Tennessee Payroll Tax: Regulations, Rates, and Future Outlook for 2025 and Beyond

In This Article:

- Executive Summary

- Overview of Payroll Taxes in Tennessee

- Tennessee State Unemployment Tax (SUTA) Deep Dive - 2025

- Tennessee UI Trust Fund Solvency and Its Implications

- Economic Outlook for Tennessee and Its Influence on Payroll Taxes (2025 and Beyond)

- Payroll Tax Credits and Exemptions for Tennessee Employers

- Future Outlook and Strategic Considerations for Employers (Beyond 2025)

- Key Resources for Tennessee Employers

- Conclusions

Executive Summary

Tennessee's payroll tax system presents a unique environment for employers. A significant advantage is the absence of a state income tax on employee wages, which simplifies payroll administration and enhances employee take-home pay. However, employers remain subject to federal payroll taxes—Social Security, Medicare (including an additional tax for high earners), and the Federal Unemployment Tax Act (FUTA). For 2025, these federal obligations carry specific rates and wage bases that employers must adhere to.

The primary state-specific payroll tax is the State Unemployment Tax Act (SUTA), also known as State Unemployment Insurance (SUI). Tennessee's SUTA system is characterized by a relatively low taxable wage base of $7,000 per employee. New employers typically pay a rate of 2.7%, while experienced employers face a wide potential range from 0.01% to 10.0%, determined by their individual experience rating. For the first half of the 2025 rate year (January 1 - June 30), a more constrained rate range of 0.01% to 2.3% has been indicated, with updates for the latter half of the year anticipated.

The health of Tennessee's Unemployment Insurance (UI) Trust Fund is a critical factor for future SUTA rates. As of March 2024, the fund's Average High Cost Multiple (AHCM) was 0.72, below the federally recommended level of 1.0, suggesting potential future pressure on SUTA rates to ensure long-term solvency. However, a significant state budget allocation of $939 million towards UI Trust Fund solvency in the 2024 budget indicates a proactive approach to bolstering the fund.

The economic outlook for Tennessee in 2025 projects GDP growth potentially outpacing the national average, alongside continued job creation. However, a slight increase in the state unemployment rate is also forecast, which could temper any downward pressure on SUTA rates. Employers must navigate these dynamics by staying informed of regulatory changes, particularly with the TDLWD's recent modernization of its SUTA system to the Jobs4TN.gov portal, and by managing their unemployment claims effectively to control experience-rated SUTA costs.

Overview of Payroll Taxes in Tennessee

The "No State Income Tax" Advantage

Tennessee stands out as one of a minority of states that does not impose an income tax on wages earned by individuals. This characteristic offers tangible benefits for both employees and employers operating within the state. For employees, the absence of state income tax withholding translates directly into higher net take-home pay compared to individuals earning an identical gross salary in states with an income tax. This can enhance their disposable income and overall financial well-being.

For employers, this simplifies state-level payroll administration, as there is no requirement to calculate, withhold, remit, or report state income taxes for employees. This reduction in administrative burden can lead to cost savings and fewer compliance complexities. Furthermore, the "no state income tax" environment can serve as a compelling recruitment tool. Businesses can highlight this feature to attract talent from other states, as it represents a clear financial advantage for prospective employees. This can be particularly impactful when competing for skilled labor, potentially allowing Tennessee-based companies to offer more attractive overall compensation packages or gain an edge in negotiations. This inherent tax advantage should be considered a strategic asset for businesses in their talent acquisition and retention efforts.

Federal Payroll Tax Obligations

Despite the absence of a state income tax on wages, employers in Tennessee are fully subject to federal payroll tax laws. These taxes are uniform across the United States, and employers are responsible for withholding employee portions and remitting both employee and employer contributions to the Internal Revenue Service (IRS).

Social Security Tax (Old Age, Survivors, and Disability Insurance - OASDI)

The Social Security tax funds retirement, disability, and survivor benefits. Both employees and employers contribute to this system.

2025 Rates and Wage Base:

- Employee Contribution: 6.2% of taxable wages.

- Employer Contribution: 6.2% of taxable wages.

