Free Canadian Payroll Tax Calculator

Using Our Canadian Free Paycheck Calculator

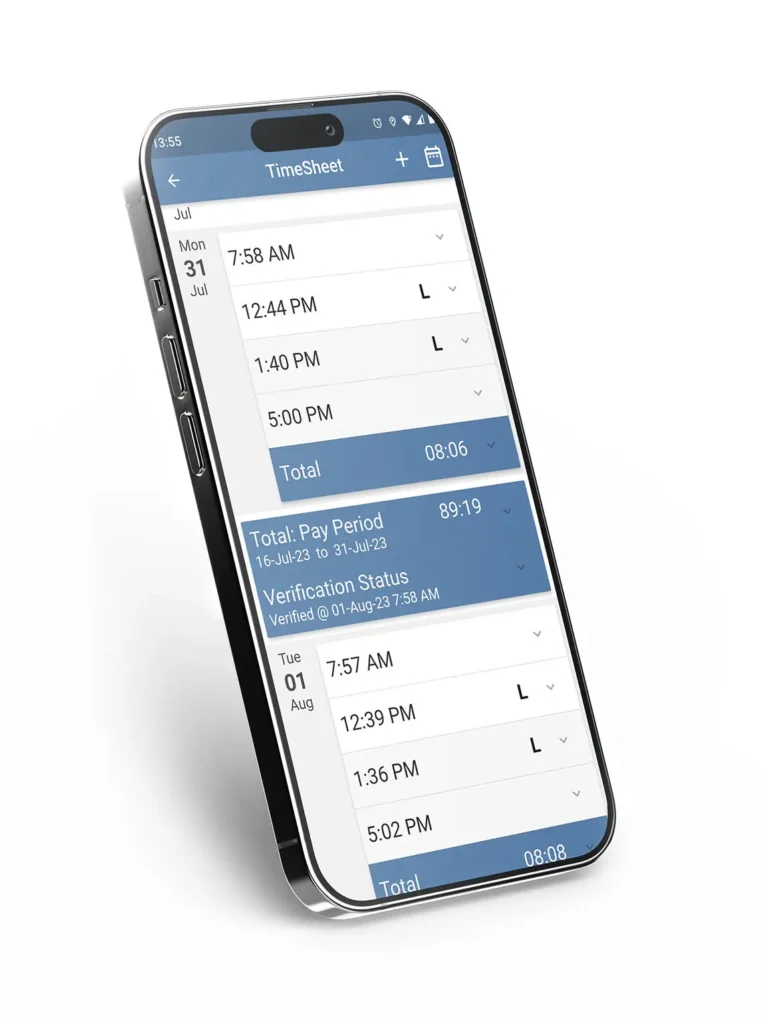

TimeTrex offers a user-friendly Canadian payroll tax calculator for accurate calculations. Follow these steps using the dropdown menu for tailored results:

Country and Province Selection:

- Choose your country and province/state from the dropdown for location-specific tax rates.

Federal and Provincial Claim Amounts:

- Input federal and provincial claim amounts from your tax documents for correct withholding calculations.

Annual Pay Periods:

- Indicate your yearly pay periods to match the calculations with your payment frequency.

Gross Wage Per Pay Period:

- Enter the gross wage for each pay period pre-deductions.

Pay Date:

- Pick the pay date to align tax calculations with your payment timeline.

Calculate:

Press the calculate button for a comprehensive breakdown of your payroll taxes.

Understanding a Payroll or Paycheck Calculator

A payroll or paycheck calculator is a vital tool for automating employee wage calculations. It considers factors like work hours, tax rates, and other deductions to compute net pay and taxes owed.

- Importance: In today's fast-moving business world, precise and efficient payroll management is critical. A Payroll Calculator is key to ensuring accurate and timely employee payments and aiding employers in adhering to tax laws.

- User-Friendliness: This calculator is designed for ease, allowing quick data input by employers and employees for prompt, precise calculations.

- Time Efficiency: Automating complex payroll calculations, this tool cuts down the time spent on payroll tasks, freeing up resources for other important business activities.

Common Paycheck Terms

- Gross Pay: This is the total amount earned by an employee before any deductions are made. It includes wages, salaries, bonuses, and overtime pay.

- Net Pay: Often referred to as 'take-home pay', Net Pay is the amount an employee receives after all deductions, such as taxes and insurance, have been subtracted from the gross pay.

- Payroll Deductions in Canada: These are sums subtracted from an employee's total earnings. They include compulsory deductions like income tax, Canada Pension Plan contributions, and Employment Insurance premiums, as well as optional ones such as health insurance and retirement savings. These deductions are essential for both legal compliance and personal financial management.

- Weekly Pay Periods: Paychecks are issued 52 times a year, once every week.

- Bi-weekly Pay Periods: Paychecks are issued every two weeks, totaling 26 pay periods a year.

- Monthly Pay Periods: Paychecks are issued once a month, totaling 12 pay periods a year.

- Annually Pay Period: A single paycheck issued once a year, covering an entire year’s salary.

- Gross Wage per Pay Period: The total earnings before any deductions (taxes, benefits, etc.) for each pay period.

