schedules

| Pay Schedule | Pay Periods |

|---|---|

| Weekly | 52 |

| Bi-weekly | 26 |

| Semi-monthly | 24 |

| Monthly | 12 |

Example:

If an employee has an annual salary of $60,000 and is paid monthly, the gross pay per pay period would be:

Gross Pay = Annual Salary/Number of Pay Periods

Gross Pay: $60,000/12 = $5,000

This means the employee’s gross pay each month, before any deductions, is $5,000.

Gross Pay Calculation Explained

Gross Pay is calculated by dividing the Annual Salary by the Number of Pay Periods within a year.

This formula determines the amount an employee earns per pay period before any deductions like taxes or benefits are applied. For instance, if an employee's annual salary is $60,000 and they are paid monthly (12 times a year), their gross pay each month would be $5,000.

Hourly Employees

For hourly employees, gross pay is calculated by multiplying the number of hours worked in a pay period by their hourly wage. If they work overtime, the overtime hours are typically paid at a higher rate, often one and a half times the regular hourly rate.

Example:

An employee earns $20 per hour and works 40 regular hours and 10 overtime hours in a week. The overtime rate is 1.5 times the regular rate.

Regular pay: 40 hours x $20/hour = $800

Overtime pay: 10 hours x ($20/hour x 1.5) = $300

Total gross pay: $800 + $300 = $1,100

This means the employee’s gross pay for the week, before deductions, is $1,100.

Hourly Pay Calculation Explained

Regular Pay: Calculated by multiplying the number of regular hours worked by the hourly wage.

40 hours × $20/hour = $800Overtime Pay: For hours worked beyond the standard workweek, calculated at a higher rate (typically 1.5 times the regular hourly rate).

10 hours × ($20/hour × 1.5) = $300Total Gross Pay: The sum of regular pay and overtime pay.

$800 + $300 = $1,100Gross Pay Calculation Methods

| Employee Type | Calculation Method | Example Calculation | Gross Pay |

|---|---|---|---|

| Salaried | Annual Salary ÷ Number of Pay Periods | $60,000 ÷ 12 = $5,000 | $5,000 |

| Hourly | (Hourly Rate × Hours Worked) + (Overtime Rate × Overtime Hours) | (40 × $20) + (10 × $30) = $1,100 | $1,100 |

Pro Tip: Foster Transparent Communication

Develop Clear Payroll Policies: Establish and communicate clear policies regarding pay schedules, overtime, bonuses, and deductions. Transparency fosters trust and reduces confusion and disputes over pay.

Understanding Gross Income

In the landscape of financial planning and management, understanding the concept of gross income is fundamental. Gross income represents the total earnings an individual receives before any deductions or taxes are applied. This figure is crucial for a myriad of reasons, from determining tax obligations to establishing eligibility for loans and financial assistance. By grasping the intricacies of gross income, individuals can make more informed decisions regarding their finances, budgeting, and future financial planning.

The Relevance of Gross Income

Gross income serves as a cornerstone in personal financial planning. It affects various aspects of financial health, including:

- Tax Planning: Gross income is the starting point for calculating taxable income. Understanding your gross income is essential for accurate tax preparation and planning, ensuring you’re not caught off guard by tax liabilities.

- Loan Applications: Lenders often use gross income to determine your borrowing capacity. A higher gross income can lead to better loan terms and higher borrowing limits, enabling you to achieve your financial goals, such as purchasing a home or car.

- Budgeting: Knowing your gross income helps in creating a realistic budget. It allows you to allocate funds efficiently across savings, investments, and expenses, promoting better financial health.

Calculating Annual Gross Income from Gross Pay

To calculate your annual gross income, follow these straightforward steps:

- Identify Your Gross Pay: This is your pay before any deductions. For salaried employees, it’s the annual salary. For hourly employees, it’s the hourly rate multiplied by the typical number of work hours in a year.

- Include Additional Earnings: Add any additional income you receive on a regular basis, such as bonuses, overtime pay, commissions, and second jobs.

- Sum Up the Total: The aggregate of your gross pay and additional earnings constitutes your annual gross income.