- Wage Base Limit for 2025: There is a discrepancy in available information regarding the 2025 Social Security wage base limit. One source indicates $160,200, while another suggests $176,100. Employers must consult the official 2025 announcement from the Social Security Administration (SSA) or the IRS to ascertain the definitive wage base limit. Using an incorrect wage base can lead to erroneous withholdings and payments. This underscores the necessity for businesses to verify such critical figures annually from primary government sources before implementing them in their payroll systems.

Medicare Tax (Hospital Insurance - HI)

The Medicare tax funds hospital insurance benefits for eligible individuals. Similar to Social Security, both employees and employers contribute.

2025 Rates:

- Employee Contribution: 1.45% of all compensation.

- Employer Contribution: 1.45% of all compensation.

- No Wage Base Limit: Unlike Social Security, the Medicare tax applies to all of an employee's covered wages without an upper limit.

Additional Medicare Tax for High Earners:

- Rate: An additional 0.9% is levied on employee wages.

- Applicability: This is an employee-only tax. Employers are responsible for withholding it but do not pay a matching employer portion. The tax applies to wages exceeding the following thresholds:

Payroll systems must be accurately configured to track employee earnings and apply this additional withholding once the relevant income threshold is surpassed.

Federal Unemployment Tax Act (FUTA)

The FUTA tax, in conjunction with state unemployment programs, provides funding for unemployment benefits for workers who have lost their jobs.

2025 Rate and Wage Base:

- Standard FUTA Rate: 6.0%.

- Taxable Wage Base: This rate applies to the first $7,000 of wages paid to each employee during the calendar year.

- Maximum Tax per Employee (before credit): The maximum standard FUTA tax per employee, before any credits, is $420 ($7,000 * 6.0%).

FUTA Credit for SUTA Contributions:

- A crucial aspect of the FUTA system is the credit employers can receive for payments made to their state unemployment fund. Employers may qualify for a credit of up to 5.4% against their FUTA liability if they pay their state unemployment taxes (SUTA) in full and on time.

- Effective FUTA Rate: With the maximum credit, the effective FUTA tax rate is reduced to 0.6% (6.0% - 5.4%).

- Employer-Only Tax: FUTA tax is solely an employer responsibility and is not deducted from employees' wages.

Diligent SUTA compliance is not only about avoiding state penalties but also about minimizing federal tax liabilities.

State-Specific Payroll Taxes: Focus on State Unemployment Tax (SUTA)

While Tennessee employers benefit from the absence of a state income tax on wages, they are responsible for the State Unemployment Tax, commonly referred to as SUTA or State Unemployment Insurance (SUI). This tax is levied on employers to fund unemployment benefits for eligible workers who lose their jobs through no fault of their own within the state. The SUTA system is administered at the state level and has its own set of rules, rates, and reporting requirements, distinct from federal payroll taxes. This tax represents the primary state-level payroll tax obligation for businesses operating in Tennessee.

| Tax Type | Employee Rate | Employer Rate | Wage Base Limit | Thresholds for Add. Medicare Tax (Employee Only) |

|---|---|---|---|---|

| Social Security (OASDI) | 6.2% | 6.2% | $160,200 (Source) or $176,100 (Source) (Note Discrepancy - Verify with IRS/SSA) | N/A |

| Medicare (HI) | 1.45% | 1.45% | No Limit | N/A |

| Additional Medicare Tax | 0.9% on earnings over threshold | Not Applicable | Applies to earnings over threshold | $200,000 (Single), $250,000 (Joint), $125,000 (Married Filing Separately) |

| Federal Unemployment Tax (FUTA) | Not Applicable | 6.0% (Standard) / 0.6% (Effective with max credit) | $7,000 | N/A |

This table provides a consolidated view of the federal payroll tax obligations. The discrepancy in the Social Security wage base for 2025 underscores the critical importance for employers to obtain the definitive figure from official IRS or SSA publications for the applicable year to ensure accurate payroll processing.

Tennessee State Unemployment Tax (SUTA) Deep Dive - 2025

The State Unemployment Tax Act (SUTA) is the most significant state-level payroll tax for Tennessee employers. Understanding its nuances is crucial for compliance and cost management.

