Effortless Tax Compliance: Automate Payroll Taxes and Stay Ahead of Regulations

TimeTrex’s Tax Compliance module simplifies the complexities of payroll taxes, ensuring accuracy, timeliness, and peace of mind. Never worry about IRS penalties or changing regulations again.

Simplify Tax Compliance with Automation

Automated Federal Tax Calculations

Our software automatically and accurately calculates all federal tax withholdings, including federal income tax (FIT), Social Security, and Medicare (FICA). Eliminate manual errors and ensure precise calculations for every employee, every payroll.

State Income Tax (SIT) Withholding

Effortlessly manage state income tax for employees across multiple states. The system stays current with all state-specific tax laws and rates, automatically applying the correct SIT withholdings based on each employee's work and residence location.

Local and County Tax Management

We simplify the complexity of local tax jurisdictions. Our platform accurately calculates and withholds all applicable city, county, and municipal taxes, ensuring full compliance with hyper-local regulations that are often overlooked.

Unemployment Tax (FUTA & SUTA) Calculation

Stay on top of your unemployment insurance obligations. The system automatically calculates your Federal Unemployment Tax Act (FUTA) and State Unemployment Tax Act (SUTA) liabilities, helping you manage your tax rates and contributions effectively.

Tax Reciprocity Agreement Automation

Our software intelligently handles state tax reciprocity agreements. It automatically determines the correct state to withhold taxes for employees who live in one state but work in another, preventing double taxation and ensuring compliance.

Automated Quarterly 941 Filing

Transform your quarterly reporting process. We automatically generate and electronically file your Form 941 (Employer's Quarterly Federal Tax Return) with the IRS, ensuring timely and accurate submissions every quarter.

Annual 940 Filing Assistance

Filing your annual federal unemployment tax return is simple. The system compiles all necessary data throughout the year to prepare and e-file your Form 940, reducing year-end administrative burdens.

Digital W-2 and W-3 Generation

At year-end, instantly generate accurate W-2s for all employees and a W-3 transmittal form for the Social Security Administration. We handle the calculations and formatting, making year-end reporting stress-free.

1099-NEC Form Filing for Contractors

Easily manage payments to independent contractors. Our system tracks all 1099-NEC qualifying payments and generates the necessary forms at year-end for electronic filing with the IRS and distribution to your contractors.

Electronic State-Specific Form Filing

Beyond federal forms, we support electronic filing for a wide range of state-specific tax and payroll reports. This ensures you meet all state-level compliance requirements without having to navigate multiple government websites.

New Hire Reporting Compliance

Meet all federal and state new hire reporting requirements effortlessly. The system automatically gathers the necessary employee information and submits new hire reports to the appropriate state agencies on your behalf.

Employee Self-Service Portal

Empower your employees by giving them secure, 24/7 access to their pay stubs, tax documents (like W-2s), and withholding information. This reduces administrative inquiries and improves employee satisfaction.

Ready to Simplify Your Business Taxes?

See firsthand how TimeTrex can streamline your operations, control labor costs, and drive efficiency on every project. Start your free trial today and transform your business.

Start Your FREE 30-Day Trial- No credit card required

- Full access to all features

- Dedicated setup support

Automated Tax Compliance Software for Accurate Payroll

Achieve flawless payroll with our automated tax compliance software. This powerful solution handles all federal, state, and local tax calculations, ensuring your business avoids costly penalties and remains fully compliant. Get the best payroll tax software on the market.

Why Your Business Needs a Payroll Tax Software Solution

A dedicated payroll tax software solution is no longer a luxury—it’s a necessity. Managing federal, state, and local tax obligations is a complex task, and our tax compliance software provides the automation and reliability needed to prevent costly fines and legal complications.

The Benefits of Integrated Tax Compliance Software

Integrating tax compliance software with your payroll system creates a seamless workflow. Our platform ensures that all data, from hours worked to tax withholdings, is perfectly synchronized, making our automated tax compliance system a single source of truth for your financial data.

Achieve Flawless IRS Compliance with Our Software

Maintaining IRS compliance is critical for every business. Our tax compliance software is designed to meet all IRS regulations, from calculating the correct withholding amounts to generating accurate 941 forms, ensuring your business passes any audit with confidence.

Streamline Year-End Reporting with W-2 Generation Software

Year-end reporting is simple with our W-2 generation software. This key feature of our payroll tax software automates the creation and distribution of W-2 and 1099 forms, saving your HR department countless hours of tedious work during tax season.

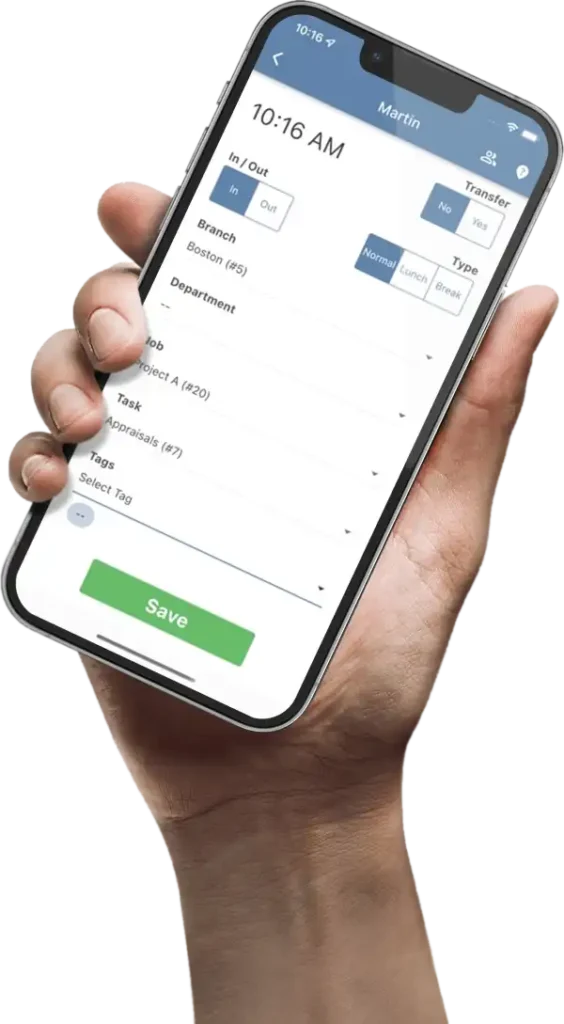

Time To Clock-In

Start your 30-day free trial!

Experience the Ultimate Workforce Solution and Revolutionize Your Business Today

- Eliminate Errors

- Simple & Easy To Use

- Real-time Reporting

Saving businesses time and money through better workforce management since 2003.

Copyright © 2025 TimeTrex. All Rights Reserved.