U.S.-India Trade Relations Amidst Tariffs and Geopolitical Realignment

The U.S.-India trade and tariff landscape is a critical area of focus for American businesses. Understanding the complexities of the current U.S.-India trade relations, the impact of recent US tariffs on India, and the underlying geopolitical tensions is essential. This article provides a shallow dive into the U.S.-India trade deficit, the ongoing tariff war, and the strategic imperatives driving both nations, offering key insights for navigating this turbulent economic corridor.

Article Index

- TL:DR

- The U.S.-India Economic Corridor: A Statistical Overview

- The Tariff Fulcrum: Unpacking the 2025 U.S. Tariffs

- The Geopolitical Crucible: The Russia-Ukraine War and India's Calculus

- Strategic Imperatives: Analyzing U.S. and Indian Motivations

- The Path Forward: Navigating a Dual-Track Relationship

TL:DR

The U.S.-India relationship is defined by a sharp contradiction: escalating trade hostility, headlined by a blanket 25% U.S. tariff on all Indian goods, coexists with deepening strategic cooperation in defense and technology. The U.S. tariffs are less a trade remedy and more a geopolitical tool, linking long-standing grievances over trade imbalances to frustration with India's significant energy and military purchases from Russia. India has defended its actions as an economic necessity and a reflection of its foreign policy of "strategic autonomy." With both sides constrained by domestic politics, a comprehensive trade deal is unlikely. The relationship is set for a "managed stalemate," requiring businesses to prioritize political risk mitigation and supply chain diversification, understanding that strategic partnership and economic conflict will define the U.S.-India corridor for the foreseeable future.

The U.S.-India Economic Corridor: A Statistical Overview and Evolving Partnership

To comprehend the current tensions in U.S.-India trade and tariffs, it is essential to first establish the dimensions of the economic relationship. While a persistent goods trade deficit fuels U.S. protectionist measures, a more nuanced view reveals a nearly balanced services trade and a deep, parallel track of strategic cooperation under initiatives like TRUST (Trade, Resilience, and Ubiquitous Technology).

The Trade Ledger: Quantifying the Relationship

According to the United States Trade Representative (USTR), total U.S.-India trade in goods and services reached an estimated $212.3 billion in 2024, an 8.3% increase from 2023, making India the 10th-largest goods trading partner for the U.S. The key point of contention is the merchandise trade balance; the U.S. goods trade deficit with India was $45.8 billion in 2024, often cited as justification for punitive tariffs. However, the services trade acts as a counterbalance, with the U.S. registering a $102 million surplus in 2024. This highlights a complex interdependence, where a U.S. focus on the goods trade deficit obscures a more balanced overall relationship.

| Trade Category | 2023 Value | 2024 Value | 2024 Balance (U.S. Perspective) |

|---|---|---|---|

| Goods Trade | $149.7 Billion | $128.8 Billion | -$45.8 Billion (Deficit) |

| Services Trade | $72.2 Billion | $83.4 Billion | +$102 Million (Surplus) |

| Total Trade | $191.9 Billion | $212.3 Billion | -$45.7 Billion (Overall Deficit) |

The Cooperation Track: The TRUST Initiative and Strategic Alignment

Contradicting the conflict narrative is the robust TRUST (Trade, Resilience, and Ubiquitous Technology) initiative. As detailed by the Carnegie Endowment for International Peace, this initiative, launched in February 2025, aims to build resilient supply chains and foster collaboration in advanced technology. Key pillars include building Indian manufacturing for Active Pharmaceutical Ingredients (APIs), creating a joint roadmap for AI infrastructure, and deep space cooperation, symbolized by the joint NASA-ISRO NISAR satellite launch. This strategic divergence suggests a "two-wallet" approach in U.S. policy, where security agencies view India as an indispensable partner while trade bodies see it as an economic rival.

The Tariff Fulcrum: Unpacking the 2025 U.S. Tariffs and Historical Frictions

The recent tariff action is not a standard trade remedy but a coercive geopolitical instrument. On July 30, 2025, the U.S. announced a blanket 25% ad valorem tariff on all goods from India, effective August 1, 2025. Uniquely, this action denied product-level exemptions, even for critical goods like pharmaceuticals and electronics where the U.S. has high import dependency. This willingness to inflict self-harm indicates the primary motivation is political pressure, not economic protectionism. The Global Trade Research Initiative (GTRI) has called it one of the toughest trade actions against a key partner.

