The Best Canadian Payroll Software: 2025

Finding the best Canadian payroll software in 2025 is a critical strategic decision for any business. The right platform ensures payroll compliance in Canada, streamlines administrative tasks, and boosts employee satisfaction. This guide provides an in-depth analysis of the top payroll solutions, helping you navigate the complexities of CRA payroll deductions, provincial labour standards, and the unique challenges of Quebec payroll processing. Whether you're a small business, a growing mid-market company, or a large enterprise, this review will identify the perfect payroll partner to manage your workforce, from integrated time tracking to automated tax filing.

In This Article:

The Canadian Payroll Landscape: Navigating Complexity and Compliance

Beyond the Paycheque

In the intricate machinery of a modern business, payroll is far more than a bi-weekly administrative task; it is the engine of employee trust, a critical nexus of financial control, and a high-stakes test of regulatory compliance. The selection of payroll software is, therefore, not a simple procurement decision but a strategic choice that reverberates through an organization's operational efficiency, financial health, and legal standing. An optimal solution streamlines one of the most resource-intensive administrative functions, mitigates significant compliance risks, and enhances the employee experience by delivering accurate, timely, and transparent compensation.

The Canadian business landscape presents a particularly formidable challenge. Navigating the country's multi-layered regulatory environment requires a sophisticated understanding of both federal and provincial statutes. Employers must meticulously manage deductions and remittances for federal programs like the Canada Pension Plan (CPP) and Employment Insurance (EI), while simultaneously adhering to a patchwork of provincial labour standards governing minimum wage, overtime, vacation pay, and statutory holidays. This complexity creates a significant administrative burden and exposes businesses to the risk of costly penalties for non-compliance.

This challenge is most acute in Quebec, which operates a distinct and parallel system. Businesses with employees in Quebec must contend with Revenu Québec, managing separate deductions for the Québec Pension Plan (QPP) and the Québec Parental Insurance Plan (QPIP), and issuing unique year-end forms like the Relevé 1 (RL-1). This "Quebec Litmus Test" serves as a crucial dividing line in the Canadian payroll software market; any solution aspiring to serve a national business must demonstrate flawless and fully integrated support for Quebec's unique requirements.

This report provides an exhaustive analysis of the top 10 payroll software solutions available to Canadian businesses in 2025. Our evaluation methodology goes beyond a simple feature checklist, assessing each platform against a rigorous set of criteria designed to reflect the real-world needs of business operators: Canadian Compliance (including Quebec), Core Payroll Features, Integrated HR & Time Tracking capabilities, Pricing & Value, User Experience & Support, and Scalability. The objective is to provide a definitive guide that empowers business leaders to select not just a piece of software, but a strategic partner for growth and stability.

| Software | Best For... | Pricing Model | Ideal Business Size | Full Quebec Support | Automatic Tax Filing |

|---|---|---|---|---|---|

| TimeTrex | Integrated Workforce Management & Payroll Accuracy | Public | SMB / Mid-Market | ✅ Yes | ✅ Yes (Excl. QC) |

| QuickBooks Payroll | Integrated Accounting & Small Businesses | Public | Micro / SMB | ✅ Yes | ✅ Yes |

| Wagepoint | Simplicity & Customer Support for Small Businesses | Public | Micro / SMB | ✅ Yes | ✅ Yes |

| ADP Workforce Now | Scalability & Comprehensive HR for Mid-Market/Enterprise | Quote | Mid-Market / Enterprise | ✅ Yes | ✅ Yes |

| Ceridian Dayforce (Powerpay) | Reliability & Small Business Compliance | Quote | SMB | ✅ Yes | ✅ Yes |

| Payworks | Canadian-Owned Solution for Dedicated Service | Quote | SMB / Mid-Market | ✅ Yes | ✅ Yes |

| Rise | Modern HR & Employee Experience | Public | SMB / Mid-Market | ✅ Yes | ✅ Yes |

| Wave Payroll | Micro-Businesses & Freelancers (outside Quebec) | Public | Micro | ❌ No | ✅ Yes |

| Deel | Global & Remote-First Canadian Companies | Public | All Sizes | ✅ Yes | ✅ Yes |

| Humi | All-in-One HR for Canadian Startups (outside Quebec) | Public | SMB | ❌ No (Waitlist) | ✅ Yes |