Governing Body: Tennessee Department of Labor and Workforce Development (TDLWD)

The Tennessee Department of Labor and Workforce Development (TDLWD) is the state agency responsible for the administration of the SUTA program. Its responsibilities include establishing SUTA rates, collecting SUTA premiums, managing employer accounts, processing unemployment claims, and overseeing the UI system. Employers interact with the TDLWD for all SUTA-related matters. The TDLWD can be contacted by phone at (844) 224-5818, and its main office is at 220 French Landing Drive, Nashville, Tennessee 37243. Businesses must stay abreast of TDLWD communications, especially regarding updates like the new Jobs4TN.gov portal.

Employer Liability and Registration

Specific criteria determine when a business becomes liable for paying SUTA taxes in Tennessee.

Determining Liability: An employer generally becomes liable for SUTA if they meet any of the following conditions:

- Pay $1,500 or more in total gross wages in any calendar quarter.

- Have at least one employee during any part of a day in 20 different weeks within a calendar year.

- Acquire the trade or business of an employer already subject to SUTA.

- Specific rules also apply to non-profit organizations, state/local governments, domestic service employers, and agricultural labor employers. The low thresholds mean many small businesses quickly become subject to SUTA.

Employer Account Number (EAN) and Form LB-0441:

- Once liable, an employer must register with the TDLWD by submitting Form LB-0441, "Report to Determine Status".

- This form can be downloaded and submitted via email, mail, or fax.

- The TDLWD then assigns a unique eight-digit Employer Account Number (EAN), typically mailed within two to three weeks. Prompt registration is crucial.

SUTA Taxable Wage Base for 2025

For the calendar year 2025, Tennessee's SUTA taxable wage base remains at $7,000 per employee. Employers pay SUTA taxes on the first $7,000 of gross wages paid to each employee annually. This wage base has been consistent since at least 2018. Tennessee's $7,000 SUTA taxable wage base is the federal minimum under FUTA and is among the lowest in the United States. This low wage base places greater emphasis on the SUTA tax rate in determining an employer's total SUTA cost.

SUTA Tax Rates for 2025

SUTA tax rates in Tennessee vary significantly between new and established (experienced) employers.

New Employer Rate:

- The standard SUTA tax rate for new employers is 2.7%.

- This rate applies until an employer has been subject to SUTA and chargeable with benefits for a 36-consecutive-calendar-month period.

- An exception exists for new employers in industries with highly negative reserve ratios, who may be assigned a different new employer rate.

Experienced Employer Rates:

- The statutory range for experienced employers is 0.01% to 10.0%.

- For January 1, 2025, through June 30, 2025, a more restricted range of 0.01% to 2.3% is indicated. Updated numbers for the rate period beginning July 1, 2025, will be announced in summer 2025.

- Employers receive an annual "Notice of Premium Rate" from the TDLWD specifying their rate for the rate year (July 1 - June 30).

How Experience Rating is Determined (Reserve Ratio Method):

- Tennessee uses an experience rating system, primarily the reserve ratio method.

- The reserve ratio is generally: (Cumulative SUTA premiums paid - Cumulative UI benefits charged) / Employer's average taxable payroll.

- A higher positive reserve ratio usually means a lower SUTA rate. The TDLWD determines the active rate schedule based on the UI Trust Fund's health. Factors influencing an employer's rate include business age, industry turnover, and unemployment claims history, as outlined in Tennessee Code § 50-7-403.

Voluntary Contributions: Tennessee does not allow employers to make voluntary contributions to improve their reserve ratio.

Reporting and Payment Requirements

Tennessee employers must file quarterly reports and remit SUTA tax payments to the TDLWD.

Quarterly Forms:

- Form LB-0456 (Premium Report): Reports total SUTA premium owed.

- Form LB-0851 (Wage Report): Details individual employee wages. These forms are typically available via the TDLWD's employer portal.

