The Indispensable Role of Payroll for Your Virginia Small Business

Payroll represents far more than the simple act of distributing paychecks. For small businesses operating in Virginia, it encompasses the entire process of calculating employee wages, salaries, and bonuses; meticulously handling deductions for taxes, benefits, and other contributions; ensuring timely and accurate payment distribution; and maintaining rigorous compliance with a complex web of federal and state regulations. It stands as a fundamental operational function, integral to the smooth running and legal standing of any enterprise.

Mastering payroll is not merely advisable for Virginia small businesses; it is an absolute necessity for several critical reasons:

- Regulatory Compliance: This forms the cornerstone of responsible payroll management. Federal agencies like the Internal Revenue Service (IRS) and state bodies such as the Virginia Department of Taxation (VA Tax), the Virginia Employment Commission (VEC), and the Virginia Department of Labor and Industry (DOLI) impose strict rules. Virginia law frequently aligns with federal requirements; for instance, if federal law mandates income tax withholding, Virginia typically requires it as well. Failure to comply, even due to unintentional errors, can trigger substantial penalties, interest accrual, and significant legal complications. The IRS takes payroll tax mistakes seriously.

- Employee Morale and Trust: Consistent, accurate, and on-time paychecks are fundamental to maintaining employee satisfaction, motivation, and financial well-being. Errors or delays can quickly erode trust, foster disengagement, and harm retention efforts. Accurate handling of benefits and compensation is core to payroll's responsibility.

- Company Reputation: Reliable payroll practices project stability and trustworthiness, enhancing the company's brand among potential hires, employees, partners, and investors. Payroll mishaps can lead to negative publicity and damage credibility.

- Financial Planning and Stability: Payroll is often a significant business expense. Accurate tracking and reporting are vital for effective budgeting, cash flow management, and informed strategic decisions about hiring, salaries, and expansion. Well-maintained records are often needed for loans or financing.

The dual nature of payroll—as both a critical operational task and a substantial compliance challenge—is clear. Success demands proficiency in both. Small businesses, often with limited resources, can find balancing these demands challenging.

Moreover, viewing payroll merely as an administrative cost overlooks its strategic value. Payroll data provides critical financial insights, while smooth execution influences the company's reputation as an employer, impacting talent attraction and retention. Effective payroll management is intertwined with financial stewardship and strategic human capital management.

Setting the Stage: Payroll Setup and Registration in Virginia

Before processing the first paycheck, Virginia small businesses must establish a payroll system and complete essential federal and state registrations. Choosing the right approach depends on the business's size, complexity, resources, and comfort level with compliance tasks.

Choosing Your Payroll Method

Three primary methods exist for handling payroll:

| Method | Description | Pros | Cons |

|---|---|---|---|

| Manual Payroll | Spreadsheets or pen-and-paper calculations. | Low initial cost. | High error risk, time-consuming, significant compliance risks. Suitable only for very small/simple payrolls. |

| Payroll Software | Dedicated software (e.g., TimeTrex, QuickBooks, Gusto, ADP) automates calculations, filings, payments. | Time savings, reduced errors, improved compliance, scalability, employee self-service features. | Subscription costs, initial setup/training required. |

| Payroll Services/Outsourcing | Hiring external providers (Payroll Service, PEO) to manage payroll and tax compliance. | Expertise, offloads administrative burden, reduces compliance risk, potentially cost-effective, error guarantees possible. | Service fees, requires selecting a reputable provider. |

Essential First Steps: Federal & State Registrations

Regardless of the chosen method, several registrations are mandatory:

- Obtain a Federal Employer Identification Number (FEIN): A unique nine-digit number from the IRS, essential for identifying your business entity. Required for federal employment taxes and Virginia state registrations (VA Tax, VEC). Apply directly via the IRS website. Use the same FEIN consistently.

-

Register with the Virginia Department of Taxation (VA Tax): Required for businesses employing workers in VA or paying wages subject to VA income tax. Covers employer income tax withholding and possibly other taxes.