The Top 10 Canadian Payroll Software Solutions of 2025

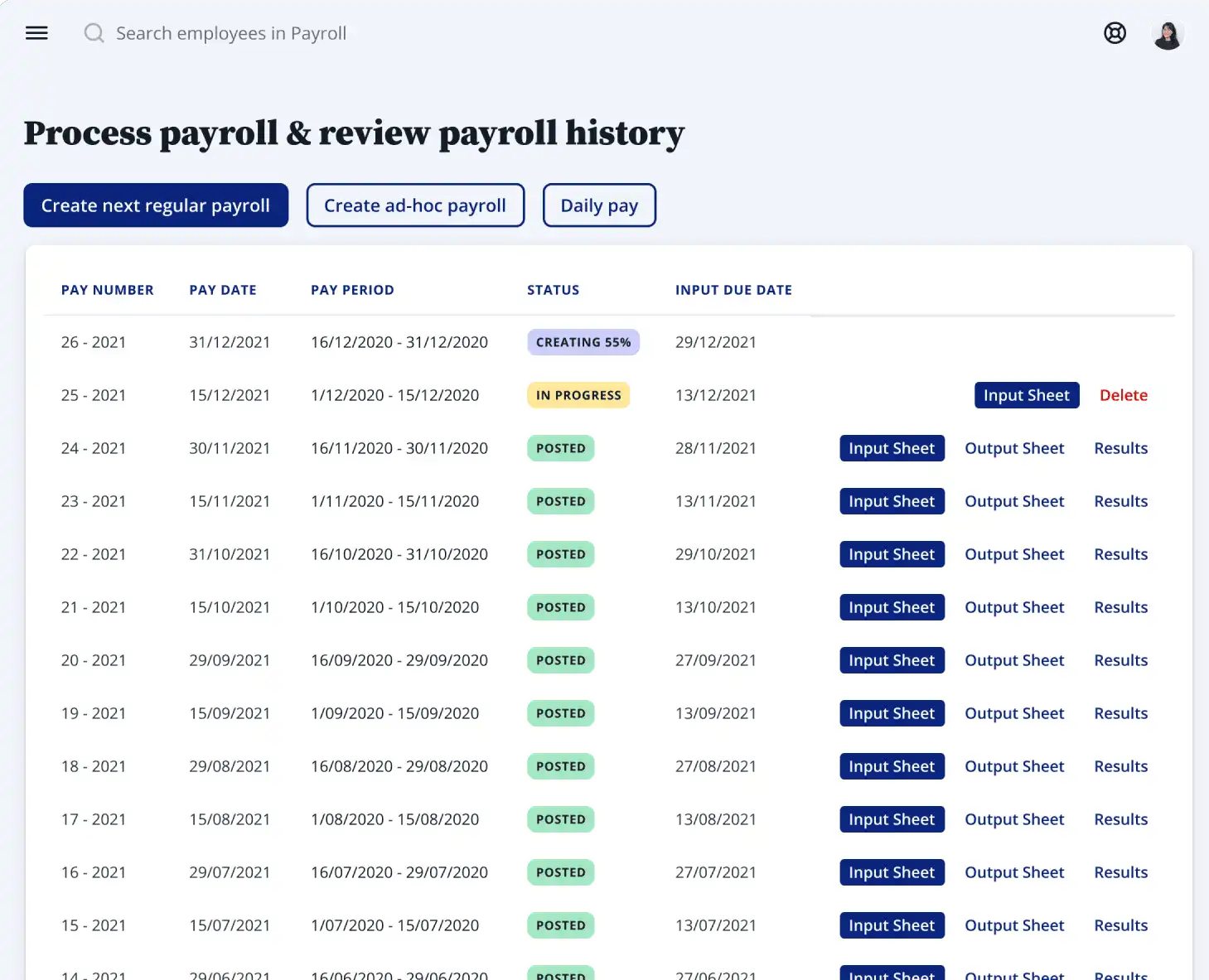

1. TimeTrex: Best for Integrated Workforce Management and Payroll Accuracy

TL;DR

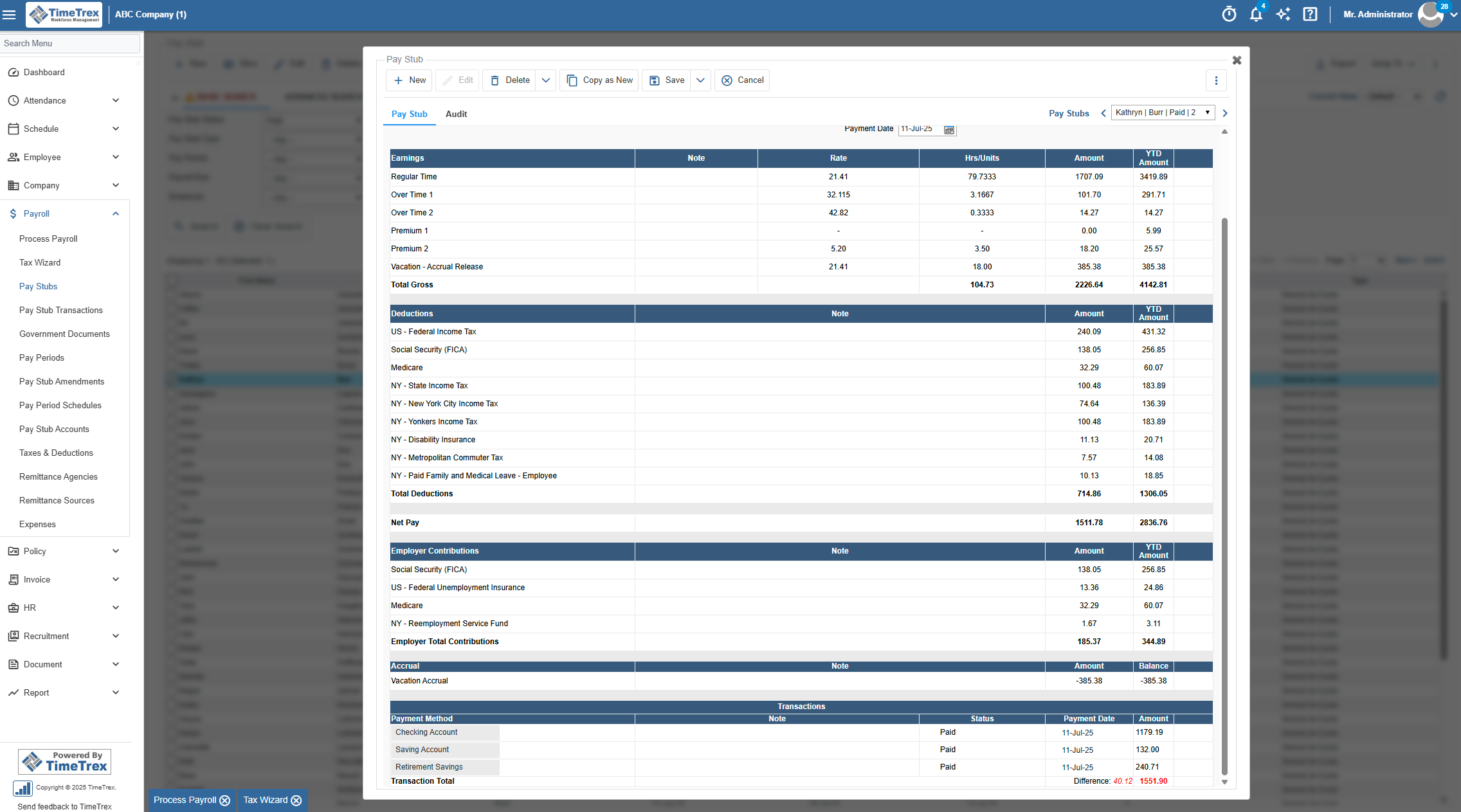

TimeTrex earns the top position not merely as a payroll processor, but as a comprehensive workforce management system that engineers unparalleled accuracy before payroll is even run. For businesses where labour is a complex and significant expense—particularly those with hourly, mobile, or shift-based workforces—TimeTrex’s elite time and attendance engine eliminates errors at their source. By ensuring the data flowing into the payroll calculation is flawless, it transforms the final pay run into a simple, precise execution. This foundational focus on data integrity makes it the premier choice for operators who demand absolute control and accuracy.

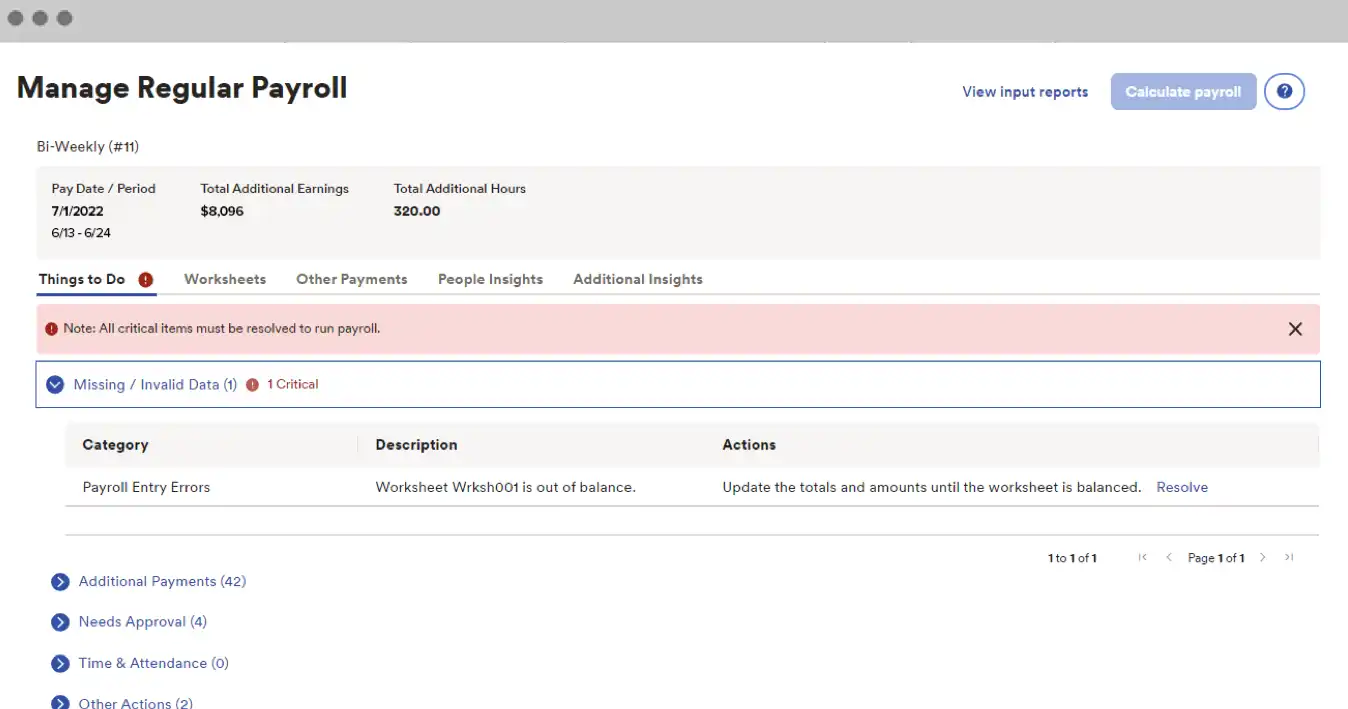

The fundamental value of TimeTrex lies in its philosophy of error prevention rather than post-facto correction. The majority of costly payroll mistakes do not originate from faulty tax calculations, but from inaccurate source data: missed punches, incorrect overtime logging, buddy punching, and misapplied pay rules. TimeTrex attacks the problem at its root, creating a secure and verifiable data pipeline from the moment an employee begins their work.