Example Calculation

Let’s break down an example to illustrate the process:

Salaried Employee: Suppose you have an annual salary of $50,000. You also received a year-end bonus of $5,000. Your annual gross income would be:

Annual Salary + Bonus = Annual Gross Income

$50,000 + $5,000 = $55,000

Hourly Employee: If you earn $20 per hour, work 40 hours a week, and received $2,000 in overtime pay over the year, your calculation would be:

(Hourly Rate×Hours per Week × Weeks per Year) + Overtime Pay = Annual Gross Income

($20×40×52) + $2,000 = $44,000

These examples underscore the importance of considering all sources of income in your gross income calculation, offering a clear picture of your financial standing. Understanding and calculating your gross income accurately is a vital step in effective financial planning, allowing for smarter budgeting decisions, tax preparations, and financial goal setting.

Salary Calculation Explained

Salaried Employee:

Annual Gross Income: This is calculated by adding the annual salary to any bonuses received.

$50,000 (Annual Salary) + $5,000 (Bonus) = $55,000Hourly Employee:

Annual Gross Income: Calculated by multiplying the hourly rate by hours worked per week and the number of weeks in a year, plus any overtime pay.

($20 × 40 × 52) + $2,000 (Overtime Pay) = $44,000Pro Tip: Stay Ahead with Compliance

Regularly Update Compliance Knowledge: Keep abreast of federal and state tax law changes, minimum wage adjustments, and other regulatory updates. This proactive approach prevents costly penalties and ensures your payroll processes remain compliant.

What is Net Pay?

Net pay, often referred to as take-home pay, is the amount of money an employee receives after all deductions have been made from their gross pay. These deductions can include federal and state taxes, Social Security and Medicare contributions, retirement plan contributions, health insurance premiums, and other voluntary or mandatory deductions. Net pay is essentially the money you have available to spend or save after all legal and contractual obligations have been met. To help calculate your Net Pay, use our Free Payroll Tax Calculator here.

The Importance of Net Pay in Personal Finance

Understanding net pay is crucial for personal financial planning and budgeting. It represents the actual income that individuals have at their disposal for monthly expenses, savings, and investments. Here’s why net pay holds significant importance in personal finance:

- Budgeting Accuracy: Knowing your net pay allows for more accurate budgeting since it reflects your actual disposable income. It helps in allocating funds appropriately to various expenses, savings, and debt repayments.

- Financial Planning: Awareness of net pay is essential for long-term financial planning, including retirement savings, investment strategies, and setting up an emergency fund. It ensures that financial plans are based on realistic income expectations.

- Loan Applications: When applying for loans or credit, lenders often consider your net pay to assess your ability to repay, affecting loan approvals and interest rates.

The Difference Between Net Pay and Gross Pay

The primary difference between net pay and gross pay lies in their definitions and financial implications:

- Gross Pay: This is the total income earned before any deductions. It’s useful for understanding one’s total compensation and for calculating taxes. However, it doesn’t accurately represent what an employee can spend or save.

- Net Pay: Net pay is the amount left after all deductions are taken from the gross pay. It’s a more accurate reflection of an employee’s available funds for personal use.

While gross pay gives an overview of an employee’s total earnings, net pay provides a realistic picture of their financial situation. Understanding both concepts is essential for effective financial management, ensuring individuals can make informed decisions regarding their income, expenditures, and savings.

Pro Tip: Strategic Tax Planning

Encourage Smart Tax Withholding Choices: Guide employees in making informed decisions about their tax withholdings to optimize their net pay. This can involve consulting with tax professionals or using IRS tools and calculators.

Factors Affecting Net Pay

Net pay is influenced by a variety of deductions, which can significantly reduce the amount of money an employee takes home. Understanding these deductions is crucial for employees to accurately predict their take-home pay and manage their finances effectively. Here is a comprehensive list of the common deductions that affect net pay:

Federal and State Income Tax Withholdings

- Federal Income Tax: This is deducted based on the employee’s earnings, filing status, and the information provided on Form W-4. The amount withheld is determined by federal tax brackets, which are progressive, meaning the rate increases as income increases.

- State Income Tax: Similar to federal taxes, state income tax rates vary depending on the state’s tax laws. Some states have a flat tax rate, while others use progressive tax brackets. There are also states with no income tax at all.