- Preferred method: Online via the Virginia Tax Online Services for Businesses (iReg) portal. Faster and less error-prone.

- Required Info: FEIN, business details (name, address, entity type, NAICS), primary user/responsible party info (incl. SSN), tax types needed, start dates.

- Successful online registration usually yields immediate VA Tax account numbers and online services access.

- Paper Option: If online isn't possible, use Form R-1 (Business Registration Form).

-

Register with the Virginia Employment Commission (VEC): Required for employers liable for Virginia State Unemployment Tax (SUTA).

- Often completed simultaneously with VA Tax via iReg. Select "VEC Only" if registering separately.

- Required Info: Similar to VA Tax (FEIN, name, address, entity, activity, owner details, date first wages paid).

- Assigns a 10-digit VEC employer account number upon registration.

- Mandatory: Enroll in and use the VEC's Employer Self Service (ESS) portal for electronic notifications and submissions regarding unemployment claims.

Key Point: The integrated Virginia registration process (iReg) highlights the importance of accuracy and consistency from the start. Discrepancies can lead to cross-agency compliance issues. The strong emphasis on online registration and electronic filing signifies that digital engagement is a fundamental requirement for Virginia businesses.

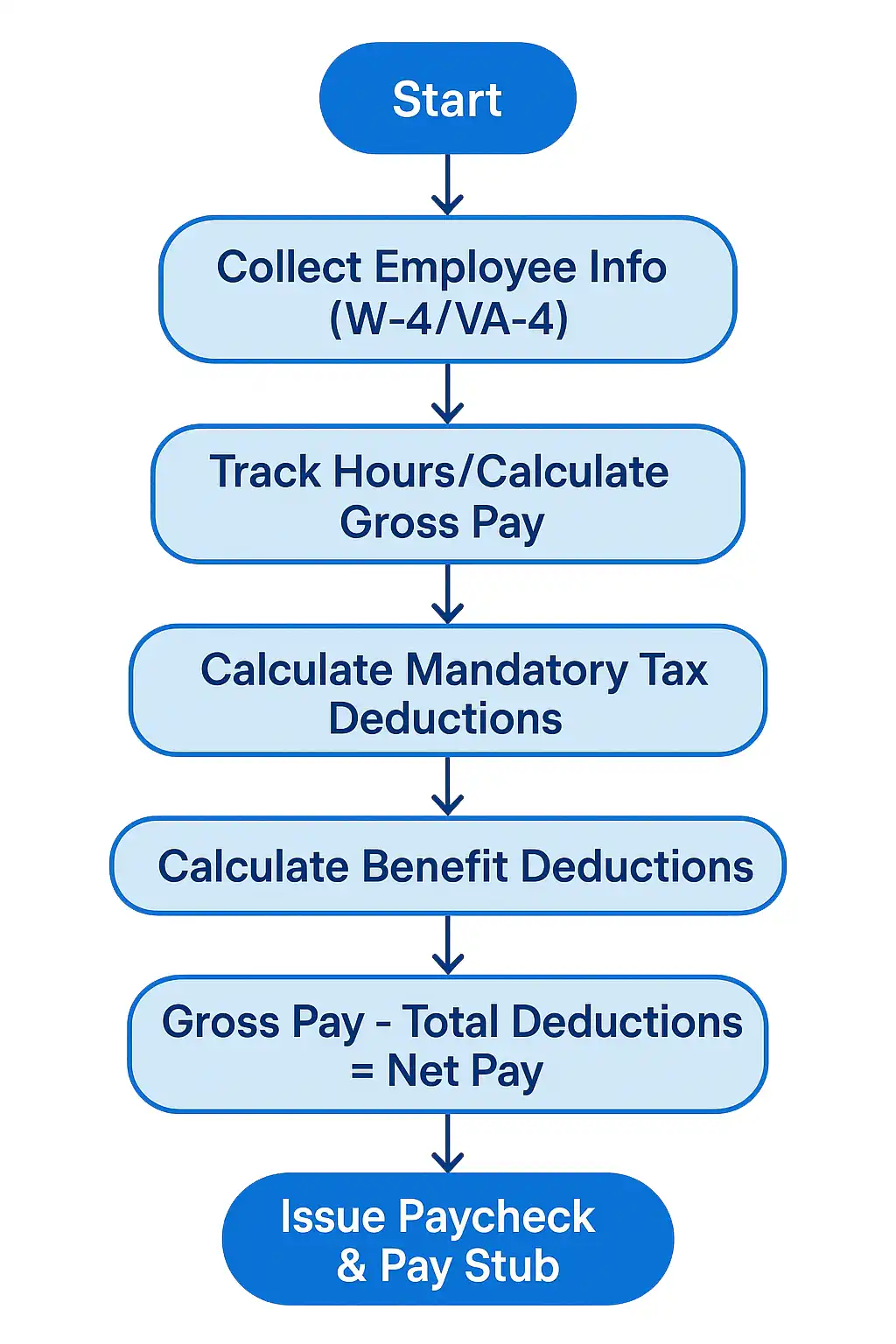

Decoding Payroll Calculations: From Gross Pay to Net Pay

Accurate payroll processing hinges on meticulous calculations at every stage, transforming an employee's total earnings into their final take-home pay.

Need help with the numbers? Simplify complex calculations with the easy-to-use

TimeTrex Virginia Payroll Tax Calculator

Gathering Employee Information

Correct information is the foundation:

- Personal Information: Full legal name, current home address, Social Security Number (SSN).

-

Tax Information:

- Federal Form W-4 (Employee's Withholding Certificate): Determines federal income tax withholding based on filing status and adjustments. Obtain upon hire.

- Virginia Form VA-4 (Employee's Withholding Exemption Certificate): Determines state income tax withholding based on exemptions claimed. Obtain upon hire.

