Free Alabama Payroll Tax Calculator

Alabama Payroll Tax Calculator (Step-by-Step)

Understanding your paycheck is critical, and our Alabama Payroll Tax Calculator simplifies the process. Follow these easy steps to estimate your net pay accurately:

Step 1: Enter Your Location and Filing Status

Country: Ensure “United States” is selected (pre-filled).

State: Choose “Alabama” from the dropdown (pre-filled for convenience).

Federal Filing Status: Select your federal filing status (e.g., Single, Married Filing Jointly) based on how you file your federal taxes.

Federal Allowances: Enter the number of federal allowances you are claiming, as shown on your Form W-4.

Alabama State Filing Status: Select your Alabama state filing status (Single, Married Filing Jointly, Head of Household, etc.).

Alabama State Allowances: Enter the number of Alabama state withholding allowances you are claiming. (Refer to Alabama Form A-4 for guidance.)

Step 2: Input Your Pay Information

Pay Frequency: Choose how often you get paid (e.g., Weekly, Bi-Weekly, Monthly) from the dropdown. This helps ensure accurate annual calculations.

Gross Wage per Pay Period: Enter your total earnings before any deductions for the selected pay period. This is your gross pay.

Pay Date: Select your pay date using the calendar tool. This is for your records and does not impact the tax calculations directly.

Step 3: Calculate Your Taxes

Review the estimated taxes based on the details you entered.

To adjust your results, simply update the inputs and click “Calculate” again.

To reset the calculator for a new estimate, click the “New Calculation” button.

Important Notes:

This calculator provides estimates based on your inputs and current Alabama tax rates.

Your actual tax amounts may vary depending on factors like pre-tax deductions (e.g., health insurance, retirement contributions) and any changes in federal or Alabama tax laws.

For accurate tax withholding, make sure your federal Form W-4 and Alabama Form A-4 are up to date.

Found our Free Alabama Payroll Tax Calculator useful? Bookmark and share it.

Overview of Employer Payroll Tax Responsibilities in Alabama

Federal Context

Employers must first satisfy federal payroll taxes—FICA (Social Security & Medicare) and FUTA (federal unemployment)—before addressing state obligations.

State-Level Obligations

- State Income Tax (SIT) Withholding: Employers withhold progressive-rate income tax from wages.

- State Unemployment Insurance (SUI): Employer-only contributions fund unemployment benefits.

- Local Occupational Taxes: Municipalities impose varied rates and rules on wages earned within their jurisdictions.

Employer Registration Requirements

Register with the Alabama Department of Revenue for SIT withholding and with the Alabama Department of Labor for SUI. Local taxes require direct registration with each municipal government.

Alabama State Income Tax (SIT) Withholding

2025 Tax Rates and Brackets

| Filing Status | Taxable Income Bracket | Tax Rate |

|---|---|---|

| Single / Head of Household / Married Filing Separately | $0 – $500 | 2% |

| Same statuses | $501 – $3,000 | 4% |

| Same statuses | Over $3,000 | 5% |

| Married Filing Jointly | $0 – $1,000 | 2% |

| Same status | $1,001 – $6,000 | 4% |

| Same status | Over $6,000 | 5% |

Standard Deductions and Personal Exemptions for 2025

Current figures (subject to final ADOR publication): $4,500 standard deduction for single filers; $11,500 for married filing jointly. Personal exemptions are $1,500 per filer; dependent exemptions vary by income level.

| Item | Single Filers | Married Filing Jointly | Dependent Exemption |

|---|---|---|---|

| Standard Deduction | $4,500 | $11,500 | — |

| Personal Exemption | $1,500 | (Not specified; typically double) | — |

| Dependent Exemption | — | — | $1,000 (wages ≤ $50k) $500 ($50k–$100k) $300 (> $100k) |

Withholding Requirements and Employee Forms (Form A-4)

Employees complete Form A-4 to declare filing status and allowances. Alabama does not permit zero withholding election. Supplemental wages (bonuses) carry a flat 5% withholding.

