Perfect Payroll Deduction Management with TimeTrex

TimeTrex automates every payroll deduction—from taxes to benefits—so you don’t. Eliminate manual calculations and costly mistakes, maintain compliance by design, and give employees transparent, self-serve visibility into their pay.

Easy Payroll with Automated Deduction Management

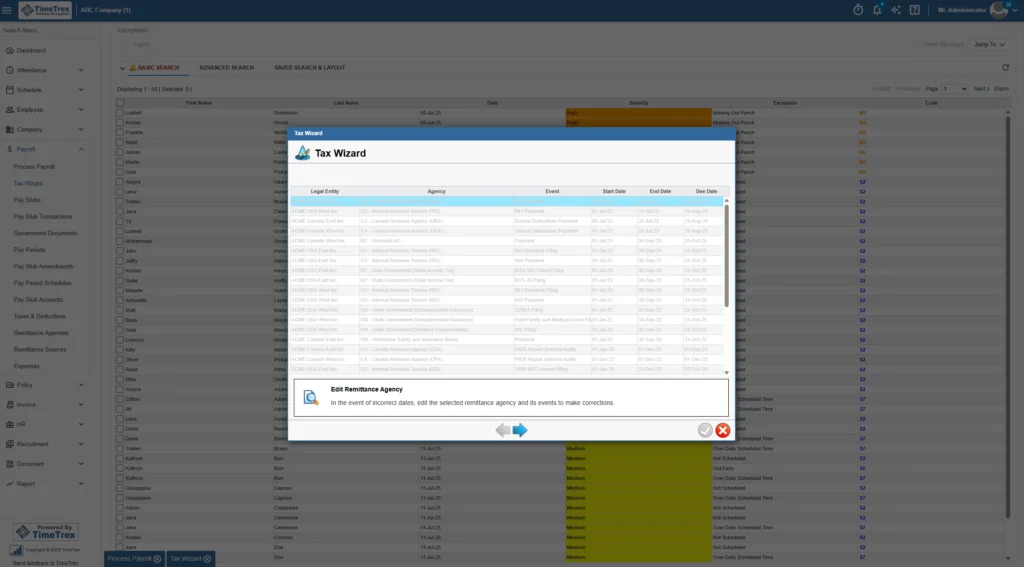

Automated Tax Withholding

Our software automatically calculates and withholds the correct federal, state, and local taxes for every employee, every pay period. This core feature eliminates manual calculations and ensures you remain compliant with ever-changing tax laws.

Integrated Benefits Administration

Seamlessly manage all benefits deductions, including medical, dental, and vision insurance premiums. The system connects directly with your benefits plans, ensuring accurate premium amounts are deducted and paid on time.

401(k) & Retirement Plan Management

Automate employee and employer contributions for 401(k)s, 403(b)s, and other retirement plans. Set contribution rates, manage matching, and generate reports for plan administrators with ease.

Garnishment & Levy Administration

Comply confidently with court-ordered garnishments for child support, tax levies, or other debts. Our system manages the complex calculations, prioritizes payments according to regulations, and remits them to the appropriate agencies.

Employee Self-Service Portal

Empower your team with a secure portal where they can view their pay stubs, see detailed deduction breakdowns, and manage their W-4 information. This transparency reduces HR inquiries and improves employee satisfaction.

Custom Deduction Categories

Create unlimited custom deduction types to fit your unique business needs. Whether it's for a uniform allowance, a company loan repayment, or a parking fee, our flexible system can handle any payroll deduction scenario.

Automated Pre-Tax & Post-Tax Classification

The software intelligently classifies deductions as pre-tax or post-tax, ensuring accurate tax calculations and maximizing potential tax savings for your employees. This automation removes guesswork and guarantees compliance.

General Ledger (GL) Integration

Automatically sync your payroll deduction data with your accounting software. Our GL integration maps deductions to the correct accounts, saving hours of manual data entry and ensuring your financial records are always accurate.

Advanced Payroll Deduction Reporting

Generate comprehensive reports on every aspect of your payroll deductions. Analyze deduction totals by type, employee, or date range to gain valuable insights into labor costs and ensure accurate record-keeping for audits.

Enhanced Paystub Transparency

Provide employees with clear, easy-to-understand pay stubs that itemize every earning and deduction. This transparency builds trust and helps employees see the full value of their compensation package.