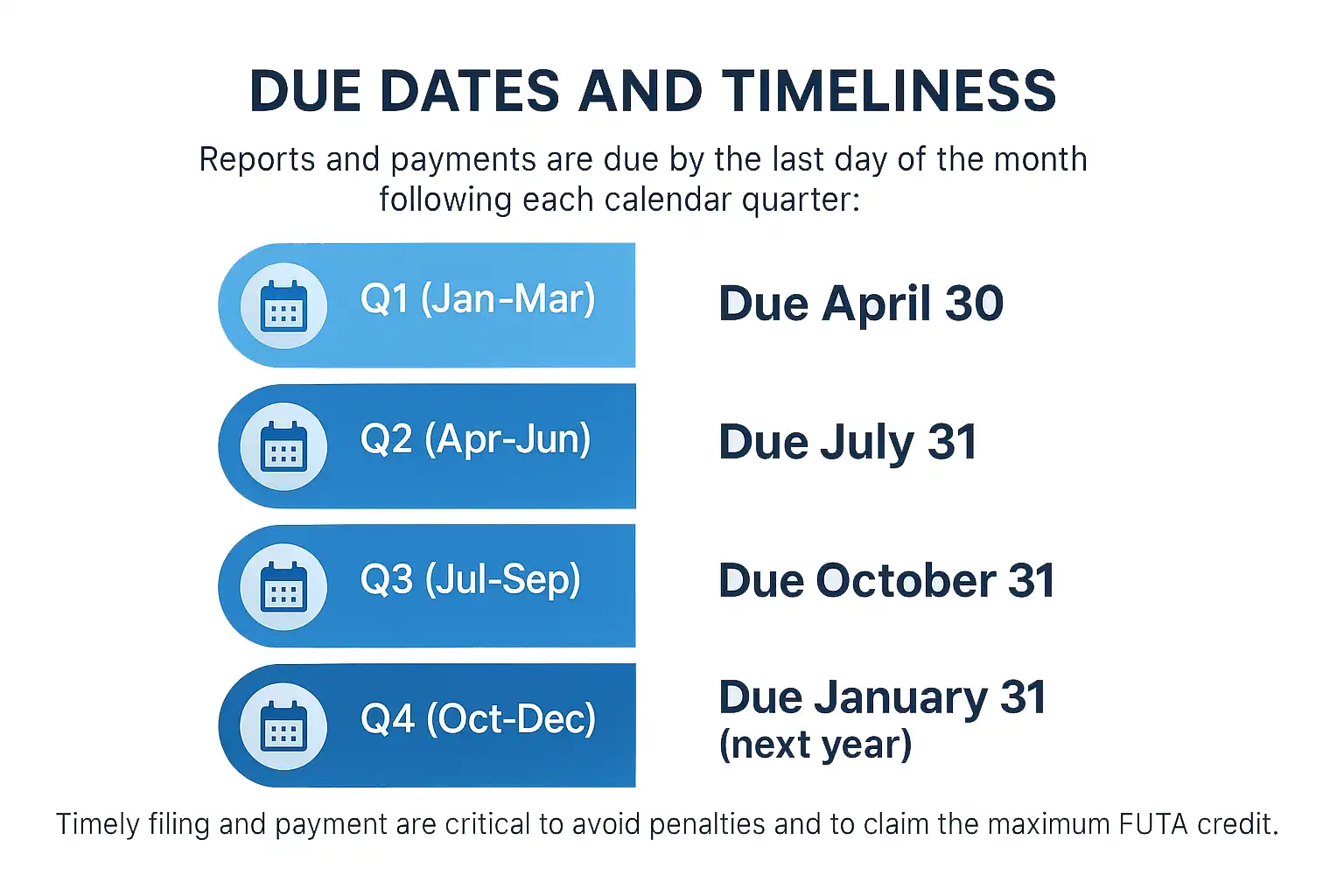

Due Dates and Timeliness: Reports and payments are due by the last day of the month following each calendar quarter:

- Q1 (Jan-Mar): Due April 30

- Q2 (Apr-Jun): Due July 31

- Q3 (Jul-Sep): Due October 31

- Q4 (Oct-Dec): Due January 31 (next year)

Timely filing and payment are critical to avoid penalties and to claim the maximum FUTA credit.

Impact of Federal Disaster Relief on 2025 Deadlines (IRS IR-2025-47):

In response to severe storms beginning April 2, 2025, the IRS announced tax relief for Tennessee, postponing various federal tax filing and payment deadlines between April 2, 2025, and November 3, 2025, to a new deadline of November 3, 2025. This applied to quarterly federal payroll tax returns (e.g., Form 941).