- Pay Rate and Basis: Clearly defined hourly wage or annual salary, and pay period frequency (weekly, bi-weekly, etc.).

Calculating Gross Pay

Gross pay is total earnings before deductions:

- Hourly Employees: Hourly rate × total hours worked (including overtime at premium rates). Requires accurate time tracking.

- Salaried Employees: Fixed amount per pay period based on annual salary.

- Other Compensation: Include bonuses, commissions, tips, etc.

Calculating Deductions

Amounts subtracted from gross pay:

- Mandatory Statutory Taxes:

- Federal Income Tax (based on W-4 and IRS tables).

- Virginia State Income Tax (based on VA-4 and state tables/formulas).

- FICA Taxes (Social Security & Medicare - employee share).

- Voluntary Deductions (Benefits):

- Health, dental, vision insurance premiums (employee share).

- Retirement plan contributions (401(k), Simple IRA).

- Other benefits (life insurance, disability).

- Other Deductions:

- Wage Garnishments (legally mandated for debts like child support, tax levies).

Arriving at Net Pay

Net pay (take-home pay) is calculated as: Gross Pay - Total Deductions = Net Pay.

Providing Pay Stubs

Employers must provide employees with a clear, detailed pay stub (earnings statement) each pay period, outlining:

- Gross earnings

- Itemized list of all deductions

- Net pay amount

Accuracy is Key: Pay stubs ensure transparency. The complexity of these calculations highlights the risk of errors, supporting the use of automated payroll software or services for accuracy.

Federal Payroll Tax Obligations: A Primer for Virginia Employers

Virginia small businesses must comply with several federal employment tax requirements administered by the IRS.

Federal Income Tax Withholding (FITW)

- Requirement: Legally obligated to withhold federal income tax from employee wages.

- Determining Amount: Based on employee's gross wages and Form W-4 information (filing status, adjustments). Use IRS withholding methods (Pub 15-T). Employees can use the IRS Tax Withholding Estimator.

- Depositing Taxes: Deposit withheld FITW (and FICA) electronically via EFTPS. Deposit frequency (monthly or semi-weekly) depends on tax liability (see IRS Pub 15).