- Pay Date: The specific date on which an employee receives their paycheck for a given pay period.

- Taxable Income: The portion of an individual’s or a corporation's income used to calculate how much tax they owe the government in a given tax year.

- Provincial Tax: A tax levied by a province or territorial government in Canada, calculated based on the income earned within that specific province or territory.

- Federal Tax: The amount of money deducted from an employee's gross pay for federal income tax, based on their income and filing status.

- Total Tax: The combined amount of all taxes (federal, state, and any other applicable taxes) deducted from an employee's gross pay.

Found our Free Canadian Paycheck Calculator useful? Bookmark and share it.

2022 - 2023 Provincial Income Tax Brackets

| Province/Territory | Tax Rate |

|---|---|

| British Columbia | 5.06% on the first $45,654 of taxable income 7.7% on taxable income over $45,654 up to $91,310 10.5% on taxable income over $91,310 up to $104,835 12.29% on taxable income over $104,835 up to $127,299 14.7% on taxable income over $127,299 up to $172,602 16.8% on taxable income over $172,602 up to $240,716 20.5% on taxable income over $240,716 |

| Alberta | 10% on the first $142,292 of taxable income 12% on taxable income over $142,292 up to $170,751 13% on taxable income over $170,751 up to $227,668 14% on taxable income over $227,668 up to $341,502 15% on taxable income over $341,502 |

| Saskatchewan | 10.5% on the first $49,720 of taxable income 12.5% on taxable income over $49,720 up to $142,058 14.5% on taxable income over $142,058 |

| Manitoba | 10.8% on the first $36,842 of taxable income 12.75% on taxable income over $36,842 up to $79,625 17.4% on taxable income over $79,625 |

| Ontario | 5.05% on the first $49,231 of taxable income 9.15% on taxable income over $49,231 up to $98,463 11.16% on taxable income over $98,463 up to $150,000 12.16% on taxable income over $150,000 up to $220,000 13.16% on taxable income over $220,000 |

| Québec | 14% on the first $49,275 or less of taxable income 19% on taxable income more than $49,275 but not more than $98,540 24% on taxable income more than $98,540 but not more than $119,910 25.75% on taxable income more than $119,910 |

| New Brunswick | 9.4% on the first $47,715 or less of taxable income 14% on taxable income over $47,715 up to $95,431 16% on taxable income over $95,431 up to $176,756 19.5% on taxable income between $145,955 and $166,280 |

| Nova Scotia | 8.79% on taxable income that is $29,590 or less 14.95% on taxable income over $29,590 up to $59,180 16.67% on taxable income over $59,180 up to $93,000 17.5% on taxable income over $93,000 up to $150,000 21% on taxable income over $150,000 |

| Prince Edward Island | 9.8% on the first $31,984 of taxable income 13.8% on taxable income between $31,984 and $63,969 16.7% on taxable income over $63,969 |

| Newfoundland and Labrador | 8.7% on the first $41,457 or less of taxable income 14.5% on taxable income over $41,457 up to $82,913 15.8% on taxable income over $82,913 up to $148,027 17.8% on taxable income over $148,027 up to $207,239 19.8% on taxable income over $207,239 up to $264,750 20.8% on taxable income over $264,750 up to $529,500 21.3% on taxable income over $529,500 up to $1,059,000 21.8% on taxable income over $1,059,000 |

| Nunavut | 4% on the first $50,877 or less of taxable income 7% on taxable income over $50,877 up to $101,754 9% on taxable income over $101,754 up to $165,429 11.5% on taxable income over $165,429 |

| Yukon | 6.4% on the first $53,359 or less of taxable income 9% on taxable income over $53,359 up to $106,717 10.9% on taxable income over $106,717 up to $165,430 12.8% on taxable income over $165,430 up to $500,000 15% on taxable income over $500,000 |

| Northwest Territories | 5.9% on the first $48,326 or less of taxable income 8.6% on taxable income over $48,326 up to $96,655 12.2% on taxable income over $96,655 up to $157,139 14.05% on taxable income over $157,139 |

Quick Facts About Canadian Personal Income Tax

- Progressive Federal Tax Brackets: Canada's federal tax system is progressive, with tax rates increasing with higher income levels.

- Basic Personal Amount: This non-refundable tax credit lowers the amount of income tax that every Canadian must pay.

- Spousal and Dependant Credits: Tax credits available for supporting a spouse, common-law partner, or dependant with a physical or mental impairment.

- Medical Expense Tax Credit: Significant medical expenses can be claimed for a non-refundable tax credit.

- Charitable Donation Credits: Donations to registered charities are eligible for tax credits, promoting philanthropy.

- RRSP Deductions: Contributions to Registered Retirement Savings Plans (RRSPs) are deductible, reducing taxable income.

- Tax-Free Savings Account (TFSA): Contributions are not tax-deductible, but earnings and withdrawals are tax-free.

- Capital Gains Tax: Only 50% of capital gains on investments like stocks or property are taxable.

- Business Expense Deductions for Self-Employed: Self-employed individuals can deduct legitimate business expenses to lower their taxable income.