Crucial Clarification: This IRS disaster relief automatically applies only to federal tax obligations. It does not automatically extend deadlines for state tax obligations like Tennessee SUTA filings unless the State of Tennessee or TDLWD explicitly announced conformity. Employers should have verified any state-specific extensions directly with the TDLWD.

Modernization of the SUTA System: Jobs4TN.gov Portal

Tennessee has transitioned its unemployment insurance tax system to the Jobs4TN.gov Employer e-Services portal. Legacy systems like TNPAWS and TPU were shut down on May 2, 2025, with the new integrated system going live on May 27, 2025. The modernized portal aims to offer comprehensive online account management, self-service registration, user-friendly reporting tools, and secure communication with TDLWD. All employers and payroll providers must use this platform.

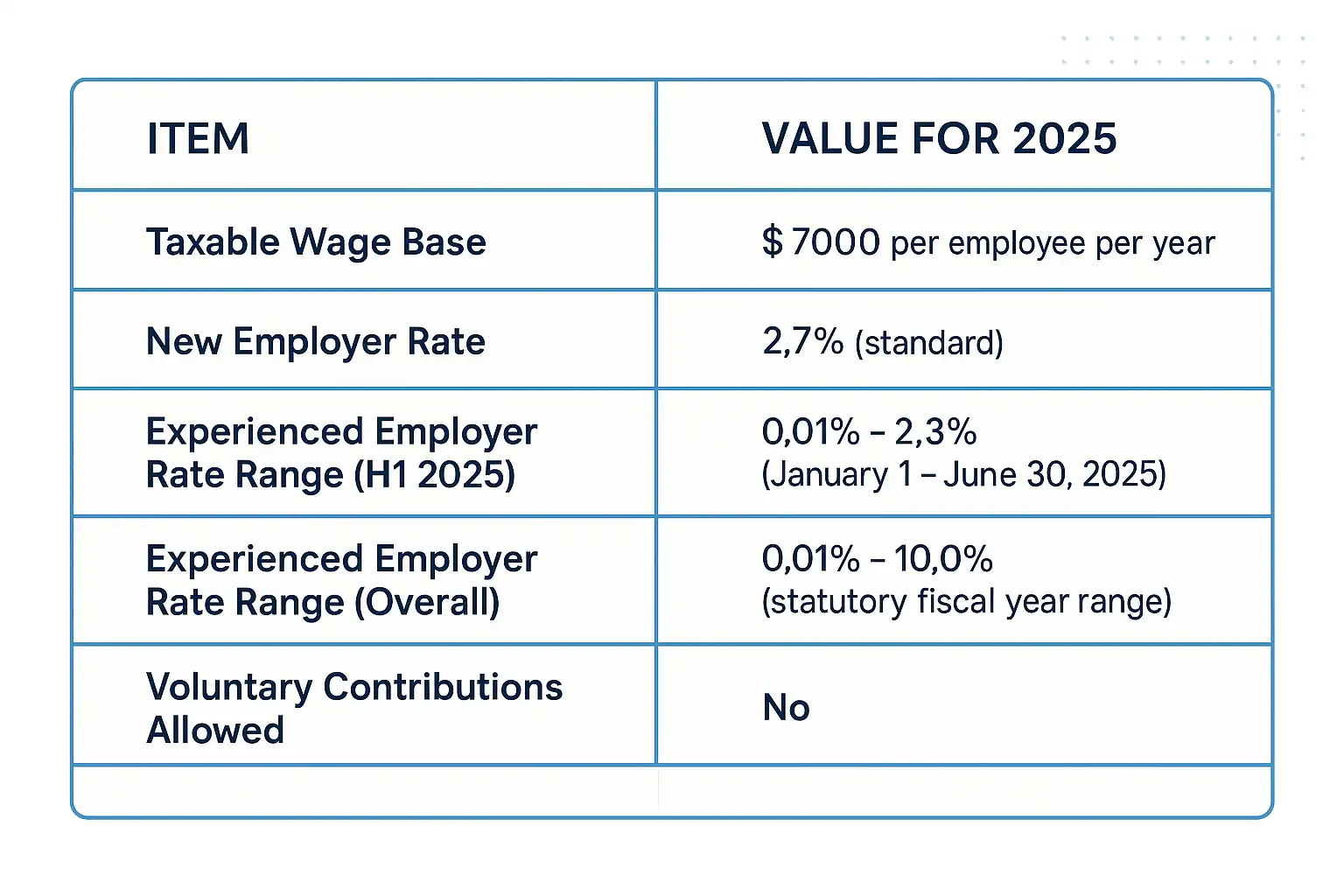

| Item | Value for 2025 |

|---|---|

| Taxable Wage Base | $7,000 per employee per year |

| New Employer Rate | 2.7% (standard) |

| Experienced Employer Rate Range (H1 2025) | 0.01% - 2.3% (January 1 - June 30, 2025) |

| Experienced Employer Rate Range (Overall) | 0.01% - 10.0% (statutory fiscal year range) |

| Voluntary Contributions Allowed | No |

Source for table data: OnPay and other referenced SUTA information.

Tennessee UI Trust Fund Solvency and Its Implications

The financial health of Tennessee's Unemployment Insurance (UI) Trust Fund is a paramount factor influencing future SUTA rates.

Current Status (Average High Cost Multiple - AHCM)

A key metric for UI trust fund adequacy is the Average High Cost Multiple (AHCM). The U.S. Department of Labor recommends an AHCM of at least 1.0. As of March 2024, Tennessee's AHCM was reported to be 0.72, below the recommended minimum. This suggests vulnerability in handling a significant economic shock.

Factors Affecting Solvency

The UI trust fund balance is influenced by:

- Benefit Payouts: Higher unemployment leads to increased payouts.

- SUTA Contributions: Employer taxes replenish the fund.

- Economic Conditions: Recessions increase payouts and can decrease contributions. Growth periods have the opposite effect.

- Legislative/Administrative Changes: Alterations to benefits or tax structures impact the fund.

Potential Impact on Future SUTA Rates