- Reporting: Report quarterly on Form 941 (or annually on Form 944 for eligible small employers).

FICA: Social Security & Medicare Taxes

The Federal Insurance Contributions Act (FICA) funds Social Security and Medicare via contributions from both employees and employers.

| Tax Component | Employee Rate | Employer Rate | Total Rate | Annual Wage Base Limit (2025) |

|---|---|---|---|---|

| Social Security | 6.2% | 6.2% | 12.4% | $176,100 (Est. - Check current IRS figures) |

| Medicare | 1.45% | 1.45% | 2.9% | None |

| Additional Medicare Tax | 0.9% (on wages > $200k*) | None (No Employer Match) | 0.9% | *Threshold varies by filing status |

Note: 2025 FICA wage base is estimated based on source text; always verify current limits with the IRS.

- Depositing & Reporting: FICA taxes (employee and employer shares) are deposited with FITW via EFTPS and reported quarterly on Form 941 (or annually on Form 944).

FUTA: Federal Unemployment Tax Act

- Requirement: Employer-only tax funding state unemployment program administration. Not withheld from employees.

- Liability Trigger: Generally liable if paid $1,500+ wages in any quarter OR employed someone for part of a day in 20+ different weeks (current or prior year).

- Tax Rate & Wage Base: Standard rate is 6.0% on the first $7,000 of wages per employee per year (max $420/employee).

- FUTA Tax Credit: Employers receive a credit (up to 5.4%) for paying state unemployment taxes (SUTA) on time. In states like Virginia (typically not a credit reduction state), this reduces the effective FUTA rate to 0.6% (max $42/employee).

- Credit Reduction States: If a state has unrepaid federal loans, the FUTA credit may be reduced, increasing the effective FUTA rate for employers in that state. Check IRS annually (Virginia is usually unaffected).

- Depositing FUTA Tax: Deposit electronically via EFTPS. Generally quarterly if liability exceeds $500. Due last day of the month following quarter end.

- Reporting: Report annually on Form 940, due January 31 of the following year.

Complexity Alert: The complexity of federal taxes (FITW, FICA with limits/surtax, FUTA with credits) makes automated systems or professional services highly recommended to ensure accuracy and avoid penalties. The FUTA credit system also shows how state financial health can impact federal business taxes.

Navigating Virginia State Payroll Taxes: Compliance Essentials

Virginia small businesses must also comply with state-specific payroll taxes administered by VA Tax and the VEC.

Virginia Income Tax Withholding

- Requirement: Employers must withhold Virginia income tax from wages paid to employees working in VA or VA residents working elsewhere. If federal withholding is required, VA withholding is likely also required. Withheld funds are held in trust for the Commonwealth.

- Employee Form VA-4: Obtain a completed Form VA-4 from each employee to determine exemptions for calculating withholding.

- Calculating Withholding: Use the official Virginia withholding tables or methods/calculator from the VA Tax Employer Withholding Instructions, based on wages, pay frequency, and VA-4 info.

- Deposit Schedules & Filing Frequencies (Electronic Mandatory): VA Tax assigns frequency based on average monthly liability. ALL filings and payments must be electronic.

| Average Monthly Liability | Filing Frequency | Payment/Reconciliation Form(s) | Due Dates |

|---|---|---|---|

| Less than $100 | Quarterly | Form VA-5 | Last day of month following quarter end (Apr 30, Jul 31, Oct 31, Jan 31) |

| $100 to $999.99 | Monthly | Form VA-5 | 25th day of the following month (e.g., Jan payment due Feb 25) |

| $1,000 or more | Semi-Weekly | Payment: Form VA-15 Reconciliation: Form VA-16 (Quarterly) |

Payment: Follows Federal Schedule (Paydays Wed/Thu/Fri -> due next Wed; Paydays Sat/Sun/Mon/Tue -> due next Fri). Reconciliation: Last day of month following quarter end. |

| *Note: Waiver from semi-weekly may be possible for employers with 5 or fewer employees. Source: VA Tax. | |||

- Annual Reconciliation (Form VA-6): All employers must electronically file Form VA-6 by Jan 31 (or 30 days after final wages), reconciling total tax withheld and paid.