- Home Office Deductions: Remote workers can deduct home office expenses under certain conditions.

- Tuition Tax Credits: Students can claim tuition fees for post-secondary education for tax credits.

- Childcare Expense Deductions: Deductions available for childcare expenses incurred due to employment or education.

- First-Time Home Buyer's Credit: Offers tax relief to first-time homebuyers to help with purchase costs.

- Public Transit Tax Credits: Incentives for using public transit to promote environmentally friendly travel.

- Disability Tax Credit: Designed to provide greater tax equity by allowing relief for disability costs.

- Pension Income Splitting: Allows seniors to split eligible pension income with their spouse for tax benefits.

- Foreign Income Declaration: Canadians must declare foreign income, subject to Canadian tax laws.

- Inflation Adjustments: Tax brackets and credits are annually adjusted for inflation.

- Non-Resident Taxation: Non-residents pay taxes on Canadian-sourced income.

- Tax Filing Deadline: Most Canadians must file their tax return by April 30th.

Understanding Canadian Tax Deductions

Understanding Canadian Tax Deductions: Navigating the complexities of Canadian tax deductions can be challenging. This section provides essential insights into various deductions that can significantly impact your tax filings. From understanding the progressive nature of federal and provincial tax brackets to maximizing contributions to RRSPs and TFSAs, we cover key areas that affect your financial health. Learn about deductions for significant medical expenses, the benefits of charitable donations, and childcare expenses. We also delve into specific deductions like home office expenses for remote workers, tuition tax credits for students, and the first-time home buyer’s credit. Additionally, find valuable information about the disability tax credit. This comprehensive guide aims to simplify tax planning and help you make informed decisions.

- Federal and Provincial Tax Brackets: Learn how progressive tax rates affect your income.

- RRSP Contributions: Discover the benefits of contributing to a retirement savings plan.

- TFSA Benefits: Understand the tax-free nature of a Tax-Free Savings Account.

- Medical Expenses Deduction: Explore how significant medical expenses can reduce taxable income.

- Charitable Donations: Find out about tax credits for charitable contributions.

- Childcare Expenses: Learn about deductions available for childcare costs.

- Home Office Deductions: Information on deducting home office expenses for remote workers.

- Tuition Tax Credits: Insights on claiming post-secondary education tuition fees.

- First-Time Home Buyer's Credit: Details on tax relief for first-time homebuyers.

- Disability Tax Credit: Guidance on tax deductions for individuals with disabilities.

Canadian Federal Tax Brackets

| Federal Tax Bracket | Tax Rate |

|---|---|

| On the first $53,358 of taxable income | 15% |

| On taxable income over $53,359 up to $106,717 | 20.5% |

| On taxable income over $106,717 up to $165,430 | 26% |

| On taxable income over $165,430 up to $235,675 | 29% |

| On any taxable income over $235,675 | 33% |

Provincial Tax Rate Trends in Canada

Understanding the trends in provincial tax rates is crucial for financial planning and tax compliance in Canada. Each province has its unique tax structure, reflecting local economic policies and priorities. This section explores the latest trends in provincial tax rates, providing a snapshot of how these rates vary across the country and evolve over time.

- British Columbia: Notable for moderate tax rates with a focus on middle-income earners.

- Alberta: Known for its flat tax rate system, unique among Canadian provinces.

- Saskatchewan: Features a progressive tax rate with a focus on lower to middle-income brackets.

- Manitoba: Maintains a balanced approach with a slightly higher rate for higher-income earners.

- Ontario: Has a complex tax system with multiple brackets and surtaxes.

- Quebec: Exhibits the highest tax rates, reflecting its extensive social programs.

- New Brunswick: Offers a progressive tax structure aimed at equitable income distribution.

- Nova Scotia: Known for higher tax rates, especially for high-income earners.

- Prince Edward Island: Features modest tax rates with a focus on middle-income families.

- Newfoundland and Labrador: Balances between middle and high-income tax rates.

- Yukon, Northwest Territories, and Nunavut: Generally lower tax rates, reflecting the unique economic and living conditions.

Disclaimer: The content provided on this webpage is for informational purposes only and is not intended to be a substitute for professional advice. While we strive to ensure the accuracy and timeliness of the information presented here, the details may change over time or vary in different jurisdictions. Therefore, we do not guarantee the completeness, reliability, or absolute accuracy of this information. The information on this page should not be used as a basis for making legal, financial, or any other key decisions. We strongly advise consulting with a qualified professional or expert in the relevant field for specific advice, guidance, or services. By using this webpage, you acknowledge that the information is offered “as is” and that we are not liable for any errors, omissions, or inaccuracies in the content, nor for any actions taken based on the information provided. We shall not be held liable for any direct, indirect, incidental, consequential, or punitive damages arising out of your access to, use of, or reliance on any content on this page.

Time To Clock-In

Start your 30-day free trial!

Experience the Ultimate Workforce Solution and Revolutionize Your Business Today

- Eliminate Errors

- Simple & Easy To Use

- Real-time Reporting

Saving businesses time and money through better workforce management since 2003.

Copyright © 2025 TimeTrex. All Rights Reserved.