| Country/Region | Average U.S. Tariff Rate (Effective Aug 2025) |

|---|---|

| China | 20-60% (Varies by product) |

| India | 25% (Blanket) |

| Vietnam | 20% |

| Bangladesh | 20% |

| Sri Lanka | 15% |

| Indonesia | 10% |

| Japan | 2.5% |

| European Union | 3.5% |

| South Korea | 2.8% |

| United Kingdom | 3.5% |

The Geopolitical Crucible: The Russia-Ukraine War and India's Energy Calculus

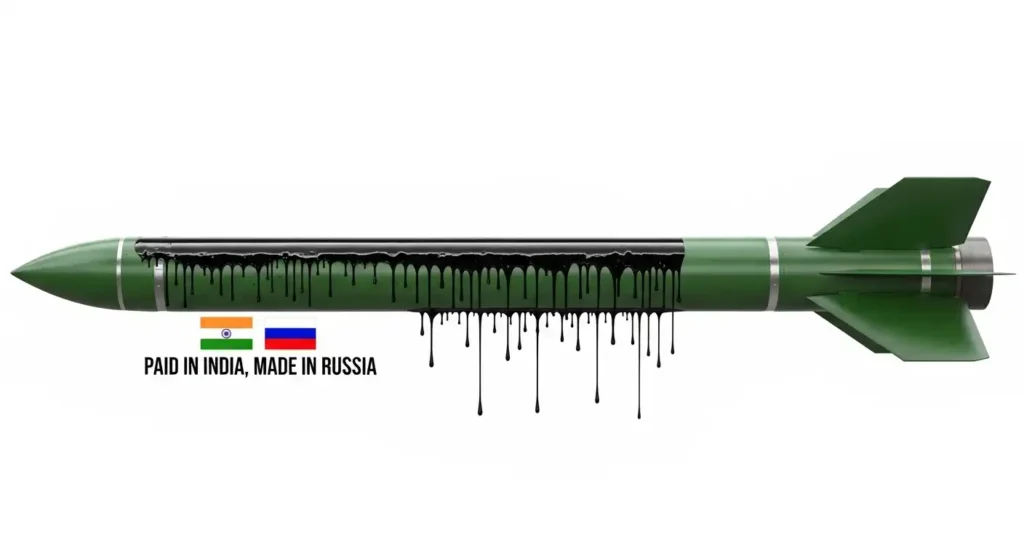

The war in Ukraine was a catalyst, reconfiguring the U.S.-India trade dynamic. India's decision to dramatically increase imports of discounted Russian crude oil—from 0.2% of its total imports pre-war to 35-40% by FY 2024-25—became a central U.S. grievance. India's rationale was purely economic: the Russian discount provided a crucial cushion against soaring global energy prices, saving the country an estimated $25 billion on its import bill. India countered U.S. criticism by labeling it "unjustified and unreasonable", arguing it was an economic necessity initially encouraged by Washington to stabilize global markets. Furthermore, India highlighted the "double standards" of the U.S. and EU, who themselves continue to engage in substantial trade with Russia.

| Supplying Country/Region | Share of India's Oil Imports (FY 2021-22) | Share of India's Oil Imports (FY 2024-25) |

|---|---|---|

| Russia | 0.2% | 35-40% |

| Iraq | ~23% | ~20% |

| Saudi Arabia | ~18% | ~16% |

| United States | ~9% | ~5% |

Strategic Imperatives: Analyzing U.S. and Indian Motivations and Red Lines

The trade friction is a surface-level manifestation of a deeper collision. India's guiding principle is "strategic autonomy"—the freedom to make policy based on its own national interests. This is linked to its ambition for a multipolar world, resisting U.S. pressure to demonstrate it will not bow to coercive diplomacy. Domestically, this is framed within the narrative of Atmanirbhar Bharat (self-reliant India), creating hard red lines in negotiations, particularly the protection of its agricultural and dairy sectors. For the U.S., the tariffs are a tool to enforce geopolitical alignment and rebalance a trade relationship it perceives as unfair, driven by a political narrative demanding a tough stance on trade.

The Path Forward: Navigating a Dual-Track Relationship and Strategic Recommendations

The relationship is poised for a "managed stalemate," not a swift resolution. Prospects for a comprehensive Bilateral Trade Agreement (BTA) are bleak. India is responding by diversifying its trade partnerships, accelerating deals with the UK and EU, and using its significant defense relationship with the U.S. as a bargaining chip.

Strategic Recommendations for Stakeholders

- For U.S. Policymakers: Reconcile strategic goals with trade tactics. The use of blanket tariffs against a key partner like India risks undermining the larger objective of balancing China. Delink strategic cooperation from trade disputes to provide stability.

- For Indian Policymakers: Continue to amplify the counter-narrative of Western "double standards" to shape international opinion. Conclude trade deals with other partners to demonstrate viable market alternatives.

- For Corporate Strategists: Incorporate a political risk premium into all U.S.-India corridor business plans. Embrace radical supply chain diversification beyond a simple "China+1" model. Actively lobby both governments to protect and expand areas of strategic cooperation, which offer the most stable long-term opportunities.

Calculate the Impact of U.S. Tariffs

Navigating the complexities of U.S. tariffs on Indian goods requires precise calculation and planning. Use our comprehensive tool to understand the potential costs and strategize your next move in this evolving trade landscape.

Access the U.S. Tariff CalculatorDisclaimer: The content provided on this webpage is for informational purposes only and is not intended to be a substitute for professional advice. While we strive to ensure the accuracy and timeliness of the information presented here, the details may change over time or vary in different jurisdictions. Therefore, we do not guarantee the completeness, reliability, or absolute accuracy of this information. The information on this page should not be used as a basis for making legal, financial, or any other key decisions. We strongly advise consulting with a qualified professional or expert in the relevant field for specific advice, guidance, or services. By using this webpage, you acknowledge that the information is offered “as is” and that we are not liable for any errors, omissions, or inaccuracies in the content, nor for any actions taken based on the information provided. We shall not be held liable for any direct, indirect, incidental, consequential, or punitive damages arising out of your access to, use of, or reliance on any content on this page.

About The Author

Roger Wood

With a Baccalaureate of Science and advanced studies in business, Roger has successfully managed businesses across five continents. His extensive global experience and strategic insights contribute significantly to the success of TimeTrex. His expertise and dedication ensure we deliver top-notch solutions to our clients around the world.

Time To Clock-In

Start your 30-day free trial!

Experience the Ultimate Workforce Solution and Revolutionize Your Business Today

- Eliminate Errors

- Simple & Easy To Use

- Real-time Reporting

Saving businesses time and money through better workforce management since 2003.

Copyright © 2025 TimeTrex. All Rights Reserved.