- W-2/1099 Submission: Electronically submit copies of Forms W-2, W-2G, 1099-MISC, 1099-NEC, 1099-R showing VA withholding concurrently with Form VA-6 (via eForms or Web Upload). Timeliness is critical for employee tax returns.

- Household Employer Option: Certain domestic employers may elect annual filing (Form VA-6H). Register online or via Form R-1H.

- Electronic Payment Methods: Use VA Tax's free eForms, Business Online Services Account, or Web Upload. ACH Credit also possible. Paper checks generally not accepted without a waiver.

Virginia Unemployment Insurance (SUTA) Tax

- Administering Agency: Virginia Employment Commission (VEC).

- Liability: Generally triggered if meeting federal FUTA liability criteria ($1,500 quarterly payroll OR 1+ employee in 20+ weeks for most businesses). Different thresholds for agricultural, domestic, non-profit employers. Acquiring a liable business also confers liability.

- Registration: Register with VEC (usually via iReg online) and receive a VEC Account Number. Form T-FC-27 may be needed otherwise.

- Taxable Wage Base: SUTA tax applies only to the first $8,000 in wages per employee per year (Verify annually).

- Contribution Rates: Assigned annually by VEC.

- New Employer Rate: Typically 2.5% plus add-ons (Verify current rate with VEC), until experience rated.

- Experience Rating: Based on benefits charged vs. taxable payroll. Base rates range from 0.1% to 6.2% plus add-ons (pool/fund-building charges - Verify current range).

- Quarterly Reporting and Payment (Electronic Mandatory): Use VEC online systems (ESS, iFile, Web Upload) to file Forms FC20 (Contribution Report) & FC21 (Wage Report) and pay taxes due by the last day of the month following the quarter end (Apr 30, Jul 31, Oct 31, Jan 31).

Mandatory E-Filing: Virginia's mandatory electronic filing/payment for both withholding and SUTA necessitates digital capabilities. Businesses must use state portals, software uploads, or third-party providers. The separate rules, forms, and deadlines for VA Tax and VEC require careful management, reinforcing the need for robust payroll systems.

Adhering to Virginia Labor Laws: Wage, Hour, and Payment Rules

Beyond taxes, Virginia employers must follow state labor laws (primarily enforced by DOLI) governing wages, hours, and payment practices.

Virginia Minimum Wage

- Current Rate (Effective Jan 1, 2025): $12.41 per hour. This resulted from an automatic CPI adjustment per 2020 legislation, as further increases were not re-enacted.

- Future Increases: Scheduled increases to $13.50 (2025) and $15.00 (Jan 1, 2026) required legislative reenactment, which did not occur. Future increases beyond $12.41 will likely depend on annual CPI adjustments unless the General Assembly acts.

- Tipped Employees: Minimum cash wage is tied to federal ($2.13), but the combined direct cash wage plus tips must equal at least the state minimum wage ($12.41/hour for 2025). If tips fall short, the employer must pay the difference. Consult DOLI regulations and FLSA for tip credit rules.

- Exemptions: Certain workers (e.g., some farm laborers, domestic workers, golf caddies, minors working for parents, some students) may be exempt. Verify specific exemptions under the Virginia Minimum Wage Act carefully.

Overtime Pay

- Governing Laws: Federal FLSA requirements are generally followed. Virginia also has its own Overtime Wage Act.

- General Requirement: Non-exempt employees must receive 1.5 times their "regular rate of pay" for all hours worked over 40 in a single workweek. Calculating the regular rate can be complex as it includes hourly pay plus non-discretionary bonuses, commissions, etc.

- Exemptions & Enforcement: Carefully verify exemptions (Executive, Administrative, Professional, Outside Sales, Computer). Overtime complaints in VA are typically handled by the U.S. Department of Labor.

