Multi-State Payroll Software for Seamless Compliance

Managing employees in different states? Our multi-state payroll processing solution handles everything from local tax jurisdictions to reciprocity agreements. Trust TimeTrex for reliable, error-free multi-state payroll management.

Automate Your Payroll Across Multiple States

Centralized Multi-State Dashboard

Manage your entire workforce from a single, intuitive dashboard. Get a complete overview of payroll activities across all states, ensuring you have total visibility and control over your multi-state payroll processing without switching between systems.

Automated State Tax Calculations

Eliminate manual calculations and the risk of human error. Our software automatically calculates the correct state and local income taxes for each employee based on their specific work and home locations, ensuring precision for your multi-state payroll.

SUI Tax Management

Stay on top of State Unemployment Insurance (SUI) obligations in every state. Our system accurately calculates, accrues, and reports on your SUI liabilities, helping you manage this critical component of multi-state payroll compliance.

Local and Municipal Tax Jurisdiction Support

Our software goes beyond state-level taxes to handle the complexities of local withholdings. We manage calculations for thousands of city, county, and school district tax jurisdictions, providing comprehensive coverage for your multi-state workforce.

Built-in State Labor Law Compliance

Navigate the maze of state-specific labor laws with confidence. Our platform includes built-in compliance checks for state minimum wage rates, overtime rules, and meal break requirements to keep your business protected.

Digital W-2 and 1099 Form Generation

Make tax season simple for everyone. TimeTrex automatically generates and distributes accurate W-2 and 1099 forms for all your employees and contractors, regardless of their state, and provides them with easy digital access.

Employee Self-Service Portal

Empower your multi-state workforce with 24/7 access to their payroll information. Employees can view pay stubs, download tax forms, and update their personal details online, reducing the administrative burden on your HR team.

Flexible Direct Deposit Options

Offer your employees the convenience and security of direct deposit. Our system allows employees to split their paychecks between multiple bank accounts, a valuable feature for a diverse, multi-state workforce.

Time & Attendance Integration

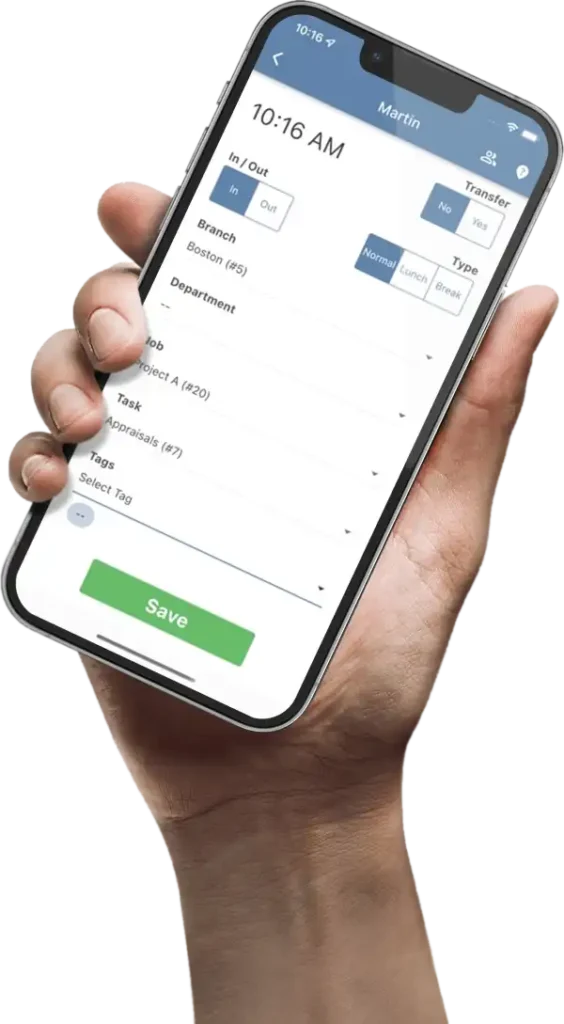

Create a seamless flow of data from punch-in to paycheck. Integrating TimeTrex Time & Attendance automatically syncs approved hours, including state-specific overtime, directly into the payroll system, ensuring accuracy.

Robust Multi-State Payroll Reporting

Gain critical insights into your labor costs across all locations. Generate detailed reports on wages, taxes, and deductions filtered by state, department, or individual employee to make data-driven decisions.

Digital Document Storage

Go paperless and stay organized. Securely store essential payroll and HR documents, such as W-4s and direct deposit authorization forms, in a centralized digital repository for easy access and management.

Multiple Pay Schedule Support

Accommodate different pay frequencies within your multi-state organization. Easily manage weekly, bi-weekly, semi-monthly, and monthly pay schedules for different groups of employees, all within a single system.

Ready for Easier Multi-State Payroll?

See firsthand how TimeTrex can streamline your operations, control labor costs, and drive efficiency on every project. Start your free trial today and transform your company.

Start Your FREE 30-Day Trial- No credit card required

- Full access to all features

- Dedicated setup support

A Comprehensive Multi-State Payroll Solution

TimeTrex offers more than just calculations; we provide a comprehensive multi-state payroll solution. From direct deposit and garnishment management to seamless time and attendance integration, our system is the all-in-one platform your multi-state business needs to thrive.

The Importance of an Integrated Payroll and HR System

For a truly effective multi-state payroll strategy, integration with HR is vital. The TimeTrex multi-state payroll and HR system ensures that employee data, benefits administration, and compliance documents are perfectly synced, creating a single source of truth for your entire workforce.

Key Features of Our Multi-State Payroll Platform

Our multi-state payroll platform is packed with features designed to simplify your life. Key functionalities include automated tax calculations for all 50 states, employee self-service portals, customizable reporting, and robust compliance tools that make multi-state payroll processing predictable and simple.

Scalable Solutions for Growing Multi-State Businesses

As your business grows into new states, your payroll system must grow with you. TimeTrex offers a scalable multi-state payroll solution that easily accommodates new employees and new state regulations, ensuring your payroll processing capabilities never limit your expansion.

Employee Self-Service for Multi-State Workforces

Empower your distributed team with employee self-service. This feature of our multi-state payroll system allows employees to access their pay stubs, view tax forms, and update personal information online, reducing the administrative workload for your HR and payroll teams.

Time To Clock-In

Start your 30-day free trial!

Experience the Ultimate Workforce Solution and Revolutionize Your Business Today

- Eliminate Errors

- Simple & Easy To Use

- Real-time Reporting

Saving businesses time and money through better workforce management since 2003.

Copyright © 2025 TimeTrex. All Rights Reserved.