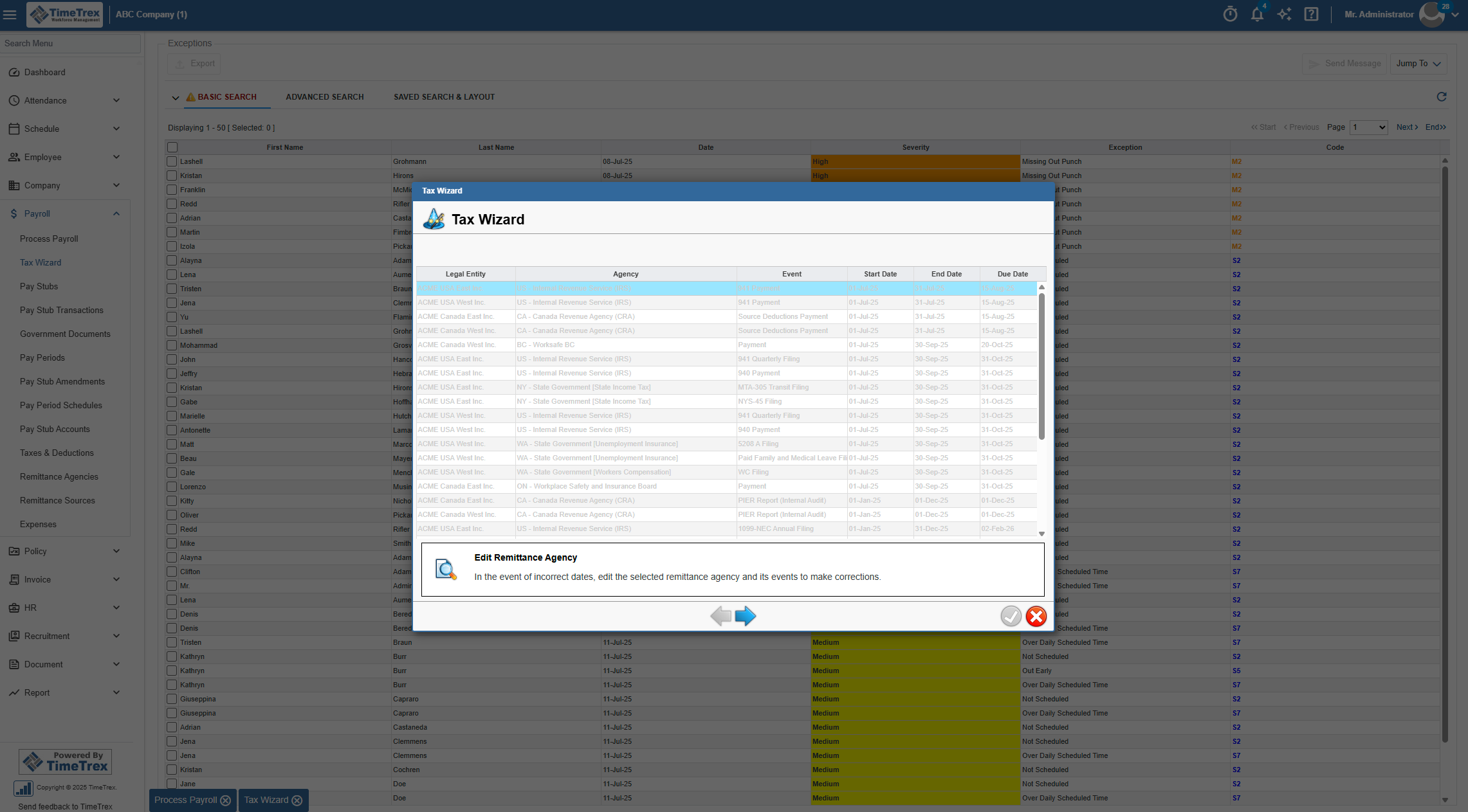

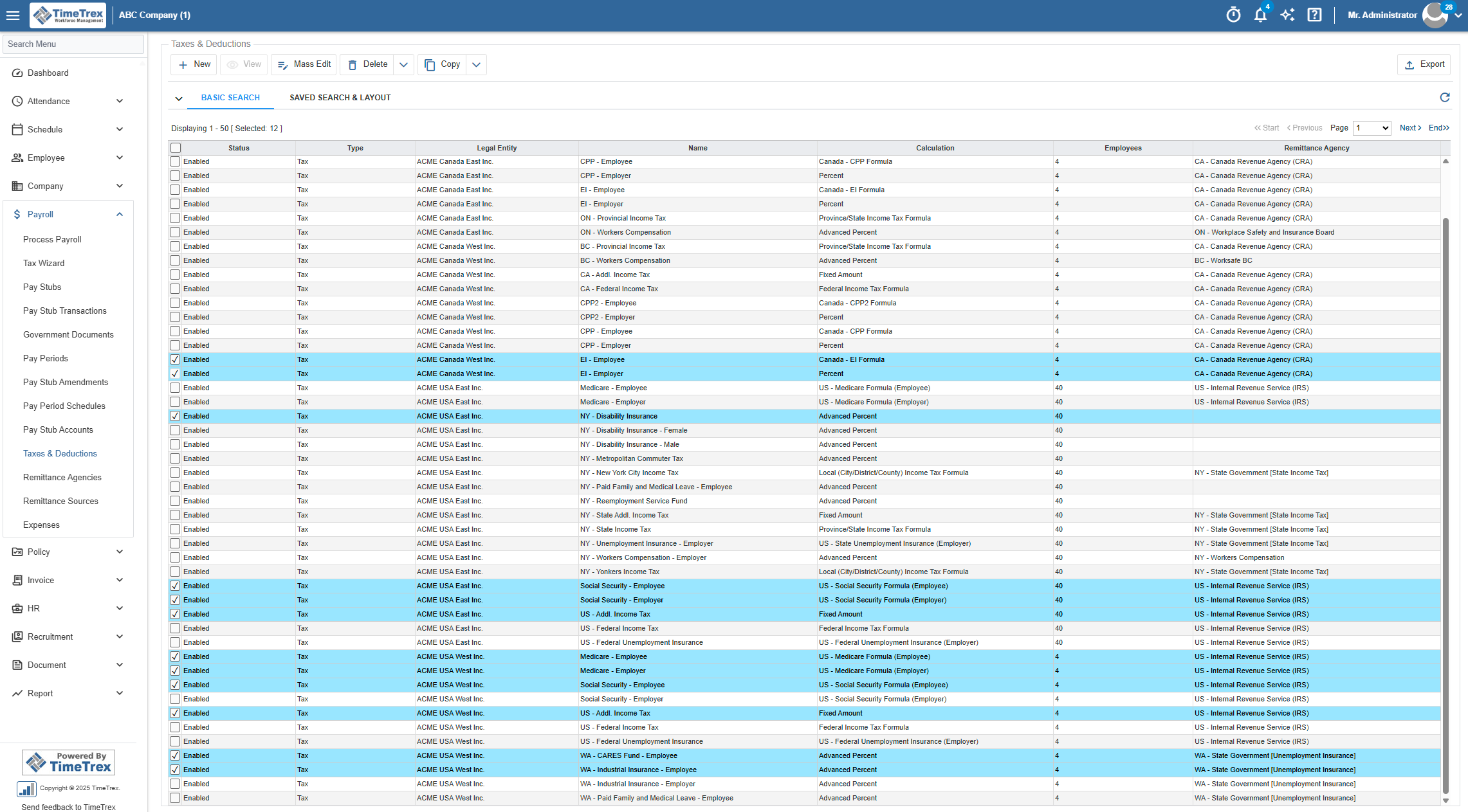

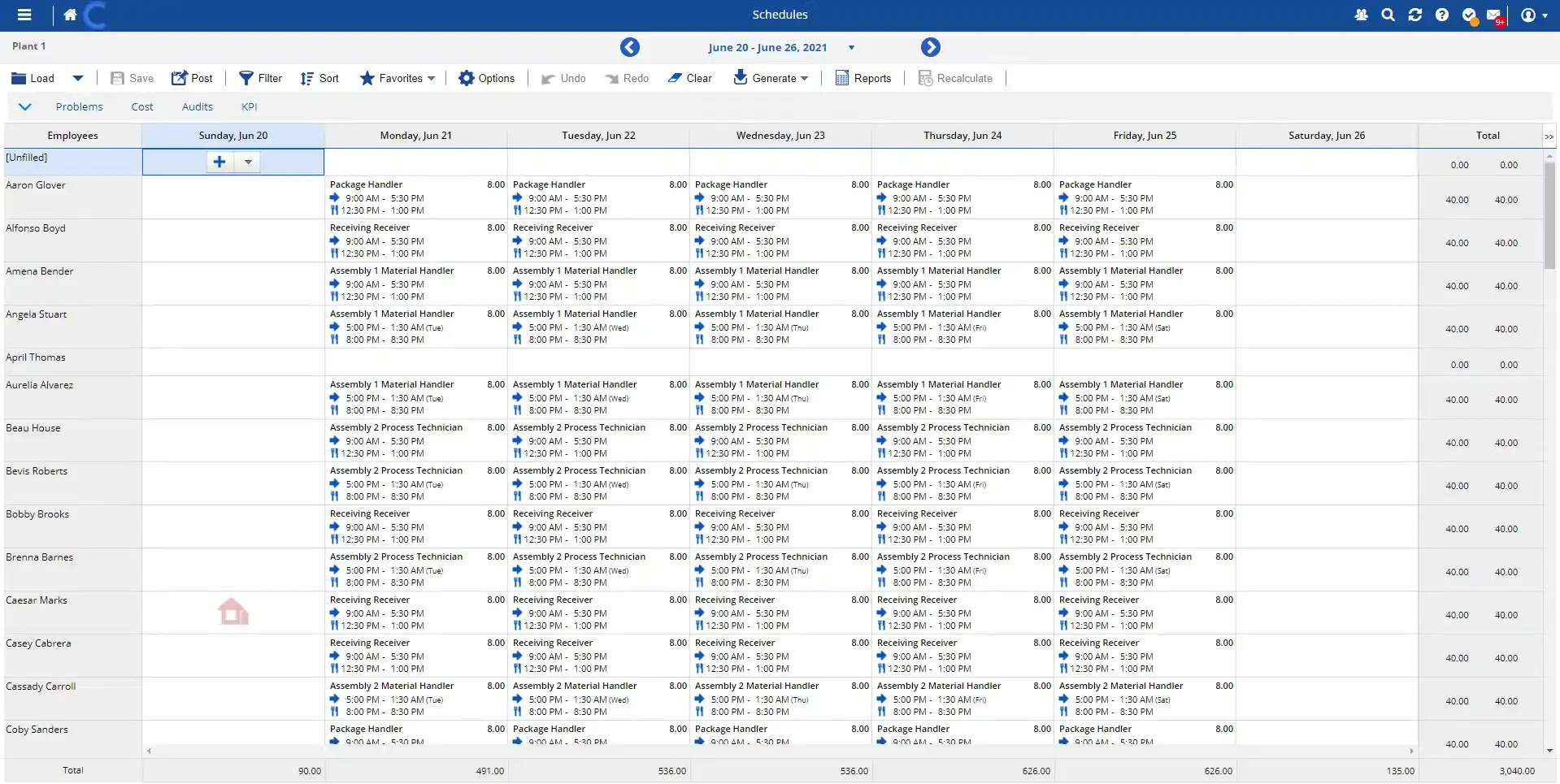

Its Unmatched Time & Attendance Engine is its core competitive advantage. It moves beyond simple timesheets to offer biometric time clocks with facial recognition to eliminate "buddy punching," and GPS-enabled mobile time tracking with geofencing to ensure employees are at their designated work locations. These tools validate the authenticity of every minute of paid time. As a Truly All-in-One Platform, Scheduling, Time & Attendance, HR, and Payroll coexist on a single database. This seamless integration means data flows from a manager's schedule to an employee's time clock and directly into the payroll engine without manual entry, drastically reducing human error.