An AHCM of 0.72 signals potential strain. States with underfunded trust funds might consider increasing SUTA rates, issuing bonds, or borrowing from the federal government (Title XII advances). The State of Tennessee's 2024 Budget includes a $939 million allocation for UI Trust Fund Solvency. This proactive measure may temporarily alleviate the need for drastic rate increases. However, long-term health depends on the balance between SUTA contributions and benefit payouts. Employers should anticipate continued focus on fund solvency.

| Metric | Value | Federal Recommendation | Date of AHCM | Implication |

|---|---|---|---|---|

| Average High Cost Multiple (AHCM) | 0.72 | 1.0 | March 2024 | Below recommended level; potential for future SUTA rate pressure or other actions. |

Source for AHCM data: Ballotpedia.

Economic Outlook for Tennessee and Its Influence on Payroll Taxes (2025 and Beyond)

Tennessee's economic climate influences payroll taxes, especially SUTA, through employment levels, wage growth, and unemployment claims.

Projected Economic Growth (GDP, Job Creation)

Recent forecasts from the Boyd Center for Business and Economic Research project Tennessee's real GDP to grow by 2.4% in 2024 and 2.5% in 2025, surpassing the projected U.S. growth of 2.0% in 2025. Job creation is expected to be around 22,500 in 2024 and 36,400 in 2025. Certain sectors like natural resources, mining, and construction are forecast to see strong job growth.

Unemployment Rate Trends and Forecasts

Tennessee's seasonally adjusted unemployment rate was 3.7% in January 2025, up from 3.2% in January 2024 but below the U.S. rate of 4.0%. The Boyd Center forecasts the state's annual average unemployment rate to be 3.3% in 2025 and 3.4% in 2026, indicating a slight rise as the economy normalizes post-pandemic.

Correlation between Economic Health, UI Claims, and SUTA Rates

Robust economic growth typically leads to fewer UI claims and stable or lower SUTA rates. Economic slowdowns increase claims and can raise rates. For Tennessee, continued GDP and job growth are positive, but the forecasted modest rise in unemployment suggests UI claims may not decrease significantly. This could offset some positive pressure on the UI trust fund, implying a relatively stable SUTA environment at best, with potential upward pressure if unemployment rises more than projected or if trust fund solvency doesn't improve.

| Key Economic Indicator | 2025 Projection (Tennessee) | 2025 Projection (U.S.) | 2026 Projection (Tennessee) |

|---|---|---|---|

| Real GDP Growth | 2.5% | 2.0% | N/A |

| Job Growth (Net New Jobs) | 36,400 | N/A | N/A |

| Annual Average Unemployment Rate | 3.3% | N/A | 3.4% |

Source for economic outlook data: Boyd Center for Business and Economic Research.