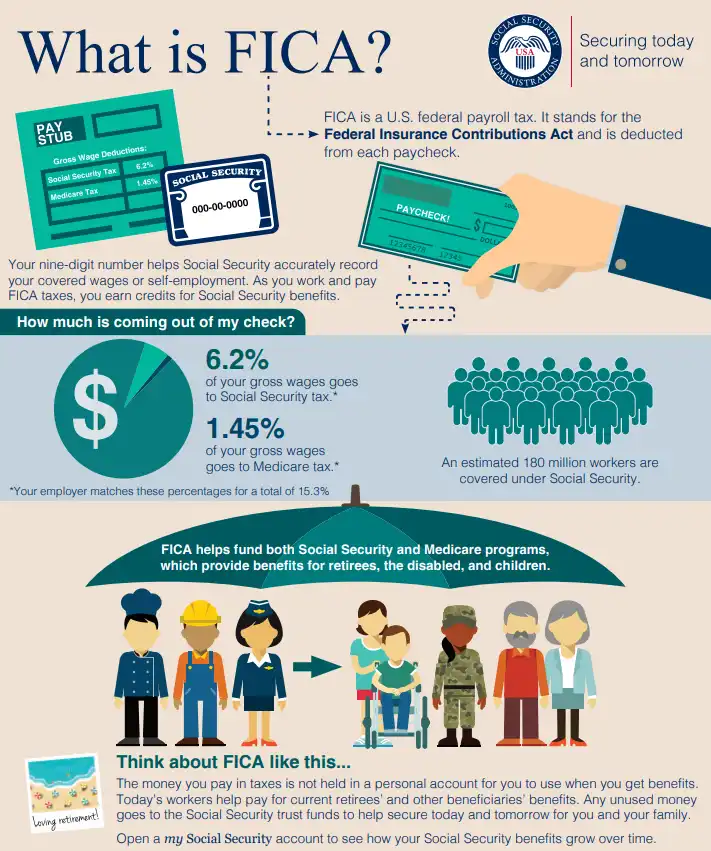

Social Security and Medicare Taxes (FICA)

- Social Security Tax: Employees contribute 6.2% of their gross income to Social Security, up to an income cap ($168,600 in 2024) set annually. Employers match this contribution.

- Medicare Tax: A 1.45% contribution of the gross income goes towards Medicare, with no income cap. For high earners, an additional Medicare tax may apply.

Health Insurance Premiums

Many employers offer health insurance plans as part of their benefits package. The portion of the premium paid by the employee is deducted from their gross pay, reducing their net pay.

Retirement Savings (e.g., 401(k) Contributions)

Contributions to retirement savings plans like a 401(k) are often made pre-tax, meaning they are deducted from the gross pay before taxes are applied. This not only reduces taxable income but also decreases net pay while building retirement savings.

Wage Garnishments

Wage garnishments are court-ordered deductions to pay debts such as child support, alimony, unpaid taxes, or defaulted loans. These garnishments are mandatory and can significantly impact net pay.

Voluntary vs Mandatory Deductions

Mandatory Deductions are those that the law requires. These include federal and state taxes, FICA taxes, and wage garnishments. Employers must withhold these amounts from an employee’s gross pay by law.

Voluntary Deductions include those that the employee chooses, such as retirement plan contributions, health insurance premiums, and other benefit programs. While these reduce net pay, they are typically beneficial for long-term financial planning and health coverage.

Understanding the difference between these types of deductions is essential for managing personal finances. By knowing what reductions to expect in their gross pay, employees can better budget their net pay for monthly expenses, savings, and investments, ensuring financial stability and planning for future needs.

Pro Tip: Optimize Benefit Offerings

Customize Benefits Packages: Tailor benefits packages to meet the diverse needs of your workforce. Offering a range of health, retirement, and lifestyle benefits can enhance employee satisfaction and loyalty.

Calculating Net Pay

Calculating net pay involves subtracting various deductions from an employee’s gross pay. Understanding this process is crucial for both employers, to ensure accurate payroll processing, and employees, to manage their personal finances effectively. Here’s a step-by-step guide to calculating net pay, accompanied by examples and tips for managing deductions.

Step-by-Step Guide

Start with Gross Pay: Begin with the total gross pay for the pay period. This could be the monthly salary for salaried employees or hourly wage multiplied by hours worked for hourly employees.

Subtract Mandatory Deductions: Deduct federal and state income taxes, Social Security and Medicare taxes (FICA), and any wage garnishments, as these are non-negotiable.

Subtract Voluntary Deductions: Deduct any contributions to retirement plans, health insurance premiums, and other benefits the employee has opted into.

Calculate Net Pay: The amount remaining after all deductions is the net pay, or take-home pay.

Example Calculation

Let’s say an employee has a gross monthly salary of $4,000.