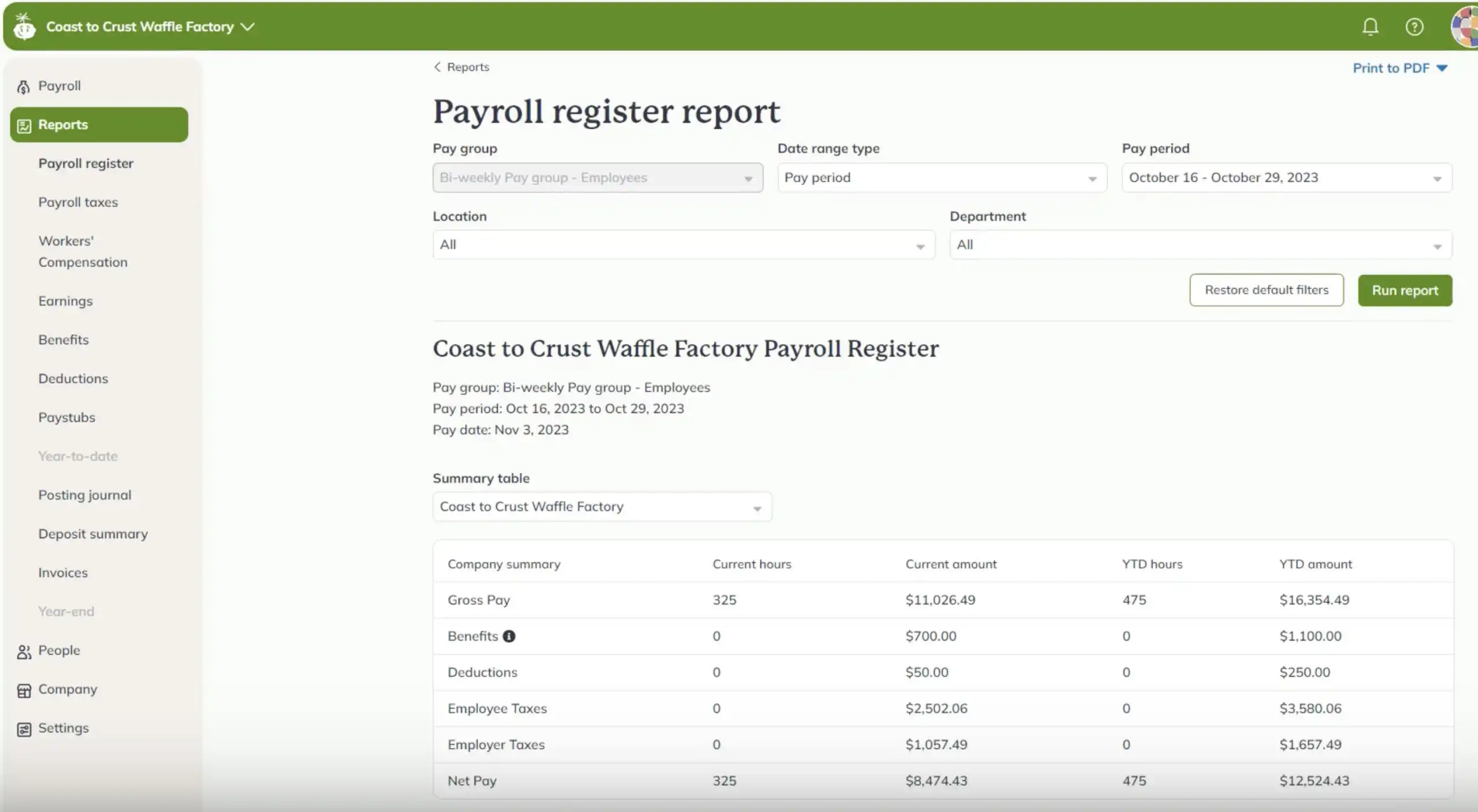

The Advanced Canadian Payroll Engine fully supports federal and provincial calculations, including detailed Quebec-specific requirements, and generates all necessary year-end forms like T4s and Records of Employment (ROEs). A key aspect of the TimeTrex model is its flexible approach to tax remittances. The platform offers fully automated tax filing and remittance services directly to the CRA for businesses across Canada. This simplifies compliance for all federal and provincial jurisdictions outside of Quebec. For its Quebec-based clients, TimeTrex maintains a model that prioritizes financial control. It automates all complex calculations and generates the necessary forms for Revenu Québec, but allows the business to perform the final review and submission. This hybrid approach offers automation where it's most efficient, while providing a final layer of human oversight and direct control over cash flow for Canada's most complex tax jurisdiction.

Ideal User Profile & Verdict: TimeTrex is the premier choice for Canadian businesses in industries with complex, hourly, or mobile workforces, including construction, manufacturing, healthcare, field services, and hospitality. It is built for the pragmatic operator who understands that payroll accuracy begins the moment an employee starts their shift.

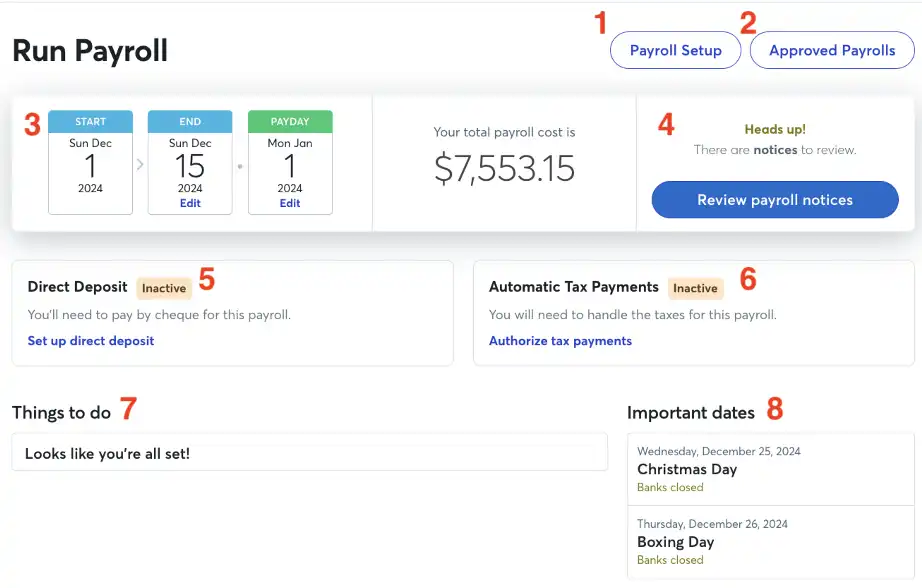

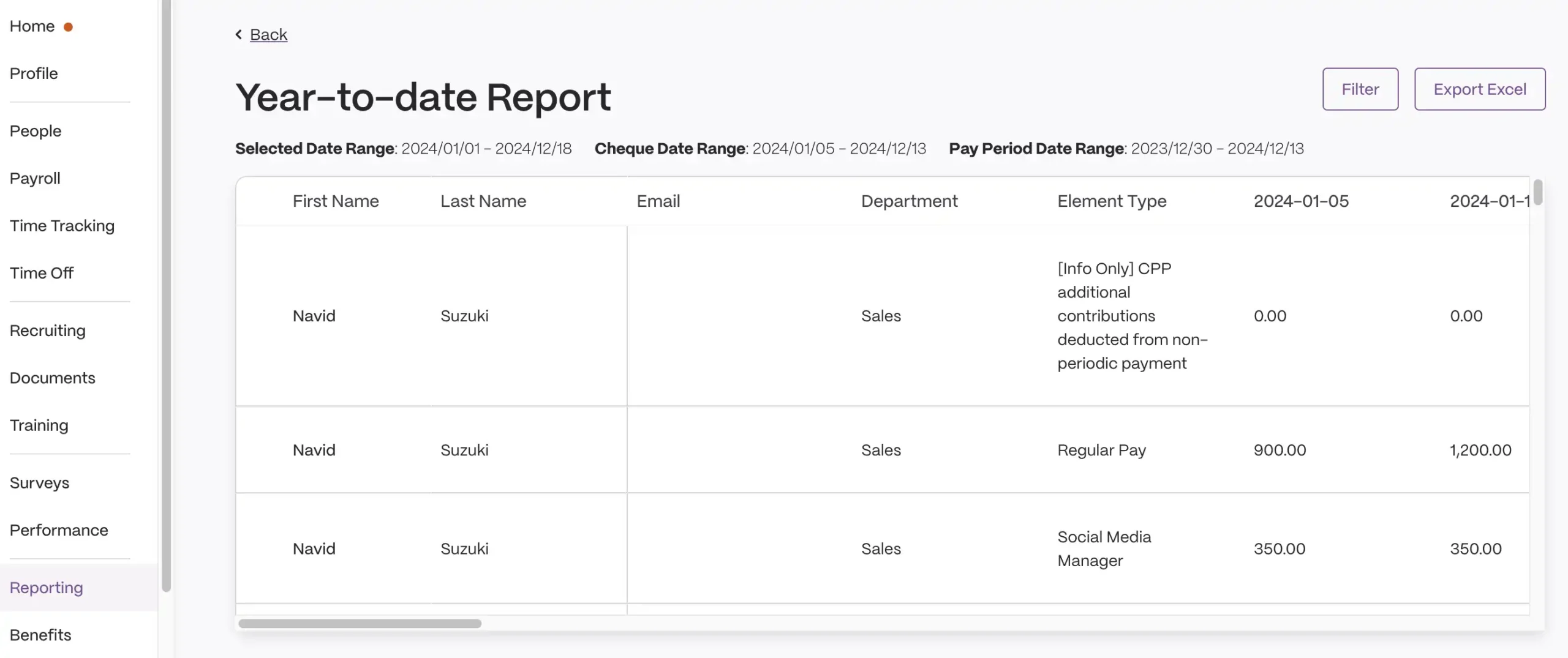

2. QuickBooks Payroll: Best for Integrated Accounting and Small Businesses

TL;DR

For the vast ecosystem of Canadian small businesses that rely on QuickBooks Online (QBO) as their financial hub, the integrated QuickBooks Payroll suite is the most powerful and logical choice. It elevates payroll from a siloed function to a seamless extension of the company's core accounting system, offering unmatched financial visibility and operational efficiency for the SMB market.