Employer Reporting and Remittance

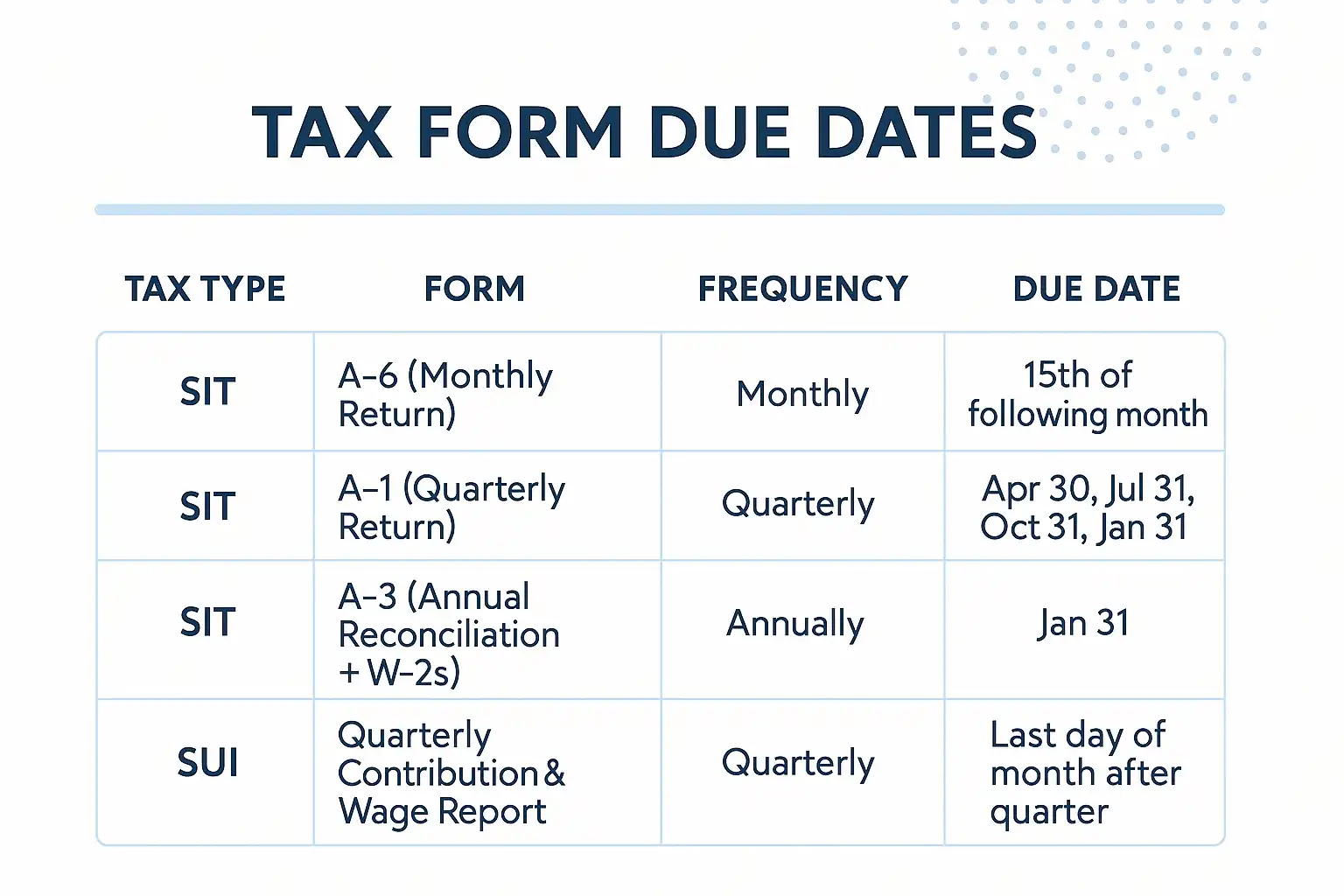

Key forms and due dates:

| Tax Type | Form | Frequency | Due Date |

|---|---|---|---|

| SIT | A-6 (Monthly Return) | Monthly | 15th of following month |

| SIT | A-1 (Quarterly Return) | Quarterly | Apr 30, Jul 31, Oct 31, Jan 31 |

| SIT | A-3 (Annual Reconciliation + W-2s) | Annually | Jan 31 |

| SUI | Quarterly Contribution & Wage Report | Quarterly | Last day of month after quarter |

Penalties for Non-Compliance (SIT)

Late filing: greater of 10% of tax due or $50. Late payment: 10% of delinquent tax. Interest accrues per federal rate. $50 penalty per inaccurate Form A-4; $50 per missing/late W-2 on A-3.

Alabama State Unemployment Insurance (SUI) Tax

2025 Taxable Wage Base

SUI applies to first $8,000 of each employee’s annual wages; no further tax thereafter.

2025 SUI Tax Rates

New employers: 2.70%. Experienced employers: 0.20% – 6.80% (includes 0.06% ESA), determined by benefit-charge experience and trust-fund health.

| Item | 2025 Value/Rate |

|---|---|

| Taxable Wage Base | $8,000 |

| New Employer Rate | 2.70% |

| Experienced Rate Range | 0.20% – 6.80% (incl. ESA) |

Employer Reporting and Payment

File quarterly reports via the Department of Labor’s eGov portal by the last day following each quarter.

Specific Employer Categories

- Non-Farm Employers: liable if ≥1 employee in 20+ weeks or wages ≥ $1,500/quarter.

- Agricultural Employers: liable if ≥10 ag workers in 20+ weeks or wages ≥ $20,000/quarter.