Pay Frequency (Virginia Code § 40.1-29)

Virginia law specifies minimum pay frequencies:

- Salaried Employees: Must be paid at least once per month.

- Hourly Employees: Must be paid at least once every two weeks OR twice per month.

- Exception: Monthly pay for hourly workers is generally not permitted unless specific criteria involving high average weekly wages or collective bargaining agreements are met - consult the statute.

Final Paycheck Regulations (Virginia Code § 40.1-29)

Timing for final wages upon separation:

- Requirement: Must pay all wages/salary earned up to the separation date, including determinable commissions.

- Deadline: Pay on or before the employee's next regular payday had employment continued.

- Accrued Leave Payout: Not required by VA law unless dictated by company policy or employment agreement.

Other Key Wage-Related Protections

- Wage Statements: Must provide a written statement each pay period showing hours (if applicable), rate, gross wages, and itemized deductions.

- Wage Discussion Protection: Employers generally cannot retaliate against employees for discussing wages.

- Worker Classification: Virginia laws grant rights to employees misclassified as independent contractors. Misclassification carries significant liability.

- Allowable Deductions: Ensure deductions are legally authorized by law, court order, or employee's written consent per Virginia Code § 40.1-29.

- Breastfeeding Breaks: Provide reasonable unpaid break time and a private location (not a restroom) for expressing milk, per federal PUMP Act requirements.

Stay Vigilant: Virginia's minimum wage requires annual monitoring for CPI adjustments. Specific state rules on pay frequency, final pay, and wage statements are mandatory compliance points crucial to avoiding wage claims.

Essential Virginia Compliance Tasks: Beyond Tax Deposits

Beyond pay and taxes, employers have other key compliance duties related to hiring, records, and notifications.

Virginia New Hire Reporting

- Mandate: Federal (PRWORA) and State (VA Code § 63.2-1946) require reporting new hires, re-hires, and (uniquely required by VA) certain independent contractors.

- Administering Agency: Virginia New Hire Reporting Center (under Dept. of Social Services).

- Purpose: Primarily child support enforcement; also aids in detecting UI/WC fraud.

- Who Must Be Reported:

- New Employees: Hired for wages, residing/working in VA (even temporary/seasonal).

- Rehired Employees: Returning after 60+ consecutive day break.

- Independent Contractors: Report if paying $600+ in a year OR contract anticipates reaching that threshold. Report within 20 days of contract start or first payment. (Verify current threshold/rules with VA New Hire).

- Required Information:

- Employee/Contractor: Full Name, Address, SSN, Date of Hire/Contract Start.

- Employer: Legal Name, Address, FEIN (MUST match FEIN used for VEC reporting).

- Reporting Deadline: Within 20 calendar days of hire/rehire/contract start.

- Reporting Methods: Electronic (Online Portal, FTP - encouraged) or Non-Electronic (Mail/Fax list, form, or W-4/W-9 copy).

- Multistate Employers: Can report all hires to one designated state (requires notifying HHS).

- Compliance: Crucial to use correct, consistent FEIN. Penalties possible for failure to report.

State and Federal Recordkeeping Obligations

Maintain various employment and payroll records per state and federal laws.

- Virginia Access Requirements (VA Code § 40.1-29 C): Current employees (and former within limits) can inspect/copy their own wage records. Provide access within reasonable time (check DOLI guidance).

- Retention Periods (Federal & State): Different rules apply; generally keep records for the *longest* applicable period:

- 3 Years (Minimum): Payroll Records (FLSA, ADEA), Basic Employee Info (FLSA), FMLA Records, ADEA Personnel Records.

- 2 Years (Minimum): Wage Computation Records (Time Cards, etc. - FLSA).

- 1 Year (Minimum): Basic Personnel Records (Apps, Resumes, Hiring/Termination docs - EEOC Title VII/ADA).

- Plan Duration + 1-6 Years: Benefit Plans (Pension, Insurance), Seniority Systems (ERISA/ADEA).

- I-9 Forms: 3 years after hire OR 1 year after termination, whichever is later (USCIS).