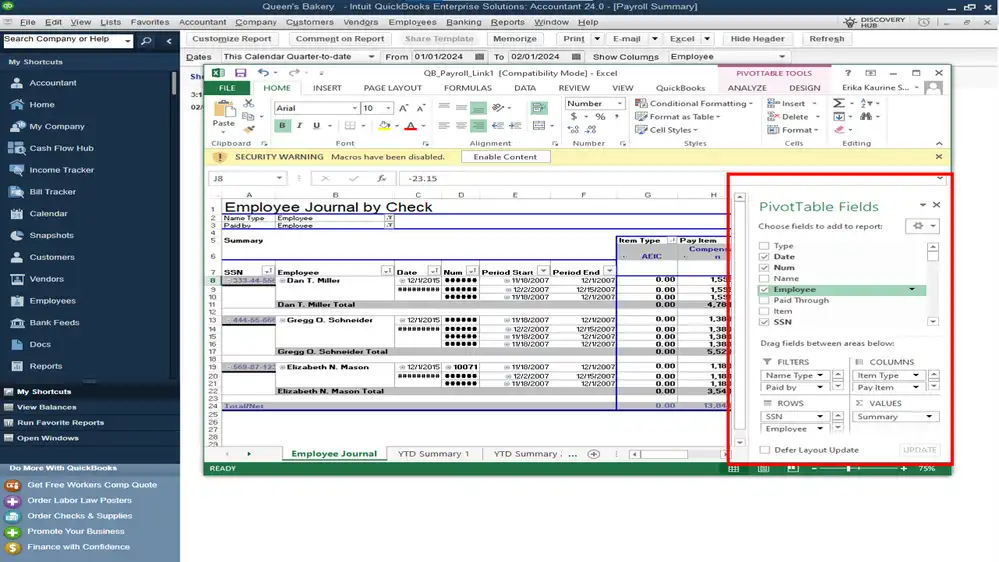

The primary advantage is its native, Seamless Accounting Integration. When payroll is run, all associated data—wages, taxes, and deductions—is automatically posted to the general ledger in QBO, eliminating manual journal entries and simplifying bank reconciliation. This creates a powerful "data flywheel"; for example, when an employee tracks time to a project, those labour costs are instantly allocated, giving the business owner a real-time view of project profitability.

It offers comprehensive Canadian compliance, with the capability to electronically file and remit payroll taxes directly to both the CRA and Revenu Québec. It also automates the generation of year-end T4 and RL-1 forms. The software is offered in three Tiered Plans for Growth: Core ($25/mo + $4/employee), Premium ($55/mo + $8/employee) which adds integrated time tracking, and Elite ($80/mo + $15/employee) which includes advanced features like geofencing and tax penalty protection.

Ideal User Profile & Verdict: QuickBooks Payroll is the definitive choice for any Canadian small or medium-sized business already invested in the QuickBooks Online accounting platform. The synergy and efficiency gains are unparalleled.

3. Wagepoint: Best for Simplicity and Customer Support

TL;DR

Wagepoint has earned a dedicated following among Canadian small businesses by delivering a refreshingly straightforward payroll experience backed by genuinely friendly and accessible human support. Its transparent, affordable pricing model with no hidden fees makes it an exceptionally attractive option for startups and growing businesses who value their time and peace of mind.

Explicitly designed for the Canadian market, Wagepoint fully automates tax calculations and remittances, ROE submissions, and year-end T4/T4A filing, including full support for Quebec payroll. The platform's success is defined by what it doesn't do—it avoids overwhelming users with enterprise-grade complexity, thus preventing "feature fatigue" for busy entrepreneurs.

Its Transparent and Fair Pricing stands out. The company advertises a "no-asterisks" approach with zero setup fees and, notably, no extra charges for year-end processing. The plans are simple: Solo ($20/mo + $4/employee) for once-monthly payroll, and Unlimited ($40/mo + $6/employee) for unlimited runs. This predictable pricing is ideal for small businesses. Above all, users consistently praise its Ease of Use and Acclaimed Support, with a reputation for having the "world's friendliest team."

Ideal User Profile & Verdict: Wagepoint is the perfect solution for Canadian startups and small businesses (2 to 50 employees) who prioritize simplicity, reliability, and outstanding support. It's for the business owner who wants to "set it and forget it."

Ready for Payroll That Just Works?

Discover how TimeTrex's all-in-one workforce management platform can eliminate errors, ensure compliance, and give you complete control over your payroll process. Accuracy starts here.

Learn More About TimeTrex Payroll4. ADP Workforce Now: Best for Scalability and Comprehensive HR

As a global leader in human capital management (HCM), ADP Workforce Now is a formidable, deeply integrated platform for Canadian mid-market and enterprise businesses. It's designed to manage the entire employee lifecycle within a single, unified database. This All-in-One HCM Suite includes Payroll, Human Resource Management, Time & Attendance, Benefits Administration, and Talent Management. This integration eliminates the data silos that plague businesses using multiple systems, reducing redundant data entry and errors.

With a long history in Canada, its payroll engine is robust, automating intricate calculations and tax payments across all jurisdictions, including Quebec. The platform is explicitly designed to scale with a business, offering tiered packages and a wide range of optional add-on modules. While its power and configurability can lead to a steeper learning curve, it is highly rated on major review sites like Capterra and Gartner, reflecting its market leadership and capability.

Ideal User Profile & Verdict: ADP Workforce Now is ideal for established Canadian companies (typically 75 to 1,000+ employees) that require a comprehensive, integrated, and scalable HCM platform with a dedicated HR department to leverage its full potential.

5. Ceridian Dayforce (Powerpay): Best for Reliability and Small Business Compliance

With a legacy of over 25 years in the Canadian market, Powerpay (now part of the Dayforce family) is a pillar of reliability for small businesses. It is a proven, trusted solution trusted by over 46,000 Canadian businesses. Its Dedicated Canadian Focus is evident in its seamless, automated payroll calculations and remittances to both the CRA and Revenu Québec.

The platform delivers essential features like integrated time and attendance tracking and an employee self-service portal accessible via a mobile app, reducing administrative burdens. A significant value-add is its customer support team, which is trained by the National Payroll Institute (NPI), ensuring a high level of expertise. While some user reviews note that its reporting can be inflexible and its pricing may be higher than some newer competitors, its reputation for stability and compliance is second to none.

Ideal User Profile & Verdict: Powerpay is an excellent and highly reliable choice for Canadian small businesses (10 to 100 employees) who prioritize a proven, stable, and compliant payroll solution backed by expert Canadian support.