- Household Employers: liable if wages ≥ $1,000/quarter.

Penalties for Non-Compliance (SUI)

State late-filing and late-payment penalties and interest apply; timely electronic filing is recommended.

Local Payroll Taxes: Occupational Taxes

Municipal occupational taxes require separate withholding, remittance, and reporting to each locality.

| City | Occupational Tax Rate | Remittance Frequency |

|---|---|---|

| Auburn | 1% of gross wages | Quarterly |

| Bessemer | 1% | — |

| Birmingham | 1% | — |

| Gadsden | 2% | — |

| Leeds | 1% of gross earnings | Monthly |

Employers must identify all work locations, contact each finance department, and configure payroll systems accordingly. Penalties vary by ordinance (e.g., Leeds: 12% interest + 10% penalty).

Significant Tax Changes for 2025 and Beyond

Overtime Pay Exemption Expiration

Overtime exemption ends June 30, 2025. Resume SIT withholding on eligible overtime paid on or after July 1, 2025, and update payroll calendars and systems.

Mobile Workforce Legislation (H.B. 379)

Effective January 1, 2026: non-resident employees working ≤30 days in-state are exempt if conditions met; beyond 30 days, full withholding applies retroactively. Employers must track days worked in Alabama.

Decoupling from Federal IRC Section 174

As of January 1, 2024, Alabama allows immediate deduction or pre-TCJA treatment of R&E expenditures, affecting overall tax planning.

Other Tax Changes

- Groceries sales tax cut to 2% and new exemptions begin September 1, 2025.

- Tax Tribunal jurisdiction and appeal deadlines extended October 1, 2025.

Special Considerations for Alabama Employers

Exemptions from SIT Withholding

Household help, farm laborers, ministers, and merchant seamen are exempt from mandatory withholding but remain personally liable. Employers may voluntarily withhold if registered.

Record-Keeping Requirements

Retain payroll and tax records for multiple years; local ordinances (e.g., Leeds: five years) may specify retention periods.

No State-Mandated Disability Insurance Payroll Tax

Alabama relies on employer-funded Workers’ Compensation for disability coverage. No separate state payroll tax for disability insurance.

Strategic Recommendations for Compliance

- Monitor Official Sources: Regularly review the ADOR B.E.S.T. library and Department of Labor updates.

- Ensure Accurate Employee Data: Verify Form A-4 details, work locations, and classifications in your payroll system.

- Leverage Technology: Adopt payroll software that automates multi-jurisdictional withholding, tracks legislative changes, and files electronically via MAT and eGov portals.

- Manage Local Taxes Diligently: Establish processes to identify jurisdictions, register, and comply with occupational tax ordinances.

- Prepare for Legislative Changes: Update systems for the overtime exemption expiry and mobile workforce rules before their effective dates.

- Seek Professional Advice: Consult Alabama tax specialists for complex scenarios or multi-state operations.

Conclusion

Alabama’s 2025 payroll tax landscape combines progressive SIT withholding, employer-funded SUI, and fragmented local occupational taxes with significant mid-year and upcoming rule changes. Employers who proactively monitor official updates, maintain accurate employee data, leverage modern payroll technology, and address local tax obligations will navigate this complexity with confidence, minimize risks, and maintain compliance.

Ready to streamline your Alabama payroll tax compliance? Get started with TimeTrex today.

Other Payroll Tax Calculators

Loading other available calculators...

Disclaimer: The content provided on this webpage is for informational purposes only and is not intended to be a substitute for professional advice. While we strive to ensure the accuracy and timeliness of the information presented here, the details may change over time or vary in different jurisdictions. Therefore, we do not guarantee the completeness, reliability, or absolute accuracy of this information. The information on this page should not be used as a basis for making legal, financial, or any other key decisions. We strongly advise consulting with a qualified professional or expert in the relevant field for specific advice, guidance, or services. By using this webpage, you acknowledge that the information is offered “as is” and that we are not liable for any errors, omissions, or inaccuracies in the content, nor for any actions taken based on the information provided. We shall not be held liable for any direct, indirect, incidental, consequential, or punitive damages arising out of your access to, use of, or reliance on any content on this page.

Trusted By

Trusted by 3.2M+ Employees: 21 Years of Service Across Startups to Fortune 500 Enterprises

Join our ever-growing community of satisfied customers today and experience the unparalleled benefits of TimeTrex.

Strength In Numbers

Join The Companies Already Benefiting From TimeTrex

Time To Clock-In

Start your 30-day free trial!

Experience the Ultimate Workforce Solution and Revolutionize Your Business Today

- Eliminate Errors

- Simple & Easy To Use

- Real-time Reporting

Saving businesses time and money through better workforce management since 2003.

Copyright © 2025 TimeTrex. All Rights Reserved.