- Federal Income Tax: $500

- State Income Tax: $200

- Social Security Tax: $248 (6.2% of $4,000)

- Medicare Tax: $58 (1.45% of $4,000)

- Health Insurance Premiums: $150

- 401(k) Contribution: $400

Net Pay Calculation:

$4,000−($500+$200+$248+$58+$150+$400)=$2,444

Thus, the employee’s net pay is $2,444.

Net Pay Calculation Explained

Gross Monthly Salary: $4,000

- Federal Income Tax: $500

- State Income Tax: $200

- Social Security Tax: $248 (6.2% of $4,000)

- Medicare Tax: $58 (1.45% of $4,000)

- Health Insurance Premiums: $150

- 401(k) Contribution: $400

Net Pay Calculation:

$4,000 - ($500 + $200 + $248 + $58 + $150 + $400) = $2,444Thus, the employee’s net pay is $2,444.

Tips for Managing Deductions

For Employees:

- Review and Update W-4: Ensure your W-4 reflects your current financial situation to avoid over or underpaying taxes.

- Maximize Pre-tax Contributions: Take advantage of pre-tax deductions like 401(k) contributions to lower your taxable income and increase your savings.

- Health Insurance Choices: Evaluate your health insurance options during open enrollment to find a plan that balances coverage needs and costs.

For Employers:

- Transparent Communication: Provide clear explanations of all potential deductions and benefits to employees.

- Benefits Education: Offer sessions or resources to help employees understand and optimize their benefits and deductions.

- Payroll Software: Utilize reliable payroll software that accurately calculates deductions and taxes, ensuring compliance and reducing errors.

Understanding how net pay is calculated and what deductions are made from gross pay can help employees better manage their finances and make informed decisions regarding their benefits and tax withholdings. Employers play a key role in this process by offering guidance, tools, and education to assist employees in optimizing their net pay.

Pro Tip: Educate Your Workforce

Offer Financial Literacy Programs: Provide your employees with financial education workshops focusing on budgeting, investments, and understanding their pay stubs. A well-informed employee is more engaged and appreciative of their compensation package.

Tax Considerations and Legal Obligations

Navigating the complexities of payroll deductions involves understanding the legal obligations and tax considerations that affect both employers and employees. This section provides an overview of these responsibilities and offers guidance to ensure compliance and informed financial planning.

Legal Obligations for Payroll Deductions

FICA Taxes: The Federal Insurance Contributions Act (FICA) mandates that both employees and employers contribute to Social Security and Medicare. Employers are responsible for withholding the correct amounts from employees’ wages and matching those contributions. For Social Security, the tax rate is 6.2% on earnings up to a specified limit, and for Medicare, the rate is 1.45% on all earnings, with an additional 0.9% for high earners.

Wage Garnishments: Employers may be required to withhold a portion of an employee’s earnings for the payment of debt through garnishment orders. Garnishments can arise from various debts, including child support, student loans, taxes, and other court-ordered debts. Employers must comply with garnishment orders, prioritizing certain types of debts as prescribed by law.

Image Retrieved from: https://www.ssa.gov/people/materials/pdfs/EN-05-10297.pdf

Tax Considerations

Tax Brackets and Withholdings: Both employers and employees must be aware of the current tax brackets and withholding requirements. Employees’ tax liabilities are determined by their gross income and filing status, impacting the amount of federal and state income tax withheld from their paychecks.

Form W-4: Employees use Form W-4 to inform employers of their withholding allowances and any additional amounts to withhold from their pay. It’s crucial for employees to accurately complete and update this form to reflect personal and financial changes, such as marriage, divorce, or the birth of a child, which can affect tax obligations.

Pre-tax and Post-tax Deductions: Understanding the difference between pre-tax and post-tax deductions is essential. Pre-tax deductions, like certain retirement contributions, reduce taxable income, potentially lowering the tax bracket into which an employee falls. Post-tax deductions do not affect taxable income but may offer other financial benefits.

Tips for Compliance and Optimization

- For Employers:

- Stay informed about changes in tax laws and rates to ensure accurate withholding and compliance.

- Provide employees with access to financial education resources and tools for managing their withholdings and deductions.

- For Employees:

- Regularly review and update your Form W-4, especially after major life events.

- Consult with a tax professional to understand how different deductions and contributions affect your taxable income and overall tax liability.

Understanding and managing payroll deductions and tax considerations are critical for legal compliance and financial well-being. By staying informed and proactive, both employers and employees can navigate the complexities of payroll taxes and deductions effectively, ensuring that legal obligations are met and financial strategies are optimized.