Payroll Tax Credits and Exemptions for Tennessee Employers

Employers should be aware of tax credits and exemptions, though direct SUTA credits are limited.

Federal FUTA Tax Credit

The most significant credit is the federal FUTA credit. Employers paying SUTA taxes fully and on time can receive a credit up to 5.4% against the 6.0% FUTA rate, effectively reducing it to 0.6% on the first $7,000 of each employee's wages.

State-Level Incentives (Primarily Franchise & Excise Tax Focused)

Tennessee offers tax incentives mainly as credits against Franchise and Excise (F&E) Taxes, not SUTA. These can improve a company's financial position. Examples, as listed by the TDLWD and other sources like Gusto, include:

- Standard Job Tax Credit: For investments over $500,000 and creating qualified new jobs.

- Enhanced Job Tax Credit: For new jobs in economically distressed counties.

- Super Job Tax Credit: For major enterprises with significant investment and job creation.

- Industrial Machinery Tax Credit: For purchase, installation, and repair of eligible machinery.

- Franchise and Excise Tax Job Tax Credit for Hiring Persons with Disabilities.

The Work Opportunity Tax Credit (WOTC), a federal credit administered by states, is also available for hiring individuals from targeted groups. Information can be found on the TDLWD website.

SUTA Exemptions

Certain employment types and employer categories may be exempt from SUTA.

Exempt Employment/Services:

- Wages from self-employment or independent contracting are generally not covered for SUTA (TDLWD guidance).

- Some non-profit organizations, especially religious ones, may be exempt. IRC Section 501(c)(3) organizations are exempt from FUTA (IRS details) and may opt for reimbursement for SUTA (TDLWD details).

- Note: Tennessee Code Ann. § 67-4-708(3)(c)(i-xvi) lists services exempt from state business tax, not SUTA (TN Dept. of Revenue).

Seasonal Employers:

- Tennessee law provides a "Seasonal Employer" designation for businesses operating 26 consecutive weeks or less annually.

- Eligibility criteria apply, and employers must apply annually using Form LB-3304 between September 1 and October 31 (TDLWD details).

- If approved, wages paid to seasonal workers may be excluded from UI benefit determination if workers have reasonable assurance of re-employment. This can help manage SUTA costs.

Future Outlook and Strategic Considerations for Employers (Beyond 2025)

Anticipating future trends is key for payroll tax management.

Anticipated Trends in Federal and State Payroll Taxation

Long-term stability of Social Security and Medicare remains a federal concern, potentially leading to future reforms. For Tennessee SUTA, maintaining UI trust fund solvency is paramount. Given the AHCM of 0.72, continued focus on fund adequacy is likely, even with the $939 million state allocation. Adjustments to the SUTA system, including rates or the $7,000 wage base (stable since at least 2018), could be considered if revenue needs increase.

Potential Legislative Changes or Regulatory Shifts in Tennessee

No specific major SUTA reforms are indicated beyond 2025. However, UI systems are subject to review. The 2009 economic crisis, which led to Tennessee using its highest SUTA rate table, shows tax structures can change under fiscal pressure. The main recent shift is the Jobs4TN.gov portal; further system refinements are possible.

Proactive Measures for Employers

To manage payroll tax costs:

- Managing UI Costs: Implement robust hiring, training, and retention programs. Document terminations carefully. Respond promptly to UI claim notices and contest ineligible claims effectively, as detailed in resources like Inova Payroll's guide on UI taxes.

- Staying Informed: Regularly visit TDLWD and IRS websites. Subscribe to updates and consult professionals.

- Budgeting and Forecasting: Accurately account for payroll taxes. Budget for potentially stable or slightly increasing SUTA rates.

- Compliance with Modernized Systems: Ensure proficiency with the Jobs4TN.gov portal and leverage its features for SUTA management.