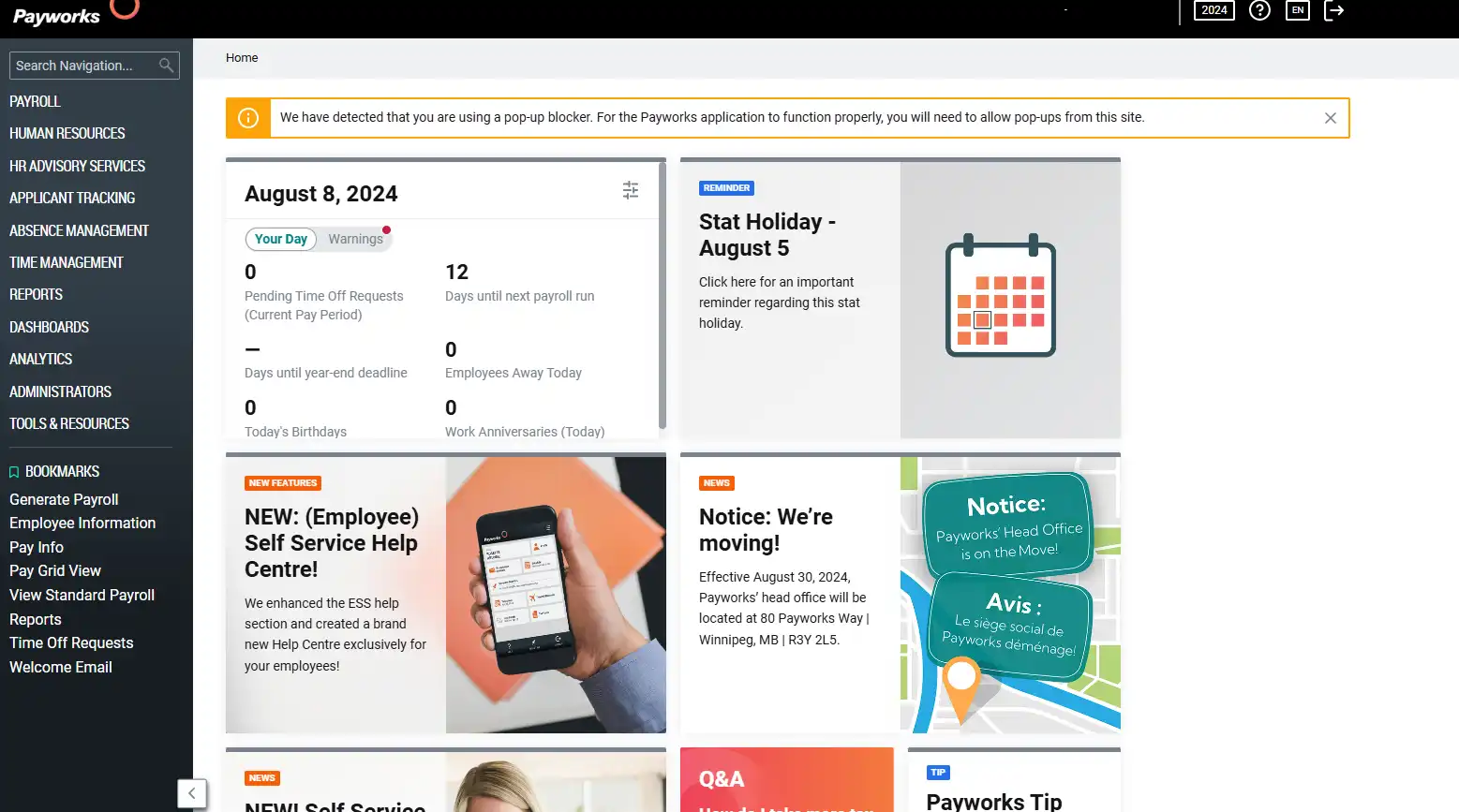

6. Payworks: Best Canadian-Owned Solution for Dedicated Service

As the largest 100% Canadian-owned provider, Payworks combines a modern, scalable platform with a refreshingly personal, high-touch service model. Its most significant differentiator is the promise of "a contact, not a call centre." Every client is assigned a dedicated, NPI-trained service representative who becomes an expert on their specific business needs. This high-touch model is a primary driver of the company's remarkable 98% client retention rate.

The platform offers a full suite of integrated solutions including Payroll, HR, Time & Absence Management, and Applicant Tracking. Critically for businesses concerned with data sovereignty, all client data is securely stored and managed within two Canadian data centres. The platform also integrates with essential accounting software like QuickBooks Online and Xero, ensuring a smooth flow of financial data.

Ideal User Profile & Verdict: Payworks is an excellent fit for Canadian businesses of all sizes that place a high premium on personalized, expert customer service and want a responsive, reliable Canadian-first partner.

7. Rise: Best for Modern HR and Employee Experience

Rise People is a modern, tech-forward platform designed for Canadian businesses that prioritize an exceptional employee experience. It combines a sleek, intuitive interface with a powerful suite of HR, payroll, and benefits tools. Its HR-first integrated approach treats payroll as the natural output of a well-managed HR system. For example, when a new hire accepts an offer, their data flows directly into the HRIS and is ready for the first payroll run, eliminating manual setup.

Built by and for Canadians, Rise handles compliance with ease, including full support for Quebec and a fully bilingual (English and French) platform. Its modern mobile app enhances employee self-service, allowing them to access pay stubs and request time off. Pricing is transparent, starting at $8 per employee per month for core features, with flexible month-to-month contracts.

Ideal User Profile & Verdict: Rise is a great fit for modern, tech-savvy Canadian companies, particularly startups and scaling businesses, that want a single, cohesive platform to enhance company culture and employee engagement.

8. Wave Payroll: Best for Micro-Businesses and Freelancers

Wave Payroll serves a vital niche by providing an affordable, straightforward solution for freelancers and micro-businesses. Its greatest strength is its seamless, native integration with Wave's widely-used free accounting software, creating a simple and cost-effective financial management ecosystem. The pricing model is highly attractive for this segment: a monthly base fee of $25 CAD, plus $6 for each active employee or contractor.

It is absolutely critical for potential users to understand that Wave Payroll is not available for businesses with employees in Quebec. Its simplicity also comes with other trade-offs: the platform lacks advanced features like integrated time tracking, and customer support is limited to email and live chat with no phone support available.

Ideal User Profile & Verdict: Wave is the best choice for freelancers and micro-businesses (fewer than 10 employees) operating exclusively outside of Quebec, especially those already using Wave's free accounting software.