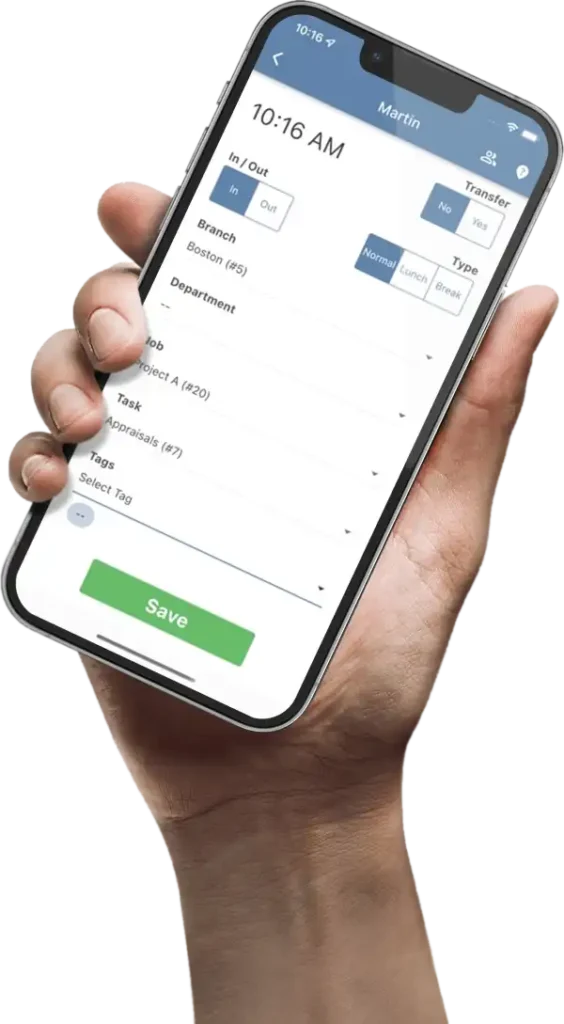

Mobile Access for Payroll Information

Employees can securely access their pay and deduction information from anywhere using our mobile-friendly app. This on-the-go access provides convenience and empowers a modern, flexible workforce.

Direct Deposit & Pay Card Integration

Our system works seamlessly with your direct deposit banking and pay card services. Ensure that net pay, after all deductions are calculated, is distributed accurately and on time to every employee.

Third-Party Payment & Remittance

Streamline payments to third-party entities, such as benefits providers, retirement administrators, and government agencies. Our system can generate payment files or process payments directly, ensuring all deducted funds are remitted correctly.

Enhanced Paystub Transparency

Provide employees with clear, easy-to-understand pay stubs that itemize every earning and deduction. This transparency builds trust and helps employees see the full value of their compensation package.

Role-Based Security & Permissions

Control who can view and manage sensitive payroll deduction information. Assign specific permissions to users based on their roles, ensuring data privacy and security across your organization.

Secure Historical Data Access

Access years of payroll and deduction records securely in our cloud-based system. This makes it easy to respond to employee inquiries, prepare for audits, or analyze historical labor cost data.

Simplified Year-End Reporting

Our software simplifies year-end processing by ensuring all deduction data is accurately compiled for W-2 preparation. Generate the necessary forms and reports with just a few clicks, making tax season stress-free.

Multi-State & Multi-Jurisdiction Support

Effortlessly manage payroll deductions for employees working in different states and localities. The system automatically applies the correct tax and labor laws based on each employee's work location.

One-Time Deduction Processing

Easily add a one-time deduction for a single pay period without disrupting recurring deduction schedules. This is perfect for handling unique situations like one-off purchases or advances.

Seamless Integration with Time & Attendance

Because our payroll deduction management is part of the unified TimeTrex platform, it integrates flawlessly with time and attendance data. This ensures that deductions are calculated based on accurate, real-time hours worked.

Ready to Simplify Your Payroll?

See firsthand how TimeTrex can streamline your operations, control labor costs, and drive efficiency on every project. Start your free trial today and transform your company.

Start Your FREE 30-Day Trial- No credit card required

- Full access to all features

- Dedicated setup support

The Core of Payroll Deduction Management

Effective payroll deduction management is the cornerstone of a compliant and efficient payroll system. Our software provides a centralized platform to oversee every aspect of the payroll deduction process, ensuring that every calculation for employee deductions is handled with precision. This focus on meticulous payroll deduction management prevents costly errors and saves administrative time.

Streamlining Your Payroll Deduction Process

A streamlined payroll deduction process is essential for modern business operations. TimeTrex’s payroll software is designed to automate this critical function, transforming your payroll deduction management from a complex chore into a simple, automated task. By optimizing the payroll deduction process, we help you achieve greater accuracy and efficiency.

Why Automated Deduction Calculation is Crucial

Manual deduction calculation is prone to human error. Our payroll deduction management system utilizes advanced algorithms for automated deduction calculation, ensuring every pre-tax and post-tax payroll deduction is perfect. This automation is a key feature of our payroll deduction solution.

How to Effectively Manage Employee Deductions

To effectively manage employee deductions, you need a system that is both powerful and flexible. Our payroll deduction management software allows for easy configuration of various payroll deductions, including health insurance, retirement plans, and garnishments. This is how modern businesses manage employee deductions for total compliance.

The Best Software for Managing Payroll Deductions

When it comes to managing payroll deductions, having the right tools is everything. TimeTrex is consistently ranked as the best payroll software because of its robust features and user-friendly interface for payroll deduction management. Make the switch to superior software for managing payroll deductions.

Time To Clock-In

Start your 30-day free trial!

Experience the Ultimate Workforce Solution and Revolutionize Your Business Today

- Eliminate Errors

- Simple & Easy To Use

- Real-time Reporting

Saving businesses time and money through better workforce management since 2003.

Copyright © 2025 TimeTrex. All Rights Reserved.