Key Resources for Tennessee Employers

Accessing accurate information is essential.

Tennessee Department of Labor and Workforce Development (TDLWD)

- Website: tn.gov/workforce

- Specific Sections:

- Tax and Insurance: Info on unemployment, Workers' Comp, hiring incentives (Employer Tax/Insurance Page).

- Unemployment Insurance Tax: SUTA details (UI Tax Page).

- Unemployment Tax System Modernization Project: Jobs4TN.gov updates (Modernization Project Page).

- Contact Information:

- Phone for Employer Taxes: (844) 224-5818 (option 2).

- Employer Handbook/Guides: Seek the most current "Employer Handbook" or "Employer UI Guide" on the TDLWD website.

Internal Revenue Service (IRS)

- Website: irs.gov

- Key Publications for Employers:

- Publication 15 (Circular E), Employer's Tax Guide

- Publication 15-T, Federal Income Tax Withholding Methods

- Form 940 Instructions (FUTA)

- Form 941 Instructions (Quarterly Federal Tax Return)

Other Resources

- Tennessee Department of Revenue: For other business taxes (Franchise & Excise, Sales, Business Tax): tn.gov/revenue.

- Professional Advisors: Payroll service providers, CPAs, tax attorneys.

- Local Chambers of Commerce and Business Associations.

Conclusions

Tennessee's payroll tax environment offers a distinct advantage with its absence of state income tax on wages. However, employers must manage federal obligations and the state SUTA tax. For 2025, federal rates are set, but employers should verify the final Social Security wage base from official IRS/SSA sources.

The SUTA system's low $7,000 taxable wage base emphasizes the SUTA tax rate. New employers typically pay 2.7%; experienced rates vary (0.01%-2.3% indicated for H1 2025, statutory 0.01%-10.0%). The UI Trust Fund's solvency (AHCM 0.72) is a concern, despite a large state budget allocation, suggesting careful monitoring for future rate stability. Voluntary SUTA contributions are not allowed, so effective claims management is key.

The state's 2025 economic outlook is positive but includes a forecasted slight unemployment increase. Adaptation to the new Jobs4TN.gov portal is crucial.

Strategically, employers in Tennessee should:

- Ensure accurate federal compliance.

- Proactively manage SUTA costs and stay informed on rates.

- Leverage the Jobs4TN.gov portal.

- Budget conservatively for SUTA rates.

- Explore Tennessee's Franchise and Excise tax credits.

- Stay informed via TDLWD and IRS resources.

By understanding these elements, Tennessee employers can effectively navigate payroll tax responsibilities in 2025 and beyond.

Simplify Your Tennessee Payroll

Navigating Tennessee's payroll taxes can be complex. Let TimeTrex help! Our powerful payroll solutions can streamline your processes, ensure compliance, and save you time. Explore our Tennessee-specific resources:

Disclaimer: The content provided on this webpage is for informational purposes only and is not intended to be a substitute for professional advice. While we strive to ensure the accuracy and timeliness of the information presented here, the details may change over time or vary in different jurisdictions. Therefore, we do not guarantee the completeness, reliability, or absolute accuracy of this information. The information on this page should not be used as a basis for making legal, financial, or any other key decisions. We strongly advise consulting with a qualified professional or expert in the relevant field for specific advice, guidance, or services. By using this webpage, you acknowledge that the information is offered “as is” and that we are not liable for any errors, omissions, or inaccuracies in the content, nor for any actions taken based on the information provided. We shall not be held liable for any direct, indirect, incidental, consequential, or punitive damages arising out of your access to, use of, or reliance on any content on this page.

About The Author

Roger Wood

With a Baccalaureate of Science and advanced studies in business, Roger has successfully managed businesses across five continents. His extensive global experience and strategic insights contribute significantly to the success of TimeTrex. His expertise and dedication ensure we deliver top-notch solutions to our clients around the world.

Time To Clock-In

Start your 30-day free trial!

Experience the Ultimate Workforce Solution and Revolutionize Your Business Today

- Eliminate Errors

- Simple & Easy To Use

- Real-time Reporting

Saving businesses time and money through better workforce management since 2003.

Copyright © 2026 TimeTrex. All Rights Reserved.