Pro Tip: Leverage Technology for Efficiency

Implement Advanced Payroll Software: Utilize the latest payroll software solutions to streamline the calculation of gross and net pay, deductions, and tax withholdings. Automation reduces errors, saves time, and ensures compliance with changing tax laws.

Frequently Asked Questions (FAQ)

Q: What is the difference between gross pay and net pay?

A: Gross pay refers to the total earnings of an employee before any deductions are made. Net pay, also known as take-home pay, is the amount an employee receives after all deductions, such as taxes and benefits, have been subtracted from the gross pay.

Q: How are taxes calculated on my gross pay?

A: Taxes on your gross pay are calculated based on your filing status, taxable income, and the tax brackets set by the IRS for federal taxes, and your state’s tax authority for state taxes. Your taxable income is determined by subtracting allowable deductions from your gross pay.

Q: How do I calculate my annual gross income if I'm an hourly employee?

A: Multiply your hourly wage by the number of hours you work per week, and then multiply that number by 52 (the number of weeks in a year). Add any additional earnings like overtime, bonuses, or commissions to get your annual gross income.

Q: What are pre-tax deductions, and how do they affect my net pay?

A: Pre-tax deductions are amounts taken from your gross pay before taxes are calculated. These can include contributions to retirement accounts, certain health premiums, and flexible spending accounts. Pre-tax deductions lower your taxable income, which can reduce the amount of tax you owe and increase your net pay.

Q: Why might my net pay change even if my gross pay stays the same?

A: Changes in net pay while gross pay remains constant can result from adjustments in tax rates, changes in benefit elections, or alterations to voluntary deductions like retirement contributions. Additionally, changes to tax laws or your filing status can also impact your net pay.

Q: How often should I update my Form W-4?

A: You should review and possibly update your Form W-4 whenever you experience a significant life change, such as marriage, divorce, the birth or adoption of a child, or a change in financial status. Updating your Form W-4 ensures that your tax withholdings are accurate.

Q: Are there any deductions that are mandatory for all employees?

A: Yes, certain deductions are mandatory for all employees, including federal and state taxes (where applicable), Social Security and Medicare taxes (FICA), and any court-ordered garnishments like child support or tax levies.

Q: What should I do if I believe my employer is incorrectly calculating my deductions?

A: First, discuss your concerns with your employer or HR department to seek clarification. If discrepancies continue, you may need to contact your state labor department or a legal professional for advice and potential action.

Q: How do contributions to a 401(k) or other retirement plans affect my take-home pay?

A: Contributions to a 401(k) or similar retirement plan are typically made with pre-tax dollars, reducing your taxable income. This can lower the taxes you owe, potentially increasing your net pay. However, since you’re contributing part of your gross pay to the retirement plan, the actual amount you take home may be less, but you’re building savings for the future.

Q: Can I opt out of certain benefits or deductions to increase my net pay?

A: Yes, for voluntary deductions like retirement contributions or certain benefits premiums, you can adjust your participation to affect your net pay. However, it’s essential to consider the long-term implications on your financial well-being and benefits coverage.

Disclaimer: The content provided on this webpage is for informational purposes only and is not intended to be a substitute for professional advice. While we strive to ensure the accuracy and timeliness of the information presented here, the details may change over time or vary in different jurisdictions. Therefore, we do not guarantee the completeness, reliability, or absolute accuracy of this information. The information on this page should not be used as a basis for making legal, financial, or any other key decisions. We strongly advise consulting with a qualified professional or expert in the relevant field for specific advice, guidance, or services. By using this webpage, you acknowledge that the information is offered “as is” and that we are not liable for any errors, omissions, or inaccuracies in the content, nor for any actions taken based on the information provided. We shall not be held liable for any direct, indirect, incidental, consequential, or punitive damages arising out of your access to, use of, or reliance on any content on this page.

About The Author

Roger Wood

With a Baccalaureate of Science and advanced studies in business, Roger has successfully managed businesses across five continents. His extensive global experience and strategic insights contribute significantly to the success of TimeTrex. His expertise and dedication ensure we deliver top-notch solutions to our clients around the world.

Time To Clock-In

Start your 30-day free trial!

Experience the Ultimate Workforce Solution and Revolutionize Your Business Today

- Eliminate Errors

- Simple & Easy To Use

- Real-time Reporting

Saving businesses time and money through better workforce management since 2003.

Copyright © 2025 TimeTrex. All Rights Reserved.