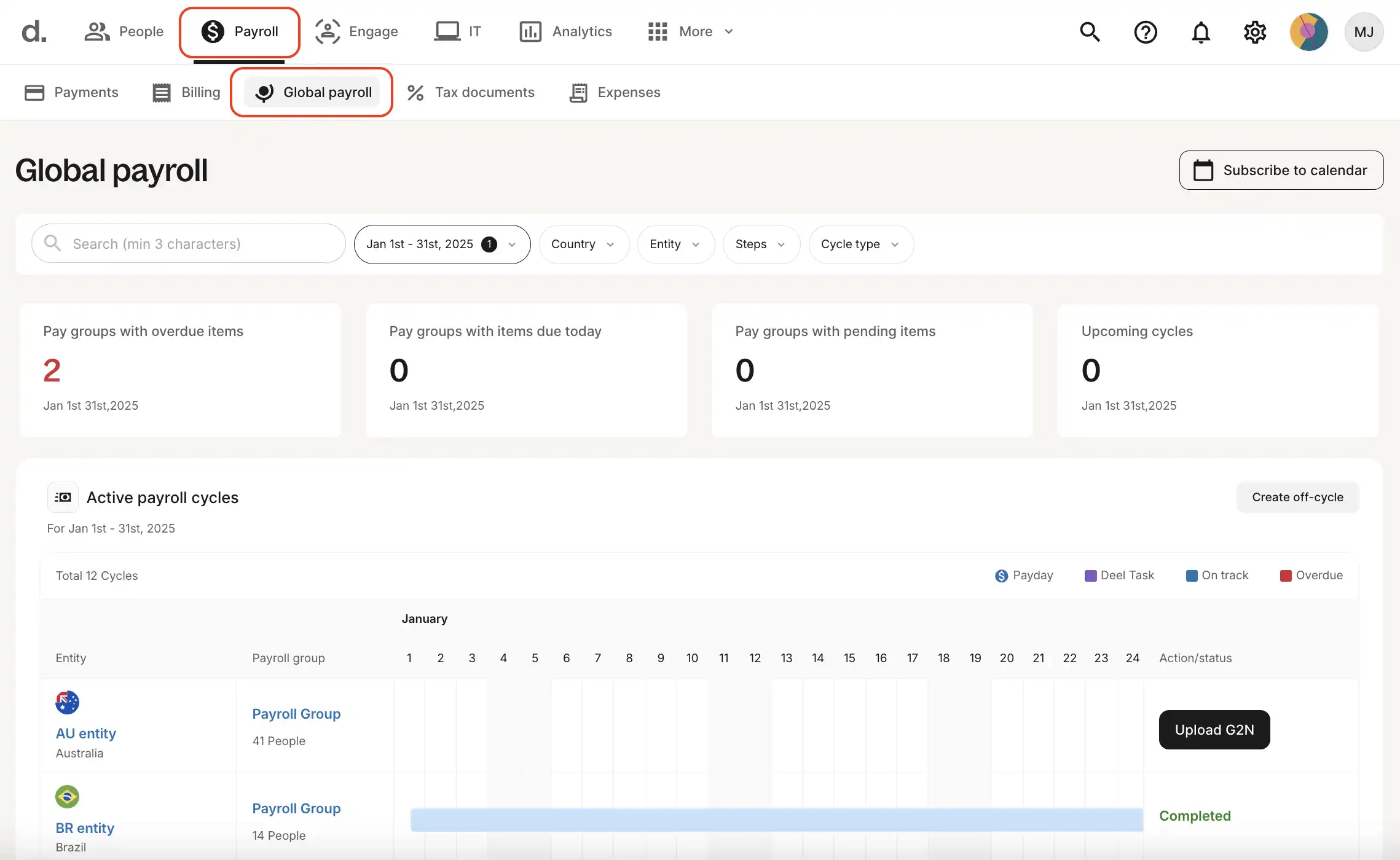

9. Deel: Best for Global and Remote-First Canadian Companies

Deel has rapidly emerged as the essential platform for Canadian companies operating with an international or remote-first workforce. Its core competency is navigating the immense complexity of paying employees and contractors across the globe while ensuring meticulous local compliance. For Canadian businesses expanding their talent pool beyond national borders, Deel provides the critical infrastructure to hire, pay, and manage a distributed team seamlessly.

Its standout feature is its Employer of Record (EOR) service, available in over 100 countries. Deel acts as the legal employer in the target country, handling everything from compliant contracts to local taxes and benefits, abstracting away enormous legal and financial complexity. The platform also excels at managing international contractors and offers a comprehensive global HR solution with a free HRIS and 24/7 support. Pricing is modular, with EOR services starting at $599 per employee per month.

Ideal User Profile & Verdict: Deel is indispensable for Canadian companies hiring talent located in other countries, or for international companies establishing a presence in Canada who need a provider that understands both global and local compliance.

10. Humi: Best All-in-One HR Platform for Canadian Startups

Humi is a comprehensive, Canadian-based HR, payroll, and benefits platform specifically designed for growing businesses. Its intelligent, modular design allows startups to adopt the features they need at an early stage and seamlessly add more capabilities as they scale. The system is built around a required "Core HR" module, with businesses able to add on Payroll, Time Off, Performance Management, and more.

As a Canadian company, it is built to meet local market needs, charging in CAD. Its pricing is clear, consisting of a $49 monthly base fee plus a per-employee fee for each module (e.g., $6/employee for Core HR, another $6/employee for Payroll). However, it has a critical geographic limitation: Humi is not yet available for businesses with employees in Quebec, though a waitlist is open for businesses interested in future functionality.

Ideal User Profile & Verdict: Humi is a strong contender for Canadian startups and scaling SMBs (operating outside of Quebec for now) looking for a flexible, modern, all-in-one platform that can evolve with them.

Strategic Recommendations and Final Verdict

The Quebec Compliance Divide: A Non-Negotiable Decision Point

The analysis reveals a critical, non-negotiable dividing line: full support for Quebec's unique regulatory environment. For any business that currently has employees in Quebec or anticipates hiring there, this must be the primary filter. This compliance divide immediately narrows the field of potential vendors, allowing for a more focused and efficient evaluation.

- Quebec-Ready Solutions: TimeTrex, QuickBooks Payroll, Wagepoint, ADP, Dayforce (Powerpay), Payworks, Rise, Deel.

- Solutions Not Currently Supporting Quebec: Wave Payroll, Humi.

Choosing Your Solution: A Decision Framework for Canadian Businesses

The "best" payroll software is the solution that aligns with your company's specific size, industry, and strategic priorities.

- For the Solopreneur & Micro-Business (<5 Employees, outside QC): Wave Payroll is the clear winner for cost-effectiveness and accounting integration.

- For the Quintessential Small Business (5-50 Employees): Choose based on priorities. Wagepoint for simplicity and support, QuickBooks Payroll for accounting integration, or Payworks for dedicated Canadian service.

- For the Complex Hourly Workforce: TimeTrex is the premier solution. Its advanced time and attendance tools ensure data integrity from the start, making it the top choice for operators who demand control and error prevention.

- For the Scaling Mid-Market Company (50-500+ Employees): ADP Workforce Now and Ceridian Dayforce are the established, scalable choices. Rise and Humi (once Quebec-ready) are modern, tech-forward alternatives.

- For the Global-First Company: Deel is the undisputed market leader for managing an international workforce.

Final Word

Ultimately, selecting the right payroll software is a foundational business decision. By carefully evaluating your company's unique operational needs, compliance requirements, and future growth trajectory against the distinct strengths of these leading platforms, you can choose a solution that not only ensures your team is paid accurately and on time but also serves as a strategic asset for long-term success.

Disclaimer: The content provided on this webpage is for informational purposes only and is not intended to be a substitute for professional advice. While we strive to ensure the accuracy and timeliness of the information presented here, the details may change over time or vary in different jurisdictions. Therefore, we do not guarantee the completeness, reliability, or absolute accuracy of this information. The information on this page should not be used as a basis for making legal, financial, or any other key decisions. We strongly advise consulting with a qualified professional or expert in the relevant field for specific advice, guidance, or services. By using this webpage, you acknowledge that the information is offered “as is” and that we are not liable for any errors, omissions, or inaccuracies in the content, nor for any actions taken based on the information provided. We shall not be held liable for any direct, indirect, incidental, consequential, or punitive damages arising out of your access to, use of, or reliance on any content on this page.

Time To Clock-In

Start your 30-day free trial!

Experience the Ultimate Workforce Solution and Revolutionize Your Business Today

- Eliminate Errors

- Simple & Easy To Use

- Real-time Reporting

Saving businesses time and money through better workforce management since 2003.

Copyright © 2025 TimeTrex. All Rights Reserved.