- OSHA Records: Varies (e.g., exposure records for duration + 30 years).

- Litigation Holds: Retain relevant records longer if a charge/lawsuit is filed, until final resolution.

- Record Format: Generally no specific format required (e.g., time clocks not mandated), but records must be accurate, complete, and accessible. Electronic records are permissible.

| Record Type | Common Minimum Retention | Governing Law(s) |

|---|---|---|

| Payroll Records (Wages, Hours) | 3 years | FLSA, ADEA |

| Wage Computation (Timecards) | 2 years | FLSA |

| Hiring/Personnel Records | 1 year (EEOC) / 3 years (ADEA) | EEOC, ADEA |

| I-9 Forms | 3 yrs after hire OR 1 yr after term | USCIS |

| Benefit Plan Docs | Plan Duration + 1-6 yrs | ADEA, ERISA |

| FMLA Records | 3 years | FMLA |

| Charge/Lawsuit Records | Until Final Disposition | Agency/Court |

Required Workplace Posters

Display federal and state labor law posters conspicuously. Failure can result in fines.

| Poster Category | Commonly Required Posters (Examples) | Issuing Agency (Typically) |

|---|---|---|

| Virginia State | Job Safety and Health Protection (VOSH), Unemployment Insurance (Notice to Workers - VEC-B-29), Workers' Compensation (Notice - VWC), Earned Income Tax Credit (EITC) Notification, VA Human Rights Act / Reasonable Accommodations / VA Overtime (DOLI posters). | DOLI, VEC, VWC, VA Tax |

| Federal | Fair Labor Standards Act (FLSA Min Wage), Job Safety and Health (OSHA), Equal Employment Opportunity (EEOC "Know Your Rights"), Employee Polygraph Protection Act (EPPA), Family and Medical Leave Act (FMLA - if covered), Uniformed Services (USERRA). | US DOL, OSHA, EEOC |

| Industry Specific | May include Davis-Bacon Act, Service Contract Act, etc. | US DOL |

| Note: This is not exhaustive. Download current, free posters directly from agency websites. Check VEC and DOLI for Virginia lists and the US DOL for federal posters. | ||

Process Matters: Virginia's contractor reporting rule adds complexity to onboarding. Navigating record retention requires adhering to the longest applicable federal/state period per record type. Accurate, accessible records are vital for compliance and defense against claims.

Common Payroll Pitfalls for Virginia Small Businesses (And How to Avoid Them)

Complexity and limited resources can lead to common payroll errors. Awareness helps prevention.

Incorrectly classifying employees (W-2) as independent contractors (1099) to avoid taxes/compliance. Agencies have strict tests. Risks: back taxes, penalties, interest, lawsuits.

Avoidance: Apply IRS/state criteria carefully; consult counsel or classify as employee if unsure. Remember VA contractor reporting.Missing deadlines or paying wrong amounts for federal/state taxes. Results in penalties/interest.

Avoidance: Use a payroll calendar; leverage automated software/services; ensure funds are available; use mandatory VA electronic systems.Failing to maintain complete/accurate records (hours, pay, deductions). Violates laws, hinders audits/defense.

Avoidance: Use reliable time tracking; document calculations; retain records per requirements (longest applicable period); store securely.Overlooking VA rules (VA-4, pay frequency/final pay, wage statements, contractor reporting, SUTA wage base/rate).

Avoidance: Review VA Tax/VEC/DOLI resources; use state forms; configure systems for VA compliance.Math mistakes in overtime, taxes, deductions, net pay. Common in manual processes.

Avoidance: Double-check manual work; strongly consider payroll software/services.Failing to incorporate changes in laws, rates (SUTA), wage bases (FICA, SUTA), minimum wage.

Avoidance: Subscribe to agency updates; use automatically updated software/services; consult professionals.Risk Mitigation: Many pitfalls stem from the gap between compliance demands and small business resources. Automation or external support is often necessary. Worker misclassification is a key risk area in Virginia, with state laws providing worker rights and specific reporting rules for contractors, making accurate classification critical.

Conclusion: Streamlining Payroll and Staying Compliant in Virginia

Successful Virginia payroll requires operational precision and rigorous compliance with federal/state laws. While navigating IRS, VA Tax, VEC, and DOLI rules seems daunting, robust processes and resources mitigate risks.

Key tasks include accurate calculations, timely tax deposits/filings (federal & state - remembering VA's mandatory electronic methods), meeting wage/hour laws (minimum wage, overtime, pay frequency, final pay), new hire reporting (employees & contractors), and meticulous recordkeeping adhering to retention rules.

Given mandatory electronic filing in Virginia and the risk of common errors, technology (payroll software, outsourcing) is highly beneficial. Automation, accuracy, compliance updates, and self-service portals streamline the process. Consider solutions like TimeTrex to simplify these complex tasks.

Simplify your payroll process today! Estimate withholdings quickly and accurately with the

TimeTrex Virginia Payroll Tax Calculator

A proactive approach is vital: regularly review procedures, stay informed on changes (VA minimum wage, SUTA rates), and seek professional guidance when needed. Utilize official agency resources for accurate information.

Key Virginia Payroll Contacts & Resources

| Agency/Resource | Relevant Area | Key Website | Phone Number(s) (Verify Current) |

|---|---|---|---|

| Virginia Department of Taxation (VA Tax) | Income Tax Withholding, Other Business Taxes | tax.virginia.gov | Business: 804-367-8037 |

| Virginia Employment Commission (VEC) | SUTA Tax, Unemployment Claims | vec.virginia.gov | General: 866-832-2363 | Employer Tax: 804-786-1082 / 804-786-3061 |

| Virginia Dept. of Labor & Industry (DOLI) | Labor Law, Wages, Safety (VOSH) | doli.virginia.gov | General/Labor Law: (See Website) | VOSH: 804-371-2327 |

| Virginia New Hire Reporting Center | New Hire Reporting (Employees & Contractors) | va-newhire.com | 800-979-9014 |

| Internal Revenue Service (IRS) | Federal Taxes (FITW, FICA, FUTA) | irs.gov/businesses | Business: 800-829-4933 |

| U.S. Department of Labor (Wage & Hour Div.) | Federal Labor Law (FLSA, FMLA, Overtime) | dol.gov/agencies/whd | 866-487-9243 |

| TimeTrex | VA Payroll Calculator | TimeTrex VA Calculator | Online Tool |

By treating payroll strategically, investing in appropriate tools/services, and staying diligent, Virginia small businesses can manage obligations effectively, foster positive employee relations, and ensure long-term compliance and stability.

Disclaimer: The content provided on this webpage is for informational purposes only and is not intended to be a substitute for professional advice. While we strive to ensure the accuracy and timeliness of the information presented here, the details may change over time or vary in different jurisdictions. Therefore, we do not guarantee the completeness, reliability, or absolute accuracy of this information. The information on this page should not be used as a basis for making legal, financial, or any other key decisions. We strongly advise consulting with a qualified professional or expert in the relevant field for specific advice, guidance, or services. By using this webpage, you acknowledge that the information is offered “as is” and that we are not liable for any errors, omissions, or inaccuracies in the content, nor for any actions taken based on the information provided. We shall not be held liable for any direct, indirect, incidental, consequential, or punitive damages arising out of your access to, use of, or reliance on any content on this page.

About The Author

Roger Wood

With a Baccalaureate of Science and advanced studies in business, Roger has successfully managed businesses across five continents. His extensive global experience and strategic insights contribute significantly to the success of TimeTrex. His expertise and dedication ensure we deliver top-notch solutions to our clients around the world.

Time To Clock-In

Start your 30-day free trial!

Experience the Ultimate Workforce Solution and Revolutionize Your Business Today

- Eliminate Errors

- Simple & Easy To Use

- Real-time Reporting

Saving businesses time and money through better workforce management since 2003.

Copyright © 2025 TimeTrex. All